HJBC/iStock Editorial via Getty Images

Our readers should know by now how much we like TotalEnergies SE (NYSE:NYSE:TTE), and today we are commenting on its Q1 results. Lately, we have also followed up with a deep-dive analysis on TotalEnergies assets in Russia. As we already mentioned, Total is a must-have in our portfolio for the following reasons:

- We like a company that can turn energy transition into profitable growth and Total is a great example of this with a long term commitment to be a multi-energy company;

- We like the top management. They maintained Total’s dividend per share when the oil price was negative;

- It’s by definition an inflation hedge company;

- TotalEnergies has a super balance sheet with an additional share repurchase program when the oil price is higher than their long-term target.

Going back to Total’s Russia exposure and following the latest sanctions from the EU which prohibit the export of LNG goods and technologies, TotalEnergies has decided to write down a $4.1bn impairment, concerning mainly the Arctic LNG 2 project currently under construction.

Q1 Results

Despite the multi-billion impairment, the company delivered a strong quarter thanks to the rise in gas and oil prices. Here are a few words from the CEO to simply explained what’s going on: “the rebound in energy prices seen in the second half of 2021 amplified in the first quarter of 2022 following Russia’s military aggression in Ukraine, with oil prices surging above $100 a barrel and gas prices in Europe and Asia historically high above 30 dollars per Mbtu over the quarter“. So, what is happening with the earnings?

In the first three months of 2022, the adjusted operating income was $9.46 billion compared to $3.49 billion a quarter year ago. Total’s main division, exploration-production, generated an adjusted operating income of $5.02 billion compared to $1.98 billion a year earlier. The Integrated Gas, Renewables & Power division, which notably includes liquefied natural gas and electricity, saw its adjusted operating income reach $3.05 billion, after $985 million in the first quarter of 2021.

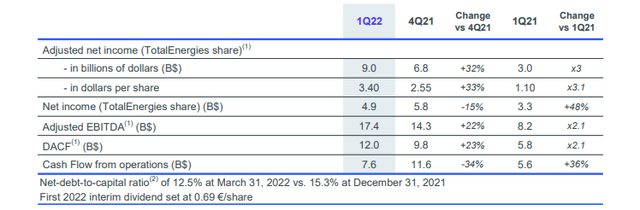

An indicator closely followed by market operators, adjusted net income, which restates certain elements such as oil stocks and financial holdings, rose to $9 billion dollars in the first quarter versus a market consensus established by FactSet of $7.89 billion. Its debt ratio has thus fallen to 12.5% and its return on average capital employed is now at 18%. A pretty positive set of numbers.

TotalEnergies Q1 Results

Conclusion and Valuation

The group confirmed the 5% increase in the first interim dividend for the 2022 financial year to the tune of €0.69 per share and authorised the Company to buy back up to $3 billion in shares first half of 2022. In terms of investments, TotalEnergies has indicated that it expects to make net investments “tending towards 15 billion dollars in 2022, of which 25% in renewables and electricity“. Oil profits reinvestment is financing the energy renewable development. This is music to our ears.

For the above reason, we are closely monitoring the Eni (E) spin-off called Plentitude to have a better valuation of TotalEnergies renewable assets. In the meantime, with a tasty dividend yield of more than 6%, we reiterate our buy rating and arrive at a target price of €60.00 per share implying a 33% upside versus the current stock price level.

Mare Evidence Lab’s previous coverage in the Oil & Gas sector:

- Total: Our Favourite Pick In The Renewable Energy Transition

- Phillips 66 Vs. HF Sinclair: We See A Champion

- HF Sinclair Vs. Phillips 66: The Story Continued

- Eni: More News To Be Priced In

- Looking At TotalEnergies’ Russian Exposure