luza studios/E+ via Getty Images

Introduction

Cryptocurrencies took a beating on news of a Russian invasion into Ukraine, dropping over 10%. The financial markets were rocked with the exception of Gold, which climbed over 4%. Unfortunately for the crypto permabears, markets quickly reversed, and Bitcoin (BTC-USD) has since gained over 15% from its low of US$34.4K, while Gold dropped 4%. In this article I describe why Trudeau has just furthered the argument for Bitcoin.

Canada’s Truckers Freedom Convoy

Truckers protesting Covid vaccine mandates in Ottawa were met with a shocker when Canada’s government invoked the Emergencies Act on 14th February for the first time since its inception. The $10M that was raised on the GoFundMe platform for the movement was banned from being distributed before the majority of which was refunded to donors. Competitor fundraising platform GiveSendGo then stepped in to fill the gap, raising another $10M before the funds there were also subject to confiscation without due process, before truckers eventually turned to the use of cryptocurrencies as an alternative means of raising funds.

This article is not meant to critic the nature of the trucker’s demonstrations, although there have been reports that the largely peaceful protests did turn into unlawful disruptions towards the end, but to highlight Trudeau’s actions in Canada, with regards to the means of financial crackdown, and its implications on the use of Bitcoin and cryptocurrencies. There seems to be some misconception surrounding the ‘immutability’ and ‘decentralized’ characteristics of this asset class, as if to say that subsequent crackdown on the Trucker’s cryptocurrency funds invalidates the whole bull thesis for Bitcoin and altcoins in general. It does not. Well, that’s my opinion at the very least.

Tallycoin Fundraiser

Following the freezing of donations on both fiat fundraising platforms, nearly 20 BTC worth of funds were sent to the Tallycoin fundraiser, before they were redistributed to over 100 crypto addresses in different fractions.

On Feb. 16, Canadian police ordered that all regulated financial firms stop facilitating transactions for 34 wallets associated with the protestors. The police sent a letter to a number of banks and crypto exchanges, Canada’s The Globe and Mail reported, but didn’t specify which ones received the warning.” – CoinDesk

Shortly after, the Ontario Supreme Court of Justice issued a Mareva injunction, a form of judicial order meant to freeze assets and accounts, targeted at nine crypto exchanges that were supposedly associated with the crypto addresses used by the Truckers.

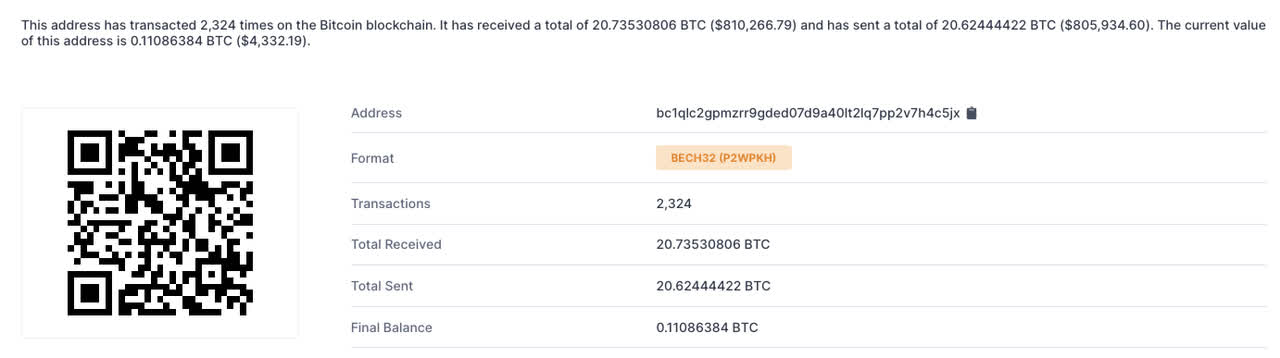

BTCs Remaining (Blockchain.Com)

Since then, it is unclear as to whether the cryptos were exchanged for fiat or how the funds were spent, although the majority of it has already been drained from the initial addresses.

Centralised Exchanges Can Be Shutdown But…

Despite turning to crypto in hopes of bypassing the initial 2 sanctions on the fiat fundraising platforms, truckers were let down by what appears to be the limitations of decentralized systems created to circumvent these issues with the traditional systems in the very first place. The Canadian government still displayed the authority to confiscate financial accounts without any fear of civil liability and were largely successful in clamping down on both fiat financial institutions such as banks and cryptocurrency platforms. A flaw seems to have been exposed in Bitcoin’s misrepresented immunity from government control, but in reality, the devil is in the details and this entire saga only points to greater need for decentralized systems that we see today.

Governments can indeed shutdown their fiat off-ramps, but can only do so when it comes to regulated centralised exchanges (CEX). These refer to exchanges that have KYC (know-your-customer) and AML protocols, and these represented the exchanges where the Supreme Court of Justice sent their warnings to. When contacted, these regulated exchanges that have oversight will need to comply to the state’s demands and freeze users assets and blacklist certain addresses, of which a violation would amount to a criminal act. Once funds have been transferred in, centralised crypto firms may also be asked to prevent the money from being transferred out of the custodial wallet.

Other Means To Circumvent Crackdown

However, there are many other ways to bypass the use of such centralised entities easily and legally, and this shows the limitations of the government’s ability to thwart transactions on proper decentralized systems which represent the true power and case for cryptocurrencies.

Decentralised exchanges (DEXs) do not need to comply to such injunctions and oversights, given that they are largely run by no one but code stored in the smart contract. KYC and AML procedures are not present and hence ‘management’ can’t even comply with sanctions even if they wanted to. See Nunchuk’s response to the Mareva Injunction here.

There are more than 100 DEXs and although governments can technically control every asset, they can’t with cryptocurrencies stored in private/self-custodial wallets where seed phrases are kept with the user and not on the exchange. Seed phrases can be thought of to be the equivalent of proof of ownership of an asset and thereby control over it, and given that it is stored with the user and not even the exchange has a copy of it, no one can attain control over it to freeze it.

One exception to this is when the smart contract for an ERC-20 token (sub-asset and not the native asset itself) on Ethereum (ETH-USD), allows the management team for the issued token to freeze certain addresses and funds within. For examples on this, we can look no further than to Tether. For full-proof ownership of your private keys, which would mean guaranteed control over your assets in entirety, it would be best to use a cold-storage hardware wallet like Ledger. Mike Fay has covered this more in depth in his piece here, as well as certain mobile based software self-custodial wallets like Exodus.

Efficacy of Government Control Remains Slim

The Truckers were able to sidestep the government’s sanctions in part and their ability to thwart the cashing out of their Bitcoin, but this could set a precedent for lawmakers to further regulate the space in a negative manner in the near future though I believe this will achieve little to nothing.

Although it is true that “authorities cannot veto transactions on Bitcoin and similar networks, they also do have leverage over regulated companies that serve as the on- and off-ramps to those networks”. The masses also still do use centralised exchanges (CEXs) that are liable to such sanctions, out of convenience and accessibility, and perhaps critics will return to this line of argument for Bitcoin’s ‘failed’ immunity from state intervention which is just not true on the granular level.

Still, the fact that cryptocurrencies offers the chance for users to hold on to their own assets and be exempt from external confiscation as and when the government likes for whatever agendas they may have, is a boon for the decentralized nature of Bitcoin and blockchain technology. If you really do care about control and privacy, use a DEX and a self-custodial wallet where you retail control of your private keys indefinitely.

Conclusion

Canada’s unjustified and unruly counter-measures taken will largely not go unnoticed, and gave the world a preview of what may happen when democratic governments decide to do without due process.

Bitcoin did pass the fundraising test as observed in the recent Freedom Convoy saga, and Trudeau’s actions only culminated in the loss of faith in the traditional banking system as more and more start to realize the vulnerability of it all and pivot to other asset classes. Continued inconveniences with traditional fiat fundraising methods just yesterday is sure to also see more turn to cryptocurrencies for adoption, regardless of the narrative you assume to be true (digital gold/store of value/p2p currency)

The case for Cryptocurrencies continues to grow stronger by the day, and Trudeau did the exact opposite of closing the Bitcoin argument. One might even go as far as to say that he could not have done a better job in highlighting the need to take back control of your wealth.

Time will tell!