Andrew Burton/Getty Images News

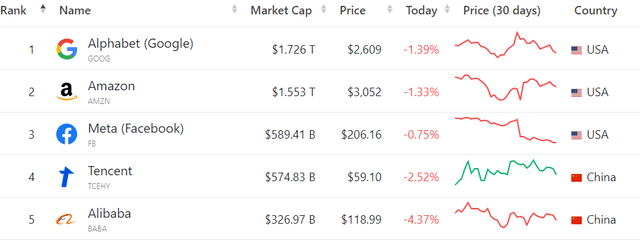

Alibaba Group Holding Limited (BABA) is the worlds 5th largest internet company by market value. It’s most direct comparable would probably be Amazon (AMZN).

Investopedia

Recently, BABA has seen its stock price and market value fall considerably mainly due to happenings in China itself rather than market concerns.

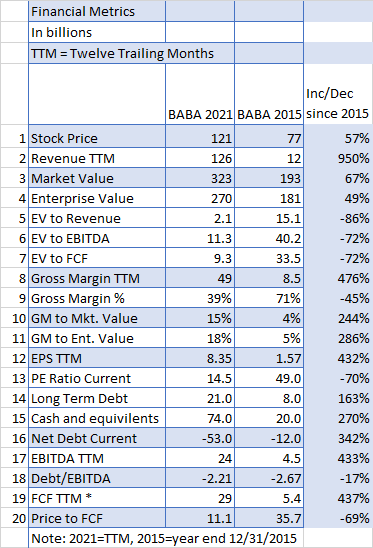

Alibaba’s Stock Key Financial Metrics

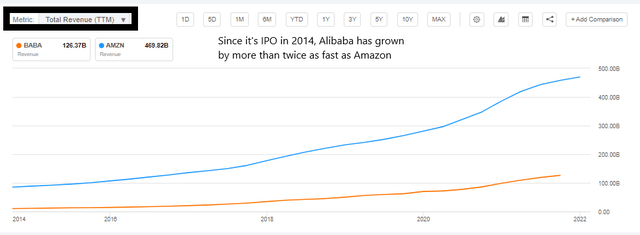

Alibaba is a Chinese based stock that IPO’d in 2014 with a value of $25 billion, the largest filing ever listed up until that time. Since then it has had huge success in the internet market growing revenue from bout $10 billion to 2021’s $126 billion. That huge growth is roughly twice as fast as Amazon’s revenue grew over the same period of time.

Seeking Alpha

Looking at BABA’s metrics going back to 2015 shows a rapid growth in virtually all financial metrics along with a substantial decrease in market value i.e. the relative price of the stock.

Seeking Alpha

Note that although revenue was up more than 900% and Gross margin dollars, EPS, EBITDA, and FCF (Free Cash Flow) were up over 400% during the period 2015 to 2021, market value has only increased by 67%. Not only that but cash in 2021 exceeds debt by an amazing $53 billion.

In fact, Cash and Equivalents for Alibaba at year end 2021 exceed $32 per share.

So financially speaking, Alibaba is in outstanding condition to weather almost any future financial issue that might arise in the foreseeable future.

Has Alibaba Stock Been A Good Long-Term Pick?

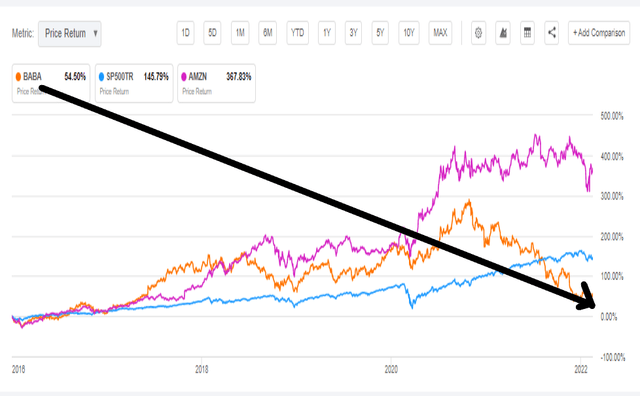

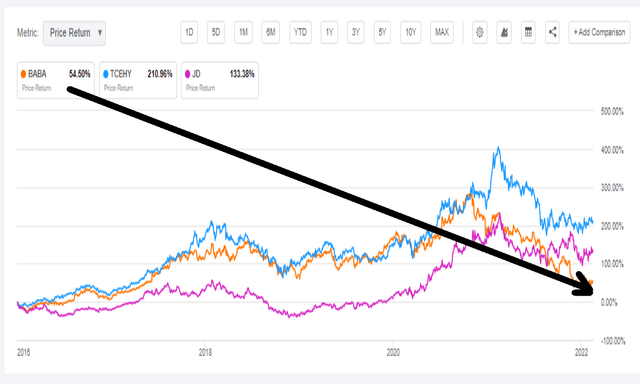

Looking at the chart above (line 1) you can see that the price of BABA has risen by 57% over the last six years a rather paltry 8% per year compounded. Compared to others in the fast growing internet market that is depressingly low.

But from the previous section above we can see that financial performance since 2015 has far out shown the price performance over that same period.

That performance, rather lack of performance, can be easily seen in the following chart. Competitor Amazon is up by over 300% and even the mundane S&P 500 was up over 100% over the same period.

Seeking Alpha

So what could be causing the lack of price performance for BABA versus the rest of the market?

Well, I would argue it does have a lot to do with being a Chinese company specifically and there is some market chatter to that effect. But a counter to that argument comes when you compare BABA’s price performance with other Chinese internet behemoths, JD.COM (JD) and Ten Cent (OTCPK:TCEHY) both of which show substantial gains at least relative to BABA.

But even there, both JD.COM and Ten Cent have underperformed Amazon over the same period of time.

Seeking Alpha

So compared to main competitor Amazon and fellow Chinese internet giants JD.COM and Ten Cent, Alibaba has not performed well at all from a stock price perspective.

What Is Expected For Alibaba Stock In 2022?

For the balance of 2022, it is difficult to determine if the negative perceptions of BABA vis a vis other internet companies will persist.

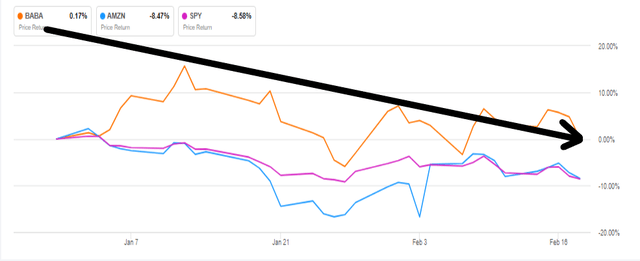

Based upon the YTD (Year To Date) market performance however, the negative perception of BABA as shown in sections one and two above, seems to have abated somewhat with BABA actually up over the YTD period while the other two are in negative territory.

That can easily be seen in the chart of BABA’s stock since the first of the year again compared to AMZN and the S&P 500.

Seeking Alpha

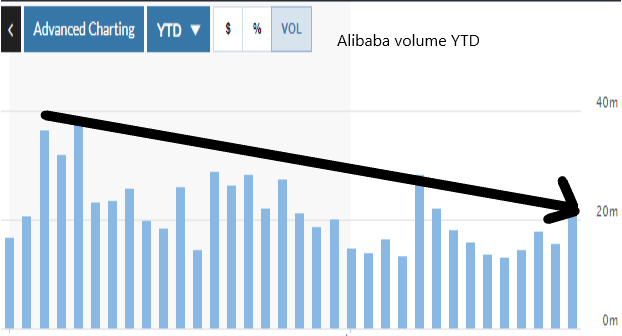

However, volume has been pointing down so we need to take that metric into account before we make an investment value decision on BABA’s 2022 stock price performance.

MarketWatch

Where Will Alibaba Stock Be In 10 Years?

We have looked at Alibaba and it’s performance over both its entire market history beginning in 2014 and more recently from the end of 2015 and YTD 2022.

What we have found is a very dynamic company that seems to have slumped in price for reasons other than normal market ones. In comparisons with competitor Amazon and Chinese counterparts JD.COM and Ten Cent we can see no pointed reason why BABA’s performance doesn’t match the others.

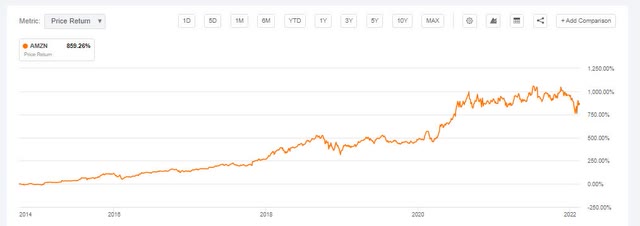

I think a reasonable comparison would be with AMZN’s stock price performance since BABA’s IPO in 2014. We then need to adjust potential future performance by the fact that being a Chinese company continues to have a detrimental effect on the share price whether valid or not.

Seeking Alpha

We can see that AMZN is up over 750% over the last seven years (33% per year), so a respectable but discounted return of 12% per year by BABA would result in BABA’s share rising by a little over 300% over the next 10 years.

That would seem reasonable taking into account that BABA now offers cloud services just like Amazon’s AWS.

Of course, dealing with the Chinese government’s potential negative intervention over 10 years is a near impossible task so I would make that the largest unknown in BABA’s investment calculus.

Conclusion: Is BABA Stock A Buy, Sell, or Hold Now?

At this point in a five or ten investment cycle, you need to checkmark items that might negatively affect Alibaba in the future.

The list is long.

1. Since 12 moths ago, BABA’s price is down more than 50%.

2. The market’s long-term trend up is due for a reset sometime sooner rather than later.

3. Inflation does not seem to be going away anytime soon.

4. International tensions between China and western nations, both economically and militarily, does not seem to be improving and if anything seem to be deteriorating.

As an example, on February 17, Alibaba ended up on the US’s “Notorious Markets” list.

Is this completely legitimate or, at least partially, a shot across the Chinese governments bow?

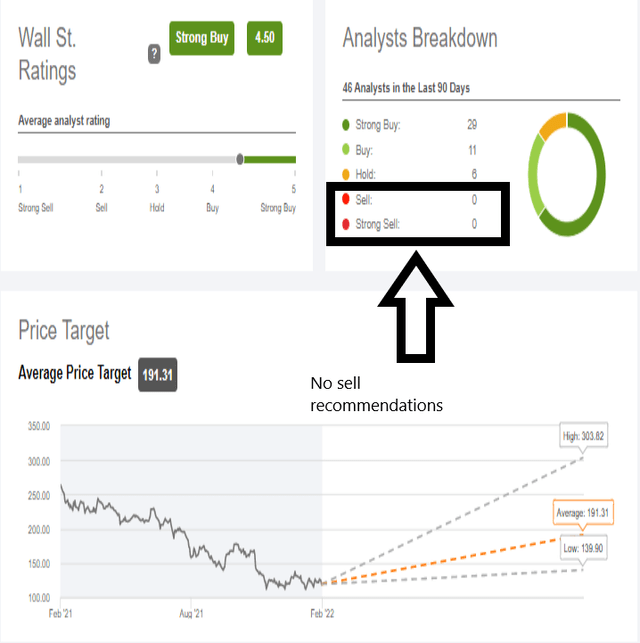

Looking at analysts opinion over the last 90 days show zero, none, nada sell recommendations.

Seeking Alp[ha

I will admit, that is as strong a general recommendation that I have seen, but my caveats listed above continue to make me wary.

Alibaba is a Hold unless you feel the international tensions between China and the west will recede soon.