Kevin Dietsch/Getty Images News

The More Things Change, The More They Stay The Same

As we grind through a period of significant fear, uncertainty, and pessimism, we contend there has not been a better time to be accumulating high quality equities in literally years. We view the current valuation environment for many companies, of which Facebook is one, as akin to the mid-1970s (some may disagree. I would say it’s hard to disagree on Facebook (NASDAQ:FB), considering it almost touched 10x p/e over the last couple months).

Notably, as we believe is the case today, most investors of the 1970s (both retail and professional) vanished during the precise times when it was very worthwhile to buy high quality, rapidly growing companies, such as Walmart (WMT) or American Express (AXP) in the 1970s or Facebook in the early 2020s (so we believe).

This idea was neatly summarized in an excerpt that’s buried deep in the annals of our content library (which, after much searching, I’ve failed to locate), but, essentially, the excerpt detailed the state of professional investor psychology in the 1970s.

The excerpt illustrated that professional investors decided not to invest simply because no one else was investing! Individuals getting paid to allocate money looked to their peers for guidance as to how they should invest.

To state that this is a rather suboptimal mental orientation would be a gross understatement.

Simultaneously, the world’s greatest investor described his experience during the aforementioned period in the following way:

In 1974, to Forbes, on stocks being undervalued: “I [Warren] feel [great buying undervalued stocks].“

[I paraphrased the quote.]

By which Buffett meant he could buy incredibly high quality companies at extremely discounted prices!

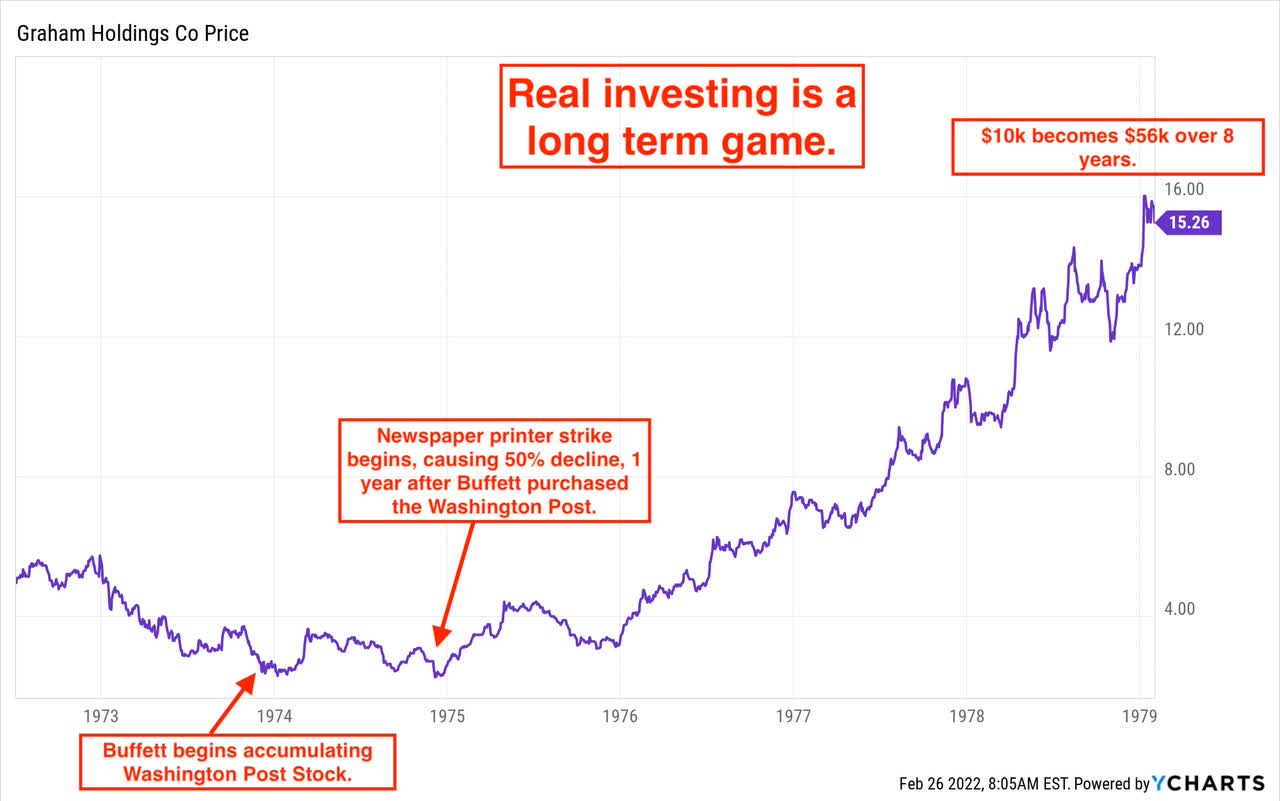

During this time, Buffett was buying companies such as the Washington Post, his purchases of which are illustrated in the chart below:

Washington Post Price (1972 to 1979)

YCharts

As can be seen above, Buffett purchased shares of the Washington Post after it’d declined 80-90% from 1972 to 1974. At the time, the Washington Post was embroiled in a battle with the Nixon administration. Imagine purchasing a company that was being targeted by the most powerful political office on earth while inflation raged!

We would relish the opportunity, of course, but it illustrates the nature of the environment in which we should be giddy to buy companies!

From the point at which Buffett purchased the Washington Post, it went on to 7x over the next 5 years. As an aside, the Washington Post was led by a “visionary founder” type.

In short, the best time to be buying is when seemingly no one else wants to buy and it feels “unsafe” to do so.

The worst time to be buying is when everyone else is buying and it feels “safe” to do so.

Both can be “good times” to buy, but the former is unequivocally the best time to buy.

I think many can attest that it’s felt quite “unsafe” to buy stocks over the last 6 months or so, during which, as we’ve mentioned, we’ve been buying hand over fist.

Applying These Ideas To Facebook

As of today, Facebook trades at ~16.5x p/e.

If we wash away expenses, and only assess the margin profile and profitability of its core, global monopoly assets: Facebook, Instagram, and WhatsApp, it trades at about 13x price to free cash flow on a TTM basis. The assumptions here are $118B in TTM revenue and 40% fcf margin. I would say the fcf margin is actually quite conservative.

So, in terms of true earnings power relative to the price, we’re paying about 16.5x p/fcf as of today with Facebook at $230/share.

This implies a free cash flow yield of about 8.5%, while the 10-year treasury note trades at sub 2%…

On a pure, quantitative basis, Facebook… well, saying “Facebook trades for nothing” really doesn’t even do it justice.

“Words cannot illustrate” how depressed Facebook’s valuation is at present, which is an ironic phrase because in typing that I used words to describe how depressed Facebook’s valuation is.

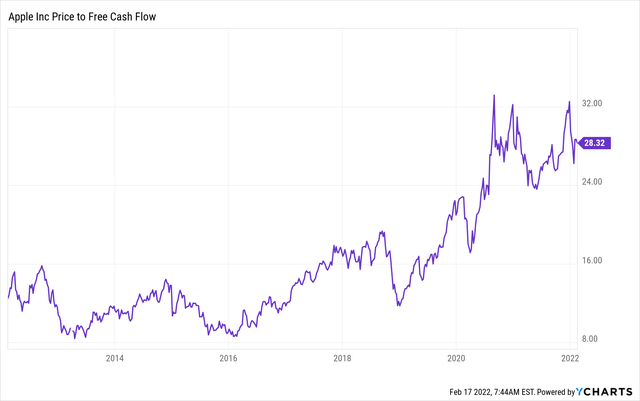

We’ve long maintained that Facebook is equivalent to Apple (AAPL) circa 2016-2018.

It may be somewhat shocking for those just joining the market, but once upon a time, Apple was actually heavily doubted by the market. On the heels of Blackberry imploding after, just years before, having hundreds of millions of mobile device users, Apple was thought to be a commodity hardware producer whose product was likely to fall out of favor, or, at the very least, commoditize to the point where it could not generate profits, as more and more smartphones came onto the market.

It’s certainly a case study worth noting.

From 2010 to 2016, this was the bear thesis.

From 2016 to 2019, the bear thesis transitioned to “Apple’s market is saturated and its days of growth are over.” Hence, it traded to ~10x p/fcf in 2018.

From The Depths Of Pessimism: Apple’s Price To Free Cash Flow 2012 To 2022

YCharts

Interestingly, Apple traded down to ~8x price to free cash flow on a couple occasions in the early 2010s.

As of today, this valuation is almost inconceivable for most investors. It represents a greater than 70% decline from where Apple currently trades.

Nothing Is Guaranteed But What Are We Getting For 16.5x Price To Free Cash Flow?

In 2016, Warren Buffett considered Apple at ~8x price to free cash flow. His reasoning probably went something like this:

Ok, what am I getting for ~8x price to free cash flow?

A user base of 600M iPhones

Giant free cash flow generation

A solid share repurchase program

A brand moat and embedding moat (where users get locked into the ecosystem)

Significant optionality in terms of future product and software releases associated with these brand and embedding moats

Alright, ~8x price to free cash flow. That’s a free cash flow yield of about 16%. What’s my next best alternative? (For Buffett, he’s always used the risk free rate, as embodied by the 10 yr and the long bond (30 yr)). At the time, to 10 yr was about 1.75%.

At the time, Apple had a massive net cash position, and with the corporate tax rate falling to ~20% in 2016, Apple was able to repatriate ~$200B in cash, with which it could buy back massive quantities of its shares.

Again, nothing is guaranteed, but that’s a great bet by any standard!

And we, at the time, used a similar reasoning methodology and agreed with Buffett’s positioning:

Turning this discussion now to Facebook, we should ask ourselves what we’re getting for 16.5x p/fcf.

In my estimation (and others will certainly disagree), we’re getting:

- ~3B users globally

- ~$120B in TTM revenue that’s still growing at ~8% annualized. 80% gross/40% free cash flow margins. Basically, a giant bond that produces massive free cash flow. This ~8% growth will occur despite Facebook lapping very tough comps related to the change in iOS policy. Our bet here is in Facebook’s ability to leverage AI & ML to create a better user tracking product whereby it can serve the advertisers on its platform better. This is no different than the work The Trade Desk has done in this realm, nor is it different from the work Snap or Amazon are doing. The industry is adapting to this new data tracking normal (where data is not as readily available), and Facebook will adapt as well.

- ~$70B share repurchase program; $20B+ in net cash on the balance sheet

- Massive optionality with its huge free cash flow and ~3B user base. Facebook today is not what Facebook will be in 3, 5, and 10 yrs in the same way that Apple evolved from an iPhone producer to a software provider. We must look into the future to determine what Facebook will become.

- Powerful brand and network effects moat. Cristiano Ronaldo will continue to use Instagram because he has ~422M followers on Instagram. That’s a huge business! And because he will continue to use it, his 422M followers will continue to use it. And because his 422M followers will continue to use it, other celebrities and brands will continue to use it. And because other celebrities and brands will continue to use it, the 422M followers will continue to use it. And because the 422M followers will continue to use it… well, you get the point.

- And because all of these users will continue to use it, Facebook will continue to be used by advertisers, both big and small.

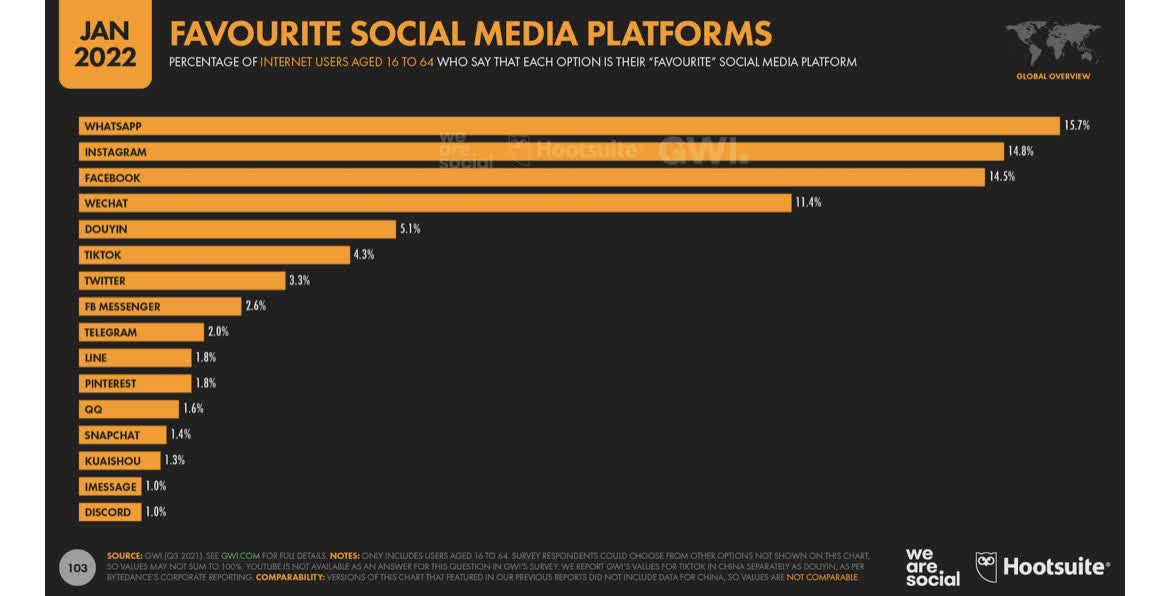

- Now, some may say, “But Facebook and Instagram are dying brands. WhatsApp and Messenger have competitors.” To that, I would say, “Let’s turn to the numbers!”

Hootsuite

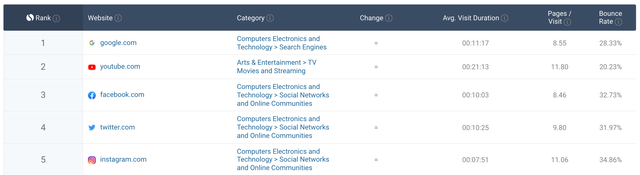

Most Visited Websites In The World

similarweb

And with every passing day that Facebook is the most dominant social media platform that goes by, it becomes more likely that Facebook will continue to be the most dominant social media platform.

What About This Metaverse Situation? Isn’t This An Illustration Of Desperation From The Company?

In short, no.

We have long owned Facebook for specifically for its metaverse ambitions.

We documented the idea that Facebook would become a metaverse company in October of 2020 via these notes before anybody else was even mentioning the word metaverse! (There were a few others, but it was certainly not mainstream yet).

- Introducing President Mark Zuckerberg | Seeking Alpha Marketplace

- The Shopify Of Mobile Gaming And More Thoughts On The Rise Of Virtual Realities | Seeking Alpha Marketplace

In the second note (which we’ve not publicly published at this time), we illustrated that Zuck had been planning this push into the metaverse, or virtual realities to put it another way, since 2015! During which time Zuck was considering buying Unity Software (U).

Concluding Thoughts

To summarize why we have bought more Facebook at ~$230/share:

- ~3B users

- Owns 3 of the most popular social assets on earth. Arguably, Meta is the Visa of digital communication. While there’s a lot of talk about this changing, as there has been for a decade now, in January of 2022, Facebook was still the Visa of global communication.

- Powerful network and brand moats, as well as a scale moat such that a new Facebook or Instagram cannot arise because the business model has become too hard with changes from Apple. Through this lens, Apple’s actions could have actually permanently solidified Facebook’s moat.

- The market is selling it due to spend on virtual realities and the metaverse. If this has been our long-held thesis on the company, why would we do anything but buy more? Our vision for the company, which we elaborated long before anyone even considered Facebook as Meta, is coming to fruition. Why would we be anything but pleased?

- ~$120B in 80% gross/40% fcf margin revenue TTM. We believe growth will re-accelerate over 10% in the coming year as a result of Facebook’s use of AI & ML to create a better product for advertisers in our new data privacy reality.

- And we’re getting all of this for 16.5x p/e or 13x p/fcf backing out near-term expenses. 10 yr currently at ~2.5%. We could see a dramatic valuation re-rating once Facebook emerges from the next 12 months of reinvestment to get the business on the right track for the next decade and beyond.

Thank you for reading, and have a great day!