colinhui/iStock via Getty Images

Investment Thesis

Texas Roadhouse (NASDAQ:TXRH) is growing its business and expanding its international reach. In 2021, the company’s sales growth and operating profitability was better than pre-covid levels. The company is opening new restaurants, improving margins, focusing on food quality, service quality, atmosphere, digitalization, guest experience, and guest satisfaction. Texas Roadhouse is well positioned to grow further, which creates a buying opportunity.

An Overview of the company

Louisville, Kentucky based Texas Roadhouse opened its first restaurant in 1993 and since then has expanded to over 667 restaurants in 49 states and ten countries. The company’s business approach is to position each of its restaurants as a local favorite for a wide range of customers looking for quality, low-cost meals provided with a friendly, attentive service. As of December 28, 2021, the company employed around 73,300 people.

Product Overview

Texas Roadhouse

Texas Roadhouse is a full-service, casual dining concept that offers a variety of highly seasoned and aged steaks that are hand-cut daily on the premises. The company also serves ribs, seafood, chicken, pork chops, pulled pork, and vegetable plates, as well as hamburgers, salads, and sandwiches. The bulk of its entrees come with two homemade side dishes, including roasted in-shell peanuts and freshly baked yeast rolls.

Bubba’s 33 is a family-friendly sports restaurant with scratch-made meals, beer, and cocktails. Burgers, pizza, and wings, as well as a selection of appetizers, sandwiches, and dinner entrees, are on the menu. The first Bubba’s 33 restaurant started in Fayetteville, North Carolina in 2013.

Jaggers is a fast-casual restaurant concept that serves scratch-made sauces with burgers, hand-breaded chicken tenders, and chicken sandwiches. Fresh salads are served with handmade dressings. Drive-thru, carry-out, and dine-in options are all available at Jaggers, which started in 2014, in Noblesville, Indiana.

The company owns 566 restaurants and franchises an additional 70 domestic and 31 international restaurants. Out of the 566 restaurants, 526 are Texas Roadhouse restaurants, 36 are Bubba’s 33 restaurants, and four are Jaggers restaurants.

Competitive Environment

Restaurant industry is highly competitive. Texas Roadhouse competes with large and diverse restaurant chains and individual restaurants in various markets. Texas Roadhouse also faces competition from meal kit delivery and the supermarkets. Based on taste, quality, and pricing, the company competes with well-established food service companies.

It also faces competition from other restaurants and retail establishments for the same casual dining customers and overall eating experience.

Financial Performance

Texas Roadhouse

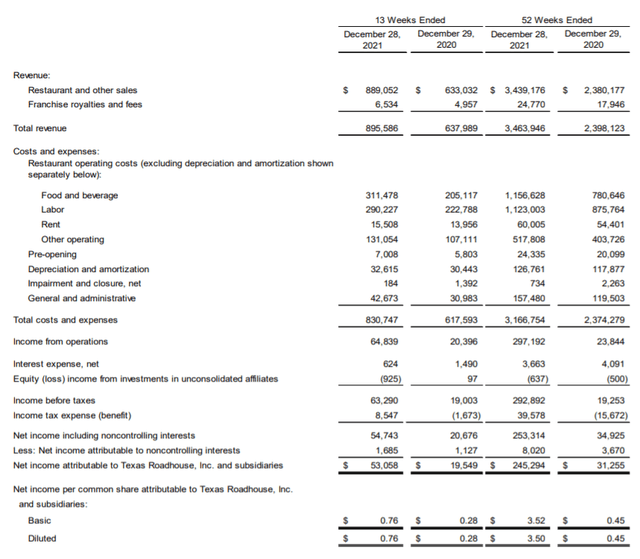

Source: Texas Roadhouse

Texas Roadhouse’s revenue increased by 40%, to $895.59 million in Q4 2021, compared to $637.99 million in the previous year. Net income was $53.06 million, an increase of 171% in Q4 2021 compared to $19.55 million in Q4 2020.

For the year 2021, the company generated revenues of $3.46 billion, an increase of 44% compared to revenue of $2.40 billion in the year 2020. Net income was $245.29 million, an increase of 685% in 2021 compared to $31.26 million in the year 2020.

In 2021, the diluted earnings per share increased to $3.50 from $0.45 per share in the prior year. The main reason of increase was a significant rise in restaurant margin which was partially offset by an increase in general and administrative expenses and tax expense.

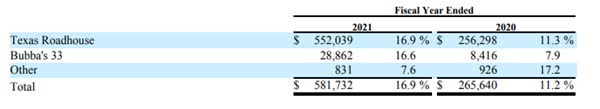

Texas Roadhouse

For the year 2021, the increase in restaurant sales was mostly due to a rise in average unit volumes, which was driven by higher comparable restaurant sales and longer store weeks. Restaurant margin was 16.9% as a percentage of restaurant and other sales, and restaurant margin dollars were $581.7 million. The improvement in restaurant margins at Texas Roadhouse and Bubba’s 33 is due to an increase in restaurant revenues that is somewhat offset by commodity inflation.

Texas Roadhouse

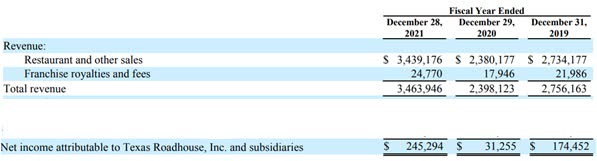

Source: 10-K

The company’s 2021 financial performance was better than pre-covid levels. The revenue increased by 26% and net income increased by 41% for the year ended 2021 compared to 2019.

Texas Roadhouse spent $51.6 million in fiscal year 2021 repurchasing 584,932 shares of common stock. The Company repurchased 423,898 shares of common stock for $37.0 million in the fourth quarter of 2021.

Growth Prospects

In 2021, the company established 29 company restaurants, including 23 Texas Roadhouse restaurants, five Bubba’s 33, and one Jaggers restaurant.

Texas Roadhouse completed the acquisition of seven franchise restaurants in South Carolina and Georgia for an aggregate purchase price of approximately $27 million in 2021.

In 2022, the company plans to open approx. 25 Texas Roadhouse and Bubba’s 33 company restaurants as well as five franchise Texas Roadhouse restaurants.

A strong cash flow allowed Texas Roadhouse to open new stores and re-instate its dividend. Additionally, it paid back a significant portion of its debt.

The company is also expanding the Texas Roadhouse restaurants in overseas locations. It has signed franchise agreements in nine countries in the Middle East as well as Taiwan, the Philippines, Mexico, China, South Korea, Brazil, and Puerto Rico. As of December 28, 2021, the company had 15 restaurants in five countries in the Middle East, five restaurants in the Philippines, four in Taiwan, four in South Korea, two in Mexico, and one in China for a total of 31 restaurants in ten foreign countries.

Valuation

The hospitality industry got severely hurt during the pandemic. As the pandemic-related restrictions got lifted, Texas Roadhouse’s business returned. The company stated that as of December 28, 2021, all its domestic company-owned and franchise locations were operating without restrictions.

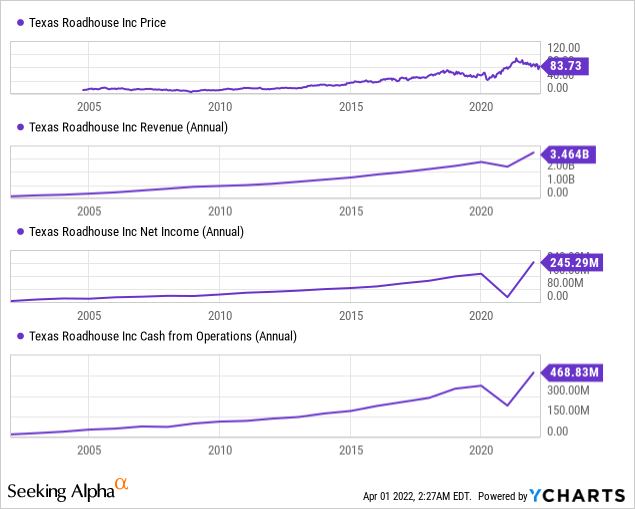

As the charts above show, Texas Roadhouse’s revenue, income, and cash from operations for 2021 are better than pre-Covid levels. The company’s revenue, profits, cash from operations have grown steadily for years.

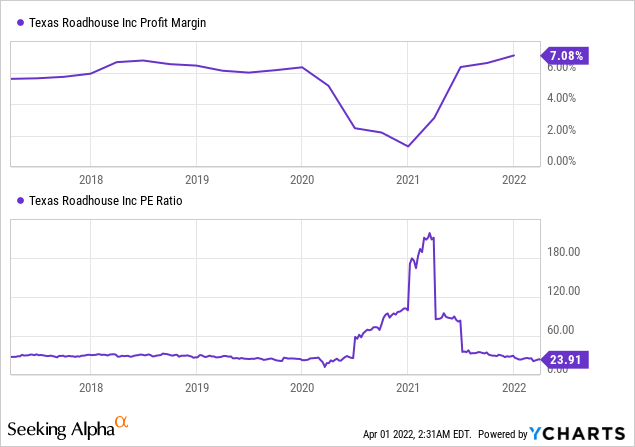

I believe that the restaurant industry will see further growth in 2022. That should bode well for Texas Roadhouse’s revenue and operating profits. The company had a good start of 2022 with a 20.6% growth in revenue in the first seven weeks compared to the same period in 2021. The stock is roughly 25% off from its 52-week high price in April 2021.

The margins are improving, and the PE ratio is around pre-covid levels. Considering Texas Roadhouse’s consistent growth, positive 2022 outlook, revenue, and margin growth as well as its expansion plan, the stock makes a long-term buy.

Seeking Alpha’s proprietary quant ratings rate Texas Roadhouse stock as buy. The stock is rated high on ‘Growth’ and ‘Earnings Revisions’ factors. It is, however, rated low on valuation. The stock’s PE ratio is higher compared to the broader consumer discretionary sector. However, it is in-line with the stock’s own historical average. As the company is growing steadily, it commands a higher valuation, and that will likely remain the case in future too.

Risk Factors

- The company has seen significant increases in certain commodity costs recently. Also, a significant number of employees are paid at rates related to the federal and/or state minimum or tipped wages, and increases in tipped wages have, as a result, increased labor costs. If Texas Roadhouse can’t offset the effects of inflation, its profitability may be impacted.

- Texas Roadhouse’s Bubba’s 33 and Jaggers restaurants may not be as successful as its Texas Roadhouse branded chain. Moreover, Bubba’s 33 have a higher initial investment cost. On the other hand, Jaggers has a lower average check amount per person. So, they may not contribute to the company’s growth and profitability in an incremental way.

Conclusion

Texas Roadhouse offers high-quality, low-cost meals for a wide range of customers. The company also invests lots of time and money in site selection and provides effective promotions to attract customers. The company is expanding new restaurants in domestic and international locations. It has delivered consistent growth over years. In addition to capital appreciation potential, the stock offers a dividend yield of around 2%.

Texas Roadhouse stock has corrected from its levels a year ago and offers an attractive buying opportunity.