Michael Vi/iStock Editorial via Getty Images

AbbVie (NYSE: ABBV) is one of the largest pharmaceutical companies with an almost $250 billion market capitalization. The company was founded in 2013 as a spin-off from Abbott Laboratories, and has since grown off of the blockbuster strength of Humira and its other drugs. As we’ll see throughout this article, we expect the company to generate strong shareholder rewards.

AbbVie Overview

AbbVie has an impressive portfolio of assets and several strong businesses especially post the $63 billion Allergan acquisition.

AbbVie Investor Presentation

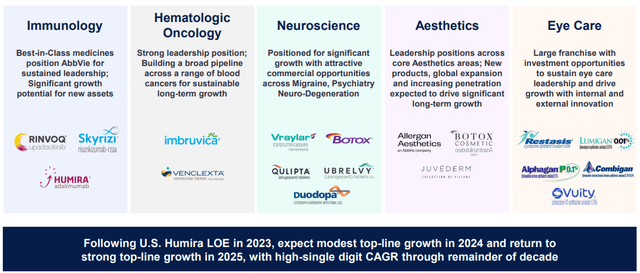

Source: AbbVie Overview – AbbVie Investor Presentation

AbbVie has 5 major sectors of its portfolio. These include immunology, hematologic oncology, neuroscience, aesthetic, and eyecare divisions. Out of this, the company’s immunology portfolio is its strongest with the single drug Humira providing 40% of the company’s annual sales and >$20 billion in annual revenue for the company.

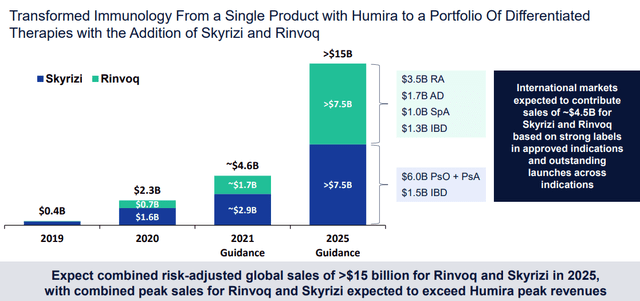

Due to a lack of universal healthcare, the U.S. tends to have much higher drug prices. It makes up 80% of the company’s Humira sales, which means it’s a big deal that the company is losing Humira LOE in 2023. The company is addressing this with Rinvoq and Skyrizi, with guidance for $15 billion in 2025 revenue from these two.

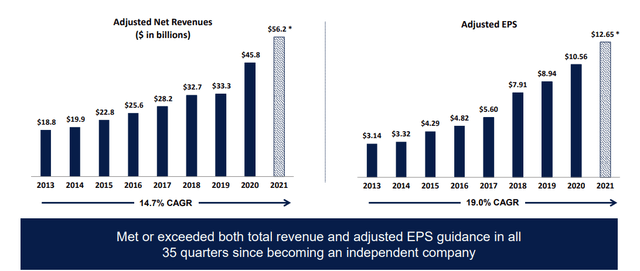

The company has a strong history of growing revenue, and it expects it should be able to maintain into 2024 and return to high-single-digit growth through the remainder of the decade.

AbbVie Historic Performance

It’s worth noting in a variety of environments, AbbVie has had strong historic performance.

AbbVie Historic Performance – AbbVie Investor Presentation

AbbVie has grown net revenue consistently, especially over the last 2 years. The company has also increased adjusted EPS hand-in-hand. The company’s steady dividend growth has given it a 4% dividend yield and the company’s 2021 adjusted EPS ($22 billion) gives it a P/E ratio of ~11 with ~$74 billion in long-term debt for the company.

There’s no denying that the loss of Humira is significant for the company, however, the company has a long history of meeting/exceeding its guidance and we see no reason why it won’t be able to do that with its post-Humira guidance.

AbbVie R&D Portfolio

AbbVie has an impressive R&D portfolio that we expect will be used to generate substantial shareholder rewards.

AbbVie Immunology – AbbVie Investor Presentation

AbbVie has transformed its business with Humira into a much stronger overall business led by Skyrizi and Rinvoq. The company is seeing 2025 revenue from these businesses reaching >$15 billion with a $10 billion increase from 2021. That alone means the replacement businesses here will replace 50% of max Humira revenue from growth.

The company has a longer pipeline than this with Phase 1 and 2 trials. That business and the potential replacement means that the company’s immunology business remains almost self-fulfilling.

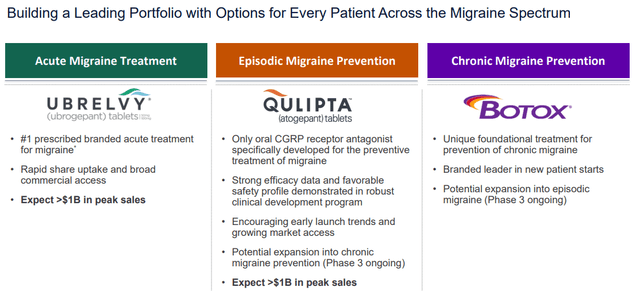

AbbVie Neuroscience – AbbVie Investor Presentation

Neuroscience represents another business where AbbVie has the potential to outperform. The company’s migraine business has the potential for billions in peak sales and the company is also investigating novel treatments (Botox from Allergan) in the potential treatment of migraines. The company is also expanding elsewhere in neuroscience.

For example, Vraylar for Schizophrenia has estimated peak sales of more than $4 billion. ABBV-951, a potential Parkinson’s treatment, is expected to have peak sales of more than $1 billion.

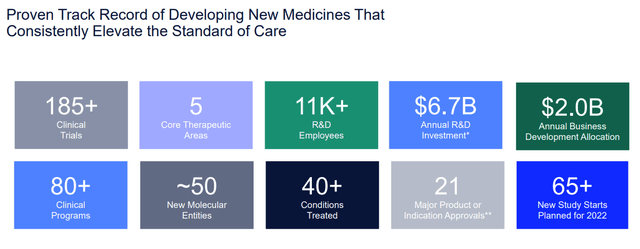

AbbVie R&D – AbbVie Investor Presentation

Overall, AbbVie has too many trials to discuss them all in detail. But across the portfolio, the company spends $6.7 billion in annual R&D. The company has dozens of potential clinical programs and new study starts at any one time, and almost 200 clinical trials operating. Any of these projects could be a blockbuster multi-billion dollar drug.

At the end of the day, the aspect to pay attention to is the company’s continued expected revenue growth, especially with the potential to take the Humira LOE in stride.

AbbVie Shareholder Return Potential

AbbVie has substantial shareholder return potential. The company has a strong history of execution and among the core of its assets is a dividend yield of 4%. The company is on track for its target synergies and EPS growth from the Allergan acquisition and the acquisition adds significant diversification for a company that was previously focused on Humira.

However, the company’s immunology business isn’t lost. The company’s new drugs here are expected to reach $15 billion in risk-adjusted revenue by 2025, which would replace the majority of Humira. The company has substantial growth potential in other businesses such as Oncology and Neuroscience, which will support growth.

We expect the company to continue reasonably increasing its dividend. At the same time, we expect the company to continue improving its debt paydown, or look at other forms of shareholder returns (such as buybacks) in the upcoming years. The company’s strong earnings and consistent growth mean the potential for continued high-single-digit shareholder rewards.

AbbVie Thesis Risk

In our view, the largest risk to the thesis is fairly standard, it’s the same risk that other large pharmaceutical companies face. The company has a popular drug losing exclusivity, so not only does it need to replace that revenue, but in a business fraught with failure, it needs to keep growing its revenue. It needs to earn enough to pay off debt from the Allergan acquisition and grow shareholder rewards, and there’s no guarantee that that happens.

Conclusion

AbbVie’s recent well-timed acquisition of Allergan costs it more than $60 billion, but added an impressive portfolio of businesses to the company’s portfolio. The company still has a strong P/E of ~11 and a very manageable debt load along with unique combined opportunities (i.e. using Botox for Migraine treatment).

The company’s largest upcoming risk is whether it’ll be able to manage Humira’s loss of exclusivity, which we expect it’ll be able to take in stride, enabling continued dividend growth and shareholder returns. The company has a comfortable history of meeting its shareholder return obligations and we don’t see why this time is different.