Olemedia/E+ via Getty Images

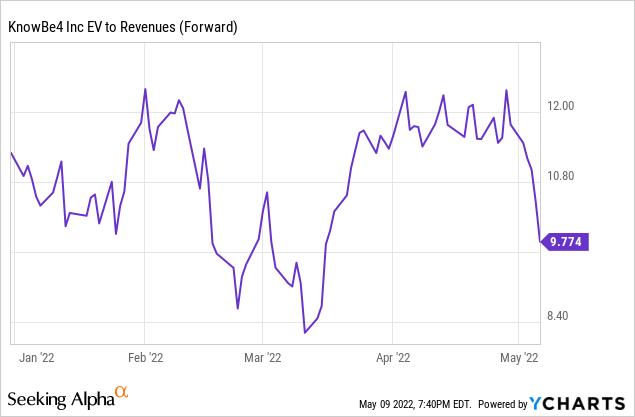

In a rising threat environment with compliance requirements and security budgets on the rise, KnowBe4 (NASDAQ:KNBE) screens favorably as a market leader looking to capture a substantial but fragmented TAM opportunity. With KNBE also looking to build an international presence and drive greater market awareness across the security landscape, the growth runway is clearly quite extensive. The catch is the valuation – in contrast to the de-rating most other software names have suffered YTD, KNBE has stayed resilient (on a relative basis). While the valuation might make sense relative to its underlying growth potential, the lofty EV/Revenue multiple (even after the recent sell-down) means shares are hardly cheap, particularly in a rising rate environment. Pending visibility into KNBE’s net retention rates and multi-product adoption/monetization, as well as its financial roadmap post-CFO transition, I would hold off on the shares.

“Building Your Last Line of Defense”

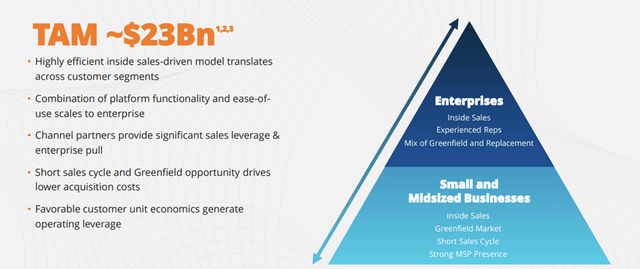

KNBE’s latest investor day was headlined by a $23 billion bottom-up TAM framework, underpinned by a lack of penetration from vendors in the market. This should change over time as awareness around the need for SAT (“Security Awareness Training”) continues to grow, aided by ongoing marketing efforts and a rising cyber threat environment globally. Supporting this longer-term view is the fact that new customer wins continue to gain traction, reflecting meaningful greenfield opportunities ahead.

KnowBe4

Source: KnowBe4 Investor Day Presentation Slides

A key statistic to keep in mind is the following – while only c. 3% of IT security spend is currently allocated to the human layer, over 50% of data breaches come directly through this vector. Perhaps more strikingly, c. 85% involve a human element in some form, highlighting the opportunity KNBE is looking to address. And with customers benefiting from a six to sevenfold reduction in susceptibility to social engineering attempts in the first year of use, the value-add from KNBE’s services is clear. Assuming KNBE can replicate its results thus far (lowering the “phish-prone” organization threshold down to sub-5% levels in the first twelve months) across verticals, the company has an extensive growth runway ahead.

Building Out the Platform for the Long Run

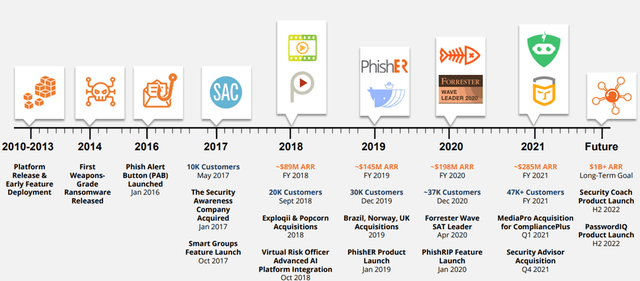

Interestingly, KNBE’s market opportunity considers its existing SKUs (KMSAT, PhishER, KCM, and Compliance Plus), as well as newer SKUs (Security Coach and PasswordIQ) set for rollout later this year. Notably, Security Coach leverages KNBE’s prior SecurityAdvisor acquisition to integrate with existing security layers in identifying and flagging high-risk user behavior. On the other hand, PasswordIQ will address security risks associated with password hygiene.

KnowBe4 Investor Day Presentation Slides

I see the upcoming Security Coach product launch as especially exciting – it marks KNBE’s expansion into the HDR (“Human Detection and Response”) category, which in contrast to KMSAT (mainly sold to IT departments), will directly reach organizations’ key decision-makers (i.e., the Chief Information Security Officer/Security Operation Center). A successful Security Coach rollout could be accretive to overall margins as well, considering it will only be made available to customers using premium pricing tiers (i.e., KMSAT platinum and above). Perhaps most importantly, the new launches significantly enhance the portfolio, which already includes PhishER, Compliance Plus, and KCM, and should, therefore, help drive cross-sell opportunities ahead. If management delivers, I see a clear path to gradually improving net revenue retention, and driving sustained long-term growth from the platform.

CFO Transition Creates Uncertainty Around the Financial Roadmap

Unsurprisingly, KNBE offered limited incremental financial disclosure at its investor day, given that CFO Bob Reich is only a few weeks into the job. Recall that former CFO Krish Venkataraman recently stepped down from the role and will instead assume a Board seat. In his place, KNBE has elected Bob Reich, a long-tenured executive with over twenty-five years of financial leadership experience, most recently at Florida-based marketing tech company, Catalina. The abrupt transition is a negative surprise, especially considering it came only months post-IPO and with the business still in its early innings.

KnowBe4 Investor Day Presentation Slides

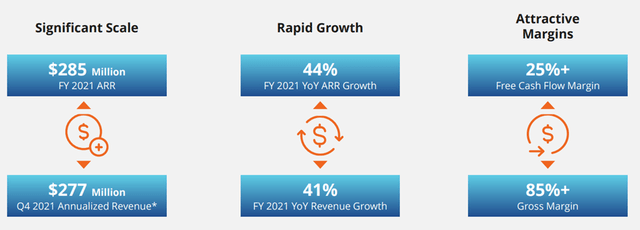

However, KNBE still has one of the most attractive financial profiles in the software space – its 40+% ARR growth and 20+% FCF margins tick the “rule of 60” box quite nicely. Additionally, the 90+% logo retention allows it to generate 100% SaaS-based revenue, from which it derives 85+% gross margins across both the enterprise and small/medium business segments. The only real drawback has been the lagging net dollar retention (i.e., the extent to which recurring revenue has grown/declined after accounting for customer expansion as well as churn and downgrades). Pending signs of improvement in this area via cross-selling, I would keep a close eye on this metric going forward.

Final Take

With the SAT industry set to thrive amid the rising threat environment and growing security budgets, KNBE is poised to benefit. Over the medium to longer-term, a 30+% FCF margin scenario is certainly possible, although the limited expansion among existing customers and newer add-ons suggest it remains early days. There could also potentially be increased competition on the horizon from larger platform vendors, and therefore, I would be hesitant to pencil in the 20+% growth guidance at this juncture.

Finally, there is an ongoing CFO transition taking place, with outgoing CFO Krish Venkataraman appointed to the company Board and an experienced CFO hire (Bob Reich) joining as his replacement. YTD, KNBE shares have been surprisingly resilient despite the rising rates, certainly outperforming its software peers on a relative basis. Yet, the current valuation isn’t cheap at ~10x EV/Revenue, and therefore, investors will need a lot to go right for the shares to appreciate. For now, I am moving to the sidelines.