Note To Readers: This is a heavily-cut/adjusted article that was earlier posted on our private marketplace, iREIT on Alpha, on the 21st of February.

Roland Magnusson/iStock Editorial via Getty Images

Oh, Ericsson (ERIC).

It’s one of those companies where my intimate and private knowledge of the company has prevented me from ever really going into it. From personnel scandals to the knowledge of fundamental trouble, excessive and unnecessary consulting costs, corruption, and an inability to pivot from legacy into a new world, there are a lot of reasons why I personally have never invested in a native Ericsson share.

However, I will admit to you, freely, that my personal bias against Ericsson may be coloring my judgment here.

So, I will do my best to throw that bias out the window and clearly present this company to you.

Let’s get this going.

Ericsson – The Legend

Telefonaktiebolaget LM Ericsson, colloquially known as Ericsson, is a Swedish multinational/global telco with headquarters in Kista, Stockholm.

The company was one of the earliest communications companies on earth.

It was founded almost 150 years ago by Lars Magnus Ericsson. When the Kreuger empire fell in the 1930s, the Wallenberg financial empire acquired the voting-strong A-shares of Ericsson and assumed essentially full control of the company.

Ericsson Phone (Wikipedia)

Legacy Ericsson was an early pioneer in building telephones and switchboards for Sweden’s first operating telco, Stockholms Allmänna Telefonaktiebolag. This building of Switchboards and phones is what the company would do for over 100 years – and still does to some extent today.

Ericsson was extremely early in global expansion, through agents. They sold their products in the UK, Russia, and other Nordics. Thanks to Ericsson building local factories, the company quickly grew internationally. Because Ericsson was built in the UK, countries associated with the UK such as New Zealand, Australia and India were exposed to Ericsson products as well. As early as 1890, Ericsson was one of the largest suppliers in the world.

The USA remained closed to Ericsson however, due to the dominance of Bell, Kellogg, and Automatic Electric dominance. Instead, they focused on South American expansion.

Through various political and other measures, the company obtained leases for upselling into the quickly-nationalizing telephone networks at the end of the 1930s. Almost one-third of the company’s sales came from such agreements. The company was the first in the world to introduce the fully automatic telephones system, MTA, in 1956. It also introduced the Ericofon, which was the first commercial telephone with a dial and handset into a single unit.

Ericsson Ericofon (Wikipedia)

Make no doubt, Ericsson was a market leader. An innovator. A trend-setter that would steer the market for decades. Ericsson crossbar switching equipment was used in telephone services in many nations. License fees, sales fees, service fees, all of these were massive.

To use a quote from a man (who sadly passed last year) who worked at Ericsson for 45 years: “Nothing could dislodge Ericsson. Nothing. We were too big. Our equipment was or is everywhere. The notion that anything would disturb us was literally laughed away by every manager.”

Then came the internet/cell phones.

It’s a common misconception to believe that Ericsson “missed” the internet. They didn’t miss it. They just handled it somewhat incorrectly and saw crippling blow after crippling blow – as well as some major “bad luck” and overall global trends.

GSM was essentially a world standard, which together with other Ericsson standards and patents meant that Ericsson controlled around 40% of the mobile market on planet earth. Consider that number for a moment. Back then, it was around 55 million subs, not including Ericsson’s nearly 190 lines connected to AXE exchanges. It doesn’t take a huge amount of research to realize why the fixed/line-connected phone services declined in value.

The reason why Ericsson saw a decline in mobile is in part it’s pushing for the WCDMA standard above the Qualcomm (QCOM) standard CDMA2000 which already had CDMA tailwinds in the USA. While this wasn’t integral in its fall, it was nonetheless the start during the 1999 lawsuit where both parties agreed to essentially pay one another for royalties for the use of their technologies.

For those of you old enough to remember mobile phones at the beginning of the 2000s, it was a different market. Ericsson Mobile was formed as a JV with Ericsson and General Electric (GE). They bought their chips from Philips because neither had their own semi capacity. However, the phones were poorly received. The company issued its first profit warning in early 2001 (I remember this because the news was very prominent in Sweden – a legacy like Ericsson essentially in trouble).

Sales to mobile operators halved. Landline phone sales declined, and new product development fell. The mobile telephone segment/JV became a financial burden, showing a loss of 24B in 2000, not much better in 2001.

Then came the Philips Chip Factory Fire in New Mexico. It was caused by a lightning bolt, and this effectively stopped chip deliveries not only to Ericsson but Nokia (NOK) back in 2001. This is the textbook case for supply chain risk, and it was, without a doubt, the death blow to Ericsson phones/mobile phones.

Following this, the company spun it off into a JV with Sony (SONY), cut tens of thousands of jobs. The segment went from 107,000 in staff to less than 50,000 in a matter of years. Then the company slowly started rebuilding with a focus on services, the development of HSDPA. Ericsson wasn’t the only telephone company that suffered essential destruction of its share prices during the time. Remember names like Motorola, Lucent, Cisco, Marconi, Siemens, Nokia – all of them saw significant drops here. The collapse of Worldcom in 2002 was another blow to the segment, with companies cutting tens of thousands in staff.

Ericsson built its last telephone in 2012. It has never, after this, built another – not a fixed-line phone or a cell phone (not as the company, at least).

That was the end of an era spanning over 100 years at the time.

I apologize for the lengthy backstory here. Let’s move on.

Current Operations

Current Ericsson operations can be described more simply.

Ericsson is a major provider of telecommunications equipment and services. The core of the business is wireless networking.

By this, I mean the infrastructure deployed by telcos to enable data and phone communication.

This is a 170+ billion SEK sales industry or more than 70% of company revenue.

The market characteristics of these operations are cyclical. Telcos invest in infrastructure during rollouts of network. It’s a front-loaded hardware order cycle, complemented by continuing orders of software and service. That’s how it works. How much they spend depends on how well they can monetize these networks. While first generations focused on GSM, current generations are focused on LTE and 5G.

I don’t need to explain to you that the amount of data and needs for these services are growing. The daily use of mobile and streaming is pushing for a new paradigm that, for Ericsson, was unthinkable in the early 2000s (and others as well, of course). Current expectations are for data usage to increase by double digits per year for the foreseeable future.

The company’s products consist of radio systems hardware, like baseband/antenna/microwave/routing/optical as well as the associated software to manage the technology. It also offers product-related services such as optimization, support, rollout assistance, and managed services, where Ericsson operates networks regardless of the equipment supplier.

There is no doubt that Ericsson, thanks to its expertise and breadth of products, has some moats in its segments. Overall, this business isn’t easy to enter due to the massive moats in terms of R&D, patents, licenses, etc. As a customer, you can’t replace Ericsson with others easily because of the massive amounts of both hardware and software stacks that would need replacing – and that’s not even mentioning the risk of network disruptions.

This is the core of Ericsson, now that its phones are gone. Ericsson has tried diversifying away from this cyclical RAN market.

These attempts have unequivocally failed.

Current/Historical segments have included IT & Cloud as well as its Media segment and others. Cloud has seen some limited success, but here Ericsson competes with a world of companies that offer services very similar to those with Ericsson. It was built upon the back of the Redback Network M&A that happened back in 2007. Hopes for this segment lead Ericsson to hire consultants and staff, inflating headcounts without corresponding profit in a highly competitive market. Ericsson has less than a 2% market share here, despite significant CapEx, and competes with far better companies such as Accenture (ACN), IBM (IBM), Nokia, Oracle (ORCL), Cisco (CSCO), Juniper (JNPR), Dell (DELL) and others.

I won’t mince words here. I view Ericsson’s venture into this as a failure. They should not be in the segment.

Media barely justifies mentioning at less than 5% 2016 revenues. The segment offers services and products to TV/Video, like compression hardware and software, pre-and-post processing solutions, advertising, content delivery, and broadcasting, that Ericsson acquired from Technicolor back in 2012. This segment is basically hamstrung by a decline in legacy and was part of a major restructuring plan as early as 2017. It has since been mostly sold off. Much like cloud, it should never have been part of Ericsson in the first place. It was a failure.

In fact, every segment aside from RAN (except RAN Cloud-related services) in Ericsson should be viewed as failure. The negative 6% operating margin, expected negative 10% in 2021 for digital service should be further proof of this.

Ericsson, for all intents and purposes, should be viewed as nothing more or nothing less than an infrastructure hardware and software provider. That is what they know and can do. One of my biggest gripes with Investor AB (OTCPK:IVSXF) is that the Wallenbergs did not enter early on and put a leash around management to stop them from burning cash through these investments.

Legacy is good. Legacy is Ericsson. Legacy is Networks and Managed services, which together account for over 95% of annual sales revenues. 18.6% OM in Networks and 7% in managed services means that only the Digital services segment is pushing the company down to a 13.7% company-wide 2021 operating margin.

Ericsson is significant. It’s one of four remaining worldwide infrastructure providers. These are:

That’s it. Any other peer you mention is too small to matter on a global scale. The lack of an American peer here is quite surprising, but M&A actions and company development have made it this way. Ericsson was earlier the undisputed market leader in this industry, but it’s been losing market share to Huawei. However, the reason Huawei is taking the first place is at the cost of profit margins. While this may matter less in the long term and in China, given their economic circumstances, it will sooner or later probably backfire. There is also the matter of many nations straight-up declining Chinese-made infrastructure, which in some contexts means that the comps are Nokia and Ericsson – none other. Still, there’s an ongoing pricing pressure where the ultimate losers are the suppliers – Ericsson and Nokia – intensifying already-existent cost pressure on equipment.

However, in the meantime, Ericsson has been suffering profitability for years. Stringent cost-cutting and preserving its bottom line to try and appease shareholders have failed, and have also put R&D efforts at risk during a time when they really need to push R&D hard.

If Ericsson did not have the Wallenbergs at their back, who have continued to buy billions and billions of SEK in shares as the company has dropped and being willing to wait on their returns, I have no doubt that Ericsson would be trading 40-60% lower than it is today due to results.

Ericsson’s balance sheet isn’t a pleasant read, but it’s not as bad as you might think. The company stands at around 2X net debt /EBITDA and gears at around 15%. EBIT Coverage of debt is good, so the near-term is safe, with 5G payments starting to roll in.

Fundamental/Recent Upsides

There is no doubt that this has slowly started to materialize. Recent results have confirmed some of the upside as these payments have started to trickle in. The fact that Huawei has been boycotted not just by the US, much of Sweden and Europe have followed. This cut Huawei from 34% of their market. Furthermore, the US went one step further and forbade 7nm chips and below to be shipped to China. Ericsson was a victim of Chinese retaliation to this – but this negative has slowly started to reverse, and Ericsson is unwinding its China dependence.

Both Nokia and Ericsson have, in fact, reversed in 2021, posting impressive results. Ericsson is posting hopeful growth from the US market, as well as its ongoing push for software as well as hardware. The company has signed agreements with both AT&T (T) and Verizon (VZ) for this. Ericsson bought Vonage for $6.2B, which should add to its leadership via exposure to cloud-based communications services. This will enable ongoing 5G-optimization, which should add to company appeal.

Ericsson was able in 4Q21 to offset Chinese business drops with strong organic growth and better profitability. It saw the best FCF in its entire history and has finally announced a dividend increase – which I am sure Wallenberg & Co. have now been waiting for some time.

Ericsson will continue to benefit from 5G expansions. They own the products and they have the necessary market exposure to make sales here. As they start entering RAN-relevant SAAS services, this should add to revenues and perhaps flatten out some of that cyclicality.

So, all the risk is gone, right? Is it a “BUY” now?”

Downside Risks

Well, no. It might be a “BUY” (more on that later), but it certainly still has plenty of downside risk.

Enter exhibit A.

Bloomberg Ericsson (Ericsson)

I wish I could say I was surprised – but Swedish Telco and infrastructure companies have a solid history (See Telia (OTCPK:TLSNF)) of getting involved in these sorts of quagmires. To a degree where I believe they really should be fundamentally discounted for it from the get-go.

While I don’t “officially” cover Ericsson (at least not til now, may start to do so more), I did a cursory review of the charges against the company.

The USA already sanctioned Ericsson with $1B back in 2019 due to corruption in Djibouti, China, Vietnam, Indonesia, and Kuwait. At the time, the US Court sanctioned Ericsson for illegally paying for the services of third-party agents which then gave the Swedish company insider information and secured contracts for them by bribing government officials.

Note one geography/nation is very much absent from that list. Iraq.

If the SEC was unaware of such allegations, that would mean that this will be news to them, and they would certainly be interested in going back and looking at Ericsson here. I don’t think we’re looking at a boycott risk, given the low amount of market alternatives after the Huawei boycott – but I do believe we could be looking at another round of penalties.

In addition, risks are present relating to the company’s high (70%+) dependence on very cyclical, low-margin revenue streams. Competition is intensifying. While there is no real competition in legacy, things like OpenRAN could definitely account for some of the market barriers for entry being made lower and lower.

Ericsson has been a terrible long-term investment.

Ericsson 15-year share price development (Google Finance)

I have never bought a single share, despite my relatively close knowledge of the company. It’s one of the companies I believe the Wallenbergs have actually mishandled, which is a rare thing for them. The fact is that even for Investor AB, this part of its holdings has been an earnings drag for many, many years.

We’ve been repeatedly told by management that things are about to turn around.

I’ll believe that when I see it. That’s the negative and risks here.

The Valuation

Anything can be attractive at the right price – Ericsson is certainly no different. We could have bought it at 50 SEK and had excellent returns. So is it a buy now, following this most recent, ISIS-related crash?

Let’s see.

I believe the change in fundamentals, including the complete restructuring and higher focus on things like OpenRAN should help Ericsson reach its 10-12% EBIT margins. 2021 seems to have been an excellent start on this. The company has a very high cost of debt for the context – almost 5% – and comes to a WACC of 8.4%. I’ve applied a range of growth that’s at 2-2.8%. This is significantly below my peer analysts – but I am very clear in that I am taking a more conservative stance here, as I expect Ericsson’s issues not to be over. I’m also bumping CapEx as a portion of sales revenue to 4-4.5%, which is above a 3.8-4% consensus seen to peers. My conservative approach gives me an implied equity value of around 139-150 SEK/share. I knew DCF would give a fairly high target, so let’s move on.

From a NAV perspective, things for the downside get a bit clearer. Assuming a sales multiple of 1-2X (no higher, that wouldn’t be feasible given the margin contraction and competition, as well as the potential for OpenRAN new entrants), we get a gross asset value of around 410B SEK. This comes to around 380B SEK when we exclude debt and commitments, or 113.7 SEK/share on a 3.342 billion share basis.

I put a fairly high weight on NAV/SOTP in this valuation target.

Peers are extremely difficult. There are really only two we can use, given that Huawei has no public listing. That’s ZTE and Nokia, and I would tend to regard ZTE with a bit of conservativism given the history of China and accounting.

Nonetheless – I’ll try to be fair.

Consensus comes to a P/E of around 14.9X on average, with an EV/EBITDA of 8.5X, a 2.3X book value multiple and a low 1.75% average yields, owing to Nokia and ZTE’s low yield. Again, it’s only two peers. That’s all we have.

The obvious conclusion from public comps given Ericsson’s current 12-13X P/E ratio, depending on how you view it as a well as a lower EV/EBITDA and same-level P/Book gives us undervaluation. let’s also not forget that yield. Based on the current post-ISIS share price of 94 SEK, that’s a 2.65% yield which again shows undervaluation to public comps.

So, if you wanted you could really consider Ericsson at least 20-30% undervalued on every public comp basis (except P/B).

However – I’m not doing that.

Yield disregards the fact that the company paid an unsure, low dividend for years, and only very recently started bringing it back to play. P/E and other multiples completely disregard the forward political risks and current standards.

My analyst peers do not apply a discount to Ericsson, owing to its strong market position as one of four companies able to deliver this sort of telco equipment in the world.

I’m going to discount it 15%.

Weighting DCF, NAV, P/E, EV/EBITDA and disregarding the yield completely as well as applying that 15% discount across the board, I get a target price of 115 SEK. That means, strictly speaking, that I would have considered ERIC overvalued prior to the ISIS crash – which is the truth.

I believe that Ericsson comes with so many legacy issues that its future cash flows, multiples, and asset values need to be discounted 10-15% before they accurately reflect what you can expect to make over the long term.

Maybe I’m wrong.

My peers give Ericsson different price targets. Equity Analysts at AlphaValue go up to almost 140 SEK/share. Again, I know how they got there. They’re not discounting that 15%. They’re giving Ericsson’s DCF weighing a hefty 35% consideration. They even have the company on their long-term Active list.

S&P Global analysts come in at a wider range, from 90 SEK low end to 160 SEK on the wide range. I really don’t know what to do with that list, except to say that 90 SEK is too cheap and 160 too expensive. The majority of analysts are considering Ericsson a “BUY” with a 127 SEK average target. (Source: S&P Global). There is, simply put, a lot of range to these assumptions.

Those are the valuation facts and assumptions from my side on Ericsson.

Thesis

So, Ericsson is a “BUY” with a 115 SEK target, thanks to the recent ISIS-related drop. We could still see significant fallout from these allegations. That’s why I’m somewhat hesitant here to go in very deeply, if at all.

Furthermore, my way of owning Ericsson is by investing in Investor AB, Sweden’s largest investment company. By doing this, I get risk diversification from a number of great businesses owned by the company, yet still, get some part of eventual profits from Ericsson.

ERIC is the active ADR here. It’s a 1:1 ADR, extremely liquid, and reflects the company well. It also reflects extremely well what the company has been through in the past two decades.

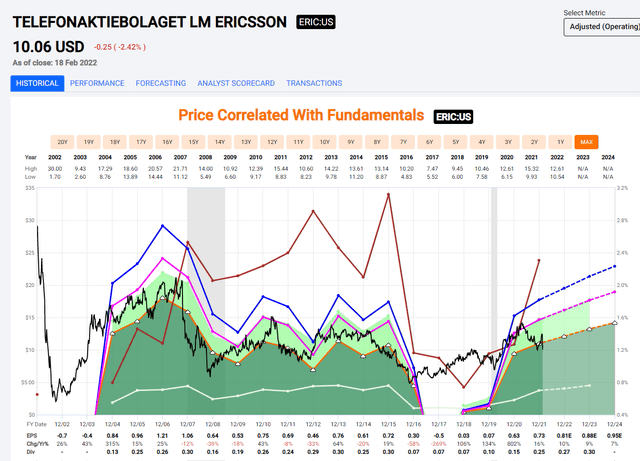

Ericsson F.A.S.T graphs (F.A.S.T graphs)

A conservative potential upside for Ericsson shows us a 14-15% annualized potential RoR from current valuations. I believe this and consider this to be not unlikely – and this is the reason I’m currently holding a “BUY” here.

But I will still be buying Ericsson using Investor AB.

Thank you for reading.