peterschreiber.media/iStock via Getty Images

The US private sector accounts for more than 80% of the country’s energy infrastructure. Energy is so important to the economy that it fuels, agriculture, health, and general welfare. Rising demand in the wake of the global economic recovery from the COVID pandemic pushed commodity prices by more than 20% in the year ending 2021.

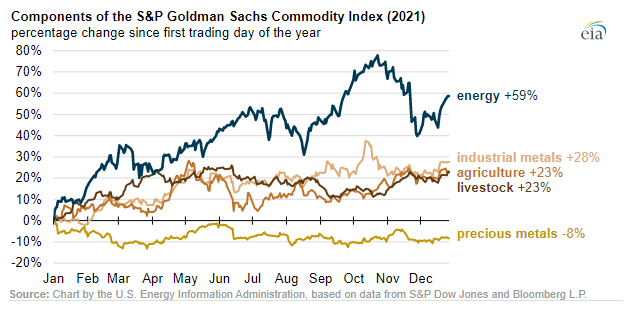

Commodity Prices in 2021

Energy prices rose the highest at 59% followed by industrial materials at 28%. Precious metals declined 8% into 2022 indicating a slow recovery for commodities such as gold and silver. In the past year, ProShares Ultra Gold ETF (NYSEARCA:UGL) was down 8.58% while ProShares Ultra Silver ETF (NYSEARCA:AGQ) declined 22.88% in the same period.

Thesis

Ahead of its next earnings date on February 10, 2022, Duke Energy Corporation (NYSE:DUK) will seek to replicate the success of its electric utilities to deliver solid full-year results. The company intends to advance its transformation towards cleaner energy forms through carbon reduction plans. Additionally, DUK thrives on a long-term earnings growth profile that will push dividend yield to the range of 5% to 7%. In this article, I will explain why this stock is a buy due to its successful capital investment opportunities and risk-adjusted return for shareholders.

Since the year ending December 2012, Duke Energy has maintained revenues above $17.45 billion on an annualized basis. As of Q3 2021, total revenues had hit $24.221 billion representing a 3.27% increase from Q4 2020. Electric utilities remain at the epicenter of revenue growth for DUK. In the 3rd quarter, adjusted earnings per share (EPS) for electric and related infrastructure rose $0.10 (YoY). Although quarterly revenues missed consensus estimates by $510.41 million at $6.95 billion, it still indicated a surge of 3.42% (YoY). Shareholders have gained 32% over the past 5 years.

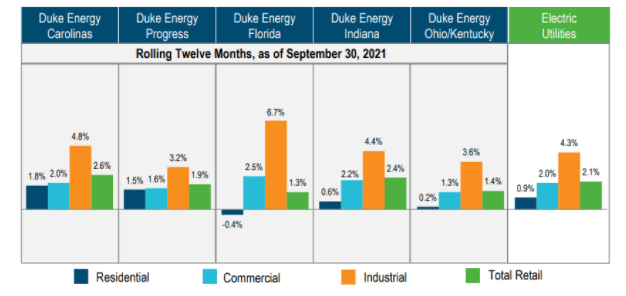

A look at the retail electric volumes shows that industrial volumes were the highest gainers into 2022. It rose 7.2% against commercial volumes at 5.3%. In contrast, residential volumes declined 0.2% despite strong customer growth. Job recovery is seen to outpace the national average even as stay-at-home workloads continue to decrease.

The Southeastern states of the Carolinas and Florida witnessed the highest residential customer growth (YTD) at 2.0% while the Midwest gained 0.8%. As of 2019, Duke’s customer base had reached 7.6 million and has since grown past 7.8 million.

In 2022, Duke Energy is planning grid improvement in the Carolinas as well as an electric distribution case to cover Ohio. While Florida ranked the least in residential revenue dropping 0.4% in the rolling 12 months ending on September 30, 2021, it registered the highest growth in industrial revenue at 6.7%.

Duke’s Energy Categories

In a bid to boost residential revenues, Duke Energy is working to balance electricity demand and supply through the “bring your own battery” (BYOB) initiative. In the study expected to end in 2023, DUK’s customers with installed batteries will discharge backed-up power into the grid when demand heightens. The aim of this project is two-fold, to reduce electricity costs as well as lower the carbon intensity in the electric network. This new feature seeks to open up diversified use of batteries alongside power storage.

Utility Investment

Overall electric utility investments will continue ramping up support in the FY 2022/2023. Investor-owned utilities (IOUs) in the year leading to July 2021, increased 306% to $130 million. The gain was due to heightened deployment of electric vehicle (EV) charging stations, rate designs to support the electrification of cars, buses, and trucks, and funding for conducting pilot programs for electric school buses.

Duke Energy Florida and NextEra Energy’s (NYSE:NEE) Florida Power & Lighting through their agreed rate case settlements added their investments to a total of $394 million. Florida’s utility commission had approved $337 million in the state by mid-2021 with North Carolina hoping to reach $80 million by mid-2022.

While Duke Energy hopes to increase its electric utility investment to cater to the robust transportation pilot programs, it is also working to reduce its operation and maintenance (O&M) costs. Since 2016, DUK has lowered its O&M for electric utility by up to $450 million. In turn, it had grown the earnings base by more than $20 billion.

In preparedness for the utility connection program expected in the Southeast, DUK announced 4 solar projects in Florida under its Clean Energy Connection initiative. The Midwest state of Ohio is also part of grid investment riders expected by 2023. The company will inject more than $30 billion to modernize the grid and improve resiliency to storm hardening and other disaster-related incidences.

Renewable Energy and Carbon Reduction Advances

In line with the global initiative, Duke Energy set a carbon reduction target of 70% by 2030. It expects to reach net-zero carbon production by 2050 with the plan scheduled for approval before 2023. The company hopes to increase the Capex for this plan from $59 billion (2021-2025) to the range of $65 billion to $75 billion between 2025 to 2029.

As a company with a stable ESG goal, I believe that this target is achievable since it had already realized a carbon reduction of 40% from 2005 to 2020. The company boasts of 10,000 MW of renewable energy within its network with a target of 24,000 MW by 2030.

The focus on clean energy became increasingly essential since the Dan River coal ash accident in February 2014. Duke Energy was responsible for the deposition of more than 39,000 tons of coal ash into Dan River, located in North Carolina. The company was forced to pay $102 million in damages to biodiversity although investigations revealed no serious long-term effects to the river. Duke was saved from going under after it was allowed in 2019 to charge ratepayers the first batch of $778 million of cleanup costs attributed to the accident.

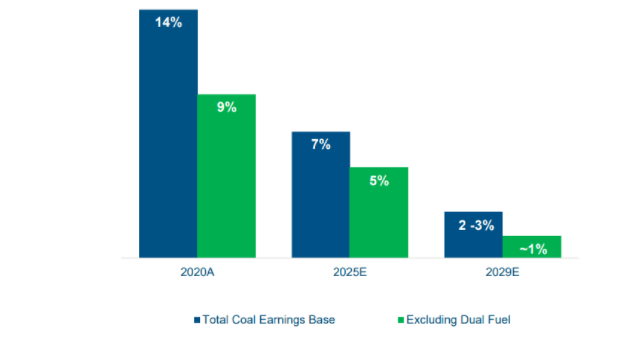

As of 2020, the total coal earnings base for Duke Energy stood at 14%. It was reduced to 9% after excluding dual fuel value. By 2025, the total earnings base for coal will be lowered to 7% before ranging at 2-3% 2025.

Seeking Alpha

To achieve a clean energy mix, Duke intends to optimize its production of solar, storage dynamics, and nuclear energy production. The Oconee nuclear station is expected to lead in the fleet transition. In conjunction with Accenture (NYSE:ACN) and Microsoft (NASDAQ:MSFT), Duke intends to develop a methane emissions monitoring system. Operating income as a result of increased innovative research and development (R&D) has increased 18.44% from $4.913 billion in 2014 to $5.83 billion in Q3 2021.

Duke has been successful in advocating for lower interconnection costs for utility-scale solar systems in North and South Carolina.

Dividend and profit

Duke’s forward dividend yield is at 3.84% at a 5-year growth rate of 3.03% and an annual payout of $3.94. The company is committed to a long-term dividend growth plan. Total shareholder return is also at a risk-adjusted rate of 10%. The EPS is expected to grow to the range of 5-7% through 2025.

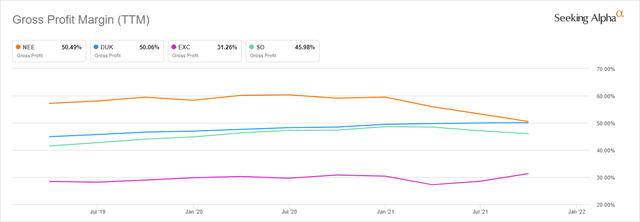

In terms of gross profit growth, Duke has trailed NEE by 0.43% over the past 3 years.

Seeking Alpha

DUK’s profit margin rose above Exelon Corporation (NASDAQ:EXC) at 31.26% and the Southern Corporation (NYSE:SO) at 45.98% since 2019.

Risk

Duke’s carbon reduction plan has to be approved by the North Carolina Utilities Commission (since the company is headquartered in Charlotte). Failure to meet this timeline by end of 2022 will affect the generation of renewable energy especially in the enactment of the House Bill 951 passed by Congress. The legislation also involves the securitization of 50% of sub-critical coal plans upon retirement. Duke expects to use this law to continue billing lower rates to customers.

The company’s total liabilities have soared 45.33% since 2014 from $79.658 billion to $115.767 billion. With current assets (including cash and its equivalents) at $9.436 billion, Duke Energy will find it hard to cater for its current liabilities (debt obligations due by end of 2022) which stand at $15.556 billion. However, the company has increased its total assets by $46.45 billion since 2014 indicating a surge of more than 38% in the stated period. Revenue per share (RPS) has also declined 6.72% from $34.06 in 2019 to $31.77 as of Q3 2021.

Bottom Line

Duke Energy’s stock has gained more than 32% over the past five years. The company intends to execute a carbon reduction plan upon approval by the North Carolina Utility Commission. The Dan River coal-ash spill accident prompted the company to begin reducing coal earnings base expected to hit a low of 2% by 2029. Duke’s renewable energy mix consists of solar and nuclear power. The company intends to begin discharging backed-up power in grids during peak demand to lower energy costs and reduce the carbon footprint. Aside from the lower revenue per share and increased liabilities, I would recommend a buy rating for the stock.