Leon Neal/Getty Images News

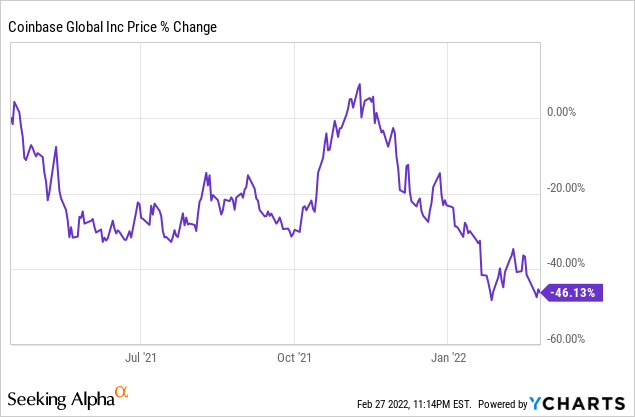

With major cryptocurrencies correcting in the fourth quarter, shares of Coinbase Global (COIN) went through a large decline in pricing as well. However, the marketplace attracted a record amount of users in Q4’21 and benefited from a surge in trading. As cryptocurrency prices swing back, Coinbase Global has considerable potential for a valuation rebound!

Exaggerated drop in cryptocurrency pricing creates opportunity to engage

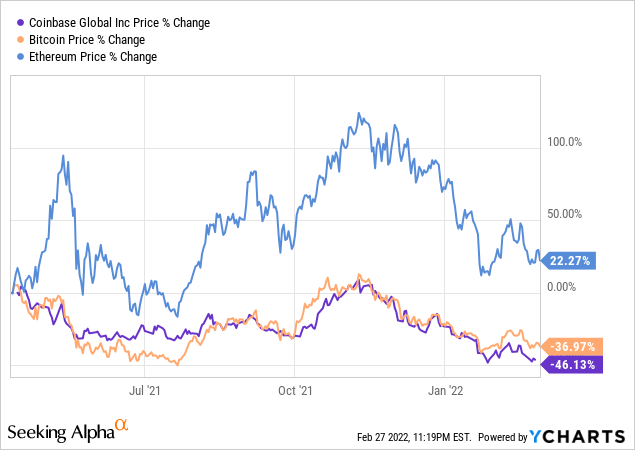

The selloff in cryptocurrencies accelerated in the fourth quarter with Bitcoin (BTC-USD) and Ethereum (ETH-USD), the two largest digital currencies, falling into a bear market. Coinbase Global as a marketplace for cryptocurrency trading depends on strong market conditions, i.e. rising digital asset prices, to spur trading activity. Cryptocurrency prices are related to Coinbase Global’s share price, with the latter roughly moving in the same direction as major digital currencies.

Strong growth in platform metrics despite market headwinds

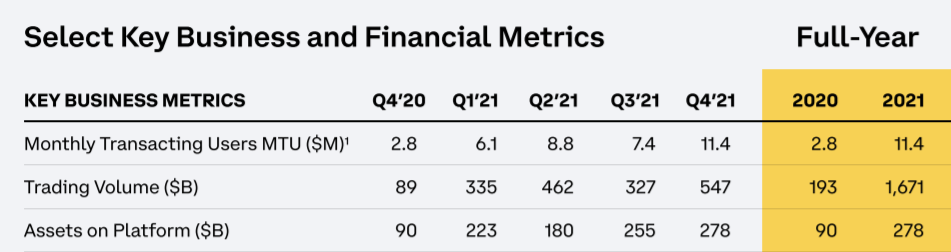

Softer market conditions in the digital currency market already impacted Coinbase Global’s commercial performance last year, especially in the third quarter. After a strong increase in monthly transacting users/MTUs and transaction revenues in the second quarter, key metrics dropped off in Q3’21. The decline in cryptocurrency prices in Q3’21 resulted in a 16% decline in the number of monthly transaction users and a 29% drop in trading volume. However, assets on the platform increased $75M to $255M in the third quarter.

But the fourth quarter showed a strong recovery in platform metrics, especially regarding monthly transacting users and trading volume which soared 54% and 67% quarter over quarter. The latest batch of results strongly indicates that high volatility in the market is good for Coinbase’s transaction business and doesn’t impact long term growth trends. The platform ended the year with 11.4M monthly transacting users, showing more than 300% year over year growth.

Coinbase

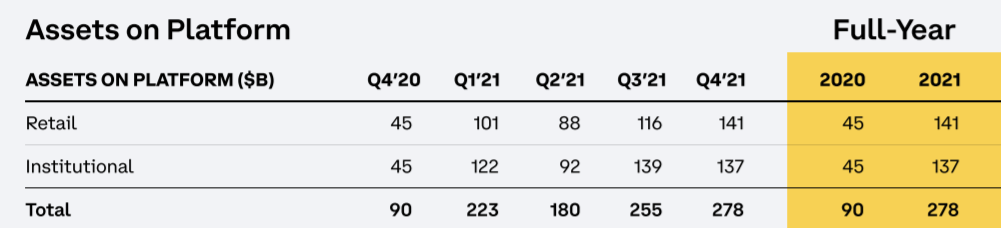

What I really like about Coinbase Global is that the platform grows in tandem with both retail and institutional investors. Retail investors are responsible for the majority of trading and generated a massive 95% of all transaction revenues in FY 2021 (96% in Q4’21) while institutional investors only contributed $5 out of every $100 in recorded transaction revenues in the last year.

In the fourth quarter, retail investors, which seem to focus more on trading volatile market conditions, overtook institutional investors regarding asset share on the Coinbase platform. Retail investors owned $141B in crypto assets on Coinbase while institutions owned $137B.

Coinbase

Coinbase Global’s commercial growth is deeply discounted

Shares of Coinbase Global went through a near-60% decrease in pricing since November and the firm’s commercial potential in the crypto universe has become too cheap. As soon as cryptocurrency prices recover, Coinbase Global is likely to see an acceleration in MTU acquisition rates as new retail traders seek to get in on a new upleg in the cryptocurrency market. Since retail traders deliver the majority of Coinbase’s transaction revenues, they are especially important for the platform’s profit growth.

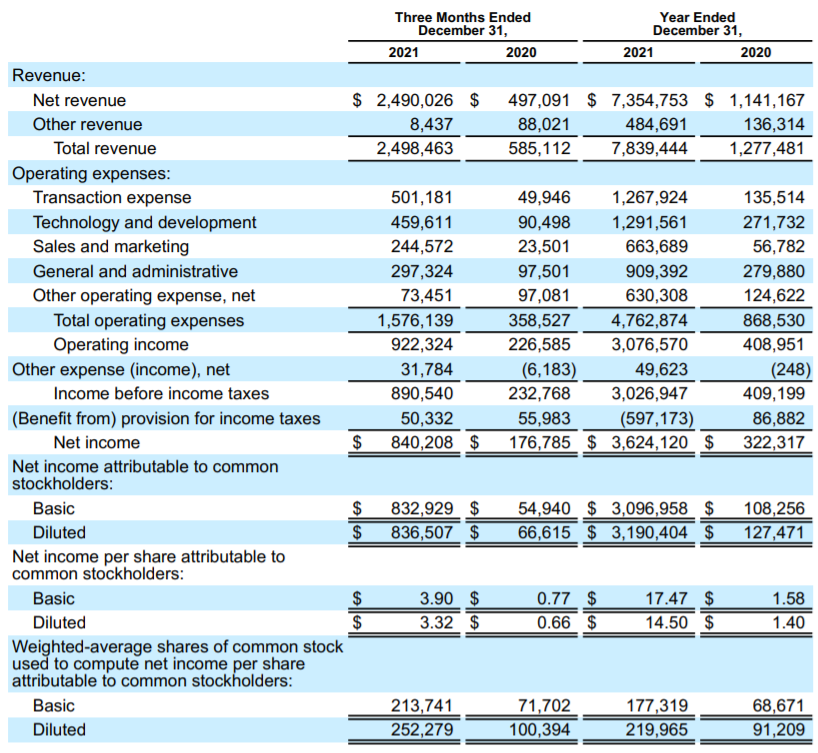

What speaks greatly for an investment in Coinbase is the platform’s enormous profitability. Coinbase’s products and services generated a profit of $837M in the fourth quarter, which represents a 12.6 X factor increase year over year. In FY 2021, Coinbase generated profits of $3.19B on revenues of $7.84B which calculates to an unreal platform profit margin of 41%.

Coinbase

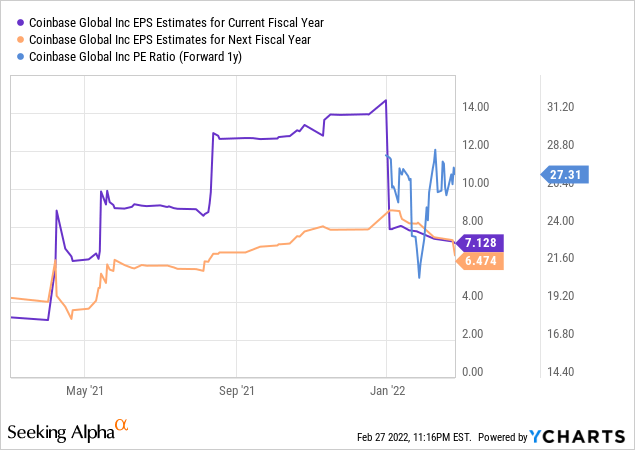

Because of these high platform margins and growing interest in the crypto-economy, the firm’s shares are undervalued. The expectation is for Coinbase to generate EPS of $6.47 in FY 2023, implying a P/E ratio of 27 X. An uptick in cryptocurrency prices could quickly increase EPS predictions. Considering how fast Coinbase has been growing its MTU base, revenues and profits, a 27 X earnings multiplier factor underprices the platform’s growth potential.

Risks with Coinbase Global

Cryptocurrencies are only gaining in popularity and new coins are listed on major cryptocurrency trading platforms almost daily. However, governments may decide to crack down on the cryptocurrency sector and introduce stricter regulations which may impact adoption rates. However, I believe Coinbase’s marketplace could indirectly benefit from tightening government regulation because it would further legitimize its business model.

Theft of cryptocurrencies and cyberattacks directed at trading platforms are also risks for Coinbase and the stock. Lastly, trading on Coinbase Global is expensive due to high fees. While high fees are driving the firm’s profitability right now, in the longer term, high fees and margins will likely be significantly lowered due to competition.

A catalyst for growth

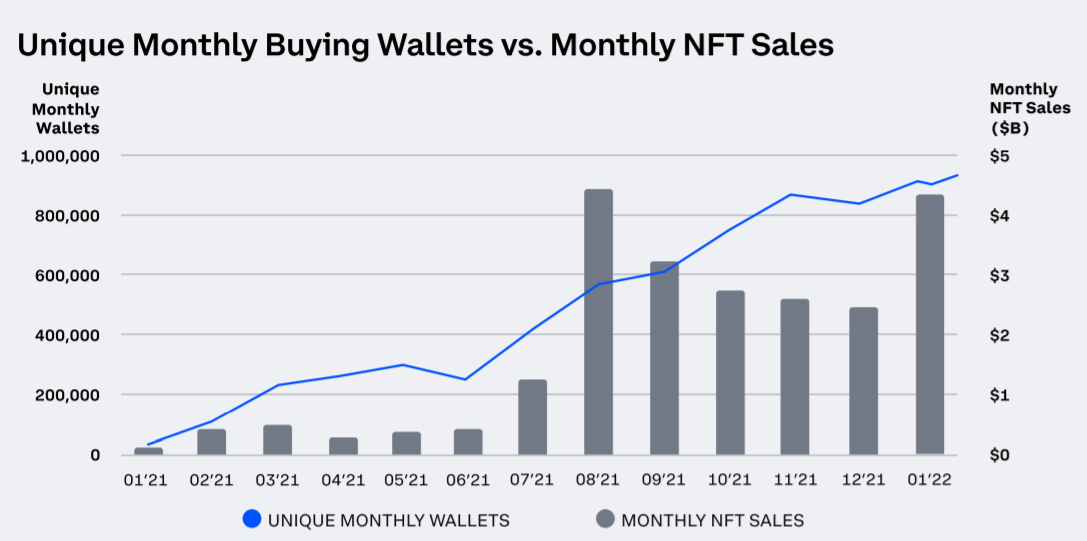

In FY 2022, Coinbase Global is going to roll out its NFT marketplace for NFTs (non-fungible tokens). The rival OpenSea NFT marketplace has been a massive success as it links buyers with sellers of digital art, strengthening the use case for cryptocurrencies. Coinbase Global said it will start an NFT peer-to-peer marketplace in 2022 which could be a catalyst for both revenue growth and stronger cryptocurrency adoption. Considering that Coinbase already has a massive user base interested in crypto, there are great synergies and possibilities for growth between these two marketplaces.

NFT sales started to soar in the second half of 2021 and remain at a high level. Growing cryptocurrency adoption and the rise of NFTs are spawning new areas of growth for Coinbase.

Coinbase

Final thoughts

Coinbase Global is a trusted brand in the cryptocurrency world. Strong recoveries in MTUs and trading volume in the fourth quarter indicate that interest in cryptocurrencies remains strong even when prices trend down. As cryptocurrency prices rebound, shares of Coinbase can revalue significantly higher.