JHVEPhoto/iStock Editorial via Getty Images

It’s been only about two and a half months since I put out my bearish piece on Westinghouse Air Brake, or “Wabtec” (WAB), and in that time the shares are down a little over 8.5% against a loss of ~3% for the S&P 500. The underperformance has me intrigued, so I thought I’d look at the investment again, determine whether now’s a good time to pull the trigger, and share my views with you readers. I’ll try to make that determination by looking at the financials again, and by checking out the stock. If you’re a regular, you may also suspect that I’ll write about options. If you hold these suspicions, prepare to have them confirmed.

Allow me to offer you the “Cliffs Notes” version of my article, in this thesis paragraph. If you read this paragraph, you’ll get the highlights of the article, so you won’t have to slog through the whole thing. I think this is a reasonably good company, and I think the dividend is sustainable. I think management overpaid for the stock it bought back in 2021, but that doesn’t necessarily impact the future very much. That said, the shares are still overpriced in my view, and so I can’t recommend buying at current levels. Just because I don’t want to buy back into this business doesn’t mean there’s nothing to be done, though. I think it’s possible to earn a decent (2.5% in six months) return on deep out of the money put options, the specifics of which I outline below. I know that I just promised that I’ll give you everything you need with this thesis statement, but I lied. You’ll need to read the article to find out the specifics of the options trade I’m recommending. I hope we can get over this episode and move on together.

Financial Snapshot

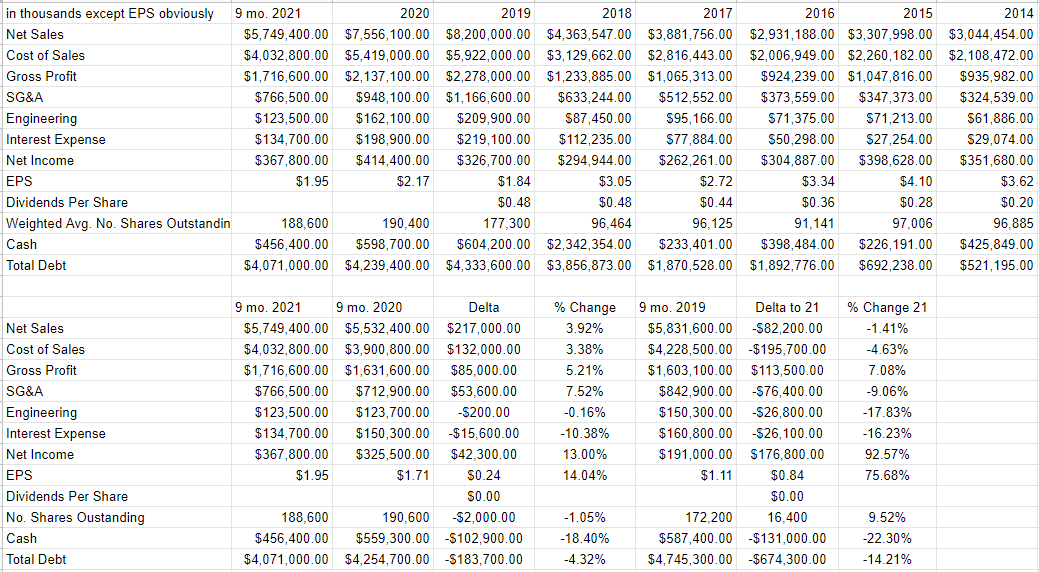

The financials haven’t been updated since I last wrote about the business. Rather than just repeat here what I wrote back then, I would recommend that you check out my previous work on this name. If you check my earlier work on the name, I think you’ll find that I covered most of the financial data with my usual rigor and extreme conscientiousness. For those who can’t stand the prospect of leaving this article just as it’s getting exciting, I’ll tell you the highlights. As you might expect, the first nine months of 2021 were better than the same period in 2020, but less obviously so when compared to 2019. Sales in 2021 were lower than the same period in 2019, but net income was much higher, largely driven by the fact that various costs (COGs and whatnot) were abnormally high in 2019. So, 2021 was not a banner year for the company by any stretch. On the bright side, the capital structure improved, with debt down about 4%, and interest expense dropping as a consequence. So, in sum, I’d say that the financials here are “fine.” Nothing special, but “fine.”

Buybacks-Why Do People Love These So Much?

Lately I’m in the mood to poke at the notion of stock buybacks, so allow me to indulge that. In my experience, too many investors consider buybacks to be unalloyed goods, always appropriate. I thought it’d be fun and informative to look at the buyback history at Wabtec to suggest that that might not always be the case. Consider the following:

- At the end of FY 2020, the company had 188,896,023 shares outstanding.

- At the end of Q3 2021, the company had 186,821,013 shares outstanding, a reduction of 2,075,010 shares over that nine month span.

- Per the cash flow statement, the company spent $200.3 million on buybacks during the first nine months of 2021.

- Breaking out our abacuses, we calculate that the company spent $96.53 per share to retire these stocks.

- Taking our brains with even a little bit more math, we learn that the current share price is ~8% lower than the price management paid for the stock.

I conclude from this that it would have been better for management to have spent this money on a special dividend to owners. This move may not have been as good for management, but a dividend would have been better for investors in my view.

Dividend-Reasonably Sustainable

Reading of dividends, I want to spend some time thinking about the dividend, not because I’m particularly impressed by the thin yield, but because if it is cut, the shares will react predictably badly in my view. With that in mind, it’s time to gauge whether there’s risk of a dividend cut. When I determine the sustainability (or not) of a dividend, I look at the size and timing of upcoming contractual obligations, and compare these to current and likely future cash.

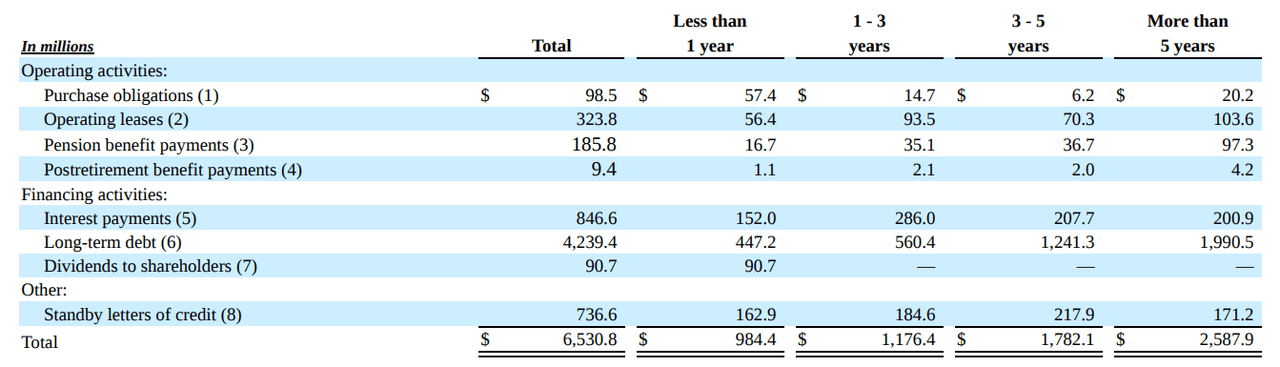

First, the contractual obligations. I’ve clipped the following graphic from the latest 10-K for your enjoyment and edification, dear readers. Please note that by this point, the 10-K is nearly a year old, so we’re into the “1-3 years” column below. The company doesn’t break down payments by period, so I’ll make a simplifying assumption and call it $588.2 million per year.

Wabtec Contractual Obligations (Wabtec latest 10-K)

Against these obligations, the company generated an average of $705 million in cash from operations over the past three years, and spent ~$1.16 billion in investing activity. In fairness, though, this investment figure includes the $2.996 billion acquisition expense from 2019. Stripping this out results in a more typical average of ~$161 million invested in the business. Finally, according to the latest 10-Q, the company has about $456 million in cash. All of this suggests to me that the company can at least manage to pay the ~$92 million it paid in dividends over 2020. I certainly wouldn’t buy this stock because of the dividend, but I’m not worried on behalf of longs that it’ll be cut anytime soon.

Wabtec Financials 2014-Present (Wabtec Investor Relations)

The Stock

We now come to the “downer” portion of the article, dear reader. Here’s where I write about the stock and drone on about the fact that an investor’s return on a given investment is almost entirely a function of the price paid for it. For instance, the investor who bought Wabtec shares the first day of this year is down ~4.3% on their capital. The investor who bought virtually identical shares only 25 days later is up about 4%. This 8%+ swing in performance for identical shares in such a short period of time is entirely a function of the price paid. The same investment is either “good” or “bad” depending entirely on the price paid. It’s for that reason that I try (but don’t always succeed) to buy shares cheaply.

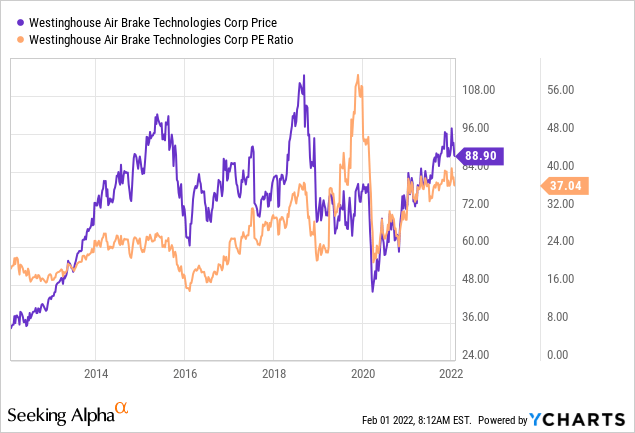

People who subject themselves to my writing regularly know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship between price and some measure of economic value, like sales, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both the overall market, and its own history. To refresh your collective memories, I recommended avoiding Wabtec in the past because the PE was hovering just north of 40 times. This made no sense for a company that has this growth profile. Shares are cheaper now, but not by much. Feast your eyes on what “8.64% cheaper than ‘morbidly expensive’” looks like.

Source: YCharts

Please note that the current valuations are associated with subsequent disappointing returns. History may not repeat, but it rhymes to a disturbing degree in my experience.

In addition to simple ratios, I want to try to understand what the market is currently “thinking” about Wabtec’s future. In order to do this, I turn to the work of Professor Stephen Penman and his tome “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market’s “assuming” about a given company’s future growth. This involves isolating the “g” (growth) variable in a fairly standard finance formula. Applying this approach to Wabtec at the moment suggests the market is forecasting a fairly rich 7.5% growth rate for this business going forward. I consider this to be exceedingly optimistic. Given the above, I can’t recommend buying at current prices.

Options- A Safer Approach

In my previous missive on this name, I pointed out that I employed some short puts on Wabtec in the past that “forced” me to buy the business at $48 per share. I then sold for a 58% gain. I point this out again mostly to brag, but also to write something about the risk reducing, return enhancing power of short put options. Just because I don’t want to buy at current prices doesn’t mean there’s no way to earn a profit here. I have no problem buying this business at the right price, and will sell someone the right to sell it to me at that price.

My regulars know that I consider short put options to be a “win-win” trade for a few reasons. Either the investor pockets a premium, which is never a hardship. If the shares trade below the strike price, the investor gets both the premium and the ability to buy a stock they like at an even more attractive price. This is also hardship-free in my view. Hence, “win-win.”

In terms of specifics, my preferred short put trade here is the July put with a strike of $70. These are currently bid at $1.80, which I consider a reasonable return for tying up capital for six months. If the shares remain above $70 over the next six months, I’ll simply add another $1.80 per share to the whiskey acquisition fund. If the shares fall, I’ll have an opportunity to buy this sustainable dividend at a price about 21% lower. That’s worked out well for me in the past, so I’m comfortable doing it again.

If you read my stuff regularly, you know what time it is. If you don’t, it’s “raining all over the party time.” This is the time when I indulge in my somewhat sadistic tendency to completely foul the mood by writing about risk. The reality is that every investment comes with risk, and short puts are no exception. We do our best to navigate the world by exchanging one pair of risk-reward trade-offs for another. For example, holding cash presents the risk of erosion of purchasing power via inflation and the reward of preserving capital at times of extreme volatility. The risks of share ownership should be obvious to readers on this forum.

I think the risks of put options are very similar to those associated with a long stock position. If the shares drop in price, the stockholder loses money, and the short put writer may be obliged to buy the stock. Thus, both long stock and short put investors typically want to see higher stock prices.

Puts are distinct from stocks in that some put writers don’t want to actually buy the stock – they simply want to collect premia. Such investors care more about maximizing their income and will be less discriminating about which stock they sell puts on. These people don’t want to own the underlying security. I like my sleep far too much to play short puts in this way. I’m only willing to sell puts on companies I’m willing to buy at prices I’m willing to pay. For that reason, being exercised isn’t the hardship for me that it might be for many other put writers. My advice is that if you are considering this strategy yourself, you would be wise to only ever write puts on companies you’d be happy to own.

In my view, put writers take on risk, but they take on less risk (sometimes significantly less risk) than stock buyers in a critical way. Short put writers generate income simply for taking on the obligation to buy a business that they like at a price that they find attractive. This circumstance is objectively better than simply taking the prevailing market price. This is why I consider the risks of selling puts on a given day to be far lower than the risks associated with simply buying the stock on that day.

I’ll conclude this long winding discussion of risks by looking again at the specifics of the trade I’m recommending. If Wabtec shares remain above $70.00 over the next six months, the put seller will simply pocket a decent premium. If the shares fall in price, they’ll be obliged to buy at a price ~21% lower than the current level. Both outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk-reducing.” That’s just the kind of dissonance we have to put up with in the modern West.

Conclusion

I think Wabtec is a fairly decent business, but the price isn’t that attractive to me. I can’t see myself buying back in at current levels. Just because I don’t want to buy more at the moment doesn’t mean there’s nothing to be done, though. The options market offers a fairly decent return for six months of time. I think the short put described above offers a “win-win” trade, so I’ll be placing it. If you’re comfortable with short puts, I recommend you do the same. If you’re not, I’d recommend waiting for these shares to drop in price before buying.