Just_Super/E+ via Getty Images

Article Thesis

Tesla (TSLA) is a fast-growing EV maker that trades at a very expensive valuation. The justification for the high valuation is, in the eyes of many investors, the company’s autonomous driving program. In that area, Tesla has recently had to take a huge loss, as Daimler (OTCPK:DMLRY) has now become the first automobile company with an approved Level 3 autonomous driving tool. Daimler is not the only company that is seemingly moving ahead of Tesla, however. In fact, some other noteworthy players look better-positioned as well. These issues in a highly important area, combined with Tesla’s high valuation and headwinds from rising interest rates, could spell trouble for Tesla.

Tesla’s Auto Business Doesn’t Warrant The Current Valuation

Tesla is active in a range of industries, but the vast majority of its revenue, around 90%, is generated by selling vehicles. I believe that it is thus logical to call Tesla an auto company, as that is where almost all of the revenue and cash flow is generated.

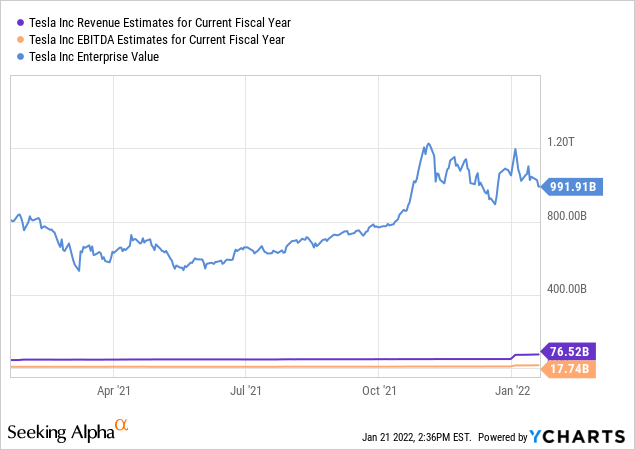

Tesla is, at the time of writing, trading with an enterprise value of around $1 trillion. The company is also forecasted to generate $77 billion in revenue in the current year, FY 2021. At the same time, the consensus EBITDA estimate stands at $18 billion. Does a $18 billion EBITDA level justify a $1 trillion enterprise value, or a $950 billion market capitalization for a car company? I do not think so.

Daimler, a premium/luxury manufacturer active in a similar market segment as Tesla (although not 100% electric), is forecasted to generate $24 billion of revenue and trades with a market cap of around $80 billion. This makes for a 3-4x price/EBITDA multiple. For Tesla, using $950 billion in market capitalization, that ratio stands at more than 50. Now Tesla is clearly growing faster than Daimler, and one can also argue that its 100% electric brand warrants a premium over Daimler and other legacy players. But I do not think that the current valuation makes sense. After all, if we were to say that Tesla’s faster growth and electric-focused brand warrant a 100% premium, we’d get to a price/EBITDA ratio of around 7. In that case, Tesla would have to trade at $130 per share. If Tesla were to trade at a 200% premium, we’d get to a share price of $250, if we want to assign a 300% premium, we get to a share price of around $380. Clearly, even at a hefty premium compared to Daimler and other legacy players, Tesla’s share price target is well below where shares are trading today (north of $950 at the time of writing).

The automobile business alone does thus, I believe, most likely not justify Tesla’s current massive market capitalization of close to $1 trillion. Many investors, even Tesla bulls, agree with me, claiming that the current market cap is justified due to other things, such as the insurance business, the energy storage business, or the autonomous driving business. Insurance and energy storage are, so far, not generating meaningful profits for Tesla — in fact, the non-auto businesses, in sum, are losing money. Insurance and battery packaging also are not moat-worthy businesses, and Tesla doesn’t have a huge lead or advantage in these markets, I believe. Assigning a lot of value to these businesses thus does not make a lot of sense to me. Autonomous driving, on the other hand, is a non-commoditized, highly valuable industry — the company that cracks this will reap huge rewards. If Tesla were to become the global leader in autonomous driving technology, that could warrant a huge part of the $1 trillion market capitalization. I do, however, not believe that it is very likely that Tesla will win in this space — others seem advantaged, despite Tesla’s efforts.

Overpromising And Underdelivering

When one only looks at the bold statements by Tesla and its leadership, particularly CEO Elon Musk, one would have to assume that Tesla must be the best there is. Elon Musk has promised, a couple of years ago, that Tesla’s self-driving technology would allow for coast-to-coast rides in 2018. Several years have passed since coast-to-coast rides should have become available, and yet, they are nowhere to be seen. Likewise, Elon Musk’s claim that there would be one million robo-taxis on the road in 2020, and yet, in 2022, there is still not a single Tesla robo taxi. Claims that Tesla’s would be money-earning assets for their owners and other promises have not come true, either. Tesla Semi, the S Plaid+, and many more promises could also be noted, which did either not come true at all or which have been delayed by a lot.

So far, Tesla bulls and Elon Musk’s fans have not really held these broken promises against the company. It is, with interest rates rising and the market becoming frothier, not certain that this will remain the case, however. I believe that investors could become more concerned about Tesla’s inability to fulfill promises on time, especially in the highly critical/important self-driving space.

Others Are Pulling Ahead

In the self-driving or autonomous vehicle tech space, Tesla is regularly making a lot of noise when it releases new iterations of its auto pilot feature. So far, these have not really been too convincing, however. Reviews such as this one or this one (both come from generally pro EV/pro Tesla sources) show that the technology is far from ready to take the wheel in all situations. The car is able to do a lot of things on its own, but that is, unfortunately, not enough. A car that makes 90 correct decisions out of 100 decisions it has to make is a great danger to its passengers and the general public, which is why Tesla’s tech can only be used with a driver that pays a lot of attention. That, in turn, means that there is no “full self driving” ability, at least for now. After all, if the driver has to be focused on the road and be ready to take control at any second, there is not really a lot of use for this technology — at least that’s what I believe.

Unfortunately, for Tesla, competitors seemingly have pulled ahead of them with their respective offerings. Mercedes-Benz, for example, recently got approval for its conditionally automated driving system — the first of its kind. It should be noted that this is still far from Level 5, but at least under some conditions (highway scenario, with a cruise speed of up to 60km/h), Mercedes-Benz’ cars are now officially approved to drive themselves:

Mercedes-Benz self-driving system approval

With a Level 3 self-driving system that is approved internationally, Daimler has become one of the most noteworthy players in this space. Surprisingly, the company has not gotten a lot of attention in that regard so far, but that might change in the future. Daimler’s system, called DRIVE PILOT, will only be rolled out in the S class and its EV equivalent, the EQS, for now. Those models are pretty expensive, with starting prices north of $100,000, thus Daimler’s technology is not being rolled out in mass market so far. Still, adapting the technology and making it available in lower-priced cars should be possible, although it may take a couple of years.

Other major competitors are doing well, too. In China, for example, Baidu (BIDU), a tech company, has started to collect fares for its self-driving taxis that are on the road in Beijing, as reported by Seeking Alpha. This service is only available in a very limited geographic market, unlike Daimler’s DRIVE PILOT feature that is being rolled out internationally. But on the other hand, Baidu’s tech seems to be able to handle complicated city traffic in a major urban market, generally seen as one of the most complicated tasks for autonomous vehicles.

Waymo, part of Alphabet (GOOG)(GOOGL), has also been rolling out its robo-taxi services in additional markets. With San Francisco being another testing market, Waymo seems to be able to handle traffic in a major metropolis as well, indicating that the company has made significant progress since rolling out the technology (for testing) in much smaller Mountain View, CA, a couple of years ago.

Looking at the California DMV’s database for companies that have a self-driving testing permit, we see a couple of other companies that are noteworthy. Cruise (GM) and Nuro are permitted to deploy their self-driving tech, while a couple of others (ZOOX, WERIDE, AUTOX, and APOLLO AUTONOMOUS) are allowed to test their tech without drivers. Tesla, on the other hand, is only allowed to test its tech with a driver, indicating that the DMV sees it as less developed and more risky. There are many more companies on the same level as Tesla, i.e. allowed to test their tech with a driver, such as Apple (AAPL), Argo, BMW (OTCPK:BMWYY), Bosch, Honda, Intel (INTC), Toyota (TM), and many more (see above link for the full list).

We can thus summarize that the first company with an internationally approved partially-self-driving system is Daimler, not Tesla. The first companies to roll out self-driving taxis are Baidu, Waymo, etc., and not Tesla. And even when it comes to testing permits, Tesla is not among the leaders. It seems to be a “middle-of-the-pack” pick, while others seemingly have surpassed Tesla.

That is not necessarily a disaster, as Tesla can still be a profitable car manufacturer even without being the AV leader. But considering that its valuation is extremely high, and that the market is assigning a massive value to the AV business, Tesla falling behind on AV tech should worry investors, I believe.

It is also noteworthy that Tesla seems rather skimpy when it comes to offering AV hardware in its vehicles. NIO, for example, deploys 33 sensors in its ET7, using cameras with up to 8MP. Compared to that, the Model 3’s 8 sensors, with 1.2MP cameras, seems pretty underpowered. It seems doubtful whether Tesla’s vehicles are really FSD-ready from a hardware perspective, as Elon Musk predicted they would be. I imagine that consumers, especially those with deeper pockets, will favor the more complete, high-powered hardware suite offered by NIO and others, relative to what they can get in a Tesla.

Risks To Consider

I do believe that Tesla is not among the top players in automotive driving tech from what I see today. It is, however, possible that Tesla will eventually launch FSD in a form that leapfrogs what we are seeing today — Tesla not looking like a leader today does not mean that it is impossible for them to turn into one such leader. I do not think that it is very likely that this will happen, but it is something investors should keep in mind, especially if they are thinking about shorting Tesla.

Tesla could also see upside momentum if other good news occurs, e.g. if the Cybertruck gets released at a sooner-than-expected time. A breakthrough in battery technology, that I do not believe is very likely but that is not to be ruled out, could also lead to renewed momentum for Tesla’s stock.

Last but not least, a so-called gamma squeeze, where option buying by investors results in increased share buying by market makers, could propel Tesla’s shares upwards. This is what initially propelled Tesla above $1000 and to new all-time highs. Sentiment does not seem too positive today, which is why I do not think another such development is likely, as it would require massive call buying by bullish investors. With a volatile stock that has a huge fan base, such as TSLA, such moves can’t be ruled out, however. Due to these reasons, I do believe that shorting Tesla could be dangerous, which is why I am not interested in doing so, despite my belief that Tesla is trading above fair value.

Takeaway

Tesla is a company with a strong brand that manages to attract a lot of buyers in the EV space. That will likely continue, which is why its growth outlook in the automobile business is very solid. That naturally justifies a premium valuation relative to how other automobile companies are valued. But the valuation difference is so large that it does not seem justified by the higher growth in the auto space alone.

With Tesla being seen as the leading player in autonomous driving technology, it seems to be clear that investors are putting a lot of value on that future business. But Tesla is, from what I see today, not the leader in this space. Others have Level 3 systems that are approved, are operating robo taxis, and offer way better AV tech in their vehicles. Tesla is great at making huge promises when it comes to its AV tech, but execution is far from great. Once more investors realize that others are pulling ahead, ultra-expensive Tesla could see its shares fall a lot. The fact that interest rates are rising, which puts a lot of pressure on expensive growth stocks, will further amplify the headwinds Tesla could be facing this year.