skynesher/E+ via Getty Images

OneWater Marine (NASDAQ:ONEW) is a premium boating retailer that is down over 44% YTD and is hovering around its 52-week low. Despite issuing strong guidance for FY 2022, the stock has been punished by the shifts in market sentiment. Management has a well-planned and articulated strategy that is preparing the company to better manage an economic downturn. I hold a long position in ONEW and will be watching over the next quarters to add to my position if management shows its strategy is working.

A Fragmented Opportunity

The US boating retail market mostly consists of small, independent retailers (over 4,000 nationwide), with most owners operating less than four locations. Many of these independent retailers offer limited brands, limited Finance and Insurance (F&I) products, and primarily focus on new boat sales.

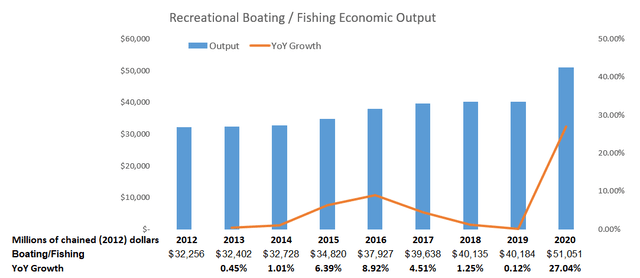

The US Boating market itself is also huge and has been slowly growing for years. With COVID driving people to seek a safe outdoor activity, boating sales jumped 19% YoY to over $49 billion in 2020 sales. Outlooks show the boating industry will continue to grow at a 6.5% CAGR between 2021 and 2027.

Author’s Chart, Data from Bureau of Economic Analysis

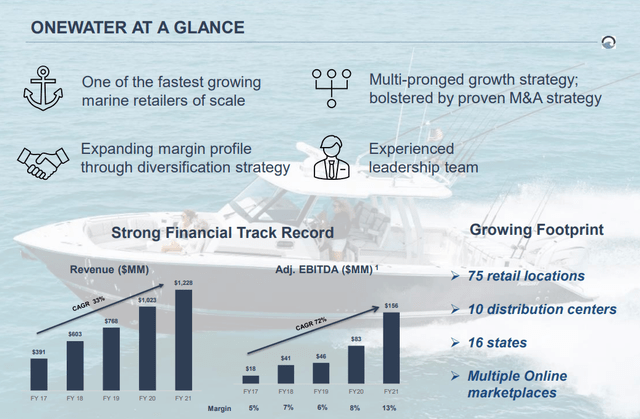

This is now where OneWater Marine comes in. At less than 3% of total industry sales, OneWater Marine is a rapidly growing premium boating retailer offering new and pre-owned boats, F&I products, repair and maintenance service, and parts and accessories. OneWater was formed in 2014 as a combination of two boating retailers with a combined 19 retail locations. Since then, OneWater Marine has expanded to 75 retail locations, 8 distribution warehouses, and various online outlets including Boatsforsale.com that it acquired and developed in 2020.

March 2022 Investor Presentation

Buyer of Choice – The Acquisition Strategy

ONEW designed its strategy around the fragmented US boating retail market. Its main strategy is to find good acquisitions and integrate them into the OneWater ecosystem, which includes optimizing their operations and providing the economies of scale of a large organization. The first key to this strategy is the goal to be the “buyer of choice” when an independent retailer wants to sell its stores. In the 2021 Q4 10-K, management says the following:

We have an extensive acquisition track record within the retail marine industry and believe we have developed a reputation for treating sellers and their staff in an honest and fair manner. We typically retain the management team and name of the acquired group. We believe this practice preserves customer relationships and goodwill in the local marketplace. We believe our reputation and scale have positioned us as a buyer of choice for marine retailers who want to sell their businesses. To date, 100% of our acquisitions have been sourced from inbound inquiries, and the number of annual inquiries we receive has consistently increased over time.

The management wants independent retailers to want to sell to OneWater. When it acquires a location, it keeps the location name, it keeps the management team, and it helps the location grow. It is a win-win for OneWater and the former owners. OneWater also does not have to rebrand locations or build a national brand. Former owners can feel good about the transition, where employees are kept, the location gets support to grow, and the business they built for years keeps its name.

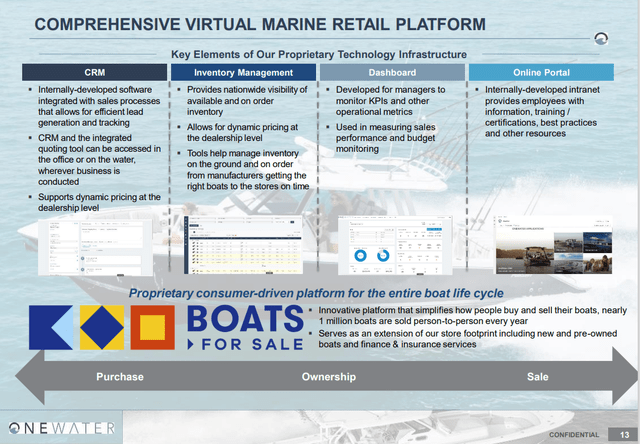

March 2022 Investor Presentation

Once acquired, the locations are quickly integrated into the OneWater ecosystem. The back-office integration typically takes 10 days and full integration typically completes in 45 days. The acquired locations now have access to inventory across the entire OneWater company, access to more brands, better F&I products, and employee training. With the resources of a large company, the location can now drive better profitability and customer satisfaction through new products and helping customers find a boat that best matches their needs.

The improvements do not stop at the sales floor. Acquired locations also have improved floor plan pricing, better relationships with manufacturers, and access to ONEW’s marketing team. Using data from all locations, ONEW can develop targeted marketing strategies and improve inventory management.

And with the highly fragmented market, there are many locations for OneWater to acquire. From the 2022 Q1 Earnings Call, Austin Singleton said:

Our acquisition pipeline for 2022 is robust and will continue to be a core component of our overall strategy. While the opportunities are plentiful, we’re committed to our disciplined approach, selecting targets that meaningfully drive growth, diversification and are in line with our goals. We believe our acquisition strategy significantly adds to the earning potential of the company.

Diversity through Brands and Locations

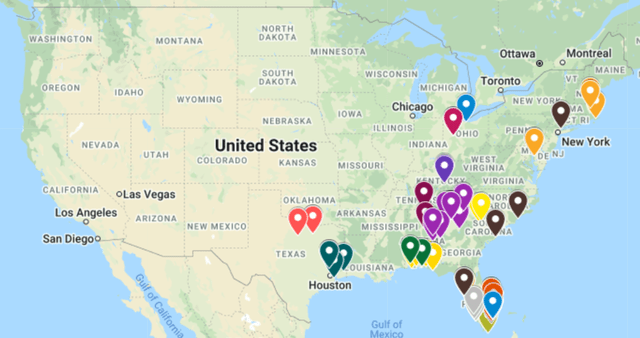

Diversifying is a common theme in OneWater Marines’ strategy, and it continues into both location selection and brands. ONEW has many locations spanning different climates, regions, and salt and freshwater. With locations in different regions, impacts of localized weather are minimized. OneWater also targets areas with strong boating cultures. Florida and Texas are the two largest markets for boating and ONEW has a strong presence in both markets, in addition to a presence in eight of the top 20 states for retail boating expenditures.

OneWater Marine Retail Locations (OneWater Marine Website)

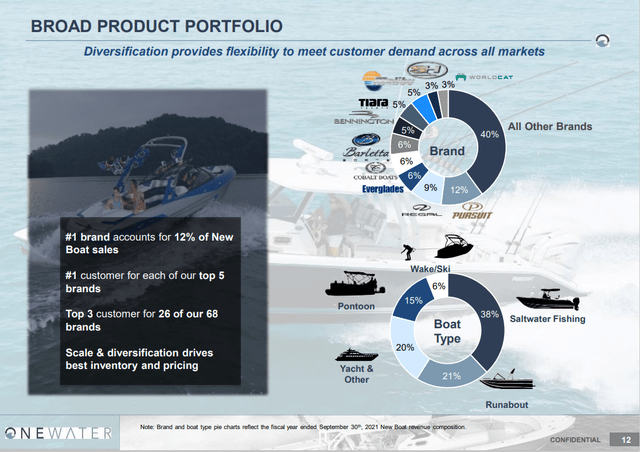

OneWater also has an advantage with manufacturers, as its size allows it to maintain better relationships with brands and offer more choices compared to smaller retailers. It carries over 68 boat brands and believe it is a top 3 customer for 26 of those brands and the largest customer for its 5 highest-selling brands. Only one of those brands accounts for more than 10% of ONEW’s revenue. Here is what management said in the 2022 Annual Report:

Our inventory and product selection allow us to cater to a highly diverse customer base with price points and boat types that appeal to a broad spectrum of budgets and preferences. The boating industry’s and MarineMax’s average selling prices for a new boat were $60,000 in calendar year 2020 and $227,000 in fiscal year 2021, respectively. By comparison, our average selling price for a new boat in fiscal year 2021 was $160,000.

March 2022 Investor Presentation

Revenue

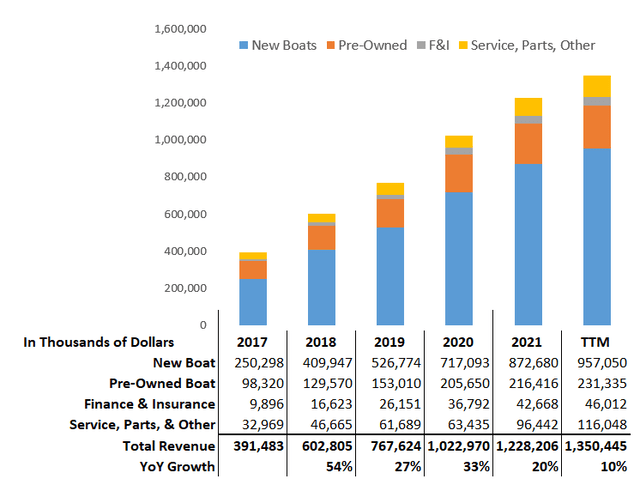

Through ONEW’s disciplined and strategic acquisition strategy, it has experienced strong revenue growth since 2017, as shown in the chart below. Note that for the TTM data, which I calculated from ONEW’s quarterly earnings, that the 10% YoY growth is calculated against the FY2021 data occurring just 1 quarter earlier.

Yearly Revenue (Author’s Chart, Data from company 10-Qs)

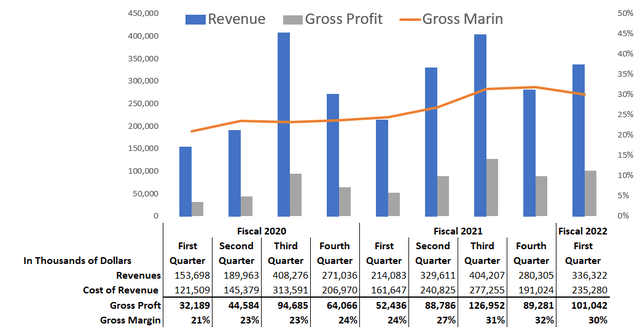

In the following chart, the seasonality of ONEW’s quarterly revenue is visible with Q1 typically being the weakest and Q3 the strongest. We can also see Gross Margins increasing through improved products and better inventory management. Additionally, management is working to expand parts and service, as this revenue is higher margin and typically increases during times of economic uncertainty. OneWater is expanding parts and services by acquiring locations that focus on parts and service, targeting two to four parts and service acquisitions per year, and using technology to reach out to customers about services.

Quarterly Revenue (Author’s Chart, Data from company 10-Qs)

EPS and Valuation

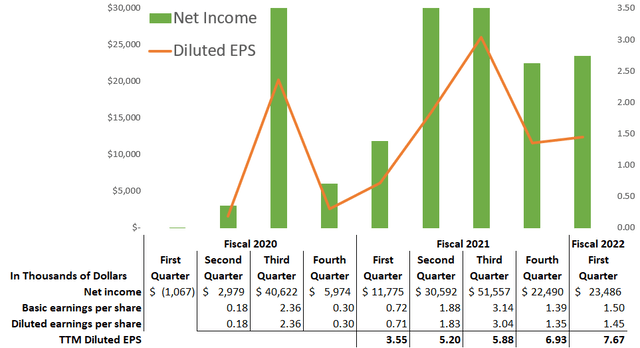

EPS has grown 116% from a diluted TTM value of $3.55 in Q1 2021 to $7.67 in Q1 2022. During the 2022 Q1 Earnings, the company guided to an EPS of $8 to $8.40 per share. While this is predicting slower growth, it does not consider any potential future acquisitions, which could substantially grow EPS. We have already mentioned management is targeting two to four parts and service acquisitions per year on top of dealership acquisitions.

ONEW Diluted EPS (Author’s Chart, Data from Company 10-Qs)

The low end of ONEW’s guidance also means the company is trading at a fwd. P/E of 4.1, giving it one of the lowest fwd. P/E ratios in its industry. At this low valuation, the market is simply not rewarding this company, its strategy, or its growth. MarineMax (HZO), one of OneWater’s closest publicly traded competitors, currently trades at a fwd. P/E of 5.29. While this is also a low P/E, giving ONEW this same ratio provides a share price of $42.32, an upside of over 25%.

Additionally, on March 31st, OneWater announced a $50 MM share repurchase program. At the time, the share price was $34.34 and represents a buyback of over 1.4 MM shares. As we will discuss in the next section, there are 15.28 MM shares between the share classes, giving this repurchase the potential to reduce the share count by over 9%.

I believe this share buyback program is not only a sign that management sees continued strong EPS values, but that this is an opportunity to repurchase shares at a low valuation. Recall that in June of 2021, management elected to provide a special dividend of $1.80 per share instead of buybacks.

Speaking of dividends, we will likely never see a regular dividend as this is restricted in its Inventory Financing Agreement. For the June 2021 special dividend, the management received permission from its lenders.

Dilution

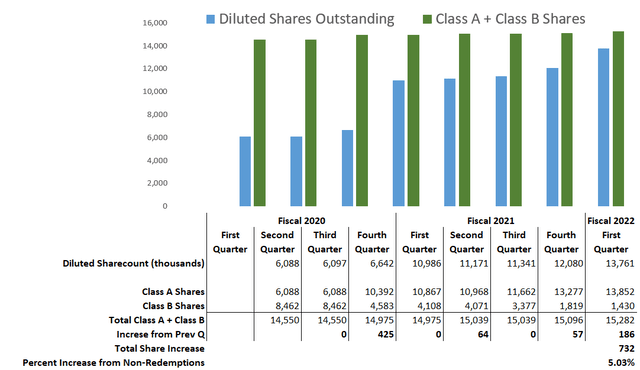

Since becoming a public company, the diluted share count has increased over 125%. Shocked at the increase, I feared the constant acquisitions were diluting shareholders, so I dug deeper.

Most of this dilution is from share redemptions between share classes. ONEW entered the market with two share classes. Class A shares are the common shares we can all buy. They grant the holder a vote for every share and economic interest in ONEW.

Class B shares are a remnant of the formation of OneWater Marine, Inc. and represented ownership in OneWater, LLC. Class B shares are not available on a public market, have 1 vote per share, and have no economic interest in ONEW. For example, Class B shareholders would not receive any dividends. Holders of Class B shares can redeem them for Class A shares, which is what we have been witnessing with the increasing share count.

In the chart below, you can see diluted shares went from 6 MM to 13.76 MM since Q2 2020. Most of this increase is from exchanging Class B to Class A shares. Only 732,000 shares, representing a 5% increase, are from a combination of new share offerings, equity-based awards, and acquisitions. Dilution is certainly something to monitor moving forward, but it is less than I expected. Additionally, the previously mentioned share buyback program should remove more shares than the 5% increase.

Share Counts (Author’s Chart, Data from 10-Qs)

Looking Forward

During different phases of the economic cycle, consumer behavior may shift away from new boats; however, we are well-positioned to benefit from revenue from pre-owned boats, repair and maintenance services, and parts and accessories, which have all historically increased during periods of economic uncertainty. – 2022 Q1 10-K

During the 2022 Q1 Earnings on February 3, 2022, ONEW issued the previously mentioned EPS guidance of $8.00 to $8.40. At this time, it also guided to high-single-digit same store sales growth and raised full year adjusted EBITDA guidance to $210 to $220 MM. While economic issues were already starting, there have been many unfortunate changes since.

Russia invaded Ukraine on February 24, inflation continues to climb, supply chains still face challenges, and interest rates are rising. Major companies have also issued less than exciting earnings and market sentiment has shifted. Since ONEW’s guidance, SPY is down over 7.5%, Vanguard Consumer Discretionary ETF (VCR) is down over 9%, and ONEW itself is down over 35%.

As concerns over interest rates and recession shift the market, it becomes concerning to invest in stock that is not only seasonal, but cyclical. Consumers can usually delay discretionary spending. Management has been working to prepare the company for economic downturns, as it is not its first time. In its 2021 Q3 10-Q, management states the following:

Our business was significantly impacted during the recessionary period that began in 2007. This period of weakness in consumer spending and depressed economic conditions had a substantial negative effect on our operating results. In response to these conditions we reduced our inventory purchases, closed certain stores and reduced headcount. Additionally, in an effort to counteract the downturn, we increased our focus on pre-owned sales, parts and repair services, and finance and insurance services. As a result, we surpassed our pre-recession sales levels in less than 24 months.

Today, ONEW is a much stronger company and in a better position to take corrective actions during a recession. It has diversified revenue into parts and services, which typically increases during economic downturns. Inventory management is also improved through sharing inventory between locations allowing them to operate with lower inventory levels. Additionally, manufacturers are also better prepared. During the Q1 2022 earnings call, Austin Singleton said the following:

When we had 2008, 2009, there wasn’t an opportunity for the manufacturers to understand how a flatten production schedule where there’s not peaks and valleys in their production schedule makes them much more efficient, makes the dealers healthier, it creates turns, it creates margin. . .

. . . they’re going to create scarcity by not producing boats. I just don’t think they’re going to ramp up to overproduce and start flooding the inventory field. Because one, I don’t think the dealers want it, I don’t think the floor plan company wants it. And now I don’t think the manufacturers want it. I don’t think they want these old peaks and valleys of inefficiency and production.

A key part of my investment strategy is to get a feel for the management team, the decisions it makes, and if I can trust it. This team has significant experience in the boating industry, navigated the 2007 recession, and provided a well-articulated business strategy. I believe this team is worth trusting with my limited capital, even as we potentially enter times of economic uncertainty.

Conclusion

Inflation is high, interest rates are rising, the word recession keeps passing through the news and market sentiment is shifting. The S&P 500 is down over 13% YTD, the VIX is increasing, and the Fear and Greed index sits solidly in “Fear”. It is not a good time for equity investors, much less cyclical equities like ONEW.

For additional pain, recreational stocks that boomed during the depths of COVID will face pressure as the economy opens. The boating market, viewed as a safe activity during the pandemic, experienced huge growth beginning in 2020, but will face competition as more activities are viewed as safe.

Despite these headwinds, ONEW is a well-run company with a well-defined strategy and a disciplined approach to M&A. The recent announcement of a large share buyback program gives me confidence that management believes the company can weather a potential economic downturn, and it believes the shares may be undervalued.

While I am not ready to add to my position, I believe ONEW is near the bottom and has been impacted by market sentiment, not its performance. It trades at a very attractive fwd. P/E ratio and if I did not already have a position, I would be looking to enter. During the next earnings call, I will be listening for any adjustments to guidance for FY 2022, as well as comments on how customers are responding to increasing interest rates. If management continues to issue solid guidance and the market continues to punish these shares, I will expand my position.