Edwin Tan/E+ via Getty Images

As a holding company that delivers more return on capital than the S&P 500, Danaher (NYSE:DHR) is often referred to as Berkshire Hathaway’s (BRK.A) (BRK.B) little brother. But Danaher’s portfolio is much more concentrated than Berkshire’s, which can make the stock interesting for covering the healthcare sector in a portfolio. Given the solid key metrics and long-term track record, I think the stock is worth buying despite a current overvaluation by conventional valuation methods.

What Makes Danaher Corporation So Interesting?

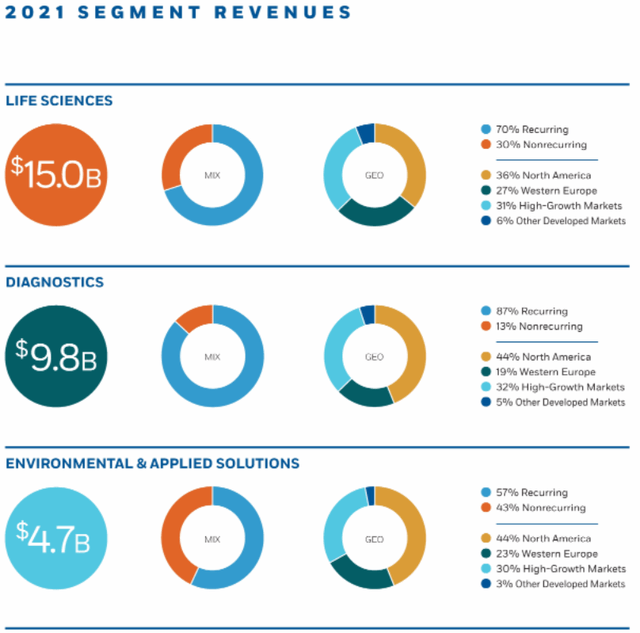

Danaher is a healthcare holding company that owns companies in the life sciences, diagnostics and environmental & applied solutions segments. Based on sales, the segments are listed below by size:

Danaher’s Segments And Related Revenues (Danaher)

It is noticeable that Danaher places value on recurring sales. Sustainable and growing revenue streams are the company’s growth driver. In addition, at least 30% of sales in each segment can be traced back to rapidly growing markets.

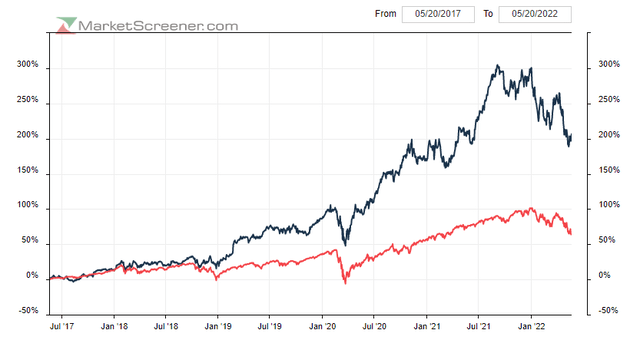

Historically, Danaher has attracted interest from the financial markets based on its performance relative to the benchmark. Basically, you won’t find a longer period (>2 years) in which the S&P500 offered better returns. The price development over the last 5 years is shown below for illustration purposes.

Danaher’s Performance Vs. The S&P 500 (Marketscreener)

In addition, a dividend, albeit a small one, has been paid for 28 years. The dividend payment has been growing for 13 years and has never been lowered in its 28-year history. Moreover, there are returns from spin-offs, in which shareholders in Danaher also receive shares in the spin-off companies.

But What Is Behind The Success Story?

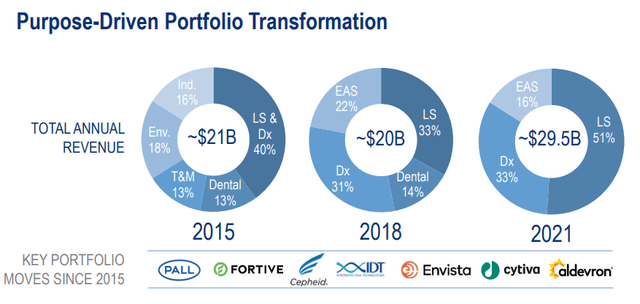

Unlike other holding companies, such as Berkshire Hathaway, they only acquire companies from the three segments already mentioned. In recent years, they have made their portfolio more focused, which has been rewarded with sales growth of around 40%.

Danaher’s Key Portfolio Moves Since 2015 (Danaher)

In addition, acquired companies are subjected to a downsizing regimen. Danaher’s concept is to improve everything and everyone, from the CEO to the employee, and to get rid of superfluous or unprofitable components. They are extremely growth and profit-oriented in order to increase the value of the company and thus the value for the shareholders. In summary, after the acquisition, they create structures to improve the quality, supply chains, costs and innovative strength of the acquired company.

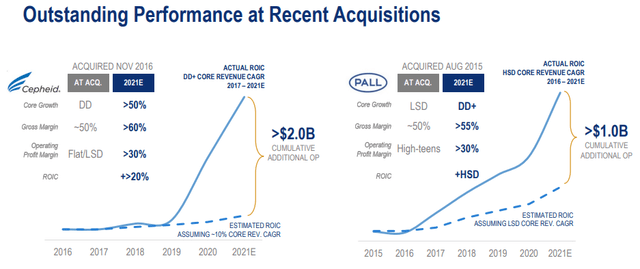

At an investor event in 2021, they gave an example of how these adjustments within the acquired companies can affect sales. The companies Cepheid and PALL were used as examples. While that doesn’t mean that sales can always be increased that much, it does show that Danaher can have a major impact on a company’s growth.

Danaher’s Impact On Acquired Companies (Danaher)

Evaluation Of The Key Metrics

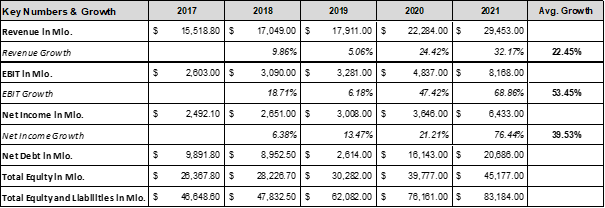

To evaluate the financial condition of Danaher Corporation, growth, profitability and risks are evaluated below based on the consolidated financial releases for the last 5 years. The figure below shows the key numbers used for the calculation.

Danaher’s Key Numbers And Growth Rates (Author)

At first glance, Danaher stands out as a COVID beneficiary. Despite the pandemic, 2020 and 2021 went much better compared to previous years. This is mainly due to the acquisition of General Electric’s Life Science division, which acted as one of the growth drivers under Cytiva. However, positive trends in terms of sales and profit growth were also discernible in previous years. Overall, excellent growth rates in the low to mid double-digit range were achieved.

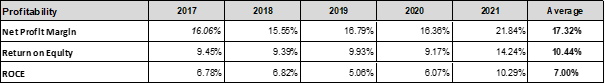

To continue with profitability, Danaher has good numbers to show for a healthcare company. The average net profit margin was 17.32% and was relatively constant. Compared to the sector median (-2.27%), the value is all the better. Healthcare companies are often characterized by being unprofitable for a long time until they make a breakthrough and have a product that turns the tide. However, sometimes this breakthrough never comes and the company does not become profitable. This risk does not exist at Danaher as they are very broadly diversified. In addition, the profit orientation and focus in the profitability indicators are clearly recognizable.

Danaher’s Profitability Metrics (Author)

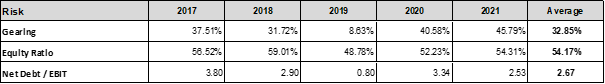

The key risk indicators consistently show solid values. Gearing has increased from 37.51% to 45.79% in the last 5 years, but is still within an unproblematic range. The equity ratio is kept constant and averaged 54.17%. In addition, the ratio of net debt to EBIT shows a downward trend and, at currently 2.53, is also considered to be less risky.

Danaher’s Risk Metrics (Author)

So all in all, the metrics are rock solid and Danaher’s financial statements show that it is a quality company.

Valuation

The problem with the valuation of Danaher Corporation is that the stock is actually always too expensive and in hindsight it was still worth buying. This is due, among other things, to the high quality and stability, to surprising increases in profit or sales or to synergy effects from newly acquired companies. Therefore, I will not set up a discounted cash flow model when evaluating Danaher shares, which would lead to a strong overvaluation. I think it is much more realistic to work with multipliers from the past and relate them to current estimates.

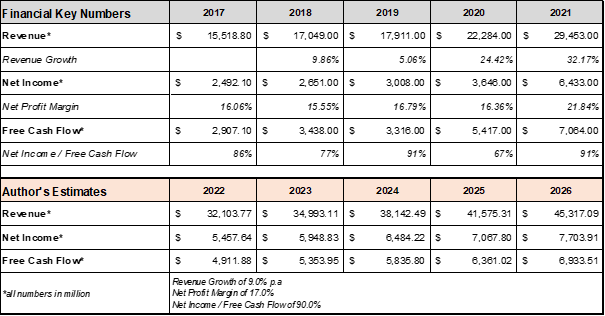

The estimates were assumed based on the revenue growth, the net profit margin and the ratio of net income to free cash flow over the past few years. I assumed that the high growth rates of the last two years would not be repeated since the synergy effects from the acquisition of General Electric’s Life Science division should slowly wear off. Nevertheless, I think an average sales growth of 9% p.a. is possible. The analysts are currently assuming sales growth of around 6% p.a. The margins have been stable over the last few years, which is why I set the net profit margin at 17%. Here the analysts assume higher values (approx. 21%). I won’t go into detail about the free cash flow without a discounted cash flow model, but I wanted to include these estimates because of its stability.

Danaher’s Financial Key Numbers And Author’s Estimates (Author)

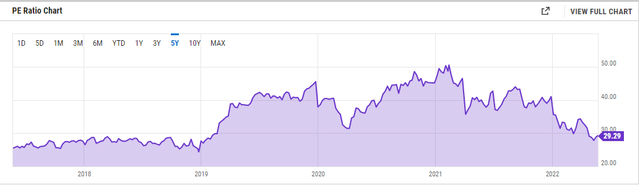

The historical P/E-ratio shows that the values from 2018/2019 will slowly be reached again in 2022 due to the increase in earnings and the return of the price. The low of the P/E-ratio in the last 5 years was 24.4 and the median 36.9. If you extend the observation horizon to 10 or 15 years, values between 12 and 17 corresponded to the rule, but at the time revenue and net profit were also relatively inconstant. The current P/E-ratio is 29.3.

Danaher’s Historical P/E-Ratio Over The Last 5 Years (Y-Charts)

From the recent past, I would rate values between 25 and 30 as plausible for future assumptions assuming constant growth. With an estimated net income for 2026 of around USD 7.700 million and a constant 737 million shares outstanding, this would mean a price target of USD 261 to USD 314 per share. With an observation period of 4.5 years and a current price of USD 253 per share, this results in a return of between 1% and 5% p.a. Since I am personally aiming for a return of around 10% p.a., the price target would be between USD 170 and 205 USD per share. The dividend yield of approx. 0.35% and profits from spin-offs were neglected.

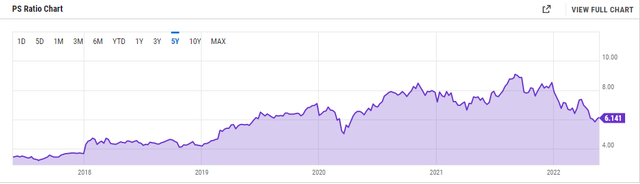

To check the plausibility of considering the P/E-ratio, I would like to go into the P/S ratio briefly below. The P/S-ratio has shown an upward trend over the past 5 years. It had a minimum of 3.2 in 2018 and reached its maximum of 9.1 in 2021. In the meantime, the rating with regard to the P/S-ratio is somewhat lower again at 6.1.

Danaher’s Historical P/S-Ratio Over The Last 5 Years (Y-Charts)

Over the long term, I would consider a P/S-ratio of 5 to 5.5 to be fair given the current market situation and with recent sales growth in mind. With the estimates for 2026 in terms of revenue of around USD 45.300 million and a constant 737 million shares outstanding, this would mean a price target of USD 307 to USD 338 per share. This is at the high end of the price target considering the P/E-ratio.

Thus, based on the assumptions I have made, a return of around 4 to 5% p.a. can be expected on Danaher shares over the next 4.5 years. However, it’s important to remember that Danaher has outperformed the S&P500 in almost every period under review. In the past 5 years, an average return of 24.4% p.a. could be achieved, whereas the S&P500 could only achieve 10.5% p.a. Conventional valuation methods often overvalue as the future cannot be accurately represented, and Danaher is very good at beating estimates. In this case, the market grants a price premium for this.

Risks That Could Speak Against The Assumptions Made

Danaher is broadly diversified and therefore has a relatively low risk for a healthcare company. If an acquisition is not profitable, the companies in the portfolio cushion this well. In order to be able to maintain the outstanding performance, however, new growth opportunities must be constantly generated. Since the healthcare sector is very innovative, I consider the risk of weak growth to be low, but there could be years of weak innovation in which the stock market punishes this with lower multiples.

Added to this is the great competition in the healthcare sector. Many companies are researching the same or a similar problem, and whoever solves it first often reaps disproportionate profits.

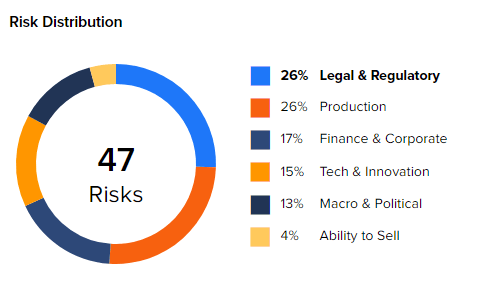

In addition, the products of Danaher’s subsidiaries affect a large number of people, which is why legal or political requirements can always arise. However, these affect the entire sector, which is why competing companies face the same risks.

Tipranks has compiled an overview of the major risk factors affecting Danaher. Many legal and regulatory risks are specified as well as problems in production. There are also risks related to finance, innovation and politics. However, it should be noted that risks are only listed here and no probabilities are assigned to these risks.

Risk Distribution Of Danaher (Tipranks)

Conclusion

All in all, Danaher is an absolute quality company. Shareholders have enjoyed high returns in the past and Danaher is well positioned for the future. The diversified portfolio of the holding company makes it an excellent opportunity to cover the healthcare sector in your portfolio. Only the valuation is currently too high according to conventional valuation methods.

However, I think that soft factors, such as the incredible history in terms of returns and the continuity that goes with it, should also be taken into account. For me, Danaher is a stock I’d rather own than not own. I will buy Danaher in multiple tranches to potentially cushion the high valuation. Therefore, despite the conventionally high valuation, I rate the share as a “buy”.