onurdongel/E+ via Getty Images

Note: This article was published exclusively to the subscribers of ‘Turnaround Stock Advisory’ on February 1, 2022.

Energy Transfer LP (ET) and Kinder Morgan, Inc. (KMI) are two of the largest pipeline companies in North America. Combined, they have over 170,000 miles of pipelines.

Both are popular on Seeking Alpha with 13 articles published on ET and 11 on KMI in January. However, KMI has about 150,000 followers while ET has 130,000.

Other differences include KMI formerly being an MLP but switching to C-Corp in 2014 and ET being strictly an MLP (Master Limited Partnership) as well as KMI being involved mostly with NG (Natural Gas) while ET is more diversified between oil and NG.

In this article, I will compare the two’s history, current events, and future to determine who will most likely succeed for investors by 2025.

Here are four interesting comparisons between ET and KMI.

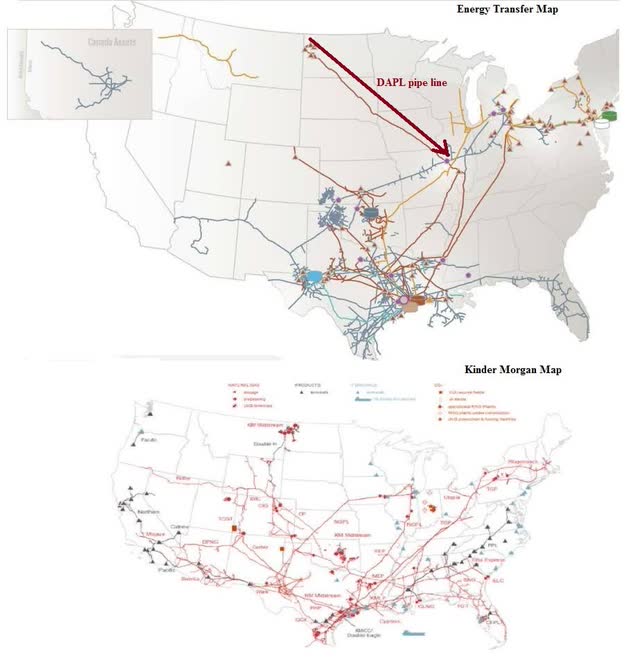

1. With a combined 170,000 miles of pipelines, ET and KMI pipelines span North America

As the map below shows, ET (100,000 miles) and KMI (70,000 miles) have an enormous pipeline footprint.

ET has a large footprint extending into Florida and even Canada while KMI also services some of the same areas. ET has a very big presence in Texas and surrounding areas.

And ET’s problematic DAPL (Dakota Access Pipeline) is easy to spot starting in North Dakota and extending into Illinois. I have written articles on the DAPL issue including “Energy Transfer: The Elephant Is Leaving The Room” and “Energy Transfer: What’s The Worst Thing That Can Happen?“.

KMI on the other hand has a more geographically diverse presence with locations in almost every state in the union.

ET was founded in 1996 and KMI in 1997.

ET and KMI

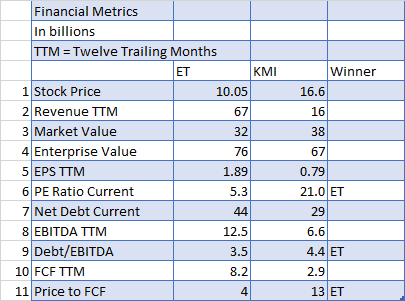

2. Financial metrics show ET to be superior

Looking at key financial metrics, ET is the winner in four out of six key measures.

Seeking Alpha and author

The numbers that jump out at you are lines 3 and 4 which show ET with 4X the revenue but a lower MV (Market Value). This shows the disdain that the market currently has for ET.

This is in spite of ET having a much lower PE ratio, debt to EBITDA ratio and price to free cash flow ratio.

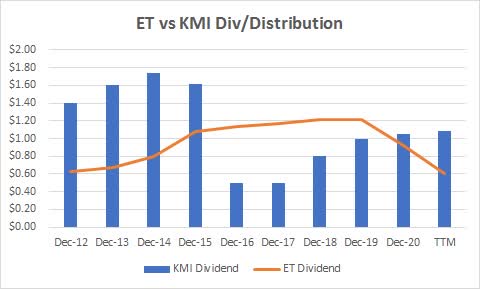

3. When it comes to distributions neither company has done well

Most people who invest in pipelines like ET and KMI are looking for reliably growing distributions. There are not many investors who invest in pipelines who do so for capital gains as the prime reason. Relatively high, steadily increasing distributions are the usual motivation, and if you can get big capital gains too, that’s a bonus.

As the chart below shows, both ET and KMI have cut their distributions significantly over the last 10 years, but over the last four years, KMI has increased while ET has decreased the distribution.

But on Jan 25, 2022, ET raised its dividend by a substantial 15% perhaps indicating that large increases will be more likely going forward.

Seeking Alpha and author

Current rates are relatively high with ET at 7% vs KMI at 6.5%.

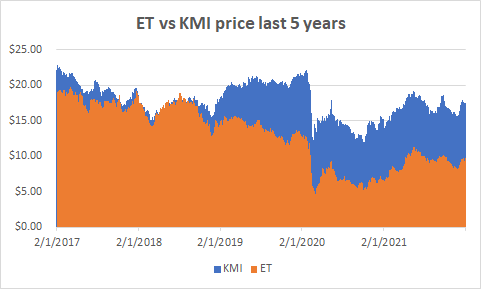

4. KMI’s stock price is down 21% over the last 5 years while ET is down 47%

It turns out that over the last five years, both ET and KMI have lost value based upon the stock price. ET is down 47% while KMI is down 21% over the same period.

NASDAQ and author

Adding five years’ worth of distributions (KMI = $4.43, ET = $5.67) would bring KMI to almost breakeven for the 5-year period at minus 2% and ET down 16%.

But considering the S&P 500 (SPY) is up 99% in that same period, both have been lousy investments.

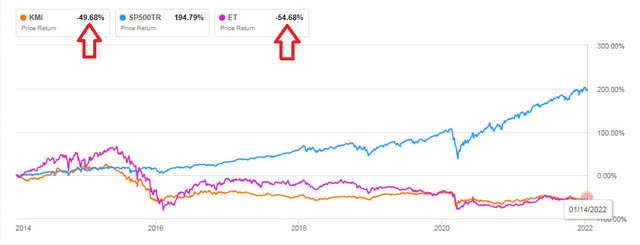

And over the last 7 years, both KMI and ET are down substantially compared to the S&P 500.

Seeking Alpha

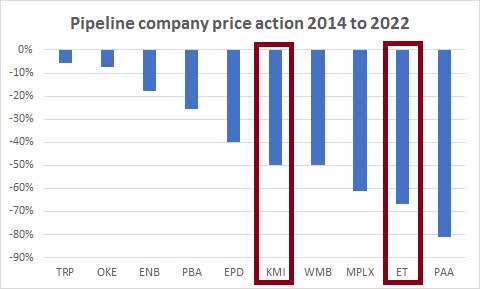

A large part of that may be because pipelines, in general, have been down over the last 7 years.

Seeking Alpha and author

Note that even conservative stalwarts like Enbridge (ENB) and Enterprise Products Partners (EPD) are down over the same period. No one in the pipeline business has been spared.

Conclusion:

When you compare Energy Transfer to Kinder Morgan, you may want to take into account that neither one has done well, price-wise, over the last several years.

Part of that may have been due to the increased investment scrutiny ESG (Environmental, Social, and Governance) movement has had on all things related to petroleum. It is hard to consider that pressure for ESG reform will lessen any significant amount over the next several years. If so, then price pressure may well continue into 2025 and beyond even in the face of better results.

On the other hand, if you look at ET’s price action over the last several years, you could certainly argue, as I have, that ET has been overly punished by the market. As such, ET has a chance for a significant rebound even in a downhill market-sector like pipelines.

ET does have some continuing and worrisome problems including the unresolved DAPL court issue mentioned above and a recent fine of $410 million from the Delaware Chancery Court in its suit involving the aborted 2016 merger with The Williams Companies (WMB).

Offsetting those caveats is the recent announcement by ET that it would increase its dividend by 15% to .175 per quarter (.70 annually) with the goal of restoring it to its previous value of $1.22. The press release also mentions share buybacks and debt paydown.

The distribution is an approximately 15% increase over the previous quarter and represents the first step in Energy Transfer’s plan to return additional value to unitholders while maintaining its target leverage ratio of 4.0x-4.5x debt-to-EBITDA. Future increases to the distribution level will be evaluated quarterly with the ultimate goal of returning distributions to the previous level of $0.305 per quarter, or $1.22 on an annual basis while balancing the partnership’s leverage target, growth opportunities and unit buy-backs. Source: Energy Transfer

Based upon ET’s low price, the rapidly increasing dividend, and potential share buybacks, I rate Energy Transfer as a buy. I rate KMI as a hold due to the relatively strong price compared to ET and the negative sentiment around the pipeline business in general.