Sean Gallup/Getty Images News

Alphabet (GOOG) (NASDAQ:GOOGL) has solid fundamentals and great growth figures, but the cloud segment is not big enough to move the needle. This is a great investment in the digital economy, but for investors who want more exposure to the cloud segment, other big tech companies may be a better option.

Background Of Google

Google is one of the largest tech companies in the world, offering several services and products, to both small and large companies and individuals around the world. Its current market value is about $1.9 trillion, being one of the largest companies in the world by this measure.

As I’ve discussed several times in previous articles, I invest mainly in secular growth companies within a few investing themes, including semiconductors, electric vehicles, digital payments, 5G and big data. Google does not fit necessarily into these themes, given that its business is spread across digital advertising, social media (YouTube) and the cloud, not being therefore a pure-play in any of these secular growth trends.

Nevertheless, in cloud computing, Google is the third largest player globally and this segment is the one that is growing faster, thus Google may be an interesting company for my portfolio. In cloud computing, I own Microsoft (MSFT) and on social media/digital advertising I own Meta Platforms (FB), thus my goal in this article is to analyze if Google can also be an interesting play in these areas or if there is significant overlap to my current positions.

Google’s business profile is structured around two main segments, namely Google Services and Google Cloud. Beyond these segments, the parent company Alphabet also reports non-Google businesses as “Other Bets,” which include its moonshot investments in other areas, like artificial intelligence, quantum computing or autonomous driving (Waymo).

As expected, Google represents the vast majority of Alphabet’s revenues and this profile is not expected to change much over the next few years due to Google’s near monopoly in data searching and “other bets” being early stage technologies that may not succeed over the long term. However, these other investments should not be overlooked because in the technology industry disruption can have a great impact in established companies, which makes new investments very important even for leading companies like Google, plus Alphabet’s moonshot investments are also justified by the company’s culture, based on innovation and not being a conventional company.

Google Cloud Vs. Peers

Despite this unique business profile, based on a cash cow search business and high-risk, high-reward investments, what’s more interesting for me personally is Google’s exposure to the cloud segment. This happens because this industry has very good secular growth prospects and can be an important growth source for many companies over the long term.

For instance, cloud is the major earnings source for Amazon.com (AMZN) and basically can be considered the segment that finances the rest of the company, showing that cloud is a massive business with very good levels of profitability that allows big tech companies to invest significant amounts on R&D and continuing to be innovative.

This profile explains why even for big tech companies the cloud segment gained a significant weight on the overall business, a trend that’s supported by the continuous growth of the digital economy, which was boosted by the pandemic with people increasingly adopting digital channels to work, study and interact.

Given that Google offers several technologies and applications that enable people, corporations and governments to operate in the digital space, it’s one of the companies that’s better prepared to benefit from these secular growth trends, of which the move of data sets to the cloud is one of the biggest growth drivers for the company over the long term.

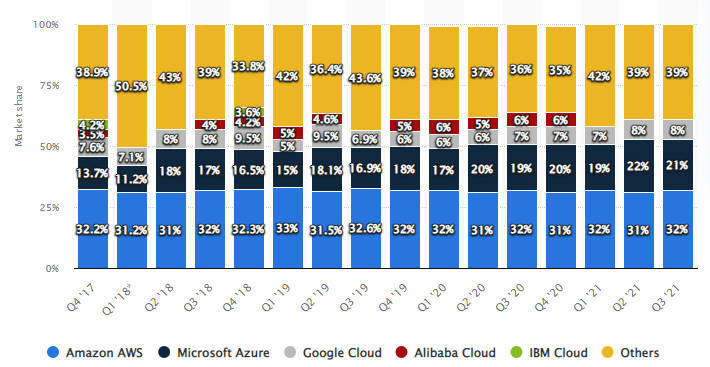

According to Statista, the cloud infrastructure market is somewhat concentrated with the three largest players – Amazon, Microsoft and Google – holding some 60% of the global market. At the end of the third quarter 2021, Amazon was the market leader with a market share of about 32%, followed by Microsoft with 21% and Google was the third-largest player with a market share of 8%.

This means that Google can gain both from market growth and market share gains, which the company has been able to gradually achieve in recent quarters given that Google’s market share was about 6% two years ago and has gradually increased in recent years.

Cloud market shares (Statista)

Beyond market share gains, Google can also benefit from overall industry growth given that current estimates expect the cloud industry to grow at a CAGR of 16% from 2021-26, growing from total revenues of $455 billion in 2021 to $947 billion by 2026. Even assuming a stable market share during this period, which may be unlikely, Google’s revenues from the cloud segment may double over the next five years.

This means that the top companies in the cloud industry have very strong growth opportunities ahead, boding very well for further revenue and earnings growth ahead for Google and its main competitors. Moreover, the cloud segment is quite concentrated and this profile is not expected to change in the foreseeable future due to the significant investments that are required in this industry to have a leadership position, something that is only available for the big tech companies.

This means that the main beneficiaries of strong industry growth will be the established companies, giving great visibility for revenue growth in the coming years. This is also a strong support for further investments in infrastructure and technologies, as the return on investment has a low risk profile creating barriers to entry in the market for smaller players.

Despite this positive background, Google’s cloud segment is relatively small within the group, given that in the last quarter it generated some $5.5 billion in revenues (+45% YoY), but only represented 7.4% of total revenues. This means that despite Google’s cloud strong growth prospects over the next five to ten years, its total weight within the group is not expected to be more than 10% of overall revenues.

This means that this segment will not become big enough to be a major driver of the company’s investment case, thus investors who want to be exposed to the cloud segment through big tech companies should invest instead on Amazon or Microsoft that have a higher exposure to the cloud industry.

Alphabet Q4 Earnings

Even though Google may not be the best way to be exposed to the cloud industry, its financial figures are impressive, its “core business” in digital advertising continues to report very strong growth figures and the company is a cash machine.

The company has recently reported earnings related to Q4 and full year 2021, which were quite good.

Total revenues amounted to $257 billion in 2021, an increase of 41% compared to the previous year. In Q4, total revenues increased by 32% YoY to $75 billion, which means that the cloud segment reported stronger growth (+45% YoY) than the rest of Alphabet’s operations, but is still much smaller than Google search ($43 billion revenues in the quarter) and even YouTube, that generated $8.6 billion in revenues during the last quarter.

Operating income in the year was $78.7 billion, an increase of 91% YoY, which is very impressive for a large company like Google. This growth is explained both by strong revenue growth and good cost control, which led to an increase in the operating margin to 31%, from 23% in 2020. Its bottom-line was $70.6 billion, +88% YoY, and its diluted EPS amounted to $112.

These are impressive growth figures for a very large company like Google, showing that its business is very well positioned to gain from the digital economy, a secular growth trend that is not expected to slow down anytime soon and provide very good growth prospects over the medium to long term. Indeed, Google’s revenues are expected to reach about $368 billion by 2025 and its EPS to reach $177, showing that its growth path is not expected to slow down in the next few years.

For retail investors Google has become even more attractive, given that the company announced a share split of 20-1, which means that shareholder will receive 20 shares for every stock they currently hold, becoming much more accessible for smaller investors. This means that Google will certainly have a larger shareholder base, which may help to boost its share price, even though a stock split does not change the fundamental value of the company.

Conclusion

Google has solid fundamentals and an impressive financial profile, it’s exposed to several growth drivers of which digital advertising is expected to remain the most important one in the coming years.

For me personally, I’m more interested in the cloud segment and in this particular field Google may not be the best option because it has a small weight within the group, but apart from that Google is a sound long-term investment in the digital economy.

Contrary to many tech companies, Google has not de-rated much in the recent stock market correction and has been an outperformer over the past two months, a performance that is explained by the company’s strong fundamentals and sound valuation.

Google is currently trading at 23x forward earnings, practically in-line with its historical average over the past two years, thus its shares are attractive right now and this valuation seems to be undemanding considering Google’s impressive growth in recent quarters.

While many speculative growth stocks have tanked in recent weeks, companies that have a leading position in their industries have done relatively well, of which Google is clearly one of the best examples. In the expected rising interest rate environment during the coming months, being more exposed to big tech companies seems to be a winning strategy and Google is certainly a good play for long-term investors.