Andrew Burton/Getty Images News

Alibaba Group Holding (BABA) will report earnings for the fiscal quarter ending December 31, 2021 before the market opens in the United States on Thursday, February 24, 2022.

The conglomerate’s earnings and sales figures are keenly awaited, especially in light of negative retail trade data from China, which has slowed further towards the end of 2021. In light of these macroeconomic trends, I believe Alibaba will lower its forecast for 2022 sales growth, and investors may want to hedge against a drop in the stock price before the eCommerce business reports fourth-quarter earnings.

Alibaba’s 4Q-21 Earnings Will Be Under The Impression Of A Slowdown In Retail Sales Growth

Alibaba’s eCommerce sales growth may have slowed considerably faster in the fourth quarter than the business and its investors would have liked. This week, Alibaba’s eCommerce expansion, which has already begun to decline, might result in significant sales and earnings-per-share failures for the company.

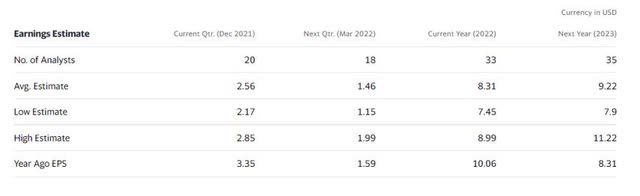

Analysts predict Alibaba to announce earnings of $2.56 per share on average, representing a 24% decrease YoY. I believe Alibaba will significantly underperform the average earnings-per-share forecast, owing to revenue headwinds and an accelerating downturn in retail spending in China in 4Q-21, which would have left a negative stamp on Alibaba’s results for the quarter.

Earnings Estimate (Alibaba Group Holding)

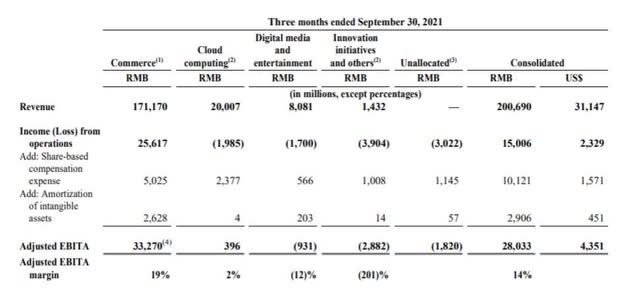

In recent years, Alibaba has begun to diversify its company and has made strong investments in its cloud business, digital media projects, and logistics. The logistics industry, in particular, benefited from the 2020 coronavirus outbreak, as the quantity of sent goods increased dramatically. While all of these initiatives were intended to reduce Alibaba’s reliance on the (slowing) eCommerce sector and diversify its revenue streams, the company has had only minimal success thus far.

Cloud computing revenues represented for barely 10% of Alibaba’s consolidated revenues for the three months ended September 30, 2021, despite years of increasing efforts. In the September quarter, cloud computing income accounted for only 1.4% of Alibaba’s total profits. Digital media and other digital marketing initiatives contributed for only 4% of revenue in the previous quarter, and the company is still losing money.

Consolidated Revenues (Alibaba Group Holding)

These percentages are unlikely to have changed significantly in the most recent quarter, which leads us to an essential conclusion: Alibaba’s eCommerce division will have borne the brunt of China’s retail sales slump, which increased towards the end of last year.

With eCommerce accounting for more than 80% of Alibaba’s income, slower retail sales growth may have had a significant impact on the company’s eCommerce results in the December quarter.

The majority of Alibaba’s investments continue to be directed into the company’s retail and wholesale eCommerce divisions. This concentration of investment money in a single industry may harm Alibaba if eCommerce growth slows in 2022.

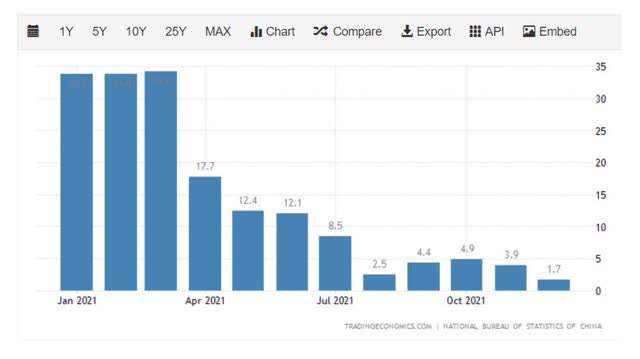

The graphic below depicts the severity of China’s retail sales slump. China’s retail sales growth fell to 1.7% YoY in December, indicating the second consecutive month of slowing growth in a market critical to Alibaba.

China’s Retail Sales (Tradingeconomics)

Importantly, the retail sales decline accelerated towards the end of 2021, implying that the 1.7% retail sales growth rate recorded for December was the worst in more than a year. One may easily ignore this result and argue that growth rates are ‘recalibrating’ since Covid-19 is no longer as significant a danger to the economy as it was in 2020. What cannot be denied is that the slowdown in Alibaba’s main theater of operations will have an impact on the company’s earnings report, which will be released this week.

What Are The Implications Of An Accelerated Slowdown In China Sales?

This is where it gets a little speculative, but I believe Alibaba’s December quarter numbers will be worse than projected, potentially generating a short opportunity in the stock. Last year, Alibaba cut its 2022 sales growth target to a range of 20% to 23% due to continuous revenue headwinds, and the alarming slowdown in China’s retail trade indicates to greater revenue and free cash flow risks this year.

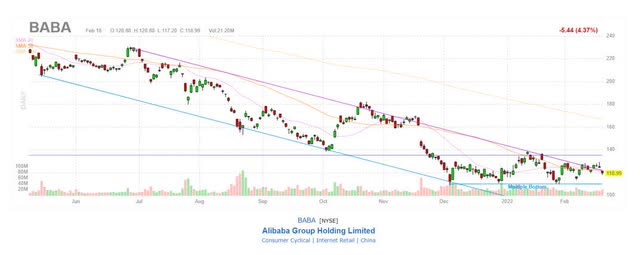

BABA Stock – Making New Lows?

If the earnings report indicates weaker-than-expected sales and earnings growth, I believe Alibaba will at the very least re-test recent lows and potentially crash through the latest low of $108.70. A significant EPS shortfall, as well as a probable drop in Alibaba’s 2022 sales forecast, might result in a dramatic price correction in Alibaba’s stock.

BABA Share Price (Finviz)

How I Am Playing Alibaba’s Earnings Report

In my opinion, the likelihood is that Alibaba will fall short of expectations, even though they are already relatively low. To profit from a deterioration in Alibaba’s fundamentals, I’m buying Alibaba put options with a strike price of $100 and a put expiration date of June 2022.

If the earnings report is as awful as I expect, the short position could allow me to profit from a dramatic decline in the price. Given how investors have reacted to the latest batch of earnings reports, particularly with regard to high-growth stocks, a 10-15% fall, even in the event of a beat, is not out of the question.

My short position is not a hedge because I do not have a long investment in Alibaba. I’m opening a short position to generate alpha, but because my position in Alibaba represents less than 0.5% of my portfolio, the risk is well-managed.

My Conclusion

The market overestimates the likelihood of Alibaba falling short of earnings-per-share projections for the December quarter. The significant deployment of investment funds to eCommerce, the apparent over-representation of eCommerce in the revenue mix, and the accelerated decline in retail sales in the fourth quarter make it even more likely that Alibaba would cut (or withdraw) its sales projection for 2022.

Should this be the case, there is an opportunity to capitalize on an unexpected, large move in Alibaba’s stock price to the downside. Because I keep my exposure to Alibaba minimal, on the very small chance of an earnings-per-share beat, losses are contained and will have little influence on my overall portfolio performance.