RichLegg/E+ via Getty Images

Investment thesis

Intellicheck’s (NASDAQ: IDN) stock lost almost three-quarters of its value in the last 52 weeks. Recent revenue growth rates have been high and with large investments into its marketing department, its technology, and internationalization I expect them to continue its robust growth rate. With the assumptions that this growth rate will continue, a significant drop in its operating expense margin, and long-term opportunities, the stock is extremely undervalued according to its 5-year forward EV/EBITDA. Investors should note however that the risk for this stock is higher than average. Furthermore, the stock hasn’t left its negative momentum period yet, which might impose more future losses.

Table of contents:

-

Introducing Intellicheck and its industry

-

Stock performance

-

Fundamental analysis

-

Risks

-

Valuation

-

Conclusion

Introducing Intellicheck

Intellicheck is a technology firm that specializes in designing, integrating, and selling identity verification solutions for commercial retail and banking fraud prevention, access control, and identity validation. ID Check®, a solution for avoiding identity fraud in any industry offered via smart devices, the internet, or integration with a customer’s system, is one of Intellicheck’s solutions.

Their technologies solve problems such as the ones shown below:

Source: Intellicheck’s homepage

Industry

Intellicheck is part of the Fraud Detection and Prevention Market. I selected several companies which have exposure to this market to create an industry proxy to benchmark Intellicheck’s performances throughout this article. I must however add a side note that it’s not a very accurate peer group, as most of them are not pure fraud detection and prevention companies and are significantly bigger than Intellicheck. So in this article, I won’t add too much weight to the peer group.

Selection of companies with exposure to the Fraud Detection and Prevention Market:

|

Company name |

Symbol |

|

International Business Machines Corporation |

(NYSE: IBM) |

|

Fair Isaac Corporation |

(NYSE: FICO) |

|

Oracle Corporation |

(NYSE: ORCL) |

|

BAE Systems plc |

|

|

DXC Technology Company |

(NYSE: DXC) |

|

SAP SE |

(NYSE: SAP) |

|

ACI Worldwide, Inc. |

(NASDAQ: ACIW) |

|

Fiserv, Inc. |

(NASDAQ: FISV) |

|

NICE Ltd. |

(TLV: NICE) |

|

Experian plc |

|

|

RELX PLC |

(LON: REL) |

Source: Seeking Alpha

Stock performance

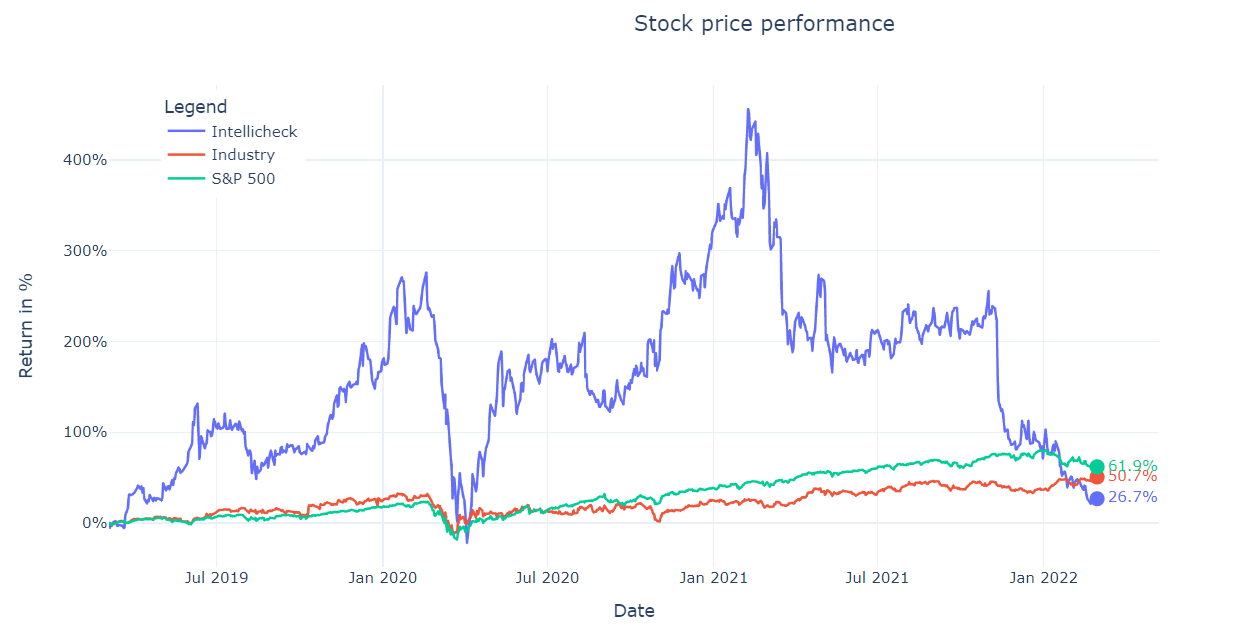

Before we delve into the fundamental analysis, let’s take a look at the stock performance. I computed a plot of the stock returns of the last 3 years.

Source: Prices from Yahoo Finance

The industry underperformed the market. Intellicheck has had massive swings in the last three years. While it massively outperformed its benchmarks at multiple points in time, after three years its return is significantly lower after a rough year.

Price changes in the last 52 weeks

|

Stock |

1M |

3M |

6M |

12M |

52W High |

52W Low |

|

Intellicheck |

-16.18 |

-33.2 |

-61.22 |

-72.66 |

-72.66 |

4.59 |

|

Industry |

-6.35 |

0.33 |

-8.94 |

8.81 |

-22.12 |

16.36 |

|

S&P 500 |

-4.43 |

-5.28 |

-4.14 |

14.23 |

-9.99 |

15.67 |

Source: Seeking Alpha

Intellicheck has lost an absurd 72.66% since its 52 week high. The negative momentum hasn’t stopped yet, as for last month and last 3 months returns are still significantly negative.

Fundamental performance

An essential part of investment analysis is fundamental analysis. I split the fundamental analysis into two parts, (revenue) growth analysis and margin analysis.

Revenue growth

Industry Growth

Research has shown that future business growth is very dependent on industry growth. According to a Valuates Reports report, the Fraud Detection and Prevention market is expected to grow at an impressive CAGR (compounded annual growth rate) of 15.3% by 2027.

According to the report, the expansion of the Fraud Detection and Prevention market is predicted to be fueled by the rising amount of online transactions as a result of digitalization. As fraudsters continue to develop and outperform the present security system, the number of financial institutions experiencing losses from financial crimes is rapidly increasing.

Moreover, businesses have historically utilized authentication systems to secure customer credentials and sensitive data. However, as customer-facing app fraud becomes more sophisticated, businesses are turning to advanced authentication solutions such as single-factor and multi-factor authentication, as well as voice biometrics.

Intellicheck historical growth

Growth performance of Intellicheck and the industry in the last few years:

|

Stock |

Revenue Growth (Quarterly YoY) |

Revenue Growth (TTM YoY) |

Revenue Growth Rate (3Y) |

Expected revenue growth next year (analysts forecast) |

Expected earnings growth next year (analyst forecast) |

|

Intellicheck |

79.0 |

47.53 |

43.96 |

18.4 |

42.9 |

|

Industry |

8.885 |

4.5 |

4.74 |

6.8 |

12.35 |

Source: Seeking Alpha, income statement and earnings

Intellicheck’s revenue growth rate for the last 3 years has been impressive. According to the Q3 2021 earnings call, most of the revenue increase in 2020, can be explained by SaaS revenue growth, which consists of software licensed on a subscription basis, with an increase of 54% compared to 2019. In the most recent quarter, Q3, SaaS grew 32% year over year but fell flat compared to Q2.

According to the call, management argues that due to COVID-19, buyers have not been shopping much on credit or, more critically, creating new credit card accounts, given the high savings rates and stimulus provided during the epidemic. They believe that post-COVID SaaS sales growth will be stronger. The strong revenue growth in Q3 (quarter over quarter) and in the last 12 months is largely explained by the company selling scanning equipment to a large bank.

Future growth and competitive position

The last few years have been transformational for Intellicheck, which helped achieve such high growth rates. The company went from a pure brick-and-mortar credit card business to reach a more expanded client base. This newly expanded client base goes way beyond credit cards and now includes banking, call centers, gambling, cannabis, (college) stadiums, as well as the digital world.

According to the Q3 2021 earnings call, Intellicheck has started investing massively in creating a marketing department, which increased inbound leads. Furthermore, the company has gone into the beta mode for “Platform 2.0”, which should increase the flexibility and refinement of its technology to become a powerhouse in the identity validation market.

The company believes it distinguishes itself in the industry by providing “what no one else can with near-perfect certainty”. They believe that they can continue to be a leader in authenticating government-issued ID as the first critical step in combating identity fraud, keeping age-controlled products out of the hands of the underaged, and increasing police officer effectiveness and safety.

Another catalyst revolves around the expansion of the validation capabilities beyond North America. Intellicheck signed a deal with a company that will give them the capability to validate identity documents from over 200 countries. Intellicheck believes its superior accuracy and functionality compared to its competition, coupled with being on par with over 200 additional countries with less sophisticated forms of identification, gives them a distinct competitive edge for clients that need international coverage.

Confirmation of its quality technology is the fact that they are trusted by 7 of the top 12 banks and credit card issuers, according to their business website.

The transformation of the company into a broader customer base and a fast-growing industry, together with investments in internalization and its marketing department should create some catalysts and help continue the high growth rate, as analysts also expect the company to grow 18.4% in revenue next year.

However, what will form obstacles to the growth are the multi-billion companies and financial institutions in the industry that invest heavily themselves in fraud detection technology.

Margins

Revenue growth means nothing when the margins aren’t good. I computed several key margins for Intellicheck and its industry. The first number in the cells in the following table refers to Intellicheck, while the number between the parentheses refers to the median of the industry.

Accounting item as % of revenue: Intellicheck (Median Industry)

|

Accounting Item |

TTM |

2020 |

2019 |

2018 |

|

Gross Profit |

77.98 (59.76) |

86.72 (59.76) |

87.0 (58.46) |

91.29 (57.97) |

|

Operating Expense |

92.79 (41.01) |

89.13 (40.48) |

121.56 (42.03) |

183.62 (39.97) |

|

Normalized EBITDA |

-18.84 (30.4) |

-8.16 (30.24) |

-31.29 (27.715) |

-86.8 (25.99) |

|

Normalized Income |

-14.75 (9.84) |

-0.21 (9.84) |

-33.26 (9.75) |

-89.42 (11.94) |

Source: Seeking Alpha, income statement

According to the annual statement and Q3 earnings call, gross margin has decreased as a result of an increase in sales in hardware. Excluding the sale of hardware, the gross margin would have been above 90%. This gross margin is with or without excluding hardware significantly higher than the industry.

The operating expense margin has been extremely high, due to the transformation process that the company has been going through and the investments. Its operating expense margin has decreased through the years, resulting in a TTM EBITDA margin of around -19%. Since the investments seem to be paying off, this level of negative EBITDA margin is acceptable, in my opinion.

Risk analysis

Before we get into the valuation of the stock, I will touch upon the risks of owning Intellicheck.

Key risk measures

|

Stock |

52W Beta, daily |

Market Correl |

Debt / Equity % |

Net Interest Coverage |

|

Intellicheck |

1.44 |

0.39 |

0.0 |

nan |

|

Industry |

0.95 |

0.91 |

94.59 |

6.28 |

Source: Yahoo Finance prices and Seeking Alpha

Intellicheck has a higher than average beta, showing that it’s quite sensitive to market movements. Correlation to the market is quite low, indicating a good additional diversification for a portfolio. Furthermore, debt is zero.

Any interested investor must keep in mind that, at the moment of writing, Intellicheck has a market cap of only 62 million USD. Such small capitalization could bring significantly more risk into your portfolio. Small companies don’t have the resources like the larger companies and are often much more volatile. Moreover, Intellicheck’s negative momentum can continue, causing a significant loss in your position.

Valuation

All the analysis up to this part could be derived to estimate a fair value and compare it with the current market value. I have computed several key valuation metrics.

Key valuation measures

|

Stock |

Enterprise Value / Revenue |

Enterprise Value / EBITDA |

Enterprise Value / Gross Profit |

Forward PS |

Forward PE |

|

Intellicheck |

3.25 |

-23.81 |

4.17 |

3.36 |

-28.5 |

|

Industry |

5.05 |

15.18 |

7.7 |

3.69 |

24.57 |

Source: Seeking Alpha

Since Intellicheck lost 75% while gaining revenue, its valuation seemed to have become extremely cheap. You won’t see many companies with such future growth prospects trading at an enterprise value / gross profit of 4.17.

Forward valuation

I computed some calculations to see what these valuations could look like in the future to take into account the growth prospect in the short/medium term. For this, I created a sensitivity analysis for future enterprise value / EBITDA valuations. The left column shows the low, best, and high estimates of the EBITDA margin after 5 years, while the top row shows different revenue CAGR.

5-year forward EV/EBITDA valuation estimations of Intellicheck

|

Revenue CAGR |

||||

|

10.0% |

15.0% |

20.0% |

||

|

EBITDA Margin |

15.0% |

13.45 |

10.77 |

8.71 |

|

20.0% |

10.09 |

8.08 |

6.53 |

|

|

25.0% |

8.07 |

6.46 |

5.22 |

|

Source: Seeking Alpha

As the best estimate of revenue CAGR for 5 years, I used 15%, which is slightly below next year’s analyst forecasted revenue growth. I’d say this is somewhat conservative regarding the growth analysis, but the fact that SaaS revenue fell flat quarter to quarter and its low 5-year historical CAGR, I’d like to be a bit more conservative here. For the EBITDA margin after 5 years, the best estimate is 20%, as after 5 years I expect its operating expense margin to have dropped significantly. In the longer term, I expect this margin to be above 30% (industry median) to about 40% as a result of its high gross margin.

These inputs result in the best estimate 5 year forward EV / EBITDA of 8.08. For comparison, the average 5 year forward EV / EBITDA would be 10.46.

With the potential of Intellicheck to increase its EBITDA margin in the long term to 30-40%, combined with the fact that they are a high investment company in an above-average growing industry, you would expect this stock to trade at a significant 5 year forward premium (offset by its higher risk level). Thus, I conclude the stock currently to be undervalued.

Conclusion

Intellicheck’s stock lost almost three-quarters of its value. Recent revenue growth rates have been robust and with large investments into its marketing department, its technology and internationalization I expect them to continue a robust revenue growth rate. With the assumptions that this growth rate will continue, a significant drop in its operating expense margin, and the presence of long-term opportunities, the stock is extremely undervalued according to the 5-year forward EV / EBITDA. Investors should note however that the risk for this stock is higher than average. Furthermore, the stock hasn’t left its negative moment period yet, which might impose more future losses.