Evgeny Gromov/iStock via Getty Images

Welcome to Vanadium miners news. January saw higher vanadium prices (especially in Europe) and a slower month of news.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

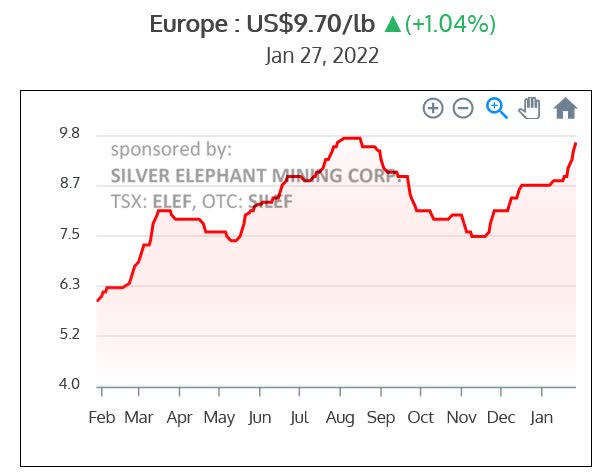

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 9.70/lb (China price not given)

Vanadium pentoxide Europe price chart

Vanadiumprice.com

China and Europe Ferrovanadium [FeV] 80% prices – China = USD 40.00, Europe = USD 39.25

Ferrovanadium China & Europe price chart

Vanadium demand versus supply

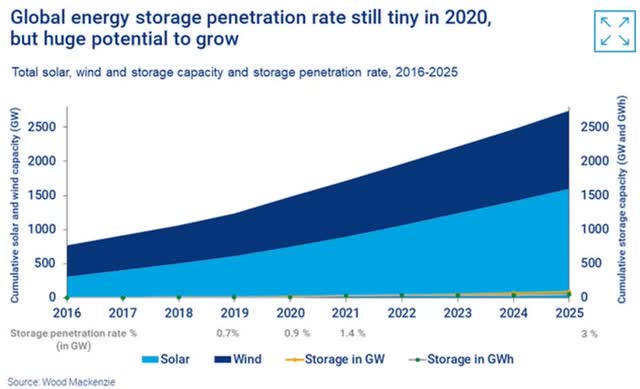

An April 2021 Wood Mackenzie report stated:

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

Woodmac forecasts high growth ahead for solar, wind and energy storage

Woodmac forecasts high growth ahead for solar, wind and energy storage

An early 2021 Roskill post stated:

The vanadium market is set to tighten over the year and more so in 2022, driven by higher demand but also by tighter supply, as Chinese steel slag producers are running close to capacity. Outside of China, incremental supply will also be limited and come mainly from AMG’s new facility in Ohio, USA, and Bushveld’s Vametco gradually increasing its production in South Africa. Roskill believes that vanadium prices reached a low in Q4 2020 and should gradually rebound in 2021…..Vanadium redox batteries (VRBs) could become a major market for vanadium amid growing demand for energy storage, should the technology develop….On the supply side, Roskill does not expect significant tonnages from new projects to enter the market before 2024.

In 2017 Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries….

Vanadium market news

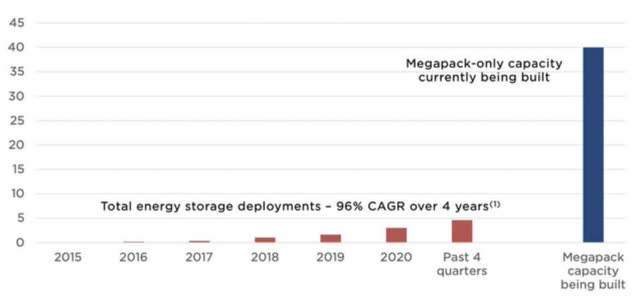

On January 7 DriveTeslaCanada reported:

Tesla set to introduce larger Megapacks this quarter, targeting to grow Megapack production to nearly 50GWh by 2023……For comparison, the company currently produces around 4GWh of Megapack storage capacity per year…..If Tesla is able to achieve that rate and sell every single unit it produces, that will equate to about $22 billion in revenue based on today’s Megapack pricing. In Q3 2021, the most recent quarter that there is data available for, Tesla earned $806 million in “Energy generation and storage” revenue…

Tesla energy storage deployments maybe about to soar

Tesla energy storage deployments maybe about to soar

On January 17 Fastmarkets reported: “Largo Q4 production down 40% after heavy rains in Brazil.”

On January 18 Fastmarkets reported:

European FeV prices gain momentum on supply concerns in Brazil, increased buying appetite……One of the main drivers is that vanadium pentoxide (V205) producer Largo was disrupted by heavy rainfall in November and December at the company’s Maracás operations.

On January 24 Fastmarkets reported:

V2O5 up by nearly 12% due to tightness following ferro-vanadium gains. Tightening prompt inventories continued to push European vanadium prices higher amid high liquidity and restocking. Vanadium pentoxide (V2O5) was up by nearly 12.0% on very low stocks in Europe. After a quiet period with little demand, an end-consumer tender triggered higher offers showing the extent of the increase, with sales concluded at $10 per kg……

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

No vanadium news for the month.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

No news for the month.

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On January 19, Bushveld Minerals Limited announced:

Revised arrangement on the VRFB Holdings Limited (“VRFB-H”) Investment by Mustang Energy Plc (“Mustang Energy”). Bushveld Minerals Limited, the AIM-quoted, integrated primary vanadium producer and energy storage solutions provider, with ownership of high-grade assets in South Africa, announces revised agreement terms regarding Mustang Energy’s acquisition of a 22.10 per cent interest in VRFB-H.

On January 26, Bushveld Minerals Limited announced: “Q4 and full year 2021 operational update.” Highlights include:

- “…..Achieved Group production for the 12M 2021 of 3,592 mtV, at the upper end of 2021 guidance of between 3,400mtV and 3,600mtV. Production was marginally lower than 12M 2020 (12M 2020: 3,631 mtV1). H2 2021 Group production of 2,018 mtV was 28.2 per cent higher than H1 2021 (H1 2021: 1,574 mtV), on the back of the operational improvements implemented after the production target rebasing in H1 2021.

- Vametco production cash cost (C1) for the 12M 2021 of US$24.0/kgV, in line with guidance of between US$23.7/kgV and US$24.2/kgV.

- Vanchem production cash cost (C1) for the 12M 2021 of US$30.6/kgV, in line with guidance of between US$30.3/kgV and US$31.1/kgV.

- ….impacted by challenges in international logistics channels arising from COVID-19, the unrest in South Africa and disruptions at local ports in July and August……

- Unaudited cash and cash equivalents as at 31 December 2021 of US$15 million (30 September 2021: US$25 million). The cash outflow includes amortising circa US$1.4 million of the Nedbank Revolving Credit Facility, retirement of Duferco convertible of US$2.5 million and final payment of deferred consideration for Vanchem of US$2.2 million.”

On January 27 Fastmarkets reported: “Bushveld Minerals looks for 20% increase in FeV production in 2022.”

You can view the latest investor presentation here.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF)(NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On January 17, Largo Inc. announced: “Largo reports fourth quarter and full year 2021 operational results; Sales exceeds lower end of guidance despite rain-related production disruption in November-December; Provides 2022 guidance.” Highlights include:

- “Quarterly sales of 2,899 tonnes of V2O5 equivalent in Q4 2021 vs. 3,751 tonnes in Q4 2020; Annual V2O5 equivalent sales of 11,393 tonnes in 2021, representing an 11% increase over 2020 and exceeding lower-end of 2021 V2O5 sales guidance (11,200 – 11,800 tonnes).

- Quarterly V2O5 production of 2,003 tonnes (4.4 million lbs1) in Q4 2021 vs. 3,340 tonnes in Q4 2020, which was the Company’s historic record quarterly production; Annual V2O5 production of 10,319 tonnes (22.7 million lbs1) in 2021 vs. 11,825 tonnes in 2020.

- Quarterly global V2O5 recovery of 76.0% in Q4 2021 vs. 80.6% in Q4 2020; Annual global V2O5 recovery of 79.7% in 2021 vs. 81.4% in 2020.

- Q4 2021 operational results were impacted by heavy rainfall at the Company’s Maracás operations in November and December.”

2022 Guidance

- “Operating, Sales and Cost Guidance: V2O5 Equivalent Production and Sales of 12,000 – 12,750 tonnes. Cash Operating Cost Excluding Royalties4 of $3.20 – 3.40/lb V2O5 sold. Vanadium Distribution Costs of $7.0 – 8.0 million. Corporate and Sales & Trading G&A of $10.0 – 11.0 million. Largo Clean Energy G&A of $15.0 – 18.0 million.

- The Company expects to deliver its first VCHARGE vanadium redox flow battery (“VRFB”) sales contract with Enel Green Power España in Q3 2022.

- Planned 6-day Maracás processing shutdown in January: The Company has planned this to perform maintenance on its plant cooler engine system and power substations; V2O5 equivalent production is expected to be in the range of 750 – 800 tonnes in January.”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a small vanadium producer.

No vanadium news for the month.

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

No news for the month.

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On December 20, Western Uranium & Vanadium Corp. announced:

Western Uranium & Vanadiumcorporate update……Mining Operations at the Sunday Mine Complex (“SMC”) continue to produce results far beyond expectations. Work on the GMG Ore Body involves the continued development of high-grade ore zones. ….Limited mining has produced over 600 tons of very high-grade uranium/vanadium ore.

Investors can read the latest company presentation here.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On January 28 Neometals announced: Quarterly Activities Report Q4 2021. Highlights include:

“Cash balance A$72.8 million, receivables and investments of A$47.9 million and no debt…….

Barrambie Titanium and Vanadium Project (“Barrambie”) (100% NMT)• Preparation of Barrambie mixed gravity concentrate sample for Jiuxing commercial smelting trials in China continued in parallel with Pre-feasibility study targeted for MarQ 22 completion;• Leading mining service providers progressing due diligence to provide “Build-Own-Operate” proposals for the development of Barrambie on a capital-light basis with Australian mining and beneficiation operation coupled to Chinese refining activities; and• Ongoing evaluation of strategic options to deliver Barrambie value to shareholders.”

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On December 29, Australian Vanadium announced: “VSUN Energy to install VRFB at Water Corporation Site.” Highlights include:

- “5kW/30kWh vanadium redox flow battery [VRFB] to be installed to power a water purification chlorinator for Water Corporation WA……”

Catalysts include:

- 2022 – BFS due.

- 2022 – Possible further off-take and/or JV partner announcements.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On January 21, Technology Metals Australia announced: “Strengthening of vanadium electrolyte technology partnership. MoU with global vanadium electrolyte leader le system expanded and extended.”

- “TMT and LE System, a leading Japanese VRFB R&D company, have mutually agreed to expand and extend the vanadium electrolyte Memorandum of Understanding [MOU].

- Scope to build Australia’s first fully integrated vanadium electrolyte plant utilising vanadium from TMT’s Murchison Technology Metals Project, a key commercial advantage.

- Investigating development of vanadium electrolyte production capacity in Australia utilising LE System’s proprietary technology.

- Feasibility Study [FS] to be prepared jointly with technical support provided by LE System.

- Vanadium electrolyte is the key component in vanadium redox flow batteries [VRFBs].”

You can view the latest investor presentation here.

TNG Ltd [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On January 25, TNG Ltd. announced:

December 2021 quarterly activities report. Australian engineering and construction company Clough appointed to help advance the integrated mining and processing layout for Mount Peake, with a new plant layout completed in November. Project financing advancing on multiple fronts. $12.5 million raised via share placement.

You can view the latest investor video presentations here.

Silver Elephant Mining Corp. [TSX:ELEF] (OTCQX:SILEF) (100% owned subsidiary Nevada Vanadium LLC)

Silver Elephant Mining Corp. is a Canadian public company listed on the Toronto Stock Exchange. The Company now plans to exit from its non-silver assets (keeping its Bolivia silver assets), such as the Gibellini Black Shale primary vanadium project and the Bisoni Vanadium Project.

January 12, Silver Elephant Mining Corp. announced: “Silver Elephant receives final court approval, sets January 14 as effective date for plan of arrangement.”

January 12, Silver Elephant Mining Corp. announced: “Silver Elephant provides update on its pre-consolidated share trading.”

January 17, Silver Elephant Mining Corp. announced:

Silver Elephant completes plan of arrangement, post-arrangement shares to trade on January 18, 2022. Pursuant to the Arrangement, the common shares of the Company were consolidated on a 10:1 basis (the “Consolidation”) and each holder of common shares of the Company will receive in exchange for every 10 pre-Consolidation common shares held: [I] one post-Consolidation common share of the Company; [II] one common share of Flying Nickel Mining Corp. (“Flying Nickel”); [III] one common share of Nevada Vanadium Mining Corp. (“Nevada Vanadium”); and [iv] two common shares of Battery Metals Royalties Corp. (“Battery Metals”). The Toronto Stock Exchange (“TSX”) issued its final trading bulletin in respect of the Arrangement on January 14, 2022. Trading in the Company’s common shares will commence on a post-Arrangement and post-Consolidation basis under the same symbol “ELEF” at market open on Tuesday, January 18, 2022. The CUSIP has changed to 82770L307.

You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On January 19, Vanadium Resources announced:

VR8’s interest in the tier 1 Steelpoortdrift Vanadium Project increases to 73.95%. Vanadium Resources Ltd, the developer of the Tier 1 Steelpoortdrift Vanadium Project (“Project”) in Limpopo, South Africa, is pleased to announce that it has received approval from the South African Government to receive transfer of an interest of 23.95% in the Project, thereby increasing VR8’s interest in the Steelpoortdrift Project to 73.95%. The increase in ownership comes at no cost to VR8, given all consideration shares for the acquisition of the asset were issued in September 2019.

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On January 4, King River Resources announced: “Project status updates.” Highlights include:

- “5N Type 1 Precursor – Campaign 4 successful.

- Improved new Precursor path to HPA under development.

- Murdoch University Hydrometallurgy undertaking further Vanadium process work.”

On January 24, King River Resources announced:

HPA project high purity metals. King River Resources Limited is pleased to provide this update on its wholly owned subsidiary High Purity Metals Limited [HPM] which holds the High Purity Alumina [HPA] Project.

You can view the latest investor presentation here.

Vanadiumcorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

Vanadiumcorp Resource Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘Vanadiumcorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

December 30, Vanadiumcorp Resource Inc. announced: “Vanadiumcorp to resume trading on the TSX Venture Exchange.”

You can view the latest investor presentation here.

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

No news for the month.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Voyager Metals Inc. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Saltbae Capital Corp. [TSXV:CUBE] [GR:01X] (OTCPK:CECBF)

- Invinity Energy Systems (LSE:IES) (OTCPK:IVVGF)

EV metal miners royalties companies

- Electric Royalties [TSXV:ELEC]

Conclusion

European vanadium pentoxide spot prices were higher in January.

Highlights for the month include:

- Tesla targeting to grow Megapack production from 4GWh now to nearly 50GWh by 2023 with new under construction factory in Lathrop, California. (Note these are lithium-ion batteries not VRFBs but show strong demand for energy storage products).

- Europe V2O5 up by nearly 12% due to tightness following ferro-vanadium gains. Heavy rains in Brazil caused Largo Q4 production to be down 40%.

- Bushveld Minerals looks for 20% increase in FeV production in 2022. Achieved group production for of 3,592 mt V in 2021.

- Largo Inc. annual V2O5 production of 10,319 tonnes in 2021 vs. 11,825 tonnes in 2020, impacted negatively by heavily rains in Q4, 2021.

- Neometals Barrambie mixed gravity concentrate sample for Jiuxing commercial smelting trials in China continued in parallel with PFS targeted for Q1 22 completion.

- Australian Vanadium: VSUN Energy to install VRFB at Water Corporation Site.

- Silver Elephant completes plan of arrangement including 10:1 consolidation. Each pre-consolidated share receives one post-Consolidation common share of the Company; one share of Flying Nickel Mining Corp.; one common share of Nevada Vanadium Mining Corp.; and two shares of Battery Metals Royalties Corp.

- VR8’s interest in the tier 1 Steelpoortdrift Vanadium Project increases to 73.95%.

As usual all comments are welcome.