Justin Sullivan/Getty Images News

The investment thesis

I first wrote about Cisco Systems (CSCO) back in July 2021. At that time, the price (about $54) was so attractive that I recommended a leveraged play using call options. Indeed, since then, its price has peaked near $64 (and I have closed my call positions before the peak). Its price has come back to the $55 level during the recent selloff, and some readers ask for an updated assessment.

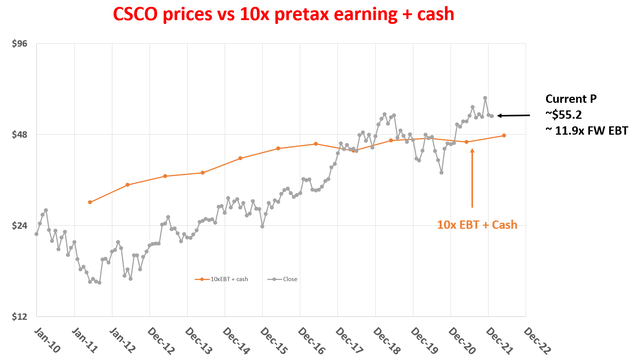

My assessment is still bullish, and the thesis is really simple. A stock with the quality of CSCO should never trade below 10x of its pretax earnings according to what I call Buffett’s 10x pretax rule. However, at its current valuation, it is trading close to that. To be more specific, when adjusted for its cash position, CSCO is now traded at about 11.9x pretax earnings.

As such, you will see in the remainder of this article, an investment here is similar to owning an equity bond with an 8%+ yield and at the same with a coupon payment that also increases ~8% per year.

I do not currently have a position in CSCO. But it is on my watch list, and I am watching its prices closely. I maintain a VERY short watch list, with 1 or 2 tickers in each sector. And CSCO is one of the 2 tickers on my tech-sector list. The other one is Texas Instruments (TXN), and I’ve also recently written about it here in case you are interested.

Buffett’s 10x pretax rule

As a starting point, the following chart shows the price history of CSCO and its 10x pretax earnings plus its cash position. Pretax earnings are also referred to as “EBT”, Earning Before Taxes, in this article. As seen, a quality stock like CSCO should trade with a significant premium above 10xEBT (again, adjusted for its cash position). And whenever the price falls near or below is far above 10x EBT, it has been a good time to buy as in 2011 to 2013.

At its current price, when adjusted for its cash position, CSCO is now traded at about 11.9x of its forward pretax earnings. Not quite the ideal example for Buffett’s 10x pretax rule, but getting quite close.

author based on Seeking Alpha data.

In case you are wondering why, out of all the valuation metrics, I chose the pretax earnings? The reasons are detailed in my earlier writings on Buffett’s 10x pretax rule. And a very brief summary is provided below to facilitate the rest of this discussion.

First, Buffett himself paid ~10x pretax earnings for so many of his largest and best deals. The list is a really long one, ranging from Coca-Cola, American Express, Wells Fargo, Walmart, Burlington Northern, and the more recent Apple. So it cannot be coincident.

Second, after-tax earnings do not reflect business fundamentals. Taxes can change from time to time due to factors that have no relevance to business fundamentals, such as tax law changes and capital structure changes. Plus, there are plenty of ways to lower the actual tax burden of a company.

Third, pretax earnings are easier to benchmark, say against bond earnings. The best equity investments are bond-like, and when we speak of bond yield, that yield is pretax. So a 10x EBT would provide a 10% pretax earnings yield, directly comparable to a 10% yield bond.

As a result, if I buy a business with staying power at 10x EBT and even if the business stagnates forever, I am already perfectly happy to be making a 10% return pretax. Any growth is a bonus.

Next, we will see that CSCO does not only have stable staying power but also a very healthy growth prospect ahead.

CSCO: does it have existential issues?

I really do not see any existential issue for CSCO either in the short run or the long run. I will just be brief and go through my thought process here and then move on to focus on the growth perspective.

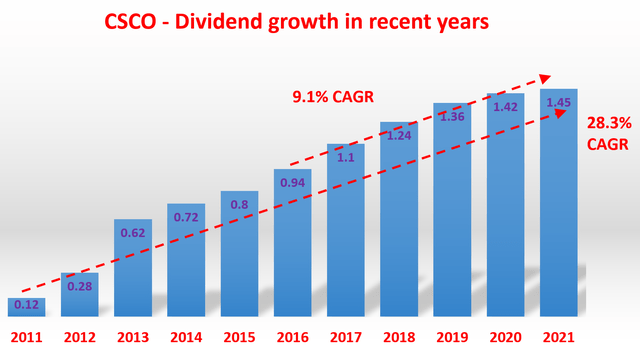

With CSCO’s market-leading position, scale, and management, I do not see any short-term survivability issues at all. A shortcut to looking into this issue is the dividend. The dividend is one of the most reliable and indicative metrics of a business, certainly more than earnings. Earnings can fluctuate from year to year for reasons out of anyone’s control. Earnings are also more open and prone to accounting manipulation and interpretation. The dividend has none of these issues.

As shown below, CSCO has been growing dividends consistently. The growth rate during the past decade has been a spectacular 28.3% CAGR. Although this growth rate is distorted by its lower dividends at the beginning of the decade, its dividend growth rate in the past 5 years has been 9.1% – still a very healthy level.

Author and Seeking Alpha data

For the long term, the existential issue ultimately is largely a subjective judgment. I do not think there is any such issue for CSCO.

Firstly, the business has been maintaining a remarkably consistent and strong financial position. As can be seen from the next chart. The business enjoys a fortress balance sheet and an extremely flexible position of capital allocation. Even with its superb cash generation capability, it consistently maintains a working capital well above its total debt (estimated to be by about $10B in 2022).

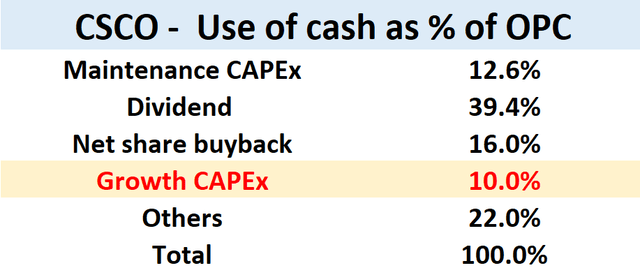

Secondly, the business overall enjoys a strong position in terms of capital allocation, further eliminating any existential issues. As seen, CSCO has been using on average ~12.6% of its operating cash flow (“OPC”) as maintenance CAPEX and about ~39.4% as dividends. So these two “mandatory” have been on average costing 52% of CSCO’s operation cash in recent years. The quotation mark means even though the dividend is usually considered an optional cost. But for a dividend stock like CSCO, it is not really optional – it probably will be one of the last costs that management is willing to cut.

For the remaining whopping 48% of its OPC, the company does have a choice. It can use it for a variety of things: reinvest to fuel further growth, retain it to strengthen the balance sheet, pay down debt, buy back shares, et al. The business has been a consistent buyer of its own shares as you can see – definitely a good sign of long-term stability and financial health. And we will examine the reinvestment rate in more detail in the next section.

Lastly, CSCO maintains a strong product portfolio and also a very healthy pipeline of new products to prepare for the future. The company has a leading position in a range of products ranging from Internet protocol-based networking and data transporting, voicing, and video equipment. With our work and lifestyle transforming into an increasingly geographically dispersed mode, CSCO is not only well-positioned for the future but also benefits from a secular tailwind for the long term.

Author

CSCO: What are its perpetual growth prospects?

With the above, I would be already happy to buy a quality business like CSCO near 10x EBT if it stagnates forever. But in CSCO’s case, I think there are good perpetual growth prospects too. In the long term (like 10 years or more), the growth rate is simply:

Longer-Term Growth Rate = ROCE * Reinvestment Rate

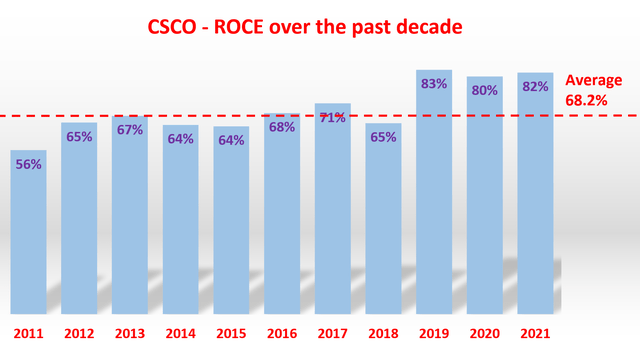

ROCE stands for the return on capital employed. Note that ROCE is different from the return on equity (and more fundamental and important in my view). ROCE considers the return of capital ACTUALLY employed and therefore provides insight into how much additional capital a business needs to invest in order to earn a given extra amount of income. The ROCE of CSCO is about 6825% on average in the long term and about 82% in recent years. To estimate the ROCE of CSCO, I consider the following items capital actually employed A) Working capital, including payables, receivables, inventory, B) Gross Property, Plant, and Equipment, and C) Research and development expenses are also capitalized.

Author based on Seeking Alpha data

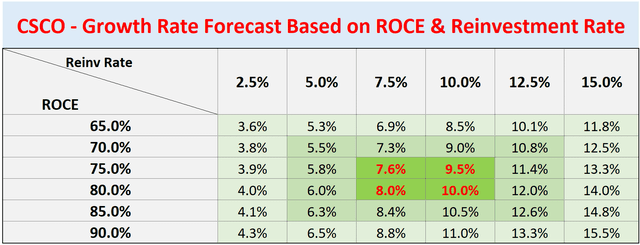

Now with both ROCE and reinvestment rate analyzed, we can estimate the long-term growth rate, as shown in the next chart. This table shows the long-term growth rate at different combinations of ROCE and reinvestment rate. The darker the background color, the more probable the scenario is expected to materialize. The numbers highlighted in red are the most likely scenario given the average ROCE in the past decade and the reinvestment rate that makes sense to me for a business at this scale. Note that in this table, I also added 2% of inflation to the growth rate. So as a result, even when CSCO reinvests 0%, it would still have a growth rate of 2% because of inflation. I think this is justified as CSCO has demonstrated in the past, it has the pricing power to adjust for inflation. As seen, the long-term growth rate is close to the double-digit range, from 7.6% to 10%.

Now to put the pieces together and conclude:

- Paying 10x EBT for a business that will stagnate forever is like owning a bond with a 10% yield.

- In CSCO’s case here, the current valuation is indeed about 11.9x FW EBT (again, adjusted for its cash position), equivalent to purchasing a bond yielding 8.4%.

- At the same time, there is a good prospect of 7.6%~10% long-term growth – a growth rate that can be funded organically and sustained by the business itself.

- So an investment here is similar to owning a bond with an 8.4% yield and at the same with the coupon payment also increase of ~8% per year, leading to a very favorable odds of double-digit return in the long term.

Author based on Seeking alpha data

Risks

Although investment in CSCO does involve its own risks, as detailed below.

The biggest risk now is the pace and degree of the post-COVID economy recovery and its impact on the global logistic chain. Although the vaccination is progressing extensively and the economy is re-opening at a pace. However, the pandemic is far from over yet. Uncertainties like the delta variant and omicron variant still exist, can prolong the general economy recovery, and also can prolong the supply chain interruptions.

In particular, management has provided commentary about supply chain disruptions. Even though demand is recovering nicely, Cisco is still limited in what it can build and ship to customers because of the supply chain disruptions. And the company has to pay much higher logistics costs to get the components and ship them to where they are most needed. This situation is still evolving and can persist.

Conclusion and final thought

This article analyzes CSCO, an industry leader that is for sale around 12x EBT. The analysis is performed under the framework of perpetual growth and Buffett’s 10x Pretax Rule. The results show that CSCO presents excellent prospects for offering double-digit returns in the long term with a wide margin of safety, a strong product portfolio, and long-term financial strength. An investment here is similar to owning a bond with an 8.4% yield and at the same with a coupon payment that increases ~8% per year also.

In particular, this analysis shows that under current conditions, the stock meets all the requirements of Buffett’s 10x EBT rule (except its valuation is a bit above 10x EBT), both qualitatively and quantitatively. Given how many times the grandmaster followed the rule himself and the success he had with it, the results from this analysis show good signs that there are favorable odds for a handsome return here.