imaginima/iStock via Getty Images

Beyond any doubt, one of the most interesting companies on the market today is a firm called Iridium Communications (IRDM). I say this because the company’s business model centers around the constellation of satellites that it has up in space today. These satellites carry payloads on behalf of other clients and also provide a wide range of communication-related services. Over the past few years, the company has exhibited consistent revenue growth and attractive profits and profit margins. Add on top of this the fact that the future is looking brighter than ever, and that shares the business have recently pulled back, and it is now looking like an interesting opportunity to consider buying into for long term, value-oriented investors who focus on value while still wanting consistent but modest growth.

Recent developments are encouraging

The last time I wrote about Iridium Communications was in an article published in September of 2021. At that time, I had called the company a quality prospect, but I also said that it was likely trading at or around fair value territory. At the end of the day, I rated the company a neutral prospect, even going so far as to say only limited upside remains for investors in the near term. Looking back, this call was not too far off. But the call could have been better. Investors in the company have generated a loss since that publication of 11.5%. That stacks up against the 0.8% loss experienced by the S&P 500 over the same window of time. In short, I was correct in pointing out that the company was not a fantastic opportunity at that time. But I underestimated how much shares might decline.

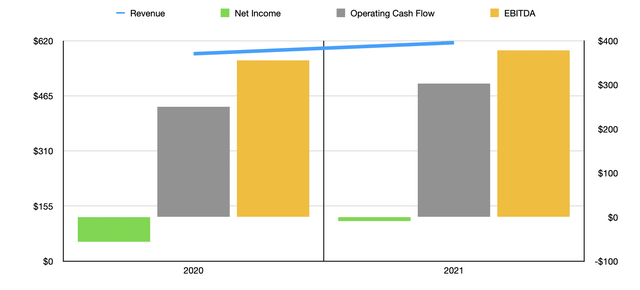

Given this drop in share price, investors might think that financial performance achieved by the company has been bad or lackluster. But that couldn’t be further from the truth. At the time of that article’s publication, financial data available only covered the first half of the company’s 2021 fiscal year. Since then, more data has come out, including data covering the entirety of that year. And looking at that data, the picture for the business is largely promising. As an example, we need only look at revenue. According to management, revenue for all of 2021 totaled $614.50 million. That represents an increase of 5.3% over the $483.44 million the company generated during its 2020 fiscal year.

Author – SEC EDGAR Data

Performance on this top line was fairly consistent year over year. Commercial service revenue for the business grew by about 7%, while government service revenue rose by 3%. Subscriber equipment revenue, which can be a leading indicator for future growth, expanded by 7%. The only area in which the company suffered was when it came to engineering and support services. Sales here actually dropped by about 11%. However, as of the end of its 2021 fiscal year, this particular set of revenue only accounted for less than 5% of the company’s overall sales. So at the end of the day, the impact here is negligible. This follows a long history of consistent revenue growth. For instance, in the five years ending in 2020, sales for the company had expanded at an annual rate of about 7.7%. And growth scene during 2021 was actually greater than what the company saw from 2019 to 2020, when revenue rose by just 4.1% year over year.

Consistent revenue growth has not been the only area that has been positive for the company. Cash flow has also been positive. But it is important to note that net profits have been elusive. For four of the past six years now, the company has generated net losses, with the last positive year being in 2017. The cash flow picture, however, has been getting better consistently over the past couple of years. Operating cash flow, for instance, totaled $302.9 million in 2021. That represents a 21.3% increase over the $249.77 million the company generated in 2020. Another important profitability metric to consider is EBITDA. This came in during 2021 at $378.2 million. That compares to the $355.6 million achieved in 2020.

For the 2022 fiscal year, management has provided some guidance for investors. They anticipate service revenue to grow at a rate between 5% to 7%. They don’t give guidance when it comes to equipment revenue or engineering and support services revenue. But even so, those are likely to fare better as well. When it comes to profitability, management anticipates EBITDA of between $400 million and $410 million. At the midpoint, that would imply a year-over-year growth rate of 7.1%. The company gave no guidance when it came to operating cash flow. But applying the same year-over-year growth rate to that that we should see from EBITDA should yield a figure of around $324.36 million. Performance figures aside, the company is also working to reward shareholders in other ways. For instance, during the 2021 fiscal year, the company bought back around $163 million worth of stock. This comes out of a $300 million share authorization plan. The goal is to finish that plan during 2022, which would imply stock buybacks of around $137 million. On top of that, the company is targeting a net leverage ratio of 3 or lower by the end of the year. That implies a net debt reduction for 2022 of $62.10 million.

Author – SEC EDGAR Data

The last time I wrote about Iridium Communications, the company was trading at some fairly lofty levels. The implied price to operating cash flow multiple of the company was 20.6. The price to free cash flow multiple was about 25.6. And the EV to EBITDA multiple was 19.6. Using the data for the company’s 2021 fiscal year, we now see that these multiples are 15.5, 18.4, and 15.8, respectively. If we assume that management can deliver when it comes to the 2022 guidance, these multiples would be lower still at 14.5, 14.7, and 17.9, respectively. Given the consistency of the company’s revenue growth and the strong cash flows it generates, this is starting to look a lot more attractive.

Takeaway

Right now, some investors who bought into Iridium Communications over the past few months may feel irritated by the company’s performance. I’m not shocked by the downside, but I do think that the downside experience was greater than it probably should have been. Fortunately for long-term investors, this now presents an interesting opportunity. Shares the company look far more attractive now than they did previously. This is especially true if management can deliver on guidance. Due to these factors, investors would be wise to consider Iridium Communications for their portfolios.