Alexey Brin/iStock via Getty Images

Introduction to Element Solutions

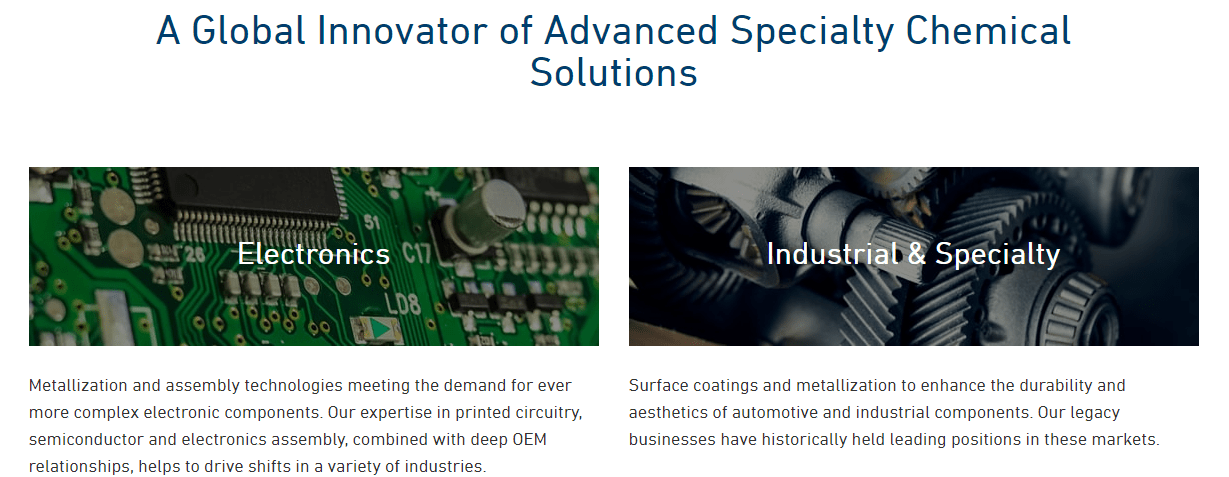

For those who did not read my prior article, here, I will provide a quick summary of what the company does. Element Solutions (ESI) is a provider of a diverse range of specialty chemicals in both semiconductors and broader industry, with applications such as ion baths, solders and fluxes, photomasks, coatings, packaging graphics, and hydraulics. Another benefit in my eyes is their R&D into circular and green materials as a way to be more sustainable, even when working with heavy industry. Further, these are concrete and helpful applications, not your average speculative EV or renewable energy play. I would recommend reading my prior article for a fuller discussion on each revenue segment.

Operations are getting more diverse every year, with the recent acquisition of Coventya adding expertise in electroplating, surface finishes, and friction control. The company has a history of add-ons and spin-offs, which has led to reduced growth and performance over the past decade. Although growth is elevated for the moment, do not expect record breaking growth long-term. The peer, RPM International (RPM), offers a better understanding of Element Solutions’ future: slow and steady dividend growth. However, a recent EPS growth over the past few years leads me to believe in a significant opportunity, and I look forward to the future long-term success of the company.

Image: Element Solutions Website. A diversified specialty chemical play, with multiple growth markets for the future, including semiconductors and automotive applications.

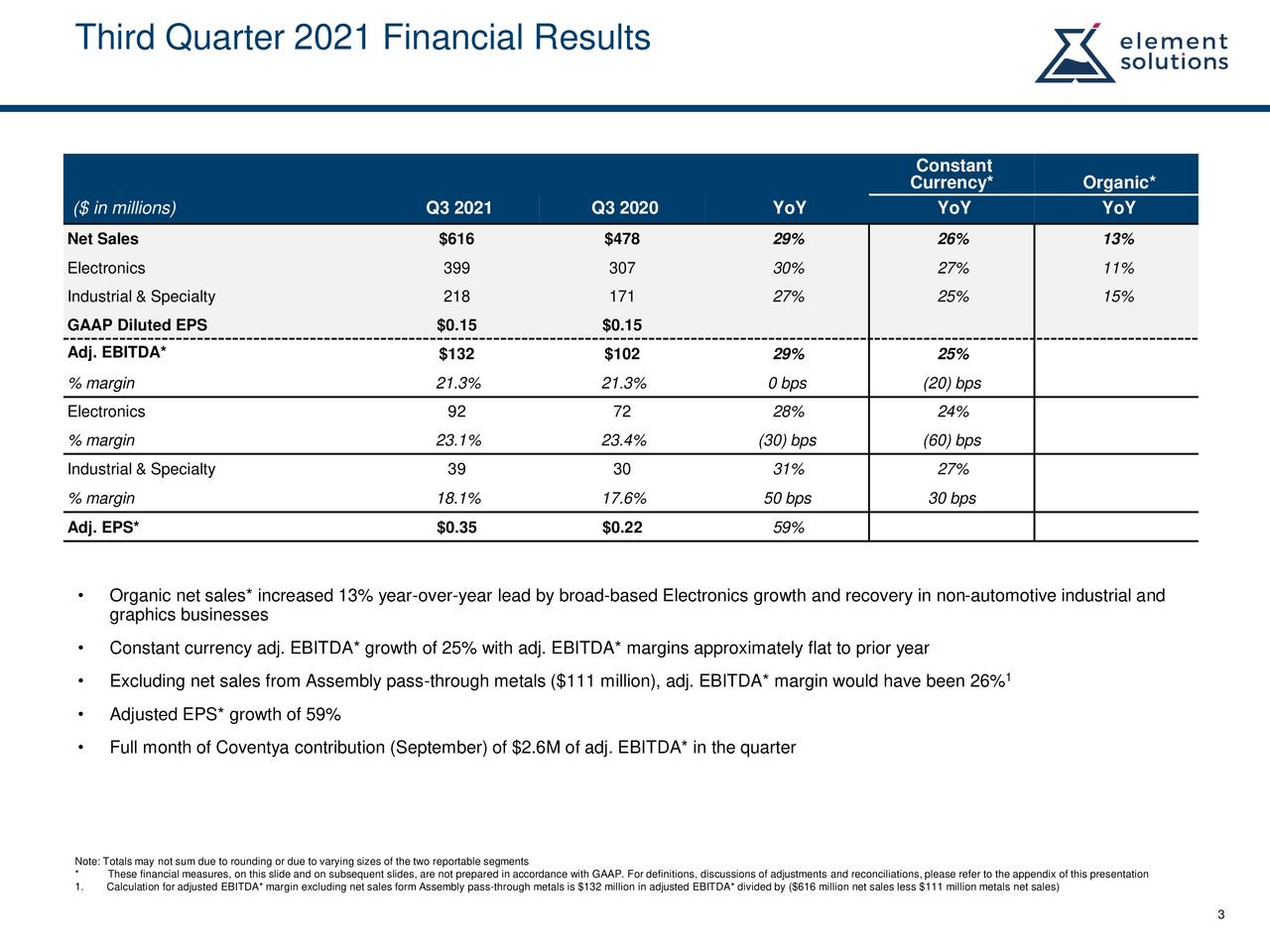

Q3 Earnings In-line with Expectations

The last earnings report was a beat in both non-GAAP EPS and revenue growth, and this is off of a strong 2020 for the company. With a 29% increase in revenues, 13% of which are organic (not based on acquisition), the underlying growth rate remains strong. Another good sign is that the net income margin is now positive, and at an incredible 10% level. With that, EPS increased YoY by 89%.

Image: Third Quarter Presentation. A summary of Q3 performance.

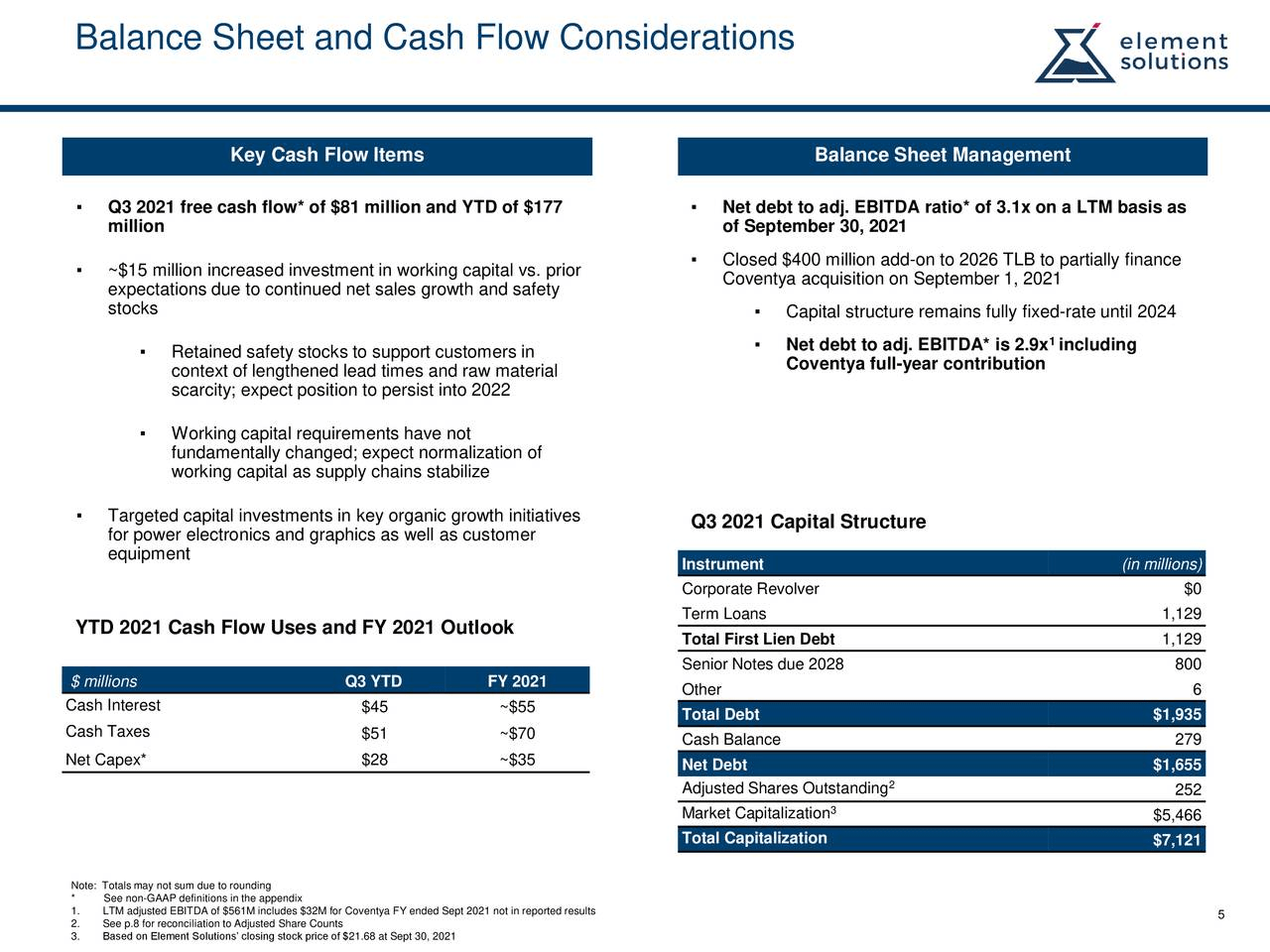

Dilution is not currently an issue, with total shares outstanding falling since 2016. However, the recent acquisition of Coventya was based solely on an increase in a loan balance, shareholders are not feeling the effects via dilution or net losses. However, investors will need to watch out for the increases in debt again, as ESI had just recently reduced debt by over $4 billion with spin-offs. The current $1.9 billion in debt is quite high, but management states that the current 3.0x leverage margin is the highest it will be, while still allowing for growth. In fact, Element remains well received by ratings companies, and the increase in debt did not lower the company’s rankings.

Image: Third Quarter Presentation. The balance sheet and cash flows remain sound fundamentally, although debt levels are a bit high for my liking. Although, they are far improved from years prior.

Comparisons VS Peers

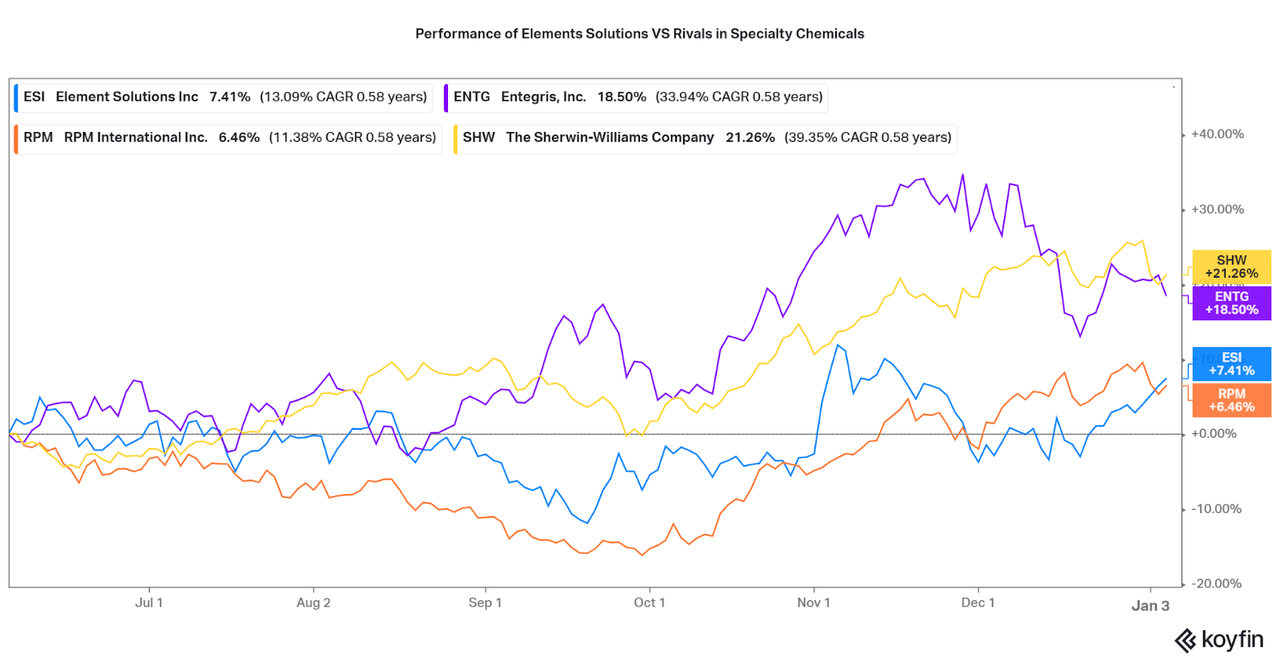

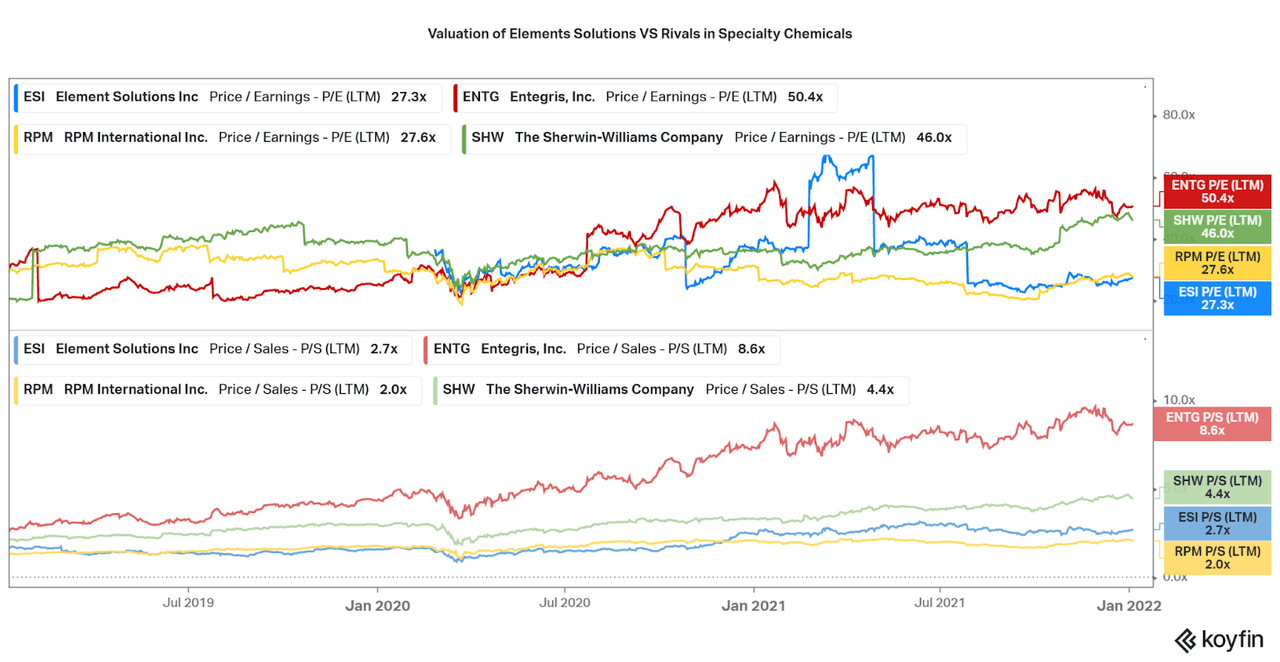

In my last article, I laid out a plan that one should invest in ESI while the leading segment growth play Entegris (ENTG) was at a high valuation and may see reduced returns. However, this did not pan out as ENTG kept rising. Although, perhaps I should maintain this plan into 2021, as I do not see Entegris’ valuation as sustainable or conducive to positive returns (although it remains in my Glacier portfolio/watchlist). This is because when you consider Element Solutions current valuation, a P/S of 2.68 and PE of 27.3, the performance seems capable of a breakout in valuation. However, investors remain hesitant after the issues over the past 5 years, and will need to see many more strong quarters before this happens.

If only considering YoY performance, about 3x better than Sherwin-Williams (SHW) and RPM, and about 30% greater than ENTG, then Element Solutions’ Price to Sales should be closer to 10.9x. This would account for a 300% increase in share price from current levels. While this is unlikely to occur, as long as ESI maintains the upward trend in performance, outsized returns remain plausible. Therefore, I will continue to add on moments of weakness, and would recommend others to do so.

Chart 1: My estimations for ESI to outperform peers has not come to fruition as ENTG and SHW lead the way.

Chart 2: Valuation remains favorable for ESI at the moment and offers an even more opportune time to add shares.

Conclusion

While my plan has risks associated with the historical performance of the company, I am not the only analyst (I consider myself on Wall Street’s level, yes) with a bullish outlook on Element Solutions. Other analysts are, on average, Very Bullish on the stock, with a consensus outlook share price of $28.70, an increase of 15% or so from today (January 5th). When combined with 3-5 year EPS growth estimates of 15% per year, there is more data that points to the possibility of value expansion. I believe this is the main catalyst for shareholder return over the next five years.

Beyond that, look for an increase of the dividend from the current 1.0% yield as the main driving force for the company. If RPM is any indication, there is a path of sustainable, high margin dividend growth in this industry. Further, if Entegris is any indication, there remains a high growth, high-value path, which would propel capital gains by 2-3 times with time.

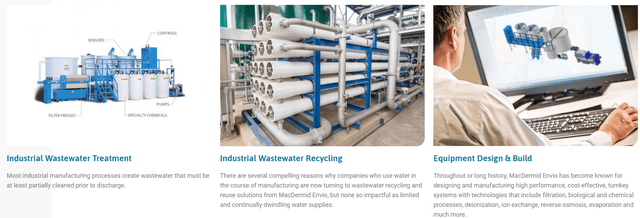

Image: MacDermid Envio Solutions Website. A selection of sustainable applications provided by ESI.

The company is also a strong fit for my portfolio beyond a plausible turnaround play, and that is in regards to sustainability. Heavy industry, semiconductors, and other energy-intensive industries are all necessary components of society, but companies that work on optimizing the industry are doing a world of good. In fact, ESI even has an entire environmental services division that aids other companies in recycling, water treatment, and efficient design. Small steps like this, as an investment, will help without being speculative, fraught with fraud, or political.