Kerkez/iStock via Getty Images

Overview

OceanFirst (OCFC) is an NJ-based regional bank serving the Northeast U.S., covering New England, NY, NJ, PA, DE, DC, and MD. Operating with 47 full-service branches, the bank has a balance sheet of $11.7 billion as of December 2021. The bank is a real-estate-focused lender with a loan portfolio that grew 28% CAGR since FY2015. Owner-occupied CRE/C&I grew 22.1% CAGR while investor-oriented CRE grew 43% CAGR. From a deposit collection perspective, non-interest-bearing deposits grew 39% CAGR from FY15-FY21. Time deposit accounted for less than 15% of deposit funding sources, which is a core advantage.

Acquisitions have been a part of the growth strategy historically. On average, OceanFirst has acquired assets at 1.58x P/TBV and a core deposit premium of 9%. The detailed deal synopsis is as follows:

- 2016 Acquisitions of Cape Bancorp; Ocean Shore Holding: Acquisition of Cape Bancorp enables OceanFirst to expand distribution, scale, and core deposit funding base, creating the largest NJ HQ bank operating in central and south NJ; Acquisition of Ocean Shore strengthens OceanFirst position as a leading central/south NJ franchise; creating the 4th largest by deposit market share in NJ;

- 2018 Acquisition of Sun Bancorp: Acquisition of Sun Bancorp further enhances the bank’s presence in NJ and gain greater access and proximity to NYC and Phila. market;

- 2020 Acquisition of Country Bank; Two River Bancorp: Acquisition of both banks strengthen the bank’s presence in NJ and metro NY market;

- 2021 Acquisition of Partners Bancorp: Acquisition of Partners Bancorp expand footprint in DE, MD, and VA market

Over time, the bank has consolidated the branches and actively invested in technology to streamline operations. From the banking office consolidation front, since 2015, the bank acquired 87 branches in total and has closed 67 branches to date. The bank expects to close an additional 10 branches in Q1 2022, driving consistent improvement in operating cost. In terms of the technology investment, the bank has increased IT FTE to 98 in FY21 from 7 in FY15; the bank has made a significant investment in teller-less branches to assist in automated services. Such investments have been driving more sticky customer utilization and an increase in adoption.

Review of Operations

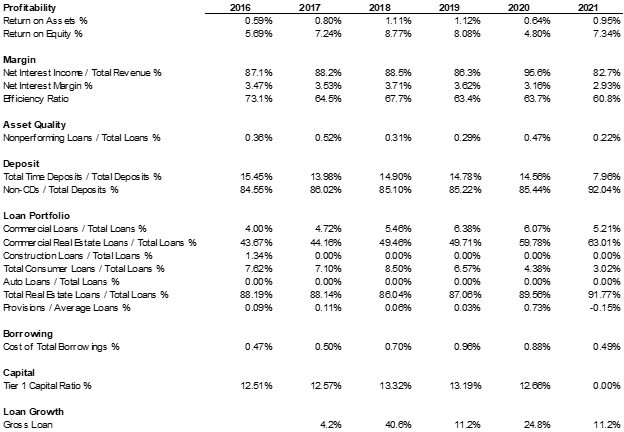

From a profitability perspective, reported ROA has been trending below 1% in most of the years given the acquisition-heavy nature of the bank. At the same time, OceanFirst ramps up technology investment to drive efficiency improvement, which to a certain extent, hurt margins. We continue to expect future investment in improving customer services. Excluding one-time merger costs and technological investments, the bank’s ROA should be healthy.

Credit quality is robust given the strong local real estate market. Despite the COVID-induced challenges, NPL increases in FY20 are manageable and provisioning in FY20 only increased to 73 basis points. FY21 even erased some credit loss that the bank experienced in FY20 as the market recovered.

The bank manages its deposit source in an effective manner, with less than ~15% of deposits coming from time deposits.

The efficiency ratio has consistently improved. As the bank consolidates its branches further, cost efficiency will further manifest itself. As such, both ROA and ROE will improve.

10-K

Valuation

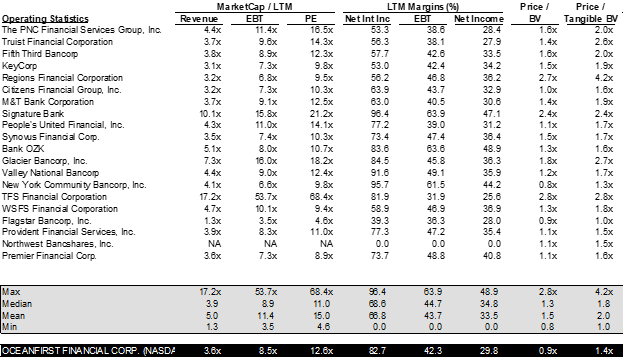

Stock is fairly priced at 12.6x P/E and 1.4x P/TBV. The price that the market subscribes to OceanFirst is lower than what OceanFirst would be willing to pay for assets. The bank is investing heavily in technology to drive efficiency. Despite the operating expense remaining high, the mix has changed, as the bank focuses more on being a technologically innovative bank and reduces the reliance on tellers. At a similar valuation to its peers, the quality of the bank is dramatically different as OceanFirst will only improve its customer service and efficiency from here. With more automation, the bank can acquire additional banks and streamline operating costs, which is something that other banks can hardly offer.

10-K

Risk/Reward

From a risk perspective, merger integration is a key risk. Also, the technological transformation can potentially drive away clients that prefer in-person services. That being said, the strong adoption of new clients more than makes up for the attrition.

From a reward perspective, a higher interest rate will benefit the bank as the loan portfolio reprice during an upcycle for interest rate. Moreover, the technological investment will drive costs down even without revenue increases. Lastly, the bank is a consolidator on the east coast and will continue to acquire banks to enhance its footprint. With the latest acquisition of Partners Bancorp, OceanFirst expanded its footprint into MD, DE, and VA markets, increasing the potential target market for consolidation efforts.

Conclusion

To sum up, the shares are attractively priced at 1.4x TBV, even lower than the acquisition price paid by OceanFirst. With enough scale, OceanFirst will continue to execute its acquisition strategy to create value. The bank has been buying back stocks with excess capital and will continue to be disciplined on capital deployment. We like the low-cost core deposit base, strong credit quality, technological investments to drive efficiency and potential upside via acquisition.