Kitzzeh/iStock Editorial via Getty Images

Last year was hardly a good one for Unilever (UL) shareholders as the company was hit hard by rising commodity prices.

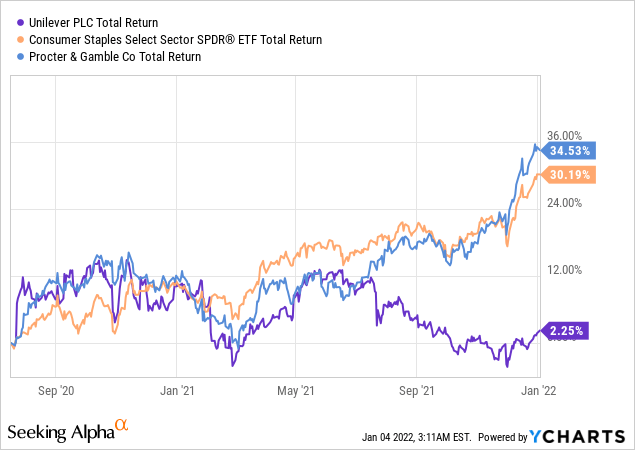

For most of the time since my first analysis of the company, Unilever’s share price has been trailing those of Procter & Gamble (PG) and Consumer Staples Select Sector SPDR ETF (XLP). However, a wide performance gap has opened since mid-2021.

This nearly 30% performance gap was largely caused by a number of external factors that have little to do with the quality of Unilever’s business model and brands. Although underperformance is likely to continue on the back of rising commodity prices, there are two major reasons why I will keep accumulating shares over the course of 2022:

- Firstly, Unilever’s business transformation and strategy remain on track which significantly improve the company’s competitive positioning.

- Secondly, Unilever is now priced very conservatively due to those external factors, which are largely irrelevant over the long term.

Exogenous Risk Factors

The gap we saw above between Procter & Gamble and Unilever opened around July of 2021, when management of the latter reported strong first half results, but also expressed caution regarding rising commodity inflation.

Source: Seeking Alpha

Since then the gap between the two companies has grown even larger, as commodity prices continued to make new highs.

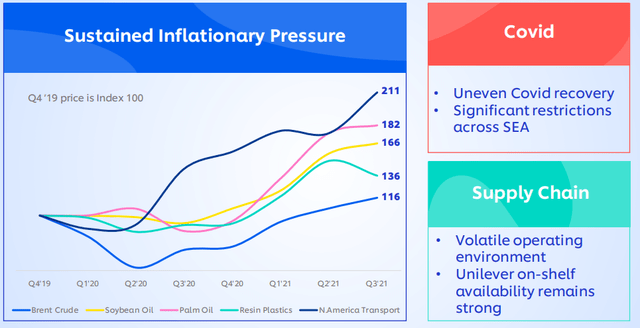

Source: Unilever Q3 2021 Trading Statement

In my last analysis on Unilever, I showed why the commodity price inflation we witnessed during 2021 is having a disproportionately stronger impact on Unilever when compared to P&G. Since then, palm oil prices continued its upward trajectory, thus further widening the aforementioned performance gap.

Source: fred.stlouisfed.org

Soybean prices cooled off a bit, however, they are predominantly impacting Unilever’s foods & refreshment business.

Source: fred.stlouisfed.org

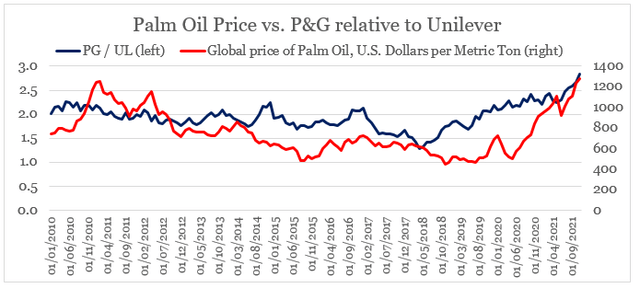

In the graph below, we could see just how important palm oil pricing is for Unilever, by comparing it with the ratio of P&G to Unilever share price.

Source: prepared by the author, using data from fred.stlouisfed.org and Yahoo! Finance

Although there are many other factors affecting the share price dynamic between the two companies, it appears that the recent outperformance of Procter & Gamble was largely driven by palm oil pricing.

And while this puts Unilever at a disadvantage for the time being, the company’s strong brands allow for sizeable pricing increases to offset the negative impact of rising costs.

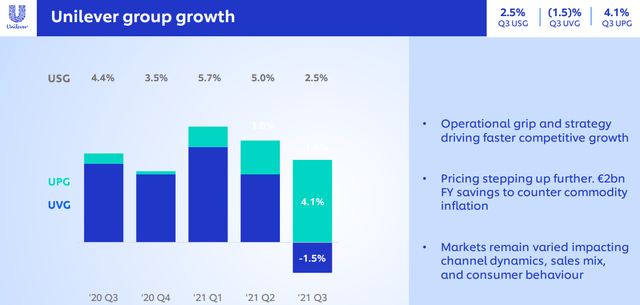

Source: Unilever Q3 2021 Trading Statement

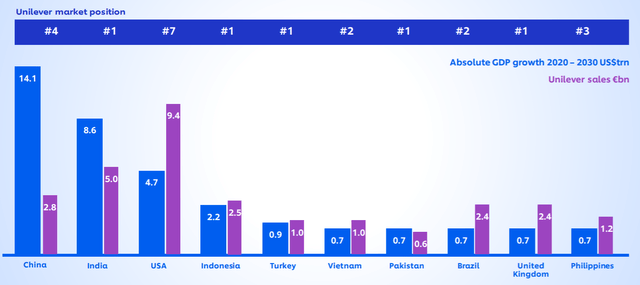

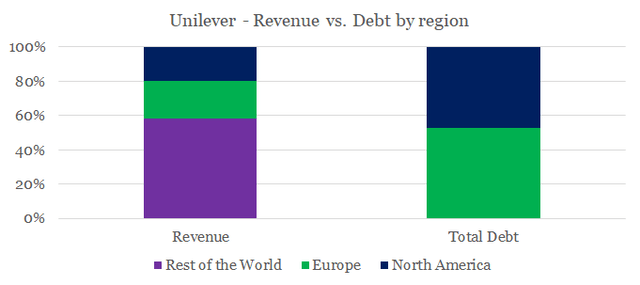

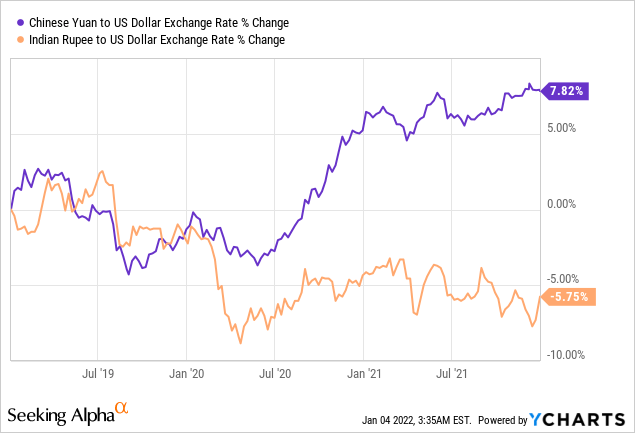

In addition to commodity pricing headwinds, exchange rates also had a negative impact over the past two years. To begin with, Unilever is a truly global business with significant exposure to many Emerging Markets.

Source: Unilever CAGNY 2021

This creates a mismatch between the denomination of its debt and its sources of revenue, thus favoring the business when the U.S. Dollar and the Euro depreciate against Emerging Market currencies.

Source: Prepared by the author, using data from Unilever Annual Report 2020

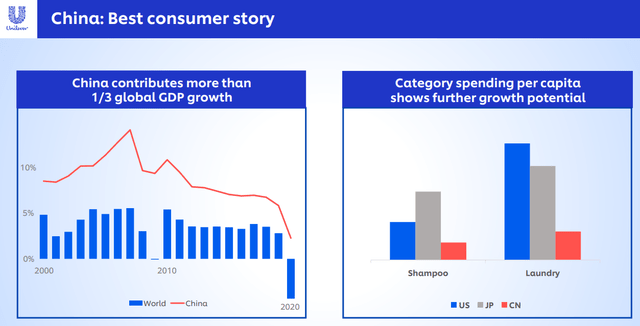

That is why the depreciation of the Indian rupee over the recent years has been a headwind, while the rising Chinese yuan could be seen as a positive catalyst.

This, however, is not entirely true as Unilever is producing and sourcing many of its products from China, where the company has established its largest production base.

Hefei Industrial Park is Unilever’s largest production base in the world, manufacturing around 10 million units a day for brands such as Dove, Clear and Lux.

Source: unilever.com

These factories serve as a major export hub for Unilever which means that as the Chinese yuan appreciates, the company’s products become less competitive for export.

Located in the Guangdong-Hong Kong-Macao Greater Bay Area, one of the most dynamic regions in China that has achieved high levels of opening-up, the plant in Guangdong will serve as an export base for Unilever China, and provide products for markets under the Regional Comprehensive Economic Partnership, and other overseas markets.

Source: chinadaily.com.cn

In a nutshell, both exchange rate movements and commodity price inflation have been two major factors behind Unilever’s underperformance relative to its peers over the recent year. However, these macroeconomic events are almost impossible to predict and tend to cancel each other out over the long-run. At the same time, Unilever’s overall competitive positioning from both brand and geographical perspective is exceptionally strong.

What Matters for Long-term Holders

As a long-term shareholder, I don’t bother with trying to forecast either future commodity prices or changes in exchange rates. What matters to me the most, is competitive positioning, product & geographic exposure, overall strategy and last but not least the strength of the brand portfolio.

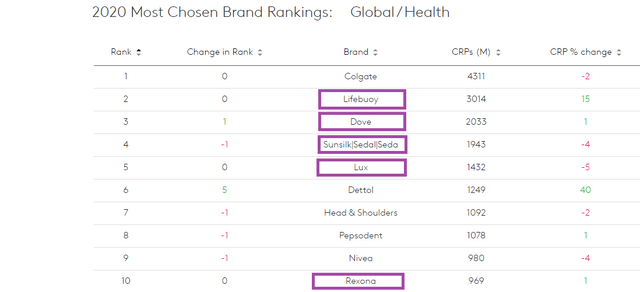

In that regard, Unilever brands made up 5 out of the 10 most chosen Health & Beauty brands globally in 2020, according to Kantar.

Source: kantar.com

The truly global presence of these brands is what creates a unique competitive advantage for Unilever. Apart from economies of scale and bargaining power with customers, this strong brand portfolio allows for a sizeable price premium for Unilever’s products.

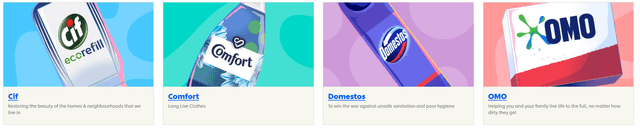

Source: unilever.com

In addition, exposure to Emerging Markets still holds an enormous potential over the long run, as even the now more developed Chinese market is still lagging behind the U.S. and Japan in terms of spending per capita on certain product categories.

Source: Unilever China – Investor Presentation

The strong global positioning also allows Unilever to acquire smaller digital and purposeful brands and to quickly scale them up on a global basis. A perfect example of this is the recent acquisition of Onnit, which has adopted a digital-first model and is exceptionally strong in the United States.

Source: unilever.com

Moreover, Unilever is now reaping the benefits of its business restructuring process which involves divestments of certain food related businesses and a stronger focus on higher margin product categories that are also a better fit for the business. I talk more about this whole process here.

Another example of where Unilever is pivoting, is skin care. As attractive as this high margins space might be, I recently highlighted that it is getting crowded. Large enterprises, such as Colgate-Palmolive (CL), Procter & Gamble, Coty (COTY) and Shiseido (OTCPK:SSDOY) are all looking to make a stronger move into the category.

Unilever is no exception, albeit the company appears a bit more careful than some of its major peers that appear to be going all-in on skin care.

Source: unilever.com

Once again, Unilever engaged in an acquisition of a purpose-led brand with strong digital presence that the company could quickly scale up globally.

Developing Unilever’s portfolio in the high growth premium skin care segment is one of our strategic priorities and I’m excited that Paula’s Choice is joining us on this journey.

Sunny Jain, Unilever Beauty & Personal Care President

Source: unilever.com

How is Unilever priced?

Having said all that, Unilever appears well-positioned to not only endure the short-term macroeconomic headwinds, but also to retain and build upon its existing competitive advantages over the medium and long-term.

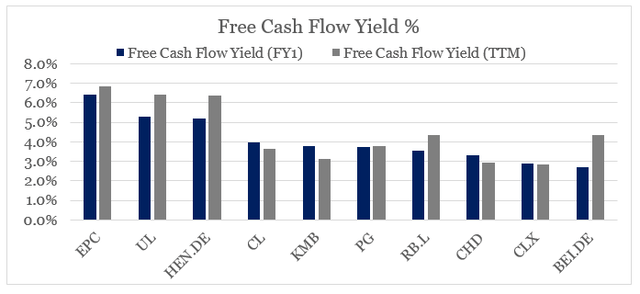

At the same time, the company is priced near the bottom of its peer group within the Personal & Home Care space with a free cash flow yield of more than 6%.

Source: prepared by the author, using data from Seeking Alpha

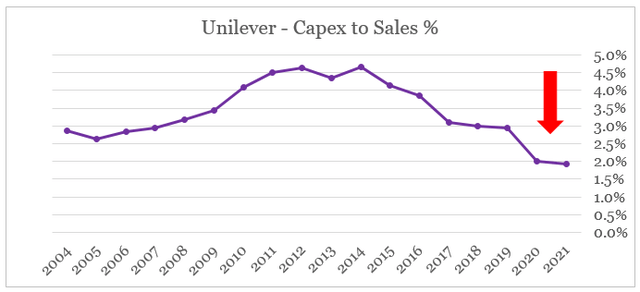

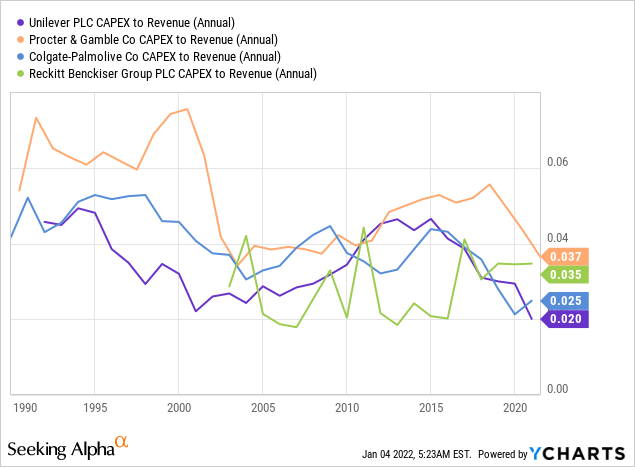

When using free cash flow metrics, however, we should also take into account Unilever’s temporarily low capital expenditure to sales ratio.

Source: prepared by the author, using data from Seeking Alpha

Management has iterated a number of times that the sustainable Capex run rate is about 2.7%.

Going forward, we think that the right level of CapEx for the business is the sort of long-term run rate of about 2.7%. On the – that’s a healthy level of CapEx for the business, recognizing that quite a bit of our production now is done through third-parties, not within our own network.

Graeme Pitkethly – Chief Financial Officer

Source: Unilever H1 2021 Earnings Transcript

Therefore, if we calculate Capex based on the 2.7% number, we arrive at free cash flow yield of 5.8% on a trailing twelve months basis, which is still one of the highest within the peer group.

Even this long-term run rate of Capex spend is still significantly lower than the historical average we saw above. This is due to Unilever now relying more heavily on third-party manufacturers which is associated with certain supply chain risks. Nevertheless, this is a trend that we observe among all major peers within the Personal & Home Care industry.

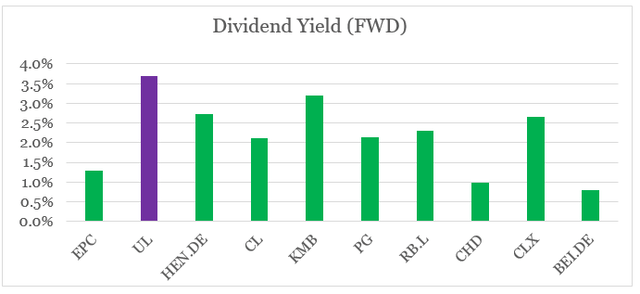

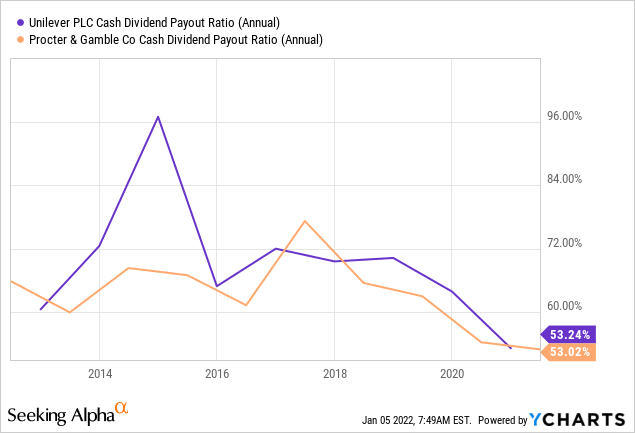

Unilever’s dividend is also among the most attractive within the competitor set identified above, with current dividend yield of 3.7%.

Source: prepared by the author, using data from Seeking Alpha

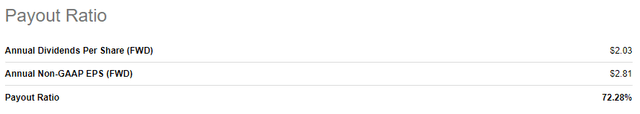

Although the recent macroeconomic headwinds did result in a somewhat higher dividend payout ratio of about 72%, on a cash flow basis Unilever is currently at par with Procter & Gamble.

Source: Seeking Alpha

Conclusion

Last year presented Unilever with significant macroeconomic challenges, which resulted in a very disappointing performance relative to peers. Nevertheless, Unilever’s management continued to execute on its strategy and is shifting its focus away from non-core business segments. This in my view significantly strengthens the long-term competitiveness of the business and given the very conservative pricing of Unilever shares, I intend to continue to build upon my long position over the course of 2022.