Taiyou Nomachi/DigitalVision via Getty Images

For almost every business in almost every market, talent is the most vital resource. Without it, companies will struggle to keep up with the competition. At the end of the day, they may even die out as a result. After all, the good decisions required to enable an organization to thrive can only come through talented individuals. It should be no surprise, then, that a large number of companies would develop over time that are dedicated to providing this talent, in one way or another, to client firms. One such company is Korn Ferry (NYSE:KFY). In recent years, this enterprise has seen generally attractive financial performance. For the most part, revenue has risen year after year, with only the pandemic affecting it negatively. Profitability has mostly followed suit as well. Relative to similar firms, shares of the business are trading near the low end of the spectrum. If current performance is indicative of a new normal for the enterprise, the company might ultimately be considered cheap on an absolute basis as well. Meanwhile, if performance does revert to what the company has seen in prior years, the worst-case scenario is likely the enterprise being considered fairly priced. This creates a scenario where, more likely than not, the downside would be a company that drops only modestly in price, while the upside could be fairly attractive.

A talent-centric enterprise

Today, Korn Ferry operates as a global consulting firm that helps to optimize the strategy, operations, and talent of its clients. Operationally, the company is also very diverse, with seven different segments that it runs. These segments are further grouped into four different lines of business for the company. The first of these is the Consulting business. Through this, the company helps organizations to align their structure, culture, performance, and people, with the goal of addressing organizational strategy, assessment and succession, leadership and professional development, and total rewards. At the end of the day, this is really about helping companies to operate more efficiently through the guidance that Korn Ferry can offer. This business line, which is also its own independent segment, was responsible for 31.3% of the company’s revenue and for 22.3% of its profits in 2021.

Next, we have the Digital line of business, which is also its own independent segment. Through this, the company uses artificial intelligence, as well as machine learning, to identify resources that help to improve operations at companies. The company’s proprietary system combines its own data, as well as client data and external market data, in order to generate insight and actionable recommendations. Last year, this segment generated just 15.8% of revenue. But it was responsible for an impressive 23.6% of profits. Next, we have the RPO and Professional Search business line, which is also its own independent segment. Through this, the company combines talented people with intellectual property in order to deliver enterprise talent acquisition solutions to its customers. These can range from searching for one specific candidate to entire departments or teams. It also includes the company’s global outsource recruiting solutions. Last year, this segment accounted for 20.7% of the firm’s revenue and for 19% of its profits.

The last line of business, which includes the four remaining segments of the company, is called Executive Search. Through this, the company helps organizations to recruit board level, chief executive, and other senior executive and general management talent. They do this through a combination of interviewing, other types of assessments, and more. The largest of these segments under this line of business is its North America unit. Naturally, this encompasses all of the Executive Search functions in North America. Last year, this segment was responsible for 21.9% of the firm’s revenue and for 26.9% of its profits. Next, we had the EMEA (Europe, Middle East, and Africa) segment, which was responsible for 7.6% of revenue and 3.2% of profits. The Asia-Pacific segment accounted for 4.6% of sales and 4.6% of profits last year. And finally, the Latin America segment was responsible for 1% of sales and 0.4% of profits.

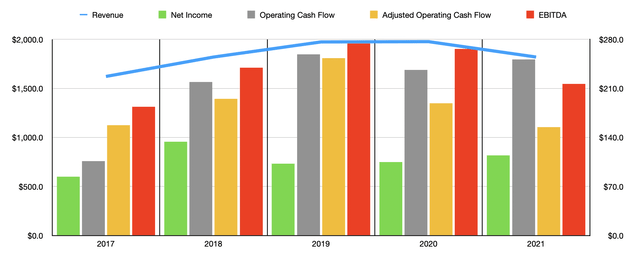

Author – SEC EDGAR Data

Over the past few years, the fundamental performance of the company has been generally positive year after year. Revenue rose from $1.62 billion in 2017 to $1.98 billion in 2020. Then, in 2021, the pandemic pushed sales of the company down to $1.82 billion. If this timing seems off, you need only remember that Korn Ferry has a fiscal year ending April 30th of each year. So much of the pain experience during 2020 would have impacted the company during its 2021 fiscal year. Since then, the company has shown some nice signs of recovery. In the first nine months of its 2022 fiscal year, sales came in at an impressive $1.92 billion. That implies a year-over-year growth rate of 51.8% compared to the $1.26 billion generated one year earlier. Based on current guidance for the final quarter of the year, management expects revenue to hit $2.60 billion in 2022. That would be 42.7% higher than what the company generated in 2021.

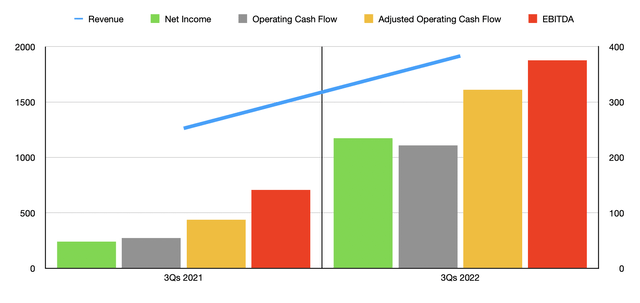

Author – SEC EDGAR Data

Over the years, management has also done well to grow the company’s profitability. Between 2017 and 2021, for instance, net income expanded, climbing from $84.2 million to $114.5 million. Other profitability metrics have also generally been positive. Between 2017 and 2019, for instance, operating cash flow expanded, climbing from $106.1 million to $258.8 million. During 2020, cash flow dropped to $236.3 million before jumping to $251.4 million last year. The one black sheep of the bunch, however, has been EBITDA. After rising from $183.7 million in 2017 to $274.1 million in 2019, it began a steady descent, eventually hitting $216.5 million last year.

For the first nine months of the company’s 2022 fiscal year, net income came in strong at $234.7 million. This compares to the $48.3 million generated one year earlier. Operating cash flow, meanwhile, jumped, climbing from $54.3 million in the first nine months of its 2021 fiscal year to $221.5 million now. Even EBITDA experienced a nice rebound, soaring from $141.5 million to $375.4 million. For the 2022 fiscal year as a whole, management anticipates net income of about $316 million. No guidance was given when it came to other profitability metrics. But if we annualize them based on results for the first nine months of the fiscal year, then operating cash flow might be as high as $693.8 million, while EBITDA should be lower at $574.4 million. To be clear, these numbers would represent a significant departure from historical performance. But given how the company has performed so far for 2022, it’s not out of the question. If in doubt, investors should err on the side of caution, however.

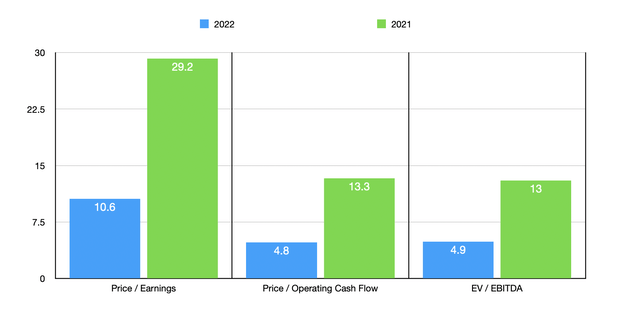

Author – SEC EDGAR Data

Taking all of this data, we can then price the company. Using our 2021 results, shares are trading at a rather lofty price to earnings multiple of 29.2. However, using other profitability metrics, shares look considerably more affordable. The price to operating cash flow approach would give us a multiple of 13.3. And the EV to EBITDA approach would give a multiple of 13. If, instead, we assume that results forecasted for 2022 represent the new normal, then these multiples would be considerably lower at 10.6, 4.8, and 4.9, respectively. To put all of this in perspective, I decided to compare the company’s 2021 results to the results of five similar firms. Using the price to earnings approach, these companies ranged from a low of 12 to a high of 41.6. Two of the companies were cheaper than Korn Ferry. Using the price to operating cash flow approach and the EV to EBITDA approach, the ranges were from 8.6 to 245.6, and from 7.3 to 30.8, respectively. In both of these scenarios, only one of the companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Korn Ferry | 29.2 | 13.3 | 13.0 |

| 51job (JOBS) | 41.6 | N/A | 30.8 |

| Upwork (UPWK) | N/A | 245.6 | N/A |

| Insperity (NSP) | 33.1 | 15.8 | 18.5 |

| ManpowerGroup (MAN) | 12.0 | 8.6 | 7.3 |

| Kforce (KFRC) | 19.8 | 20.3 | 13.8 |

Takeaway

Based on the data provided, Korn Ferry seems to be a solid company that is experiencing a boon. It’s unclear to what extent current market conditions will impact the business. However, even if results revert to what the company experienced in 2021, I don’t believe that shares of the business are likely to be considered overpriced. In that case, the company would likely be closer to fair value. Meanwhile, if things do go right in a big way, upside could be quite attractive. This clearly makes it a favorable risk to reward opportunity at this time.