VanderWolf-Images/iStock Editorial via Getty Images

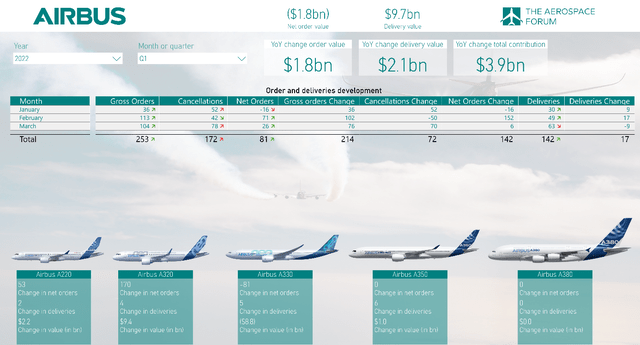

In a recent report, I had a look at the orders and deliveries in March 2022. It is, however, also important to consider the bigger picture which I partially have done in the previous report. In this report, we continue that with a detailed split out of the Q1 2021 orders and deliveries for Airbus with special attention for year-over-year changes in terms of units as well as base market value. For this analysis, we used the Airbus KPI Monitor which is part of the data analytics suite for subscribers of The Aerospace Forum. The monitor is packed with information, so we will go through it and expand where needed but will not address every metric or figure.

Improvement On Single Aisle, Wide Body Hit By Cancellations

Airbus KPI (The Aerospace Forum)

In the first quarter of 2022, Airbus (OTCPK:EADSF) net order intake for commercial aircraft totalled -$1.8B marking a strong improvement of $1.8 billion over Q1 2021. Interesting is that while net order value was negative, it still marked an improvement over the same quarter last year. Delivery value improved from $7.6B to $9.7B driven by volume and mix.

Gross Orders Down, Net Orders Up

In the first quarter of 2022, Airbus booked 253 gross orders while removing 172 orders from the books, leaving the jet maker with 81 net orders. The net orders were mainly driven by orders from unidentified customers for the Airbus A320neo family. During the first quarter, Airbus suffered 172 cancellations which is significantly higher compared to 100 cancellations in Q1 2021. Cancellations were driven by the removal of a significant number of orders for the Airbus A330neo, most notably from AirAsia X, and the cancellations of the order from Qatar Airways for the Airbus A320neo. Nevertheless, net order value improved as gross order growth outpaced cancellations leading to an improvement of $1.8B or 50% compared to last year.

Delivery Growth Broadly Supported

Airbus aircraft family (Airbus)

More interesting for the short term are the delivery numbers. That’s where we’re hoping to see significant improvements as deliveries result in a significant amount of cash changing hands. In Q1 2022, Airbus delivered 142 aircraft compared to 125 units in Q1 2021. So, there is improvement in the delivery numbers which is broadly carried. There is no single program that had an outsized contribution to the delivery growth in either direction. Appreciable was that wide body deliveries do look strong. At the same time, in March delivery numbers declined compared to last year and given the current state of the industry, I am somewhat wary of supply chain struggles. Nevertheless, delivery value improved by $2.1B marking a 28% improvement.

Combination Of Orders And Deliveries

Overall, we see an improvement in order value of $1.8B while the delivery value improved by $2.1B leading to a combined improvement of $3.9B in orders and deliveries. So, things are getting better for Airbus where 45% of the improvement is driven by better net order inflow and the remaining 55% is driven by improvement in delivery volume and delivery mix.

What we are seeing is that the combined value contributions for the Airbus A220 and Airbus A320neo are $2.2 billion and $9.4 billion for a combined single aisle contribution of $11.6 billion. This is offset by an $8.8 billion value decline for the Airbus A330neo driven by significant cancellation activity while the combined improvement for the Airbus A350 is $1 billion bringing the widebody value contribution to -$7.8 billion.

Conclusion

The Q1 2021 numbers showed a significant improvement in net order value which is primarily driven by the Airbus A320neo family. In fact, it is the single aisle programs that are responsible for the net order growth offset by the Airbus A330neo program. Looking at deliveries, all programs had a positive contribution with exception for the neutral contribution of the Airbus A380. The result is that the total value contribution has been almost equally divided between net orders and deliveries. As an investor, I am pleased with the performance that Airbus is showing on orders and deliveries, but the Airbus A330neo is not looking good at the moment from a value perspective.

This piece deals with the Q1 orders, deliveries, and cancellations on a more global level. If you wish to gain more insights in the details per month, I highly recommend reading the monthly pieces: