Roman Tiraspolsky/iStock Editorial via Getty Images

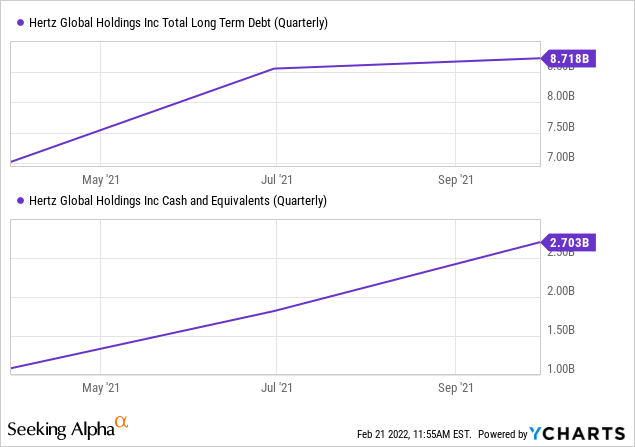

Hertz Global Holdings, Inc. (NASDAQ:HTZ) emerged from bankruptcy on June 30, 2021 allowing for a substantial balance sheet deleveraging and rightsizing of its operations. According to the press release, Hertz removed about 80% of its corporate debt, totaling about $5 billion, and bringing the total balance to $1.5 billion at a floating rate of 4%. The remaining portion is vehicle financing of $7.2 billion, which now carries an average weighted interest rate of less than 2%. With this massive recapitalization, Hertz carries about $8.7 billion in debt with a weighted average interest rate of around 3%, even when factoring in slightly higher base interest rates. Additionally, Hertz also carries $2.7 billion in cash and equivalents at the end Q3 2021.

Through the restructuring process and recovering in operating performance, Hertz effectively rebuilt its shareholders’ equity balance to $4.2 billion. Furthermore, based on FY2021 EBITDA guidance of $2.0-2.1 billion, total debt and net debt to EBITDA have also improved to a much more reasonable level of 4.4x and 3x, respectively. That’s the lowest performance leverage since 2014 when the company reported its highest EBITDA in its history.

Improving Travel

Avis Budget (CAR) reported Q4 2021 earnings with decent results overall. However, management disclosed in its Q4 2021 conference call that commercial travel in January and February has been weak, and fleet utilization is declining. Following these results, three analysts with neutral and underweight ratings all lowered their price targets. Given vehicle rentals are a commodity business, we can expect those trends to impact Hertz as well, and shares have traded down about 10% since that Q4 earnings release.

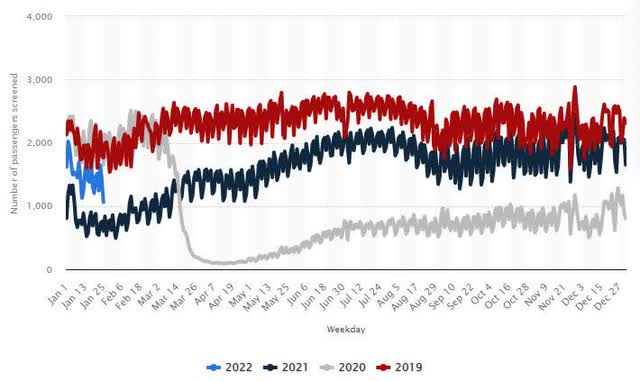

All that being said, overall travel has recovered immensely. Using the daily number of passengers screened at TSA checkpoints as an alternative data source from Statista.com, we can see that 2021 was much better, even amid the breakout of Omicron variant:

Daily number of passengers screened at TSA checkpoints in the United States (Statisa.com)

In 2022, daily travelers have declined somewhat well below 2019 and 2020 levels, which is concerning in the near term. There’s of course also structural work from home and video conferencing trends that aren’t going away. After this seasonal dip in travel in early 2022, I think the trends will directionally improve throughout the course of the year. COVID concerns continue to ease, in-person trade shows and conferences are restarting, and people are seeking to do incrementally more travel vacations.

Radically Better Performance

Hertz reported great Q3 2021 operating performance with much better vehicle utilization increased from 49% in the nine months ended Sept. 30, 2020, to 77% on Sept. 30, 2021. But these trailing 9-month figures actually understate how much performance has actually improved. Referencing TSA figures in the first half of 2021 indicates utilization was still weak at that time.

Granted Q3 is a seasonally strong quarter, I think this recent print was exceptionally and a more realistic account of how their performance will trend going forward. To be clear, Q2 and Q3 are seasonally strong and Q1 and Q4 are seasonally weak. Nonetheless, let’s observe U.S. operating performance where vehicle utilization reached 78%, revenue hit $1.9 billion, SG&A to revenue improved to 4%, and adjusted EBITDA surged higher to $830 million.

Hertz America Performance Trends (Q3 2021 Form 10-Q)

Turning to international operating performance, we can see the same positive trends occurring. It’s to a slightly lesser extent, but revenue and earnings only represent a much smaller fraction of consolidated results:

Hertz International Performance Trends (Q3 2021 Form 10-Q)

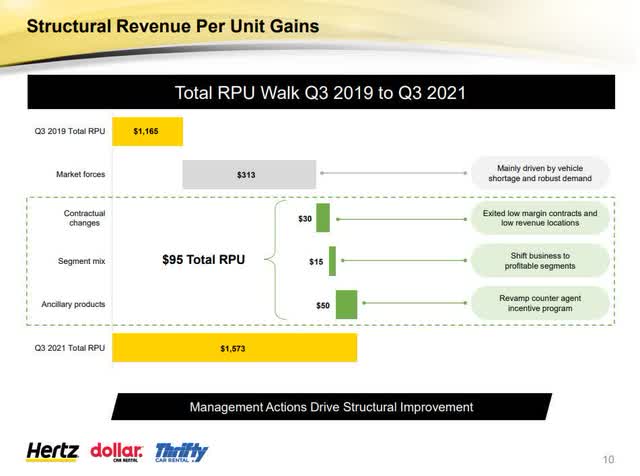

Adjusted EBITDA margins improved from pre-COVID 2019 levels of 14% to 39%, that’s an exceptional improvement. Then moving to the bottom line, Hertz Global reported a net income figure of $605 million, and then, adjusted for one-time expenses, net income was closer to $631 million. That bottom line print is also the best performance in the company’s history as a public company. Why? Most of it was industry demand, but the company also executed to drive structural lifts to revenue and margins.

Hertz Structural Improvements (Hertz Q3 2021 Investor Presentation, Page 10)

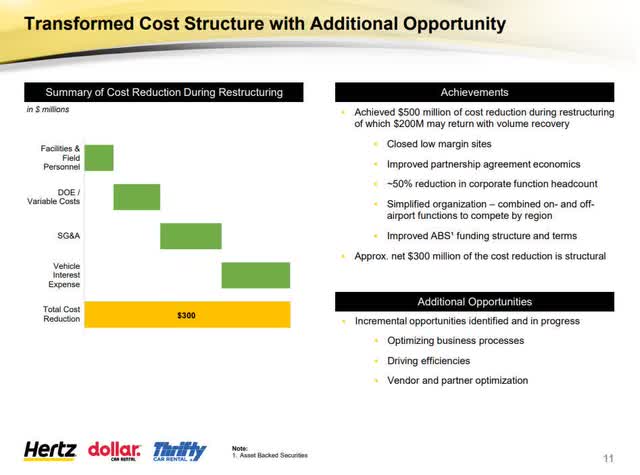

And then, management was also able to strip down the bloated cost structure down by $300 million, and they plan to continue making significant progress going forward:

Hertz Cost Reductions (Hertz Q3 2021 Earnings Presentation)

With adjusted EBITDA margins trending in the high 30% range, including 39% in Q3, it’s certainly possible EBITDA margins will trend into the 40% range. So, if we consider the directional increases in overall travel combined with further cost reductions, Hertz could certainly deliver EBITDA well above its FY21 guidance of $2.0-2.1 billion in years ahead.

Capital Allocation Is Key

Effective February 28, 2021, Hertz will have appointed Stephen M. Scherr as CEO, who is also the former CFO of Goldman Sachs. For one, I think this hire is underappreciated by the market as he will guide Hertz in an incredible way. With a pristine balance sheet, it’s up to management to maintain its incredibly cheap financing while also maximizing returns on capital.

The long-hanging fruit here is the preferred share class. The company already announced a $2 billion share repurchase program, which is a great start. However, I think management should prudently consider eliminating the preferred share balance of $1.433 billion with its 9% dividend distribution. That’s incredibly expensive and the company has the legal option to retire this mezzanine equity. Management has already indicated that $2.7 billion in liquidity is too much with the common stock buyback, so why not eliminate the $135 million dividend distribution sooner rather than later? To put that in perspective, $135 million relative to their $857 million net income estimate for next year would provide 16% incremental earnings growth to shareholders!

The next option would be to gradually roll out the share repurchase program. Shares are still quite volatile, investors and analysts are still trying to wrap their heads around operating performance, and valuations. Granted I don’t think there’s much incremental downside, there’s an inherent advantage to having $2.7 billion in cash liquidity. Deploying its buyback program of $2 billion at $15, $18, or $25 per share results in vastly different outcomes for shareholders by eliminating nearly 30%, 23%, or 17% of total diluted shares outstanding. Anything over 10% surely is substantial but with careful and timely execution, existing shareholders will only significantly more of the business, and return metrics will be much better over the long term.

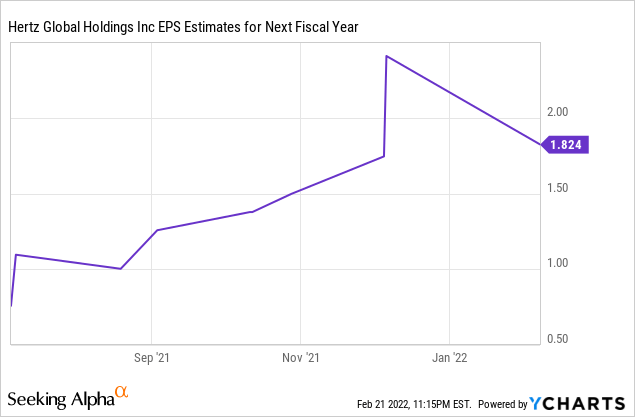

The Street anticipates EPS will reach $1.82 in 2023, and we don’t know whether buybacks are included in that figure, but that implies a 10x multiple.

However, if we hypothetically deployed all repurchases at $18/share, then EPS would increase towards $2.30. Then over the next five years, consider that Hertz should be consistently generating earnings that will allow the company to reinvest and/or deploy additional capital to shareholders. Over the next five years, Hertz could generate several billion in cumulative earnings, and assigning a 10x multiple to $2.30 EPS could bring shares to my $30 target.

Mind the Risks

There are a variety of risks that investors should be aware of regarding Hertz. To start, operating performance is very dependent on the economy, commercial and consumer travel, and subject to intense competition. We saw how these factors impacted Hertz in the final years leading up to its bankruptcy filing.

Additionally, the business model inherently requires substantial capital expenditure outlays which can delay cash accumulation. Finally, management could inefficiently allocate capital by allowing the preferred shares to continue to exist and thereby distribute dividends to that share class and/or repurchase shares at expensive or above-fair value levels.

The company also disclosed liabilities subject to compromise, dated to the fiscal period ended June 30, 2021, which includes accounts payable, accrued liabilities, and accrued taxes totaling $370 million. A small, but not immaterial risk factor, that could slightly reduce Hertz’ cash liquidity of $2.7 billion.

Bottom Line

Hertz Global offers an interesting opportunity for prospective investors after the weak travel prints in January and February, although negative momentum may continue in the short term. The company is expected to report Q4 2021 earnings after market hours on Wednesday, February 23. While I believe most of the downside has been baked in, conservative investors may wish to wait until earnings are reported to create a position. What do you think? Let me know in the comments section below. As always, thank you for reading.