simpson33/iStock via Getty Images

In June of last year, I thought Limelight Networks (LLNW) stock looked intriguing near $3. The company and the stock had struggled up to that point, with disappointing 2020 results leading to a new Chief Executive Officer and a roughly two-thirds decline in the LLNW stock price. But despite real challenges, there was hope for a turnaround. I closed that article by writing:

Either way, the long-term case doesn’t have to be right for there to be some short-term upside if it looks like Limelight Networks is getting back on track. This is a story that investors might be, and maybe should be, able to talk themselves into. Despite my own checkered history with LLNW stock, I might be one of those investors.

As I turned out, I unfortunately was not one of those investors. LLNW has gained more than 30% since, in large part due to a 14% gain on Friday following well-received Q4 2021 earnings after the bell on Thursday.

With that short-term upside secured, attention now turns to the long-term case. And there, the situation gets a bit more dicey. The broad (and slightly unfounded) optimism I held last year still holds: Limelight has a path to substantial upside ahead. But the reaction to Q4 looks like it incorporates that optimism and potentially then some with a long- and still-stagnant company once again being priced as if consistent growth is on the way.

After that rally, the case for Limelight Networks stock really comes down to trust in management. It’s not unreasonable to have that trust, but for me personally, it’s not quite enough just yet.

The Too-Simple Bull Case for LLNW Stock

It’s relatively simple to build a bull case for LLNW stock, particularly with solid Q4 results and 2022 guidance suggesting the company indeed is getting back on track. The CDN (content delivery network) provider offers a play on the steady expansion of content, ranging from video games to cloud computing to streaming media. Limelight’s move into “edge computing,” boosted by last year’s acquisition of Layer0, offers another potential growth driver going forward.

And yet Limelight looks rather cheap — and maybe stunningly cheap. Using the midpoint of 2022 guidance, LLNW trades at less than 3x revenue. Even amid a rout in growth stocks, peer Fastly (FSLY) trades at about 7x the consensus top-line estimate for this year. A ~$600 million market capitalization seemingly makes Limelight a potential acquisition target, whether for industry leader Akamai (AKAM) or even Amazon (AMZN), Limelight’s largest customer and a CDN provider itself.

It was that bull case that no doubt led LLNW to $8 back in the summer of 2020, a time when any kind of trend/growth stock was performing well. It was only a series of poor earnings reports, starting with the Q3 2020 release in October, that led the stock back to the lows. But with performance steadily improving under new CEO Bob Lyons, who took over on Feb. 1 of last year, that bull case seems set to re-emerge.

That in turn suggests at least the possibility of LLNW moving higher from the low 4s. Revenue multiple expansion to narrow the gap with FSLY can help. So can continued confidence in the story, given that LLNW held $6-plus for most of the summer of 2020 before performance turned south.

But there’s something exceptionally important to consider here: this simply isn’t a great business, at least on the CDN side. LLNW is a tech stock in the sense that Limelight is a tech business, but its profile is far less attractive than most tech names. Capex is reasonably high, averaging 11.6% of sales over the past five years. Gross margins are not close to those in the software space, for instance, topping out in the mid-40s historically. That’s in large part because pricing not only decreases over time, but falls as volume with key customers increases.

There’s a reason that Limelight went public at $15 in 2007 and sees its share price now barely above $4. To be sure, the nature of the business doesn’t preclude LLNW stock from being a buy. But it does mean that performance needs to be taken in context, and that might color the proper reaction to the Q4 report.

Was The Q4 Earnings Report That Good?

Performance in Q4 unquestionably is a sharp improvement from recent quarters. Guidance for 2022 looks solid as well. But if the premise at last year’s lows was that Limelight needed to prove it was back on track, I’m not quite sure that bogey has yet been hit.

Certainly, Limelight management tried to make that case. Lyons in the Q4 release cited “meaningful progress in our core business with dramatic performance improvements in our network” and on the Q4 claimed the quarter showed Limelight had “achieved positive momentum in the business.” 14% revenue growth both quarter-over-quarter and year-over-year supports his case.

But this is a company that was performing so poorly through the first half of 2021 that its stock price touched a two-year low (in the middle of a bull market, no less) and its CEO was fired. Year-over-year and even quarter-over-quarter comparisons should look solid. And taking the longer view, even the outlook for 2022 doesn’t look all that impressive.

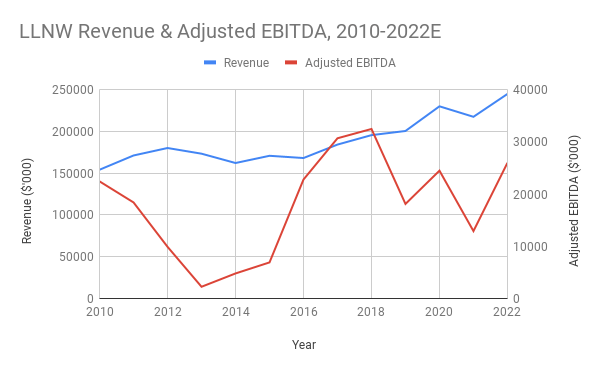

Using the midpoint of guidance, Adjusted EBITDA should rise 6% from 2020 levels. Revenue growth excluding Local0 should come in around 3-8%, meaning the CDN business still is expected to underperform 2020 results. A broader view doesn’t help the cause much either:

Vince Martin From Limelight Press Releases

The multi-year decline is due largely to a ~600 bps contraction in Adjusted EBITDA margins. And while operating leverage can drive margin expansion if revenue growth continues, that’s the only path. Limelight already pulled some $30 million in annualized costs out of the business in recent quarters. That’s a figure greater than the projected EBITDA figure for this year, and one that suggests limited room for further margin improvement beyond top-line growth.

Admittedly, it seems capricious to argue in June that progress toward a turnaround should move the stock higher — and then seemingly dismiss that progress when it arrives. So, to be clear, there is progress here. And the Q3 and, particularly, Q4 releases are important in that they at least validate the story Lyons told from the jump: that Limelight’s problems were largely self-inflicted.

That’s enormously important. There was a real possibility that Limelight’s post-pandemic struggles were due to intractable problems with the business model. Chief among them would be the reliance on streaming video, which creates high peaks of demand — and expensive periods in which capacity is left unused.

But the stock, after a modest decline on Monday, has rallied 33%. That move seemingly incorporates the good news that there was in the Q4 results and the 2022 outlook. At the midpoint of that outlook, Limelight trades at 24x EBITDA. Free cash flow, long an issue, is projected to be modestly negative excluding any working capital adjustments.

All told, from this point, Limelight still has quite a bit of work left to do for there to be even more upside ahead. The question is whether it’s worth betting that more improvement is on the way.

Same Old Limelight?

Lyons held his first conference call as CEO a little less than a year ago. And as I wrote last year, the tenor of that call was very much “same old Limelight.” Lyons reiterated a long-held goal of Limelight to be a so-called “rule of 40” business, a target that remains bizarre since: a) it applies to SaaS companies, which Limelight is not; b) it’s exceptionally arbitrary for a mature business and c) Limelight has never come remotely close to that target in the last decade. The market seemed to agree, as Limelight fell double-digits the following day.

This year’s Q4 call had a little bit of the same sense. There was a lot of cheerleading for results that, again, are meaningful, but hardly exceptional. In the Q4 release, Limelight touted a record traffic day on December 5, ignoring the point that every December should have a record traffic day, given steadily growing traffic demands and the seasonality of the business. Indeed, in the Q&A of the call, Lyons admitted that it was gaming console traffic that was the driver. Touted wins averaging $100K+ in annual contract value total in the range of 1% of annual revenue at best.

To be blunt, the commentary around the quarter sounded awfully promotional — which, in turn, once again sounds like “same old Limelight.” All that’s really happened here is that Limelight has fixed its performance issues, which has allowed it to regain traffic at multi-CDN customers like Amazon.com, its largest. (Amazon accounted for 30% of revenue in 2020; the 10-K for 2021 hasn’t yet been filed.) That’s what the numbers say, and that is what Lyons’s commentary over the past few quarters has said.

Again, that’s progress. But from here, the bull case rests on management. Limelight has to continue to improve performance. It has to find a way to take out more costs in the CDN business, given pricing compression. Lyons cited “architectural opportunities” that can increase capacity, an echo of past software-driven results that boosted results a few years back. If those improvements can be found without sacrificing performance, they can drive the margin expansion needed to get EBITDA back toward the $35 million-plus level, at which point the LLNW stock price starts becoming more justified fundamentally.

The more important initiatives, however, are in edge and security. It does seem like Limelight is going to have a busy 2022 on those fronts, with Lyons promising multiple announcements this year. Here, again, the company has work to do: Limelight’s edge business so far doesn’t appear to be all that successful. Last year, the company said about 10% of revenue came from edge, making it a tiny offering even against a legacy CDN like Akamai. The proportion this year wasn’t disclosed, and one would think Limelight would offer more color if edge revenues were growing at an impressive clip.

In terms of security, Limelight hasn’t yet given much detail, though information should be arriving relatively soon (again, per Lyons on the call). The CEO said on the Q4 call that Limelight planned to “sell security as an enterprise solution” — which seems a hugely bold plan. Limelight has essentially zero experience in that area, and in such a crowded space, it’s difficult to see how Limelight can stand out, even with its leadership in CDNs.

Certainly, neither opportunity can be written off just yet. But both are hugely important to the long-term bull case here. The danger in relying on the CDN business for upside is highlighted by the fact that the home page of Layer0’s own website claims “traditional CDNs are broken, and slow down both the development team and website speed.” The acquisition of that company, the focus on edge, and the move into security all seem like part of a broader plan led by Lyons to make Limelight no longer a traditional CDN.

That’s an intriguing plan. It’s probably a necessary plan. But it’s an ambitious and even risky undertaking. And it’s also a plan that itself belies much of the optimism delivered on the Q4 call. If Limelight itself believes that being a traditional CDN isn’t enough, as appears to be the case, then the performance of the last few quarters represents only a very small step in the broader turnaround. That in turn suggests that a 30%-plus rally since June (and an 80%-plus move off early October lows) might be as much as LLNW can post, at least until more such steps are taken.