BrianAJackson/iStock via Getty Images

While the S&P 500 is just now officially in a correction, some stock market segments have been in one for months. Most notably, those sectors with high-interest rate exposure, such as lenders. As short-term rates have skyrocketed and the yield curve has flattened, many have seen their book values decline dramatically, and their cash-flows tighten.

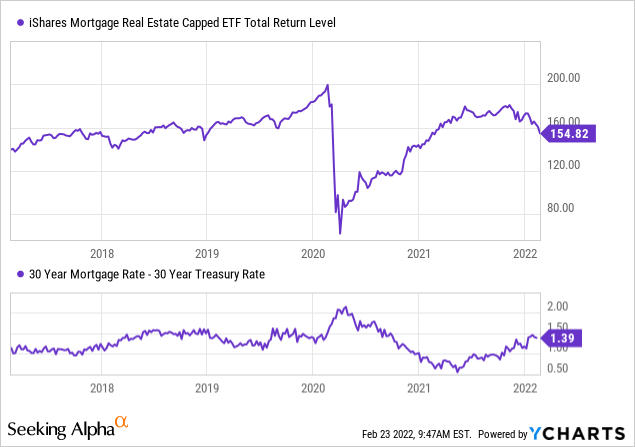

One key example is the mortgage REIT market which has declined by roughly 20% since last October, as seen in the iShares Mortgage Real Estate Capped ETF (REM). Most mortgage REITs borrow in the short-term repurchase market and use that capital to buy mortgage-backed securities (pools of mortgages) with longer maturities, often at 8-12X leverage. When short-term borrowing rates are near zero and mortgage rates are around 3%, this strategy can easily result in 10-15%+ annual returns, usually paid out as dividends. With dividend yields often near double-digit levels, many investors have clamored into these mortgage REITs, potentially without fully understanding their downside risks.

Some smaller mortgage REITs such as Orchid Island Capital (ORC) have become very popular with dividend investors. Currently, the company boasts a staggering forward dividend yield of 18% and a forward “P/E” of only 4X. On the surface, this company is very attractive to many investors. However, I generally take the view that “if something looks too good to be true, it probably is not true, at least not entirely so.” I covered ORC last in 2020 in “Orchid Island: Shuttering Mortgage Market Signals Potential Bearish Move.” Though it took time for that bearish view to pan out, the company is now down 29% since (only 11% after accounting for its dividend). My entire rating history for the company is shown below:

Harrison Schwartz Seeking Alpha Rating History For ORC (Seeking Alpha)

I have not always been bearish on ORC and was a bull during the 2020 dip. However, as noted in the October 2020 report summary:

Rising inflation factors could cause short-term rates to rise sooner than expected, possibly limiting Orchid Island Capital’s profitability and asset value.

This prediction is, more or less, exactly what has brought ORC down since then. Inflation has risen faster than most economists and analysts expected, which has caused immense pressure on highly-leveraged lenders like ORC. The stock is down quite substantially from its 2021 highs and has seen some accelerating losses lately, so it seems like a good time to take a closer look at ORC and the mREIT market as a whole.

Primer On mREITs and Mortgage Spreads

Problematically, the huge ~1% rise in the one-year Treasury rate will soon force many of these companies to pay much higher monthly interest expenses. Long-term mortgage rates have also risen dramatically from ~3% to roughly 4% today. Though higher mortgage rates increase yields on new investments, it also causes the fair value of existing mortgage-backed securities to decline dramatically. Most mortgage REITs have some protection against this through interest rate hedges on long-term Treasuries, but there is no way to perfectly hedge against higher mortgage rates if mortgage rates rise faster than Treasury rates. This issue is known as “spread risk” and is the primary culprit for the recent string of declines in mortgage REITs.

To illustrate, note the inverse correlation between REM and the spread between mortgages and Treasuries:

When the spread spiked in the early 2020s on fears of a banking crisis, many mREITs declined substantially, and a few never recovered. Subsequently, the Federal Reserve launched its massive Q.E program, which caused trillions in new money to flow directly into the mortgage-backed-security (“MBS”) market. This substantial and still ongoing infusion helped keep mortgage-backed securities afloat and managed to push mortgage rates to extreme lows of 2.5%, substantially boosting the book-values of many mortgage REITs (as their MBS assets rose in value).

However, once the Fed announced it would end its Q.E program, mortgage rates began to climb, causing mREIT book values to decline rapidly. The 30-year “mortgage spread” is now back at roughly normal historical levels of 1.2-1.5%, so this key factor may not continue to cause mREITs to decline in value. Of course, with many risks facing the mortgage and housing markets, we may see mortgage spreads climb back to abnormally high levels as they had in early 2020. Additionally, rates are still meager compared to long-term inflation expectations, so there is reason to believe mortgage REITs may continue to decline.

Why Orchid Island Has Much More To Lose

Notably, while all mortgage REITs depend highly on the financial economy, some are far more dependent than others. The significant difference between mREITs is whether or not they focus on “agency” mortgage-backed securities that carry low default risks due to guarantees from Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC). Other mREITs have more strategic non-agency assets that carry higher default risks and yields. “Agency” MBS assets, such as those in the iShares MBS ETF (MBB), have lower yields and, therefore, greater duration risk exposure to a rise in mortgage rates. This issue is worsened because many mREITs with higher agency MBS assets utilize very high leverage to offset the lower net-interest margins on their loans.

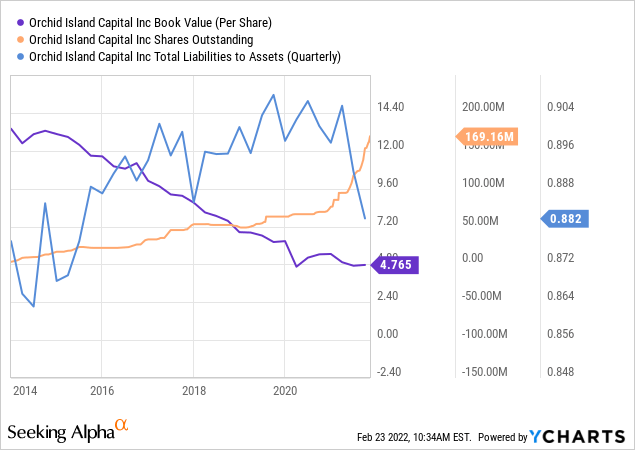

Orchid Island Capital is a notable example of an mREIT that focuses almost entirely on agency mortgage-backed securities and uses higher leverage. As of its Q3 report, 97.5% of its total mortgage assets were fixed-rate MBS, 93% of which had 30-year maturities. The company has made an effort to reduce leverage from a peak of 9.9X in 2019 to 7.5X today, but it generally remains high given the ongoing slide in the agency MBS market.

In my opinion, far too many investors in ORC and other mREITs are too focused on changes to dividends and not on changes to book value. Put simply, do you want a 20% dividend if it’s nearly certain that your asset’s value will decline more than 20% per year? ORC has a notably poor history of seeing its book-value slide, and the recent spike in rates will likely accelerate those declines. See below:

Overall, ORC is in a challenging situation and is struggling to remain afloat. The company is aggressively selling new shares to raise cash to lower its leverage before rising interest rates slash its remaining equity value. As noted in its Q3 report (pg. 51), a 50 bps increase in rates would cause its book value to decline by 10.7%, while a 100 bps increase is estimated to push its book value 22% lower.

Since the end of Q3, Treasury rates have risen by ~70 bps, so I expect this has caused its book value to slide by ~17% to around $3.9. Of course, that model assumes no change in mortgage spreads, which can substantially impact ORC’s book value since it has no hedges against mortgage spreads. The 30-year mortgage spread has risen by roughly 60 bps since the end of October. Of course, this measure may be slightly different depending on which mortgage assets are viewed, but a ball-park spread increase of 50-70 bps since Sept 30th, 2021, generally seems accurate.

Orchid does not report its “spread risk sensitivity,” but its peer (AGNC) does (AGNC 10-Q pg. 44), noting a 50 bps spread risk increase would cause a 27% decline in AGNC’s book value. Obviously, this can not tell us exactly how the mortgage spread spike has impacted Orchid’s portfolio. Still, AGNC and Orchid have nearly identical portfolios (almost entirely fixed-rate residential agency mortgage-backed securities), and Orchid has slightly higher leverage. As of their last reports, neither own mortgage-servicing rights, which can partially hedge mortgage spread risks. Thus, I believe it is fair to assume that the two generally have similar spread-risk sensitivity.

Using a large range to account for uncertainty, I estimate the 50-70 bps hike in mortgage spreads has caused ORC’s book value to decline by at least an additional 15-25% since the end of Q3. Adding on the estimated 17% impact of interest rates, we have a total estimated decline in book value of around 35% with a range of 30-40% since we don’t know how its portfolio has been altered. This estimate places its book value today at ~$3.1 per share.

The Bottom Line

Obviously, this is a speculative valuation since I’m using the limited information available, but I firmly believe that, at $3.6, ORC is likely trading materially above its current net asset value. At the end of Q4, its book value was likely closer to its price today since mortgage rates have spiked the most during Q1, so unless ORC publishes its most current book value, my $3.1 estimate is unlikely to be reported for some months. The company’s recent dividend cut and aggressive increase in shares outstanding over the past year is a strong sign that management is concerned about its cash position.

Problematically, its agency RMBS assets are subject to margin calls if they decline in value enough, so if RMBS continues to slide, ORC may quickly find itself struggling to remain afloat. Given the fact that agency MBS – see ETF (MBB) – has crashed dramatically despite continued purchases from the Federal Reserve, I can only imagine they will decline at a faster pace when the Fed’s purchasing program ends shortly. Add on the impending squeeze on net-interest margins due to rate hikes (most of ORC’s borrowings are 30-90 day repurchase agreements), and ORC’s prospects appear to be very bearish.

There is simply no such thing as a free lunch in financial markets. At least, free lunches that are lasting and dependable. When ORC was cratering, and the Fed started buying mortgages, ORC appeared to be the closest thing to a free lunch, and, indeed, the stock rose dramatically during Q.E as expected. However, “the piper wants his due,” and, for Orchid Island with its adverse exposure, this could quickly bring the stock to new all-time-lows in 2022.

Is ORC A Short Opportunity?

I do not have a short position in ORC since the volatility and high dividend costs are not for me, but I have been short Annaly (NLY) for similar reasons. ORC likely has a substantially higher downside risk than Annaly between the two. In my opinion, ORC is a short opportunity for those who are not swayed with paying high costs. Additionally, if the Fed decides to stop rate hikes or extend Q.E for mortgage-backed securities, ORC and other mREITs could see their prospects improve. While I generally believe investors should no longer count on the Fed due to inflation, an extended Q.E for mortgage-backed securities is possible since there are immense political risks associated with skyrocketing mortgage rates (notably, a large potential decline in home prices). At this time, it still seems likely that the Fed allows mortgage rates to rise, but this is a material risk factor that potential short-sellers should consider.