Tippapatt/iStock via Getty Images

Following a disappointing end to 2021 for FinTech stocks, investors have sifted through the wreckage and picked their winners with Global Payments (GPN) being the headliner. Up 20% since its December low, the stock is outperforming the sluggish -10% and -40% returns of industry stalwarts PayPal (PYPL) and Square/Block (SQ) respectively. Given this surprising trading action, let’s dive into the reasons why GPN could be a better bet for 2022 and beyond.

Strategic Focus On Core Business

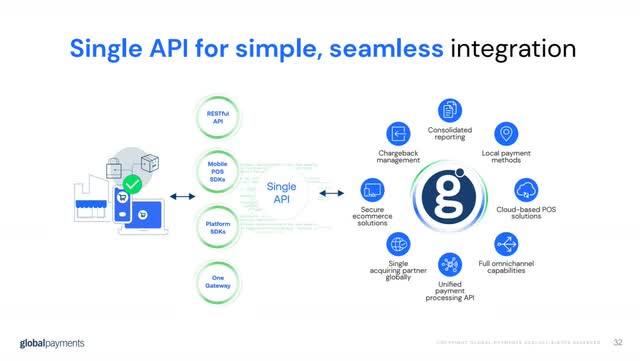

Within the FinTech space, the largest opportunity remains in the crossroads between payments and software: a growth vertical that GPN continues to exploit. For each of the company’s revenue streams, they have been able to integrate numerous technological solutions, creating a seamless experience for customers.

Global Payments 2021 Investor Day

Let’s take a look at merchant services which have come a long way from being just cloud-based point-of-sale (POS) solutions. Global Payments was able to capitalize on the digitization trend by building one platform, or API, through which businesses can manage their entire process. From payments to loyalty programs, payroll management to financial reporting, they are winning over main street and large enterprises as reflected by their 115% net revenue retention. It’s no wonder that the revamped offering has consistently delivered 10%+ organic growth annually and posted 20% growth this past quarter.

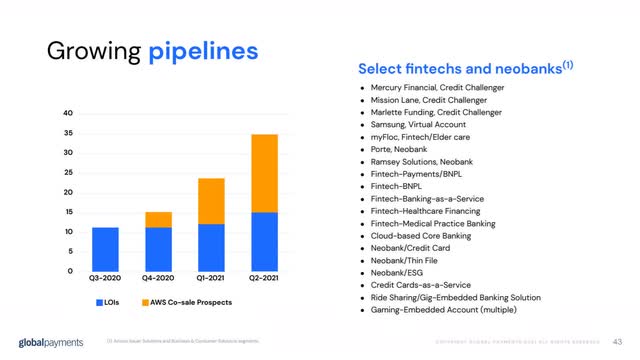

A similar story is seen in their issuer solutions where GPN has combined their cloud-native solutions with Amazon’s (AMZN) AWS to tackle the next generation of banking.

Global Payments 2021 Investor Day

By using their issuance technology to address digital-only neobanks that are expected to grow at almost 48% CAGR through 2028, they will inject this revenue stream, whose growth has slowed to high single digits, with much-needed life. Not only does help the company expand beyond traditional banking clients, but it also triples their TAM from $225B to $640B+ and exposes them to a new generation of consumers.

Both of these moves deeper into the payments software space have been enabled by strategic M&A done in the past: some small, like Ezidebt and PayPros, and some large, like Heartland Payments System and TSYS. Management understands that it has a well-established platform, all it needs to do is “plug-and-play” the technological services they acquire into their offerings.

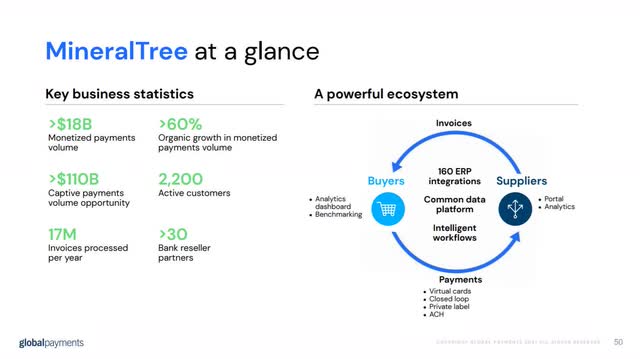

The recent $500M acquisition of MineralTree is especially emblematic of this attitude. On the surface, it seems Global Payments is acquiring a B2B payments company, but it’s so much more.

Global Payments 2021 Investor Day

GPN plans on plugging in MineralTree’s SaaS automation processes into its business and consumer solutions line to develop a large-scale supplier relationship management platform for more efficient supply chains. This perfectly adapts to our current environment where many companies are looking to digitize supply chains amid a global crisis.

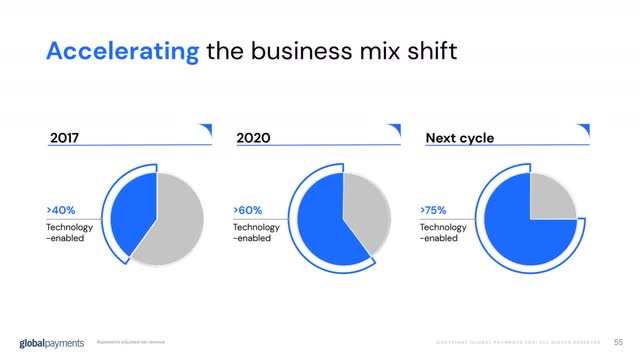

It is through efforts like this that Global Payments has been able to transform from a payment processing company to a technology-as-a-service (TaaS) company.

Global Payments 2021 Investor Day

Just look at the rapid acceleration in tech-enabled revenue growth from 2017 to 2020. And not to mention their 75% target over the next 3-5 years, which we find to be conservative given that they’ve already achieved this in the North America region: their largest geographic center. With GPN’s strategic, straightforward execution, the sky is the limit for the TaaS giant.

Better Positioned Than PayPal & Square

Global Payments will forever be linked to PayPal and Square through their payments processing ties, but while the former worked to refine its position as payments technology and services leader, the latter became uber reliant on the consumer rather than their own products. Although this resulted in explosive growth for them over the past few years, both will run into fundamental problems in the future.

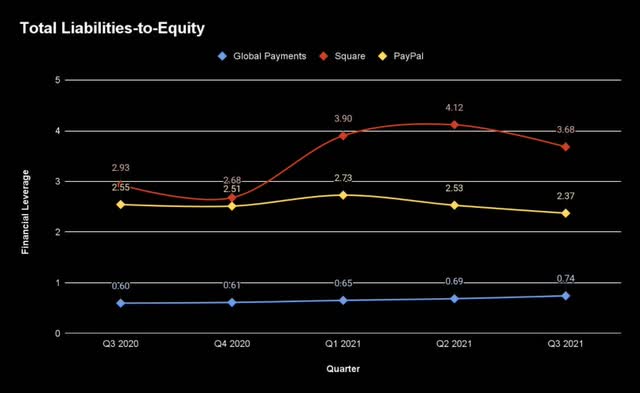

The first is the balance sheet, mainly driven by M&A expense. To grow consumer-facing businesses like PayPal and Square, you must find new ways to interact with buyers. But with this comes the need to make large deals, or a lot of them, to constantly acquire new consumers. This aggressive strategy can be best visualized by the long-term liabilities both have taken on to finance growth.

North Post Research & Stock Analysis

Using a version of the debt-to-equity ratio (total liabilities-to-equity) as our measure of financial leverage, we see PayPal and Square’s balance sheets are on life support at 3.68x and 2.37x figures.

While the two FinTech giants are forced to focus on the quantity of deals, Global Payments hones in on the quality. To put this perspective, Square’s $29B acquisition of Afterpay is equivalent to the total M&A GPN has done since 2009. And PayPal isn’t that far off either, doing $10B+ in deals over the past 3 fiscal years with President Dan Schulman committing $3B to the cause annually.

|

FY 2019 Revenue Growth |

FY 2020 Revenue Growth |

FY 2021 Revenue Growth (Expected) |

FY 2022 Revenue Growth (Expected) |

|

| Global Payments | 45.91% | 51.13% | 15% | 20% |

| PayPal | 15.02% | 20.72% | 18% | 17% |

| Block | 42.91% | 17% | 12% | 6% |

(Note that Square’s 2020 & 2021 numbers are Bitcoin (BTC-USD) adjusted)

Yet, despite all those moves, Global Payments’ revenue growth was only outperformed once (PayPal in FY 2021).

What’s more is that the two won’t be able to sustain this growth model in a rising rate environment where deals cost more. This is where we see GPN excel. Not only do they engage in strategic M&A that practically contributes to the core business, but they also simultaneously preserve the balance sheet, as evidenced by its low 0.74x leverage, perfect for a hawkish Fed.

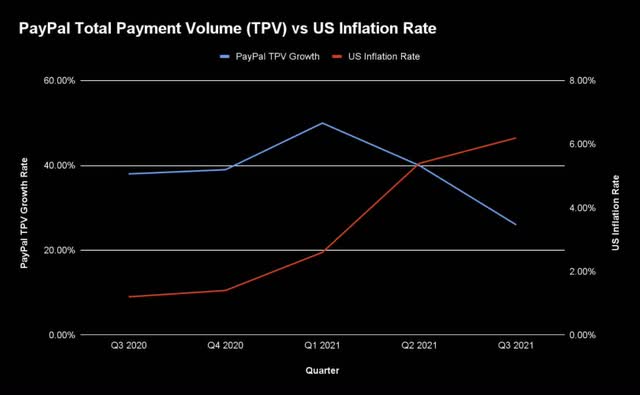

Another core issue with PayPal and Square is their high exposure to the consumer. Following the Afterpay acquisition, both companies will have a “Pay with ___” option under every online store. However, this leaves them vulnerable to many inflation-related headwinds like slowing payment volumes and consumers’ reluctance to spend due to record high prices.

North Post Research, PayPal Q3 2021 Earnings Presentation, & Trading Economics

When looking at PayPal’s total payment volume, it seems like both these issues have come to heads and hampered growth. Since Q1 2021, we see a clear inverse correlation between TPV and the inflation rate – a problem that is likely to be more evident when PayPal releases its Q4 earnings as inflation ballooned to 7%.

For Global Payments, managing this problem was far easier. Instead of relying on the consumer, they depend on businesses, small and large, to spend on their digital services. These tech-enabled offerings should serve as a stronger revenue stream and deliver higher growth as competitors grapple with the consumer crisis that inflation has created.

Finally, we believe that BNPL has a strong chance to underperform. The allure of this new payment method is there: buy anything, anywhere with small interest-free payments. However, miss one payment, and you’ll be on the hook for absurd debt payments with interest rates of up to 30%. This is a critical flaw in BNPL, especially given it targets a younger demographic that frequently overspends and doesn’t understand how to manage credit. The risk of exorbitant late fees scaring users off is often overlooked by bullish investors but is slowly becoming a major headwind.

Now it should be acknowledged that many consumers are smart with BNPL and as such, it has seen amazing 30%+ growth. Despite these figures, high expectations coupled with real concerns have left much room for it to disappoint. With PayPal and Square making substantial multi-billion-dollar pushes to dominate the space, we caution them not to put all their marbles in one basket and become overly reliant on the growth of this new payment method.

Valuation

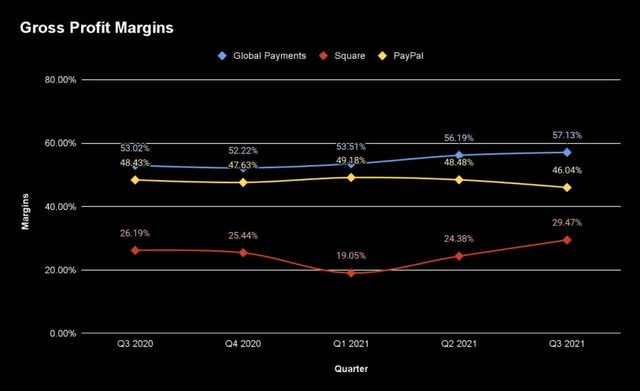

The strength of Global Payments’ business model is reflected through its industry-leading gross profit margins and strong earnings.

North Post Research & Stock Analysis

Here we see that Global Payments’ technological focus has helped it expand margins by 500 basis points over the past 5 quarters, helping it stay well ahead of PayPal and Square.

| 2021 EPS Expectations | 2022 EPS Expectations | Earnings Growth | |

| Global Payments | $8.15 | $9.59 | 17.7% |

| PayPal | $4.61 | $5.29 | 14.8% |

| Block | $1.68 | $1.89 | 12.5% |

It has also yielded higher, more sustainable earnings, as GPN is expected to lead the pack in EPS growth.

Additionally, the company is paying shareholders a 0.7% yield to sit back and watch them outperform expectations, with ample room for dividend hikes driven by a pristine balance sheet and 20%+ free cash flow growth.

Trading at just 15x FY 2022 earnings and 5x FY 2022 sales, Global Payments looks to remain a winner now and in the future.

Sustainability

At North Post Research, we have recognized the importance of valuing companies not only by traditional metrics, but also by their Environmental, Social, and Governance (ESG) goals. In addition to our analysis, we will be adding a sustainability scorecard that grades the beliefs and initiatives of each company. Global Payments’ full sustainability report can be found here. Its total average score was 8.

Environmental: 6/10

Innovation doesn’t stop at GPN’s revolutionary FinTech products – it spreads its wings everywhere, including environmental efforts. In Atlanta, they are consolidating 4 office locations into a brand-new “Office of the Future,” an eco-friendly building that looks to promote inclusion. The move is part of their larger three-fold strategy to reduce their carbon footprint.

The first step is combing physical locations with companies they have done M&A with. Since the TSYS merger, Global Payments has dramatically shot down the number of offices from 242 to 183 by the end of 2022. Next is moving more workers to a hybrid/full-virtual working environment. Not only has this worked in tandem with the first step, but productivity has also skyrocketed at the company and 73% say they feel positively engaged – 5% above the global average. Lastly, GPN is leveraging its advanced technology to move operations onto a cloud-based system. This helps support workers at home while also reducing the need for large enterprise data centers and other physical offices.

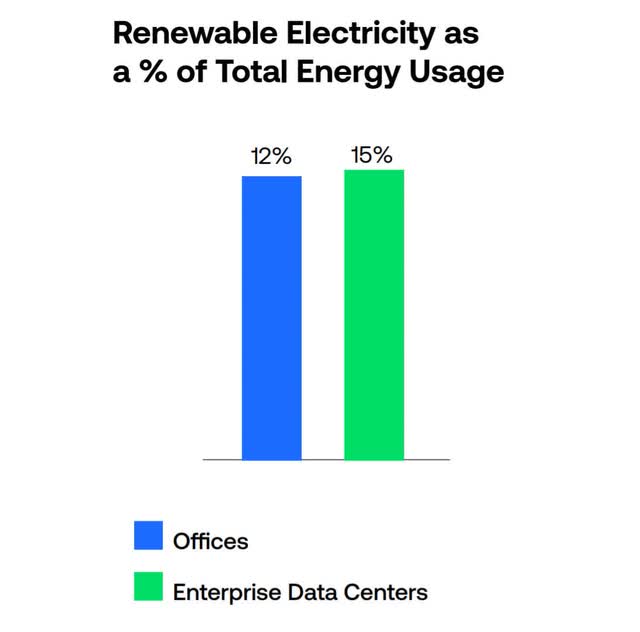

Although these efforts are laudable, the environment, unfortunately, doesn’t hand out participation trophies. Global Payments’ current environmental statistics are lousy at best.

Global Payments 2021 Global Responsibility Report

Despite a declining number of offices, just 12% of total energy usage from buildings comes from renewable sources.

The bleak figure severely puts into question their 2040 net-zero commitment goal. To put it in perspective, Home Depot (NYSE:HD), a nationwide retailer with over 10,000 locations, has the same 2040 net-zero goal with more stores and supply chain holes to cover.

This lackluster performance overshadows the unique efforts GPN has made, forcing us to take 4 points off and leave them a poor score.

Social: 8/10

Global Payments’ underlying business itself plays a considerable role in social impact. From aiding our main street businesses that power the economy to supporting non-profits and educational institutions, GPN’s solutions are very much entrenched in society.

This was very much evident during the pandemic, when it, alongside other FinTech companies, made it easier for companies to apply for loans; access over 75 lenders; and unlock a pool of billions of dollars such that small-and-medium-sized businesses could grow through COVID-19.

Additionally, there is quite a philanthropic culture amongst GPN employees. With 2 days dedicated to service projects, over 100 non-profits under their reach, and 30% regularly volunteering within their communities, they have undoubtedly become a driving force for good.

While its community impact may be unmatched, diversity could use some serious help.

Global Payments 2021 Global Responsibility Report

According to the U.S. Bureau of Labor Statistics, approximately 41% of women and 26% of POC’s held leadership positions in 2021, with those figures expected to expand rapidly over the next few years. This means that both Global Payments’ current diversity percentages and future goals would be under the U.S average. Not to mention the fact that the company never outlined its hiring practices or a plan for achieving these goals. The uncertainty surrounding leadership diversity leads us to subtract 2 points.

Governance: 10/10

With ten of twelve directors on the board being independent, and 50% of them being diverse, GPN’s management has a broad range of perspectives that have helped contribute to its success. Additionally, 83% have industry experience and 75% have a deep understanding of the cybersecurity space, something we need to see from more boards.

Management’s knowledge and active nature in the cybersecurity space is the reason why it’s the standard for data governance. Through frequent cybersecurity assessments which enable the board to review and act upon holes in the systems, Global Payments is making a true commitment to solving privacy concerns. The company’s chief information security officer (CISO) has also made it a priority to protect consumer payment data, which is why they became the first company listed as compliant with the Payment Card Industry’s (PCI) Secure Software Framework.

From a strong board of directors to secure cybersecurity practices, Global Payments has earned a perfect grade.

Final Thoughts

In a market where balance sheets finally matter and valuations are looked at closely, Global Payments presents a premier opportunity in the FinTech sector over high flying growth stocks like PayPal and Square. With double-digit growth, inflation protection, and a dividend, we recommend investors aggressively buy into the volatility as high-quality cheap stocks won’t stay at these levels for long.