MicroStockHub/iStock via Getty Images

Thesis

I believe The Charles Schwab Corporation (SCHW) has ample room for sustained growth in the short and long term. In my opinion, Schwab’s growth will be driven by attracting new clients (and assets) through minimal costs, investing & wealth management tools, and a platform that’s easy to use. Increasing total interest-earning assets coupled with a rising interest rate environment may drive Schwab’s largest revenue segment supporting total top-line growth. Continuous expansion in client accounts and assets on the platforms may lead to higher asset management fees and increased trading revenues generated from higher transaction volumes.

The future of Schwab’s success is dependent on its management team in my opinion. Based on past acquisitions, financial quality, and platform growth, I believe Schwab’s management team is excellent and may continue driving future returns for shareholders.

Background

Charles Schwab is one of the largest savings and loans holdings companies in the world with $7.80 trillion in total client assets across 33.3 million brokerage accounts as of January 31, 2022.

SCHW IR

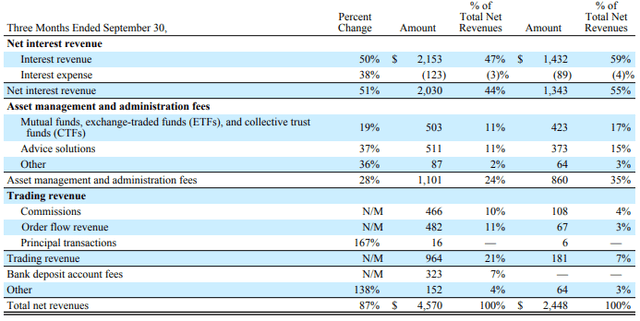

Schwab and its subsidiaries (including TD Ameritrade) conduct business in wealth management, securities brokerage, banking, asset management, custody, and financial advisory services. Schwab aims to create the best investing experience for clients on their platform by adopting an empathetic strategy of viewing their platform “Through Clients’ Eyes.” Schwab makes money through three primary segments: (as of Q3 ’21)

SCHW 10-Q

Platform Growth

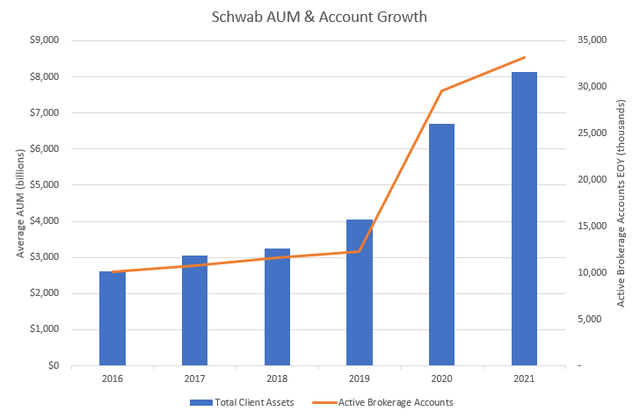

From 2010 to 2019 Schwab grew client accounts by ~5% per year and total AUM by ~11% per year. The ability to grow total accounts at a stable rate coupled with a recovering market following the Great Financial Crisis led to a $3.5 trillion increase in total assets for Schwab. The stability over this 9 year period allowed Schwab to deliver a 13.35% CAGR (including dividends) for shareholders.

Fast forward to today, Schwab now has $7.8 trillion in total AUM with over 33 million active brokerage accounts. I believe COVID and the Fed’s QE policy that followed played a massive role in creating new market participants which I believe was a tailwind for Schwab’s overall asset and account growth. While Schwab’s AUM and accounts grew by ~102% and ~169% since 2019, the consolidation of TD Ameritrade made up ~29% and ~67% of the AUM & account growth, respectively.

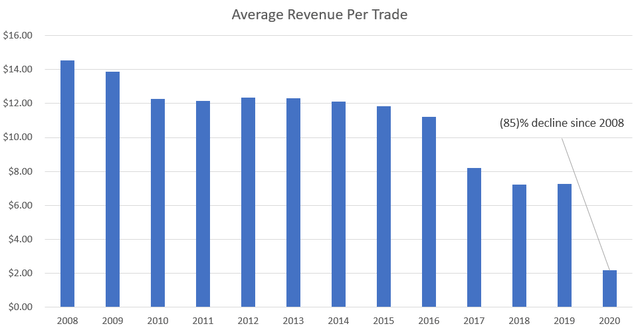

While I believe account and AUM growth will normalize following the acquisition of TD, Schwab has opportunities to generate new client accounts and earnings. I believe Schwab is on the cutting edge for retail and institutional custodial services supported by their “Through Clients’ Eyes” initiative. While COVID and QE were great in creating new market participants, Schwab was also the first of the big four to drop trading commissions to $0 back in late 2019, leading the way for major brokerages. While it may be hard to make trading any cheaper, I believe Schwab’s management will continue cultivating an easy-to-use, resourceful, and accommodative platform that will drive future account and asset growth.

SCHW IR

Between retail wealth management, registered investment advisor channels, and bank deposits, Schwab management estimates there is $70 trillion in investable wealth in the United States. Holding slightly over 10% of that total investable wealth, I believe Schwab still has room to grow assets in terms of market share as well.

Interest Rate Catalyst

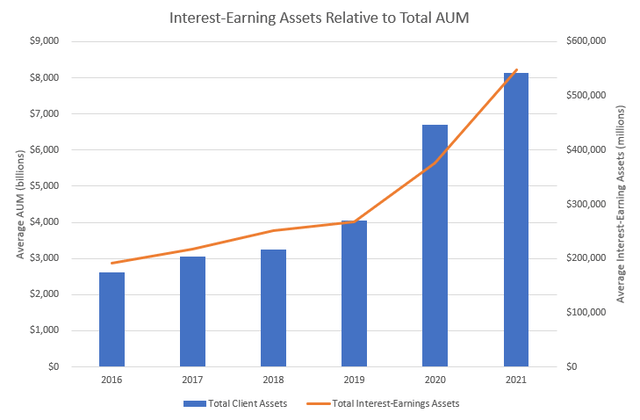

Increasing total AUM is key for future revenue growth for Schwab as they are potentially able to generate higher asset management and trading fees. While asset management fees and trading revenue can vary year-to-year with market volatility, the segment I believe is poised for immediate expansion is interest revenues.

Since 2016, Schwab has increased interest earnings assets by an annualized rate of 23%.

SCHW IR

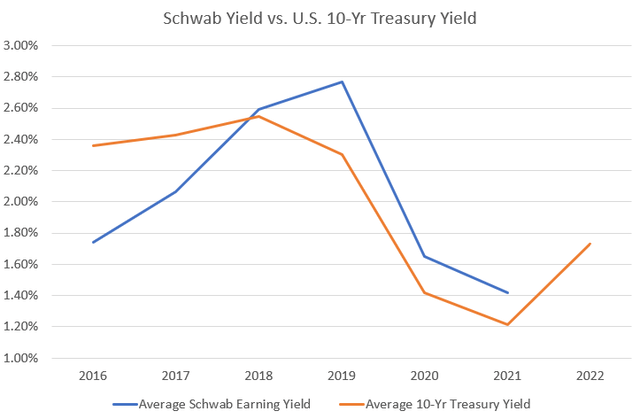

While interest-earning assets have dramatically expanded since the TD Ameritrade acquisition (+104% since 2019) average yield on these assets has contracted 135 basis points to 1.42% in 2021.

(Note: TD Ameritrade contributed approximately $12 billion of average interest-earning assets and $9.6 billion of average interest-earning liabilities following the consolidation. Removing this $12 billion from Schwab’s total interest-earnings assets would still result in the growth of ~99.8%)

Currently, the Federal Reserve is tapering the quantitative easing policies that were introduced to help combat economic harm related to COVID. With the Federal Reserve expected to hike rates numerous times throughout the year, debt markets have already begun pricing in rate increases. When comparing Schwab’s historical earning yield to the U.S. 10-Yr Treasury yield, the two are highly correlated in my opinion. As the 10-Yr Treasury yield continues its ascent, I believe Schwab’s earning yield will follow suit, potentially bolstering interest revenues:

SCHW IR, TradingView

After being flushed with new interest-earning assets in the past few years, I believe a rising rate environment will catalyze net interest revenues in the short term. I will cover this more in my financial projections below.

Management

I want to highlight Schwab’s current management team for their previous successes as I believe it plays an important role in an investment decision.

Financial Quality

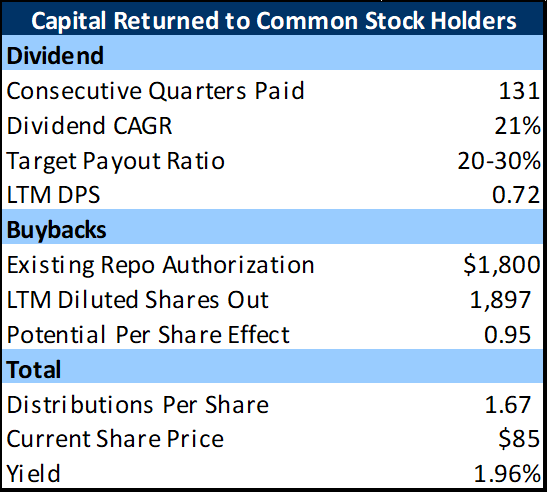

First off, Schwab management has done an excellent job keeping the company accredited in terms of financial quality, in my opinion. Charles Schwab Corp. currently has a liquidity coverage ratio of 109% (well above the 100% requirement); debt ratings of A2, A, and A at Moody’s, S&P, and Fitch, respectively; increasing profitability metrics; a stable/growing dividend, and an active buyback program.

SCHW IR

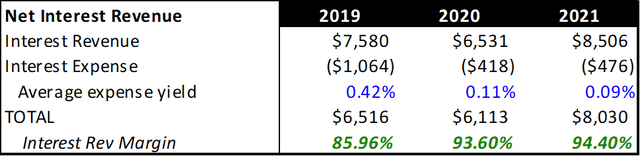

Management has also actively refinanced debt in order to keep margins elevated in its largest revenue segment.

SCHW IR

TD Ameritrade

Schwab’s financial quality gives me reason to believe management doesn’t take unnecessary risks and runs the business with a high level of competence. Along with financial stability, past acquisition history is very impressive in my opinion, specifically with TD Ameritrade.

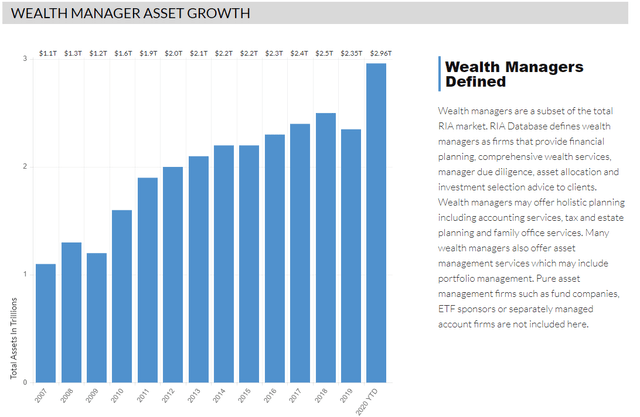

TD not only helped bump total AUM and accounts immediately for Schwab, but it also creates a runway for new assets to migrate to the platform in the future. By combining forces TD and Schwab now offer a wide range of investment products and advisory solutions for retail clients potentially attracting them to the platform. More importantly, the combination of Schwab and TD creates synergies for Registered Investment Advisors (specifically wealth managers) and will potentially allow them to continue taking market share in this segment moving forward as more RIAs switch or start up. Not only is the current RIA industry (specifically wealth managers that use platforms like Schwab) very large represented by 15,000 firms managing $3 trillion in client assets, but it is also growing as some of these firms may be actively pursuing new clientele. I believe this means if Schwab and TD can continue bringing RIAs to their platform, advisors may provide additional asset boosts if they attract new clients.

RIA Channel

The reason I want to highlight management for this acquisition is not only for future growth prospects and potential synergies driving earnings, it is because of how they were able to pull it off for the price they did.

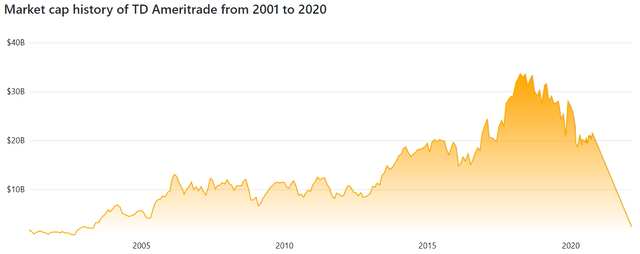

After Schwab announced they were going to drop U.S. equity, ETF, and options base commissions to zero on October 7, 2019, discount brokers including TD Ameritrade and E*Trade started feeling the pressure. Following the Schwab announcement, TD Ameritrade’s stock price fell 34%. Shortly after this route in price, Schwab stepped in and announced the acquisition of TD Ameritrade for $22 billion all-stock on November 25, 2019. Because of Schwab’s (in my opinion) strategic announcement, they were able to purchase TD at a ~35% discount off all-time highs.

companiesmarketcap.com

Forecasts

Model Highlights

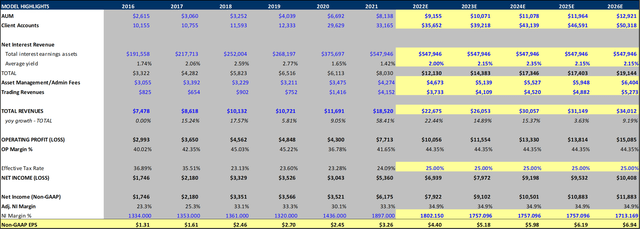

Created By Author

Source: Created By Author Using Data From SCHW IR

Price Targets

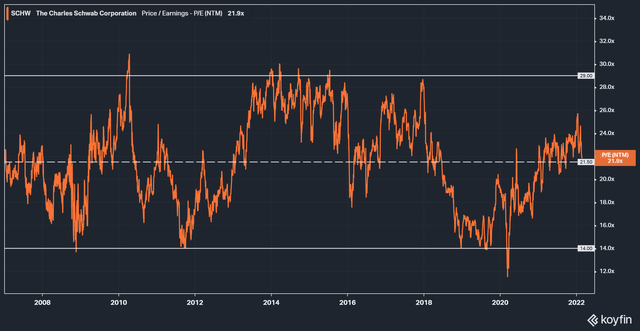

Historically, Schwab has consistently traded between 14x and 29x next twelve month [NTM] P/E, in my opinion:

Koyfin

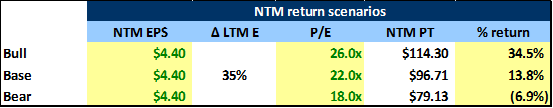

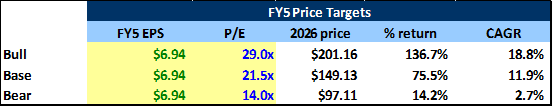

Given the historic P/E trend, I’ve conducted bull, base, and bear case price target scenarios for the next twelve months as well as 5 years out:

Created By Author

Created By Author

(EPS-based PTs are calculated by multiplying non-GAAP EPS of $6.94 by the P/E multiples of 29x, 21.5x, and 14x. % Return and CAGR columns use a present value share price of $85. CAGR is using an n=5 years.)

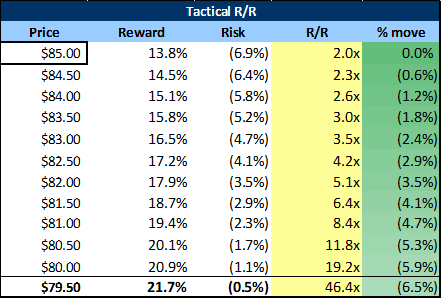

The NTM risk to reward (using base and bear case scenarios) currently represents an asymmetric opportunity (>1.0x) but is very positively asymmetric at $79.5:

Created By Author

Risks

The major risk outside of systematic equity risk for Schwab lies within the valuation, in my opinion.

TradingView

While Schwab’s NTM P/E multiple currently trades at the historic average, in my opinion, recent moves in stock price may show that the potential catalysts with the TD acquisition and rising interest rates have been priced in. After running roughly 75% since pre-COVID (32% CAGR) many investors may have already baked in this growth story, eliminating potential upside.

Summary

I believe the mitigant to catalysts already being baked in lie in Schwab’s potential for execution. In my opinion, Schwab’s management has successfully delivered value to shareholders in the past decade generating a CAGR of 21%, including dividend reinvestment. Along with overall returns, I believe Schwab’s financial quality is exceptional and I have a strong conviction the TD Ameritrade acquisition will benefit shareholders greatly. With management’s past successes, I think asymmetric return potential exists for Schwab at current prices. With Schwab’s management navigating the market with tailwinds providing potential support, I believe current entry to Schwab will deliver long-term returns.