Gerd Harder/iStock Editorial via Getty Images

Introduction

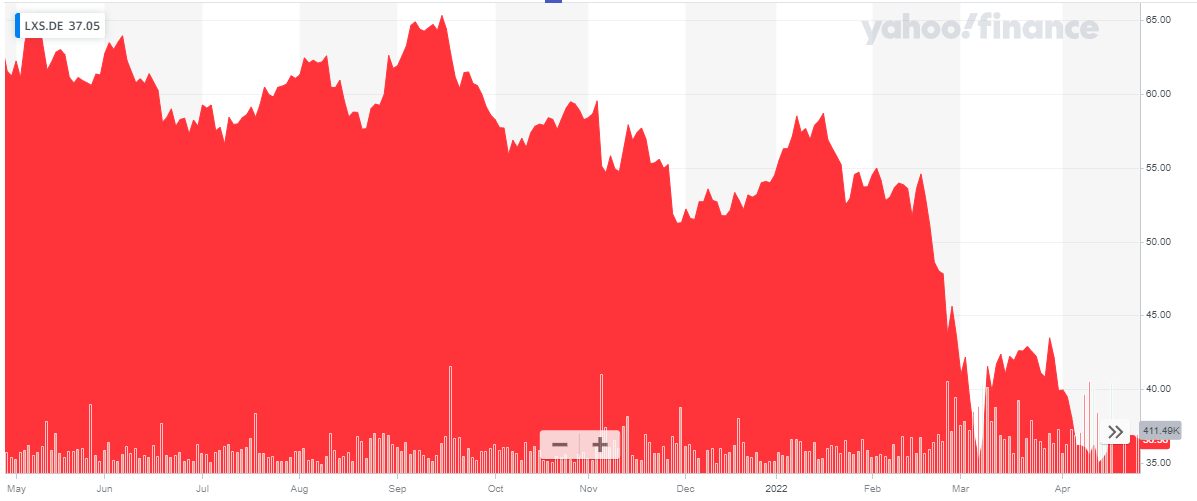

Despite the relatively strong results in 2021 and the better than expected start of 2022, Lanxess (OTCPK:LNXSF) (OTC:LNXSY), a German chemical company, saw its share price drop to the lowest point since COVID started. And if you’d exclude the COVID-dip in 2020, the current share price is even trading at its lowest level in six years, so I was getting interested in having a closer look at Lanxess to see if the current share price is sufficiently attractive to go long.

Yahoo Finance

Lanxess has its main listing in Germany where it’s trading with LXS as its ticker symbol. The average daily volume exceeds 400,000 shares per day. The German listing also offers options, which could be interesting to write put options in an attempt to initiate a long position. The company has about 86.3M shares outstanding resulting in a market capitalization of approximately 3.2B EUR.

The Lanxess website contains download-only links, but interested investors can find all relevant information (including the financial results and annual reports) on this link.

2021 was a good year

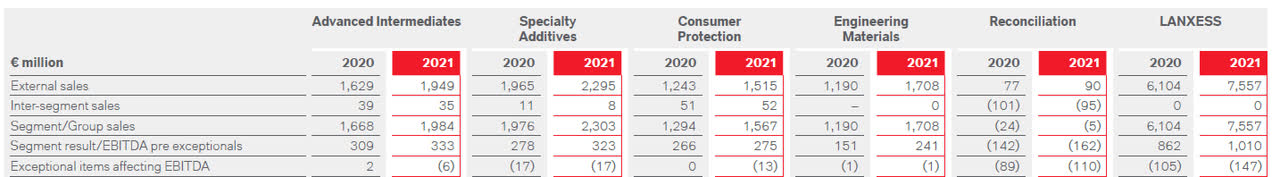

Lanxess is operating in four important divisions, each with their own focus and targeted customer base. The Advanced Intermediates segment mainly serves the construction industry, the specialty additives division has specialty lubricants and flame retardants in its product segment while it also provides additives to the rubber, plastic and paint industries. I’m also very interested in the Customer Protection division which includes the production of disinfectants and agrochemicals. And finally, the Engineering Materials produces high-tech plastics and high-performance composites.

Lanxess Investor Relations

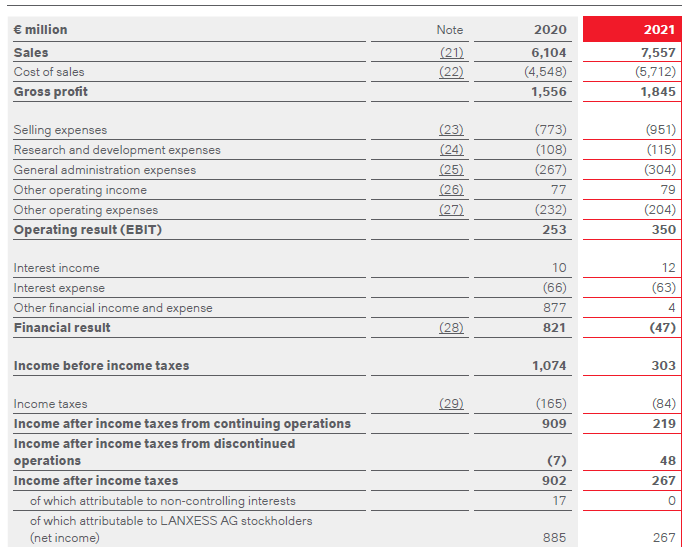

All four divisions reported a higher revenue in 2021 and the company’s consolidated revenue came in at almost 7.6B EUR, and increase of more than 20% compared to the previous year. The gross profit increased at a rate just under 20% confirming some pressure on the margins but fortunately the EBIT increased by almost 40% thanks to the company being able to keep its R&D and G&A expenses under control. Additionally, the total amount of “other” operating expenses decreased and this helped to boost the EBIT.

Lanxess Investor Relations

On top of that, the net interest expense decreased from 56M EUR to 51M EUR resulting in a pre-tax income of 303M EUR and a net income of 267M EUR. This includes 48M EUR from discontinued operations and the net income from continued operations attributable to the common shareholders of Lanxess was roughly 219M EUR or 2.52 EUR per share.

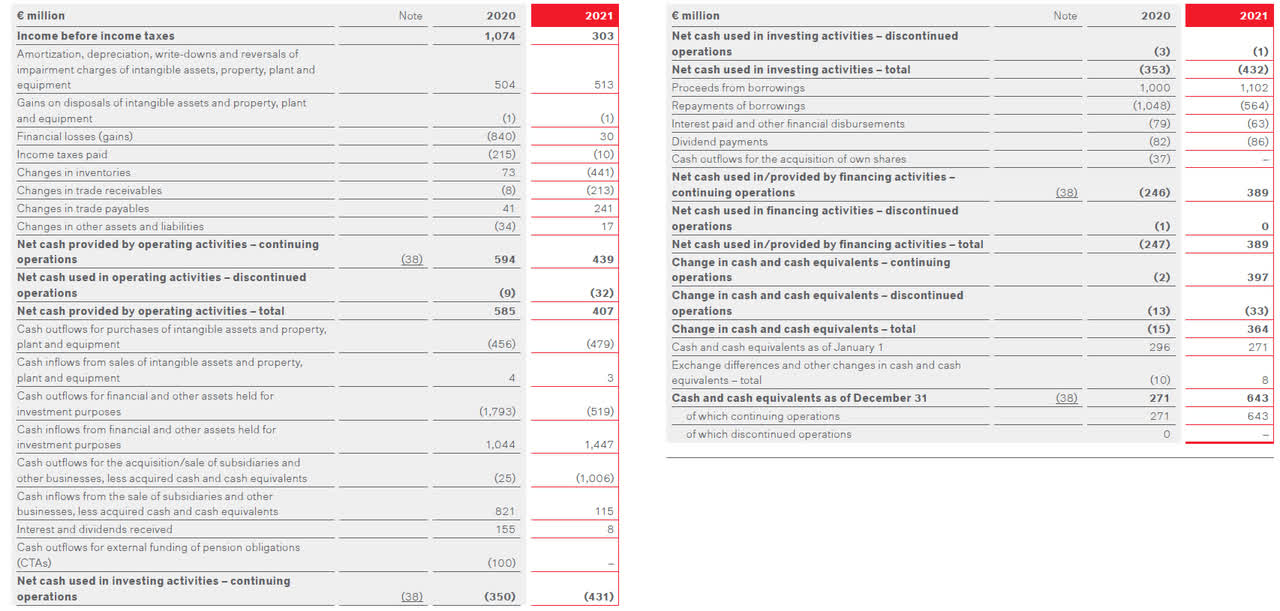

Lanxess reported an operating cash flow of 439M EUR from continuing operations, but this includes a net investment of approximately 396M EUR in the working capital position. Additionally, the cash flow statement shows Lanxess only paid about 10M EUR in taxes (versus the 84M EUR due), so I would also like to include a 74M EUR adjustment to reflect the normalized tax bill. There also were just under 50M EUR in lease payments (which I assume are incorporated in the “other financial disbursements”) and on an adjusted basis, the operating cash flow was approximately 719M EUR (including the 8M EUR in received dividends and interest payments).

Lanxess Investor Relations

The total capex was 479M EUR which means the capex + lease payments are in line with the depreciation and amortization expenses, resulting in a free cash flow result of 240M EUR. Divided over the 86.35M shares, the free cash flow result was approximately 2.77 EUR per share.

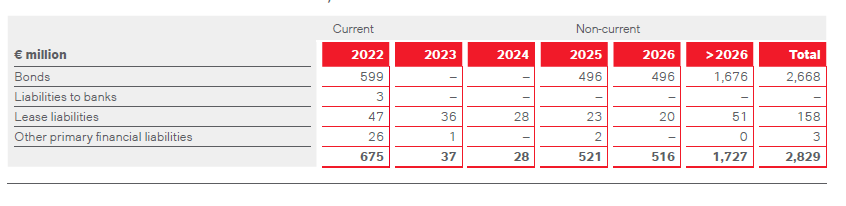

As of the end of 2021, Lanxess had 643M EUR in cash and 491M EUR in near-cash assets (money market funds). The balance sheet also contained 3.5B EUR in financial liabilities resulting in a net debt position of just under 2.4B EUR. Considering the FY 2021 EBITDA came in at 1.01B EUR, the debt ratio of approximately 2.4 times the EBITDA is very reasonable. And as the EBITDA will increase and the net debt will decrease this year, I’m not anticipating any concerns related to the balance sheet.

Additionally, the debt repayment schedule is well structured, and after this year, no principal debt repayments are due in either 2023 or 2024.

Lanxess Investor Relations

The company also timed its most recent bond issue very well. In Q4 2021, it raised 600M EUR in a green bond issue with a coupon of just 0.625% (the coupon will be linked to Lanxess meeting its sustainability targets).

2022 is starting strong, and even exceeded the company’s already-upbeat guidance

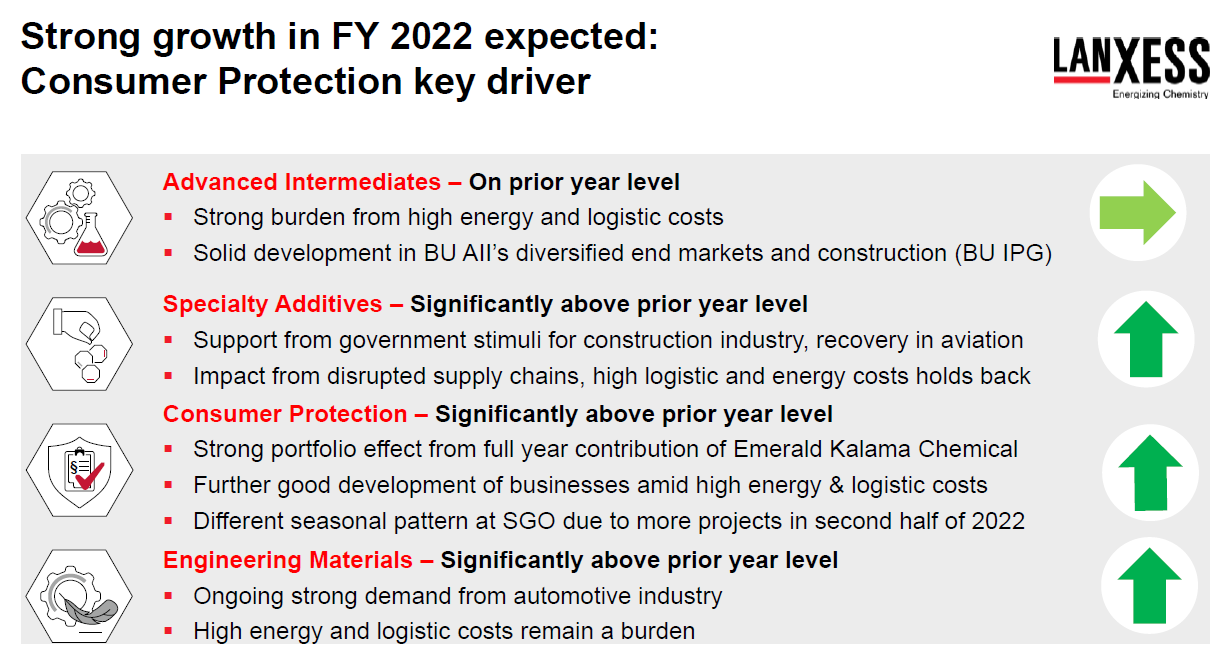

Despite some uncertainty in the markets, Lanxess appeared quite positive when it posted its initial outlook for 2022. Despite seeing much higher raw material and energy prices, the company was able to pass on these additional costs to its customer base. Therefore, it expected moderate to strong growth in all four of its divisions.

Lanxess Investor Relations

The official guidance was to see an EBITDA “significantly” higher than the 2021 level (1.01B EUR), and Lanxess was expecting a Q1 EBITDA of 280-320M EUR and in a trading update, the company confirmed its Q1 EBITDA came in at 320M EUR before exceptional items.

Investment thesis

That’s an impressive performance in the first quarter and it clearly shows Lanxess has indeed been able to hike the prices of its products to mitigate the impact from higher energy prices and the increase of raw material costs.

I think it’s safe to expect a full-year EBITDA of in excess of 1.1B EUR (which would mean the company has to generate just 800M EUR in EBITDA over the next three quarters), which should boost the free cash flow result to 320-330M EUR for almost 4 EUR per share. This makes Lanxess relatively cheap while the strong net cash flow and the dividend (which will likely cost the company less than 100M EUR) will help to reduce the net debt position.

Trading at an enterprise value of approximately 5.6B EUR, an EBITDA of just over 1.1B EUR indicates the company is trading at an EV/EBITDA ratio of around 5.

The entire chemical sector is currently trading at low multiples as the market is pricing in a slowing world economy (BASF, Covestro,… are all trading at low valuations which means Lanxess is not materially or excessively cheaper than these peers). This also pushes the option premiums higher and a P28 expiring in September can be written for an option premium of approximately 1.25 EUR while a P24 expiring in December can be written for a premium of around 1.10 EUR. I think writing put options makes a lot of sense for me to try to initiate a long position in Lanxess.