Sky_Blue/iStock Unreleased via Getty Images

Company Overview

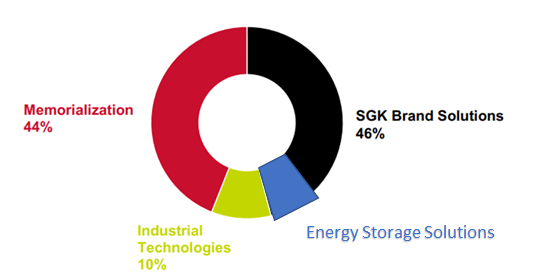

Matthews International Corporation (NASDAQ:MATW) is an industrial conglomerate with diverse lines of business. The company offers automation and brand solutions to a variety of companies, it is present in more than 20 countries and employs more than 10,000 people. It is divided into 3 segments with an emerging new business line that is the energy storage solutions.

MATW biz breakdown

MATW investor relations

Energy Solutions – Small, yet on the road to quadruple with Tesla and Porsche as main customers

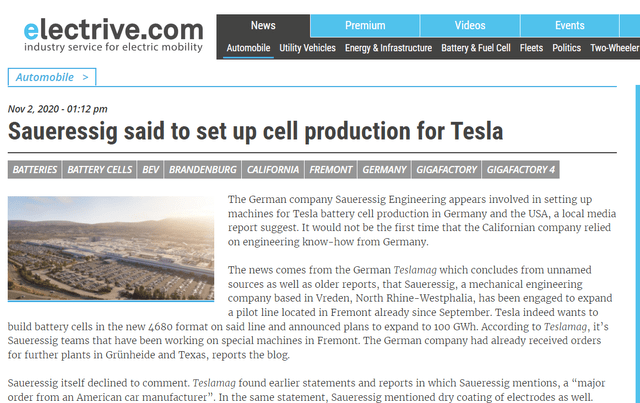

The energy storage solutions segment of the company despite being the smallest one right now it is the one with the most potential. It is led by Saueressig, a subsidiary acquired by Matthews in 2008 that specialized in Rotary machines, usually used for foiling and embossing luxury CPG packages.

Yet, in recent years Saueressig adjusted its machines for lithium-ion batteries manufacturing and especially dry-cell batteries

Below is an image of the machines the subsidiary sells for the fabrication of lithium batteries.

SAUERESSIG rotary machines

Dry-cell vs. Wet-Cell battery explained by Elon Musk

To legacy way to produce batteries is wet coating – where the electrode powder is mixed with solvents and the slurry material is coated into the metal foil. After that comes the drying part where this subproduct goes into in huge ovens to dry. This process is more expensive and energy consuming than the new alternative that is dry cell coating. Dry cell coating is a new process developed to reduce the cost of producing batteries. It eliminates the need of using solvents, the dry phase of production and requires fewer steps and equipment reducing the factory footprints. This will make the 4680 batteries cheaper for Tesla to produce and the machines used for this production will be from Saueressig, here from Tesla’s executive:

“Yes. And so, when we put it all together and go to our new 80-millimeter length, 4680 we call this a new cell design, we get five times the energy with six times the power and enable 16% range increase, just form factor alone.” – Drew Baglino Senior Vice President, Powertrain, and Energy Engineering, Tesla

In case you wonder how printing relates to battery manufacturing, here is Elon Muck explains (min 51:50 onwards)

The 4680 batteries will be a game-changer for Tesla in terms of increasing the range of its cars and making them more affordable. For this enterprise, companies are developing their own 4680 batteries for Tesla-like Panasonic and LG.

The Terrifying Economics of TESLA’S 4680 BATTERY CELL

“In terms of product development, the technological goals have largely been achieved,” Kazuo Tadanobu, CEO of Panasonic’s battery division, said. “But mass-producing them requires new techniques.”

This is where Saueressig enters, with its expertise in energy battery manufacturing the company will assist Tesla and other companies in the development of machinery that can mass-produce the 4680. Tesla announced it will ramp up its gigafactories and dry cell production, this comes with more machinery and expenditure that Saueressig will benefit from, and it is creating a huge backlog.

“In our energy storage business currently reported as part of the SGK. Our deliveries finished pretty much as planned with revenues of over $50 million for 2021. We are projecting around $100 million of revenue for ’22. And currently have more than that in our backlog. Activity in this business in both the lithium-ion battery calendaring solution and the hydrogen fuel cell solution is very high.”

Source: MATW, Q3/21 conference call

Saueressig Tesla Factory

It’s no surprise that recently Saueressig announced that is building a new factory and its American headquarters in Texas near Tesla’s gigafactory.

Tesla is currently 80%+ of MATW’s energy solutions and as Tesla ramps up its gigafactories and dry cell, the company expects this business to double in 2022 and double again in 2023. Saueressig is set to benefit from the ramping up of production because more machinery will be necessary and the company will be there to supply for the car manufactures.

The energy storage business demonstrates true growth potential to Matthews International – this year revenues were $50M and management predicts it will be $100M for 2022 with 15% EBITDA and it could reach $500M by 2025 with 20% EBITDA due to scale. Assigning x15 EV/2025 EBITDA for this segment means it’s worth $1.1B-$1.5B more than the current MATW market cap. And that only for the smallest segment of MATW

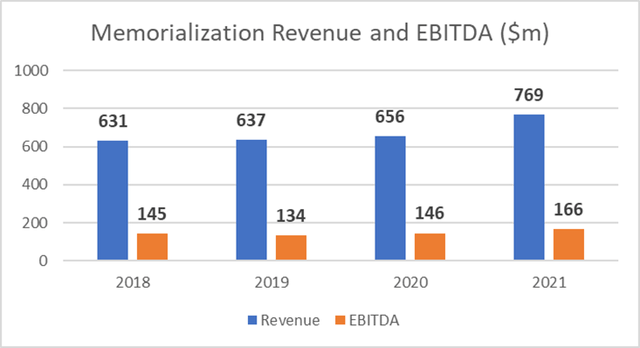

Memorialization (44% of rev, 20% EBITDA margin)

Matthew provides cemeteries, funeral homes, and monument dealers with a variety of products in the death care space ranging from caskets, bronze and granite memorials and cremation equipment. Matthews is a well-established player in the industry being the number one provider of cremation equipment globally. This segment had tailwinds from the Covid pandemic, however suffered with the supply constraints and increasing commodities (steel and lumber mainly) prices. But since the company has the leading position in the industry, management has been adjusting to implemented hikes to preserve margins. Management hints that they may preserve part of the price hikes even after commodities pressure abides (as we saw starting in Q4/21).

Memorialization products lines

Matthew’s IR Deck

This business is a real cash cow for Matthew International and the company is an absolute market leader in the US and Europe. This is a secular business where its margins are impacted by a number of deaths and cremation/burial decisions. Matthews is a strong player in both solutions so we would assign an EV/EBITDA of 14x to this business segment.

Memorialization financials

Matthews financial reports

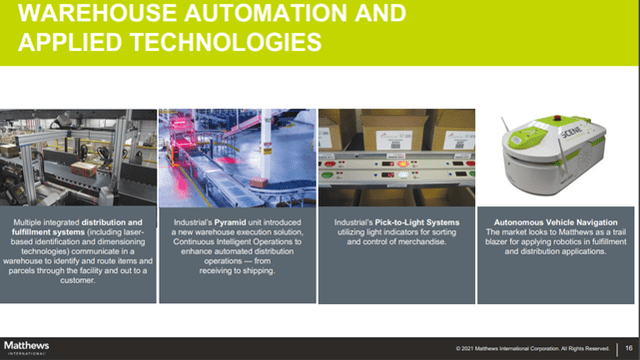

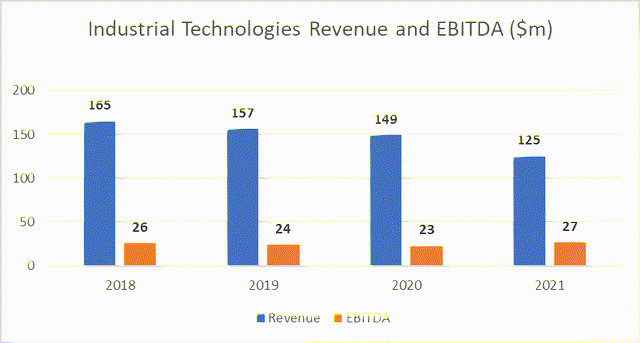

Industrial Technologies Division (9% of rev, 21% EBITDA margin)

Responsible for 10% of sales is dedicated to developing technologies and solutions for industrial automation including marking and coding. It has helped its customers develop multiple integrated distribution and fulfillment systems with laser identification. Some customers in employing Matthew’s expertise in the area are Target. Despite the tough years this segment has experienced we believe in the coming years it will recover with the solutions Matthews developed coming to market. With the expansion of ecommerce and the necessity of having an infrastructure of distribution centers to support it, Industrial Technologies is set to benefit from it.

Warehouse automation

Matthew’s investors deck

A similar company to the Industrial Technologies segment is Rockwell Automation, the company currently has an EV/EBITDA of 33X. Using it as a proxy to value the Industrial Technologies segment we believe the current multiple for this segment of Matthews is 15X as they focus their business and improve EBITDA

Industrial Technologies

Company’s financials

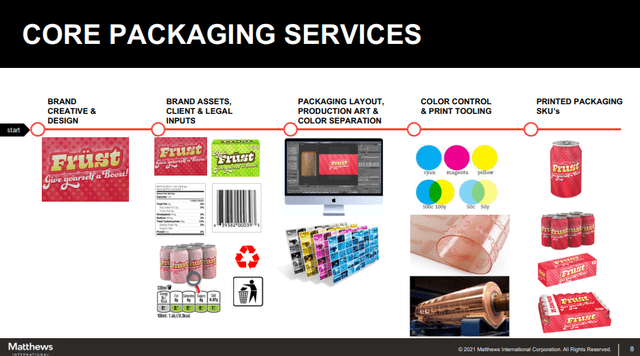

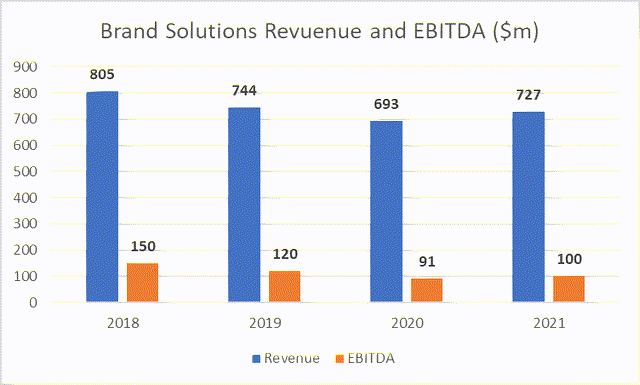

Brand Solutions – Legacy printing (46% of rev, 14% EBITDA margin)

Brand Solutions

Company’s’ IR deck

SGK Brand Solutions, a global packaging and provider of brand experience to its customers. It also offers printing support solutions to its customers in a variety of industries from healthcare, retail, and beverages. Some of their clients are Walmart, Amazon, Apple, and Tesco. They help create a brand design for the products, input all the necessary legal and brand inputs in the packaging such as code bar and nutrition information, and then produce the packaging layout and the final product package. This segment has been experiencing challenges due to the Covid-19 pandemic and is underperforming due to limited POP re-design and should recover as foot traffic in the stores get back. Another issue that has been happening is the clients have been more concerned in having the supplies to put the products in the shelves than in rebranding and this has severely negatively impacted this segment.

Brand Solutions revenues

Company’s financials

A peer we chose to compare with is R. R. Donnelley & Sons Company, which currently has an EV/EBITDA of 6.6x and it has been able to increase its revenue. Matthew’s SGK Brand Solutions has not been experiencing the same, it got hit hard by the pandemic and it hasn’t fully recovered yet, so we assigned an EV/EBITDA is of 6x.

Valuation – Sum of parts hints x2 upside

Now we summed the parts of the business to come to a valuation regarding Matthews International. We made assumptions that all business lines will recover from the Covid pandemic and get back to the same level of growth as before.

|

Business Segment |

Revenue CAGR (2018 – 2021) |

Revenue CAGR (2022 – 2025) |

EV/EBITDA |

|

Energy Solutions |

– |

60% |

15x* |

|

Memorialization |

5% |

7% |

14x |

|

Brand Solutions |

-3% |

4% |

6x |

|

Industrial Technologies |

-7% |

17% |

15x |

|

Matthews International |

1.1% |

12% |

14x |

*on 2025 EBITDA

Considering EBITDA of 2021 (bear in mind Covid was major headwinds for all legacy MATW’s business) for all business segments. For the Energy Storage solutions we took EBITDA of 2025, here is the derived EV for Matthews International: $3.2B, almost 1.7x the current EV.

| Business Segment | EV/EBITDA | 2021 EBITDA ($m) | EV ($m) |

| Energy Solutions* | 15 | 75 | 1,125 |

| Memorialization | 14 | 100 | 1,395 |

| Brand Solutions | 6 | 166 | 994 |

| Corporate Expenses | 10 | -64 | -642 |

| Industrial Technologies | 15 | 27 | 399 |

| Derived Matthews International EV | 3,271 |

*EBITDA as of 2025

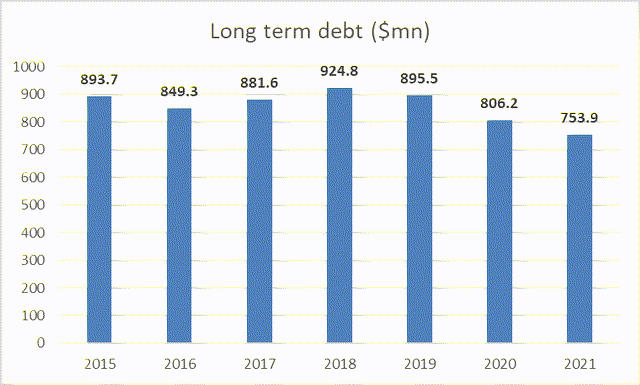

When we look more closely at this number, we can see how investors in the share of this company will benefit from the development of the Energy Storage Solutions business. Enterprise Value is composed of Market Value of Debt + Market Cap – Cash and Cash Equivalents. The debt of the company has been decreasing considerably in the past couple of quarters and the company has initiated deleveraging. This means the shareholders are the ones to benefit from the development of the Energy Storage business.

debt

company’s financials

Using the information currently available on Seeking Alpha we calculated below a possible share price for Matthew International considering the EBITDA of all its segments, except the Energy Storage solutions (EBITDA of 2025), Cash Equivalents, and debt stay the same. This price is $77 per share, more than 2 times the current price.

| Matthews International Derived EV | 3,271 |

| Current EV | 1,930 |

| Debt (2021) | 848 |

| Cash Equivalents (2021) | 49 |

| Current Market Cap | 1,131 |

| Possible Market Cap | 2,472 |

| Shares Outstanding (2021) | 32 |

| Upside Share price | 77 |

We’d like to thank Yoav from Phoenix insurance (one of the major shareholders of MATW) who brought this idea to our intention and to Caio L. from our team who put this piece together

Enormous upside opens the door for SOTP active investors

While MATW is currently a salad of business, it’s ridiculously undervalued due to its lack of theme. While management intends to shed more light on the Energy Business by taking it out from the “Marketing Segment”, it’s obvious that management needs to divest the legacy Marketing business and maybe the Memorialization as well. We believe the enormous upside will attract more capital allocation minded shareholders who will demand it from the management.