joebelanger/iStock via Getty Images

Preface

With the market correcting and inflation hitting highs not seen in four decades, precious metals mining investors have been calling for higher silver prices since the pandemic tanked the stock market in 2020, and even a few years beforehand. While this might feel like another “boy who cried ‘wolf’ scenario, it is hard to look past a market correction, dumping of speculative assets such as Bitcoin (BTC-USD), and record inflation for reasons to take refuge in precious metals. However, a straight investment into precious metal assets may provide modest returns; therefore it is most interesting to make a hybrid investment with upside optionality via high-quality junior miners that can potentially return multiples in lieu of an improvement in precious metals prices while still being exposed to potential pricing improvements through equity exposure to these companies. As such, I’ve identified an interesting junior silver miner that I think has limited risks and upside optionality without silver prices increasing significantly. I believe this miner, Guanajuato Silver (OTCQX:GSVRF), may return multiples to investors within the coming few years while providing exposure to improved metals pricing.

The Case for Higher Silver

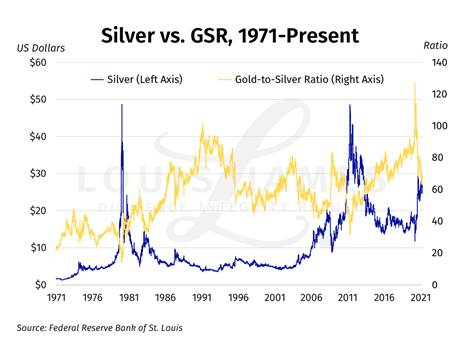

Before discussing Guanajuato Silver, let’s examine the case for higher silver. There are a few main points to be made. First, there’s a chance that the current market compression compares to the dot-com bubble, with wild speculation and many large-cap companies trading at expensive earnings ratios even in the light of low rates. During that time, mining saw a big repricing as

The second point is more concrete; massive amounts of money printing and debt loads create an environment very supportive for gold and silver through inflation.

The third is that currently, supply is declining and already not keeping up with demand. Additionally and increasingly in the future, silver may become uncoupled from gold due to its use in semiconductors including photovoltaic cells, as well as likely used in inductive power chargers as a coating to improve electric vehicle charging and a range of other electronics. Electric vehicles could be a strong driver of silver demand, and it’s well known that electric vehicles are expected to take market share over time, and most car manufacturers such as Honda (HMC), Tesla (TSLA), BMW (OTCPK:BMWYY), Ford (F), GM (GM), and many others.

Industrial Uses of Silver

There is a wide range of industrial uses for silver and many of them are in growing industries, with current production sitting around 750 million ounces per year (declining for four straight years) and the world consumption of about 1 billion ounces per year, which has been flat for years and is roughly 2:1 industrial usage versus silverware and jewelry.

Furthermore, for every 1 ounce of gold produced, about 8 ounces of silver is produced. In theory, about 16:1 silver to gold is in the earth’s crust, though this theory could be incorrect. With production declining and demand probably increasing, and a price ratio of 75:1 gold to silver versus production of 1:8 gold to silver, it seems silver might need to increase in price. While this comparison doesn’t account for costs of production, industrial users of the metals are, according to Keith Neumeyer, First Majestic Silver’s (AG) CEO, paranoid and unwilling to disclose how much metal they use. Now the ratio argument could mean that gold needs to come down and silver doesn’t need to come up, but the supply and demand situation doesn’t paint that picture, nor does the macroeconomic situation.

Kitco News Commentary

These main points are well summarized in an article talking about Neumeyer’s call for $130/oz silver. Regardless of whether this happens I think the case for higher silver is decent, as do others who call for $31/oz silver. The interesting thing with respect to the miners is that a modest increase in price can produce an outsized increase in profits-in essence, the miners’ cash flows can be much more volatile than the actual commodity, and typically silver miners’ stock prices move multiple times as much as the underlying commodity. Now on to the actual investment, Guanajuato Silver.

The Case for Guanajuato Silver

Investing in junior mining companies can be a little bit like investing in biotech companies. As opposed to decades ago, most junior miners these days are focused on their exploration projects, trying to prove out their resource estimates, whether those are inferred or implied-simply different levels of confidence based on how many holes have been drilled across a vein or potential deposit.

If investors become unhappy with management’s execution, drilling results aren’t as amazing as expected, short-sellers sniff out equity raises, or the market tanks in general, these cash raises to finance ongoing exploration might have to be done at poor valuations that can be difficult for existing investors. This is the same risk with pre-revenue biotech companies. To my limited knowledge, there are a handful of junior miners that fund exploration through smaller-scale operations, and one of those is Guanajuato. The reason I’m interested in Guanajuato Silver is that they are in the exploration business in silver (and gold) production, have a seasoned team from management all the way down to the actual foreman and laborers, and the geopolitical risk is modest. On top of that, they are ramping up production to (probably) be substantially cash flow positive, which provides a valuation backstop and even may finance exploration. There are a few hybrid model companies out there that I’m aware of, such as GoGold Resources (OTCQX:GLGDF), Aya Gold & Silver (OTCPK:MYAGF), Gold Mountain Mining (OTCQB:GMTNF), and Kuya Silver (OTCQB:KUYAF). These companies finance their relatively aggressive exploration programs with smaller production operations.

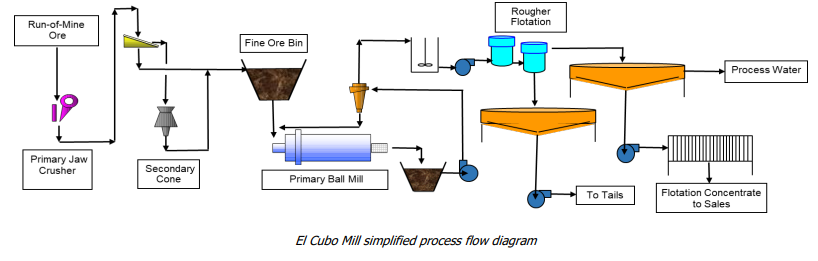

Summary on Guanajuato Silver

Two and a half years ago, CEO James Anderson and his business partner took control of a Toronto shell company and ended up taking control of what they considered a great project in Guanajuato. The company operates two main sites that are currently producing in the Guanajuato area, El Cubo, and El Pingüico. El Cubo was purchased from Endeavour Silver (EXK) for $15 million plus contingent payments and then refurbished and upgraded parts for about $5.5 million. This asset had been mined and operated by Endeavor and also decades ago as part of a historic mining district. As a result, Guanajuato has its own processing equipment on-site whereby it can obtain concentrate without sending it out to another company. Actually, they are already using excess capacity from their equipment to process third-party material. The company also has assets nearby at El Pingüico which has bulk mined material (medium to low grade) which it is shipping over to El Cubo for processing.

El Cubo Processing Line

Both sites are subject to further exploration, and further mining operations are slated to begin at El Pingüico whereas they have already begun at El Cubo.

Guanajuato Silver Corporate Presentation, January 24th, 2022

Endeavor purchased El Cubo for $200 million in 2012 and spent $30 million in upgrades when silver was at a higher price. They arguably overpaid for the asset but that most likely has to do with the disintegration of operating margins when silver prices decreased all the way to $15. This just highlights how much the margins can make a difference in operating profitability and the implied value of the asset ($200 million versus $15 million) when silver prices go up or down.

Endeavor was operating El Cubo at a larger scale, mining at wider widths to fill the capacity of the processing line on site. However, mining at wider widths can reduce the average grade of gold/silver, and this lowers the margins of mining. So when silver prices declined, it became not worth it to continue mining at El Cubo as the wider mining widths reduced the grade enough to reduce profitability. So they proceeded to sell the asset to Guanajuato Silver (named VanGold at the time). Now, Guanajuato is mining El Cubo at a higher grade and smaller widths, and silver prices have stabilized above $20/oz. This makes the mining operation much more lucrative from a grade and price perspective, but it leaves significant capacity (~50%) at the El Cubo processing line for additional material. These differences are shown in Guanajuato’s presentation graphic below.

Guanajuato Silver Corporate Presentation, January 24th, 2022

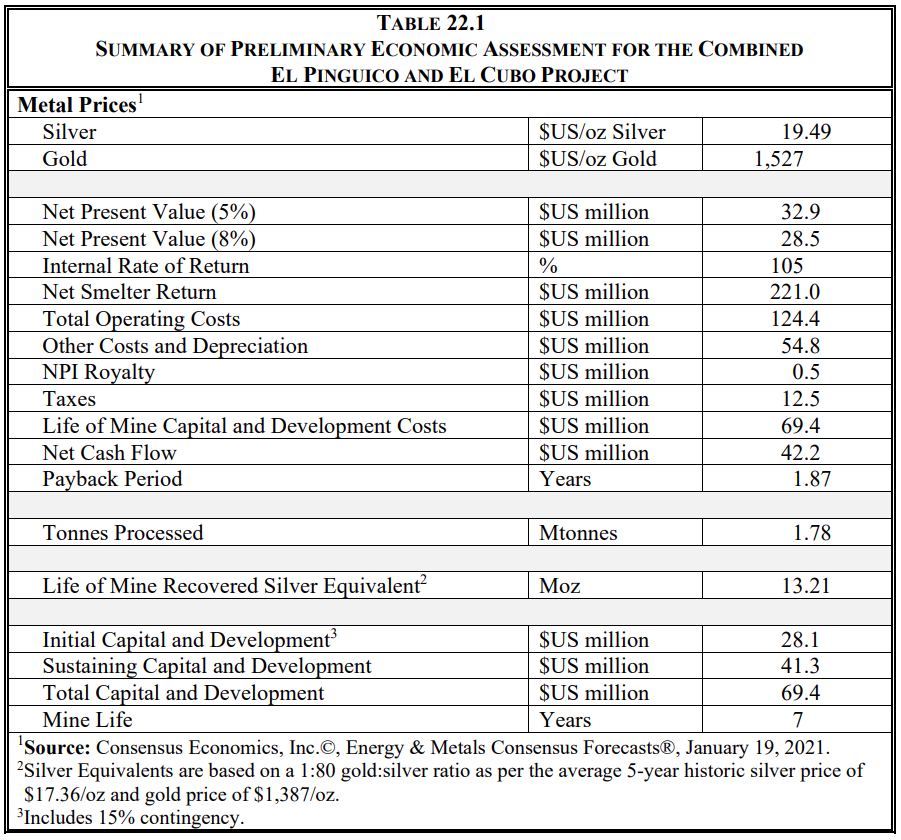

So with that, the company expects (according to the corporate presentation) with these initial operations, they can produce 1.8 moz AgEq annually, and the preliminary economic assessment (PEA) shows net cash flows of $42.2 million over 7 years.

Guanajuato Silver El Cubo, El Pingüico PEA

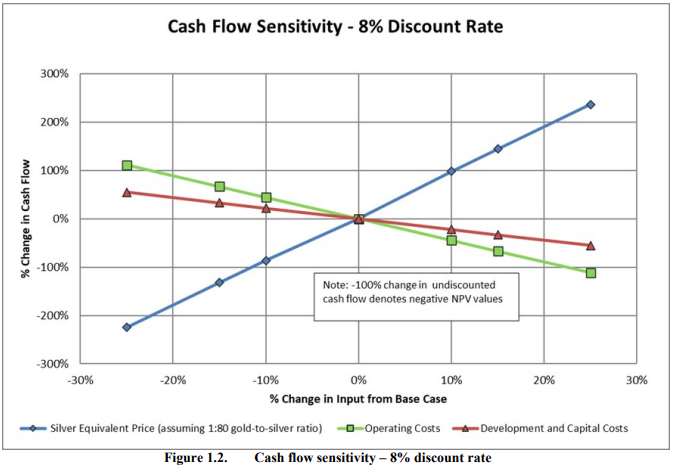

The high projected internal rate of return (IRR) (105%) demonstrates management’s ability to select strategies that minimize capital expenditures and maximize returns for shareholders. The very short timeframe in which the team has acquired the project, refurbished equipment, restarted operations, and even sold product already gives me great confidence in management that they can deliver and allocate capital well, which are the two main things aside from the actual mining assets and prospects that are most important for investments in junior miners. And, the IRR has the potential to be even higher than projected if prices improve by a small amount, as shown in the PEA sensitivity graph below.

Guanajuato Silver El Cubo, El Pingüico PEA

What is interesting to note is that silver and gold prices are already over 10% higher than assumed in the PEA ($15.49/ozAg, $1,527/ozAg), which means that the projected cash flows are already 100% higher, according to Behre Dolbear’s PEA sensitivity chart above. So now, if one assumes a rough estimate of not $42.2 million over 7 years, but perhaps $80 million-about double-over 7 years, that’s $11 million in cash flow annually, which is a robust amount of cash flow that should be able to fund exploration in new areas above and beyond capital required to continue ongoing mine exploration and development costs. There are also a few other things to mention about the NPV calculations in the PEA. Baird only used the first 5 meters of stockpile underground at El Pingüico, which is about one-quarter of the stockpile. In general, the PEA is pretty conservatively done.

Management, Personnel, and Location

James Anderson, the CEO, was a Vancouver stockbroker for the last 20 years. He is the third generation of his family in the mining business with roots tracing back to Kirkland Lake. Cofounder JJ Jennex has a background in global real estate and capital markets, with deals done with global, large producers.

The team had experience bringing companies into production so there is less concern for the team meeting operational milestones and commitments. Directors and advisors own 5.6% of the company, billionaire mining guru Eric Sprott owns 3.1% of the company,

One really interesting thing about Guanajuato is the expertise they bring to the table from the non-executive side. The company is located near the historic mining town of Guanajuato, Mexico, which is a beautiful location with about a 30 minute drive to the mine. As such, the company can attract the best mining talent, from engineers to foremen to laborers-even people who have prior experience at El Cubo-to work at Guanajuato. In fact, the entire company except for a few executives in Vancouver are Mexican nationals. As such the company brings wealth into the area and, in my opinion, reduces political risk as the company is viewed less like a foreign company.

Guanajuato: The Most Beautiful City In Mexico?

The area has produced an incredible amount of silver in the past. For instance, the Valenciana Mine nearby has been producing since 1774 and has produced about 30% of the world’s silver over the past 250 years.

Exploration

My initial calculations from Guanajuato’s recent drilling results press release indicate that their average gpt*m value for drill holes is 235.2AgEq gpt*m, with 5 of 45 different holes indicating intercept sections with over 500AgEq gpt*m. According to a well-respected geologist, Dr. Quinton Hennigh, if perhaps 3-4 out of 50 holes are over 100 “gram meters” for gold, then that proxy is useful for predicting a significant economic discovery. It is therefore shaping up that Guanajuato is finding some decent deposits, it seems. Though it is an apples-to-oranges comparison with gold to silver and what grades and gram meters are considered significant. It will be key to watch these drill results over 2022 as they start coming in. Recent highlights include:

- 0.6 metres of 538 gpt AgEq drilled at El Cubo (Drill Hole CEB21-003). – 322.8gpt*m

- 25.85 metres of 235 gpt AgEq drilled at El Cubo (Drill Hole CEB21-004). – 594.6gpt*m

- 0.55 metres of 228 gpt AgEq drilled at El Pinguico (P21-015). – 125.4gpt*m

- Over 24,000 metres of core drilling committed for 2022.

It’s important to note that Guanajuato isn’t strictly a drill hole company but these exploration programs certainly do provide the potential for upside. With various claims in the region including on the famous Veda Madre, there is the potential for some high-grade gold discoveries.

M&A Potential

Going forward, there are a whole bunch of other smaller assets in the area owned by different companies who aren’t necessarily focusing on those specific operations anymore. Large companies like Fresnillo (OTCPK:FNLPF) or others could have assets that they would rather divest to Guanajuato, and this could happen in the medium term, if at all.

Risks

With commodities pricing, there is always the risk that improved spot market pricing provides the incentive for increased production that then produces enough supply to suppress further pricing increases.

With Guanajuato Silver, there is a distinct risk that political or cultural issues make it difficult or impossible for the company to continue to conduct business, which could result in a significant decrease in the company’s stock price. There is also the chance that exploration of their assets does not show significant deposits of silver and gold. If the market is expecting more than is shown via drilling programs, the stock could decline significantly.

If silver prices decrease more than 10%, the cash flow potential for the company’s projects will significantly decline. Past that mark, it will likely be difficult for them to stay cash flow positive (per their PEA).

Conclusion

Guanajuato seems like a very healthy investment with the potential for significant upside in the coming years, and a lower risk of downside compared to drill hole exploration peers. There are some very high-profile mining individuals involved with a high amount of experience so operational risks are lower. Time will tell what their exploration endeavors produce, but for now, they seem to be on a roll ramping up production and planning 2022’s drilling program. If silver prices fall, their cash flows might be reduced, and if that happens and exploration programs fail to find significant discoveries, the stock could fall to a level that reflects the value of existing operations at lower silver prices-so perhaps by half if silver goes below $18. However, if silver can make it to just $30, cash flows could improve by hundreds of percent, and if the exploration programs find significant discoveries in an area known for historically producing most of the world’s silver, the stock could reflect the value of additional resources. In this case, GSVR/GSVRF shares should probably increase by a few multiples of their current price.