Mohammed Haneefa Nizamudeen/iStock via Getty Images

Albireo

“The successful investor is usually an individual who is inherently interested in business problems.” – Philip Fisher (Warren Buffett’s one of two mentors)

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on April 27, 2022.

One of the key tenets for successful biotech investing is diversification. That is to say, among ten companies that you’ll invest in, the winners will offset the losers for overall gains. Precisely speaking, two stocks would become multibaggers. Another two will perform above average. The other three would be average. And, two more will suffer below-average returns with one going to bust. By executing diversification, you can be sure to capture the multibaggers to offset the losses from the subpar/failed stocks.

As another diversification play, I want to bring to your attention an intriguing innovator known as Albireo Pharma (NASDAQ:ALBO). Operating in the orphan disease market, Albireo is already seeing some early launch success for its lead medicine (Bylvay). Nevertheless, there are other fundamental developments that I believe will galvanize the shares to trade higher. In this research, I’ll feature a fundamental analysis of Albireo and share with you my expectation on this growth equity.

StockCharts

Figure 1: Albireo Pharma chart

About The Company

As usual, I’ll provide a brief overview of the company for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. Operating out of Boston, Massachusetts, Albireo Pharma is focused on the innovation and commercialization of novel medicines to fill the unmet needs in orphan liver conditions.

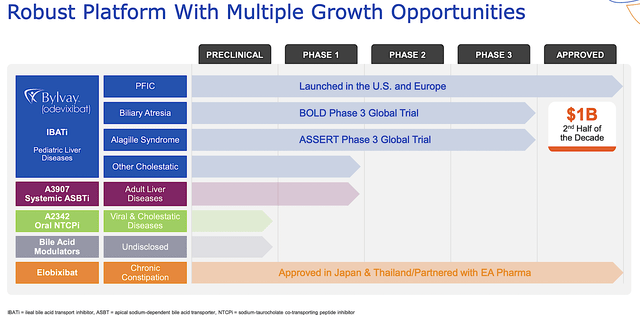

As shown below, the company has an interesting portfolio of two approved drugs and other early-stage developing therapeutics (i.e., A3907, A2342). As the crown jewel of this pipeline, elobixibat (Bylvay) is authorized to treat a rare genetic liver condition, progressive familial intrahepatic cholestasis (i.e., PFIC) that is characterized by extreme itching. The other notable molecule is elobixibat, approved for the treatment of chronic constipation (of which Albireo receives royalty payment from EA Pharma).

Albireo

Figure 2: Therapeutic pipeline

Liver Disease Focus

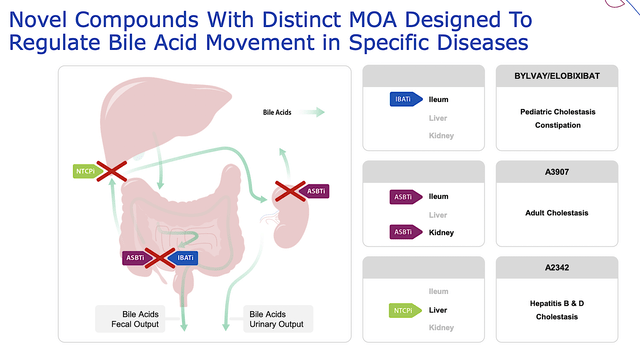

Shifting gears, let us analyze the corporate strategy. As you can see, Albireo is highly focused on liver disease which is excellent. The more niche-focused, the better the investment prospect. After all, specialization delivers deep expertise to ensure success. Aside from specialization, you can appreciate that Albireo’s drugs are novel molecules with highly differentiated mechanisms of action (i.e., MOAs). That is very important because there is less demand for other “me-too” drugs.

Albireo

Figure 3: Differentiated mechanisms of action

Orphan Status

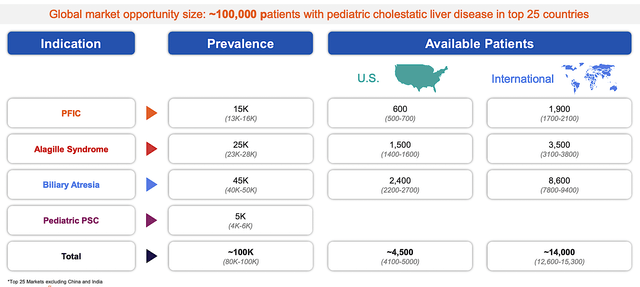

As you know, Albireo is poised to capture the market for several rare diseases. Defined as a condition affecting less than 200K people nationwide, an orphan disease can command a premium reimbursement that is $140K on average. Now, you may argue that it’s a hefty sum. Nevertheless, there is little to no innovation for rare diseases.

Without adequately compensating for these drugs, there will be no treatment for the patients. After all, a company cannot spend roughly $1B to fund a molecule from bench research to commercialization only to witness losses in commercialization.

From the figure below, you can appreciate that PFIC, Alagille syndrome, biliary atresia, and pediatric PSC are all rare diseases. In other words, they all have an annual nationwide prevalence of less than 200K. A prime example is PFIC (a condition of only 20K global prevalence). As such, Bylvay can command the $358K annual reimbursement.

Albireo

Figure 4: Prevalence of various liver diseases

Bylvay

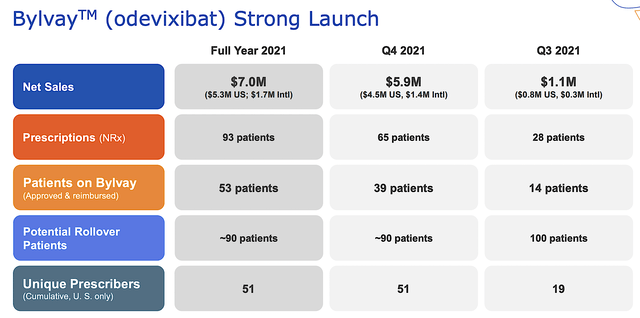

Given that Bylvay is a launched asset, it’s important that we analyze its commercialization progress. Approved in June 2021, Bylvay has been delivered to patients for over two quarters. In the first quarter (i.e., 3Q 2021), the drug garnered $1.1M. in sales. Banking on that momentum, the sales have ramped up significantly in 4Q 2021 at $5.9M. For the full Fiscal 2021, the revenues stood at $7.0M.

While that does not seem much, I believe that the growth rate will become much more aggressive as the Albireo sales/marketing team gains more traction. Putting it another way, the sales/marketing efforts for a great drug would create a snowballing effect over time. The longer the drug is in the market, the faster the growth rate. And given that the condition is orphan, Albireo can reach most of the patients in the next few years without needing a big pharmaceutical launch partner.

Albireo

Figure 5: Bylvay early market success

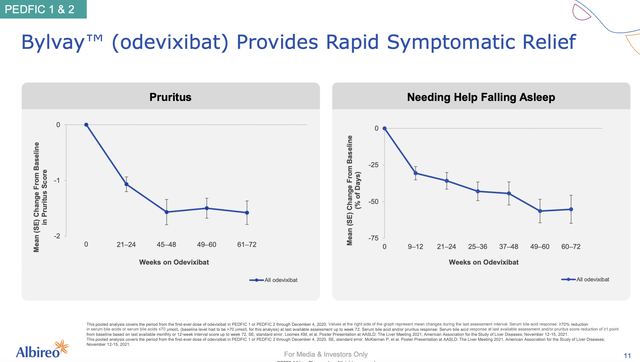

Notably, I believe in the therapeutic prowess of Bylvay because of its robust efficacy and safety data. From the figure below, you can see that Bylvay demonstrated the clinically significant and robust reduction in pruritus (i.e., itching) that is the key symptom of this disease. As the pruritus is subdued, it made sense that these patients can sleep better (without needing help falling asleep).

Albireo

Figure 6: Bylvay’s strong efficacy

Growth By Label Expansion

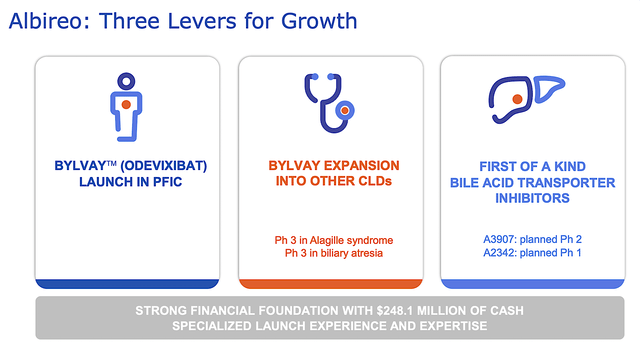

As the hallmark of a growth company, Albireo prudently expands Bylvay’s label for other indications. Specifically, the company is assessing Bylvay in the Phase 3 studies (BOLD trial for biliary atresia and ASSERT trial for Alagille syndrome). Looking ahead, you can expect Albireo to release its data for BOLD in 2H 2022. That is just a few months from now.

If positive, you are likely to see Albireo shares catapult to a new high. As I do not have an edge in biliary atresia forecast, I will take a pass on forecasting this one. About the ASSERT trial, full enrollment is expected in 2H this year with the top-line data release set for 2024. Despite not doing a forecast here, my intuition is positive regarding the upcoming trial data releases.

Albireo

Figure 7: Prudent growth strategy

Strong Management

As you know, having esteemed management is crucial to investing success. If the drugs fail, they can quickly in-license other assets for development. Additionally, they can cut losses on unfruitful franchises. While it’s very difficult to assess the management quality, I have several criteria for you.

First, you want the management as a group to have more advanced degrees (i.e, Ph.D. and M.D.) because they’ll understand the drug’s prospects better than laymen. Notwithstanding, some management do not have advanced degrees yet they are phenomenal at assessing drugs. Second and more importantly, you want management to have deep leadership experience in running other biopharma. The more established the companies they ran, the better.

From the figure below you can appreciate that the CSO (Dr. Jan Mattsson) comes from AstraZeneca (AZN). Moreover, the CEO (Ron Cooper) led Bristol Myers Squibb (BMY) as their President of Europe operations. Third, you want to see if the management can deliver on their promises. Here, securing the Bylvay approval is the proof in the pudding of their competency

Albireo

Figure 8: Strong management

Competitor Landscape

Regarding competition, Albireo goes toe-to-toe with other conventional rare disease innovators that are also focused on liver diseases. For PFIC, there isn’t any treatment except for fat-soluble vitamins (D, E, K, and A) and a liver transplant. Notwithstanding, the waiting time to get a transplant is extremely long (and most patients do not find a match). Putting those facts together, there is little to no competitive pressure in this space for Albireo.

Financial Assessment

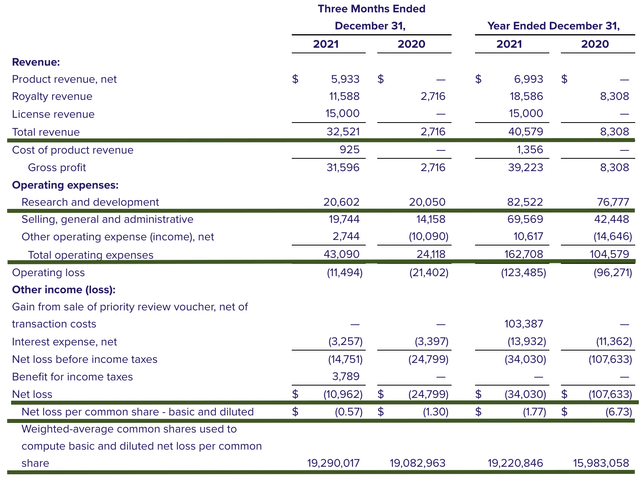

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q 2021 earnings report for the period that ended on December 31.

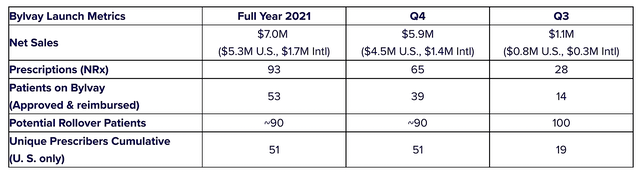

As follows, Albireo procured $32.5M in total revenues. Of that figure, the product revenue accounts for $5.9M for the quarter, which constitutes $1.4M in international sales and $4.5M in U.S. sales. There were $11.5M in royalty and milestone payments from EA Pharma for elobixibat for the treatment of chronic constipation. Additionally, Albireo enjoyed the $15M in licensing revenue from the Japan agreement.

Albireo

Figure 9: Bylvay sales statistics

That aside, the research and development (R&D) registered at $20.6M for the quarter compared to $20.0M for the same period a year prior. The R&D essentially remains the same. As a general rule-of-thumb, I like to see an R&D increase over time because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $10.9M ($0.57 per share) net loss compared to $24.7M ($1.30 per share) net decline for the same comparison. On a per-share basis, the bottom line is improved by 56.1%. You want to see the bottom line improving for a commercialized-state operator.

Albireo

Figure 10: Key financial metrics

About the balance sheet, there were $248.1M in cash, equivalents, and investments. Against the $43.0M quarterly OpEx, there should be adequate capital to fund operation into 2Q 2023. Simply put, the cash position is robust relative to the burn rate.

While on the balance sheet, you should check to see if Albireo is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 19.0M to 19.2M, my math reveals a 1% annual dilution. At this rate, Albireo easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Albireo to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 19.2M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Bylvay for PFIC, Alagille syndrome, and biliary atresia. |

$1B (Estimated from the 4,500 total patients in the US. I focus on the US market because that’s where an orphan drug gets its premium reimbursement. Now there are also 14K patients ex-USA). |

$250M | $130.20 | $78.12 (40% discount because Bylvay is launched for PFIC while pending on Phase 3 data for the other two conditions). |

| A3907 for systemic ASBTi | Too early in development (Will assess with more advancement) | N/A | N/A | N/A |

| A2342 for Oral NTCPi | Too early in development (Will assess with more advancement) | N/A | N/A | N/A |

|

The Sum of The Parts |

$78.12 |

Figure 11: Valuation Analysis

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Albireo is whether Bylvay can generate strong data for the Phase 3 BOLD study for biliary atresia by 2H 2022. The other main concern is if Bylvay can deliver positive results for the ASSERT trial by 2024.

In case of a negative data release, your stock is likely to tumble by 40% and vice versa. Keep in mind, that the share price movement is not as big as my usual 50% because Albireo already has a launched drug. On that note, another risk is if the approved drug (Bylvay) can quickly ramp up sales.

Conclusion

In all, I recommend Albireo Pharma as a speculative buy with 4.8/5 stars rating. On a one to two years horizon, I expect the $78.12 price target (i.e. PT) to be reached. As an orphan medicine innovator, Albireo Pharma has successfully transitioned from a developmental to a commercialization stage operator. Riding on the sound science of Bylvay, the company is demonstrating early signs of market success. Not waiting around, the management is expanding Bylvay’s label for other orphan liver diseases (i.e, biliary atresia and Alagille syndrome). Despite the small prevalence, Bylvay is poised to capture a sizable market due to premium reimbursement. In the next few months, you can anticipate a positive data release from the BOLD trial which is likely to rally the stock further. In the longer horizon, there are the younger pipeline assets would deliver additional growth.

As usual, I’d like to remind investors that the choice to buy, sell, or hold Albireo is always yours to make. In my view, you should buy 1/4 of a full position as a diversification/speculative play into this growth stock.