Dean Mitchell/E+ via Getty Images

The investment thesis

Omega Healthcare (NYSE:OHI) stock prices have suffered large retractions since the breakout of the COVID pandemic. Its stock price fell from a $45 peak pre-pandemic to a bottom of around $15 at the height of the panic sale amid the pandemic. Now the stock price has recovered to about $29, still about 1/3 below its pre-pandemic peak.

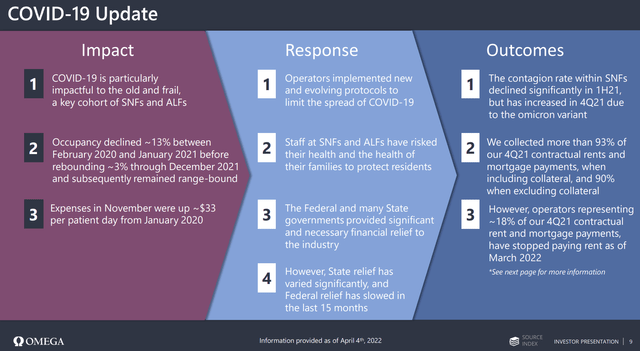

The COVID-19 pandemic indeed has hurt its business operations at a fundamental level. The elderly represents a core demographic of the customer base for its SNFs (skilled nursing facilities) and ALFs (assisted living facilities). And unfortunately, the pandemic has a particularly concentrated impact on the elderly. As a result, between February 2020 and January 2021, its occupancy dropped by 13% due to the pandemic. And the ripple effects have not completely dissipated yet, as commented in its COVID-19 Operator Update during the 2021 4Q earnings report (and the emphases were added by me):

As previously disclosed, operators representing approximately 12.2% of our 4Q21 annualized contractual rent and mortgage interest did not pay all of their contractual obligations in 4Q. We were able to apply security deposits and other collateral from some of these operators in 4Q21. However, the collateral was insufficient to fully offset the unpaid contractual rent and mortgage interest. As a result, in 4Q21, we recorded within AFFO and FAD 92.9% of our contractual rent and mortgage interest. As this collateral is exhausted and if these tenants continue not to pay rent, we expect that this would further reduce our near term Adjusted FFO and FAD financial results.

Despite such lingering ripple effects, you will see that the worst of the COVID impact has passed and OHI is well poised to resume strong operations in the near future. Occupancy began to show signs of rebounding – it rebounded by ~3% through December 2021. To me, this is a strong sign of the reversal of business fundamentals, and its stock prices have shown equally strong technical signs to support this view as detailed immediately below.

Strong technical signs

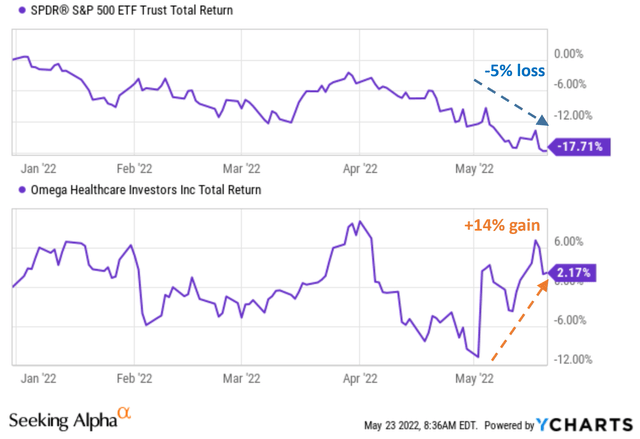

Following the extreme price volatilities shortly after the COVID break out, the stock price has been going sideways YTD mostly. As you can see in the chart below, its stock price has been Fluctuating between a range of positive 6% and negative 6% so far this year. however, when compared to the overall market (represented by SPY), such round-bound movement actually should be interpreted as a positive sign because the overall market has lost more than 17% YTD.

What has happened since the beginning of May 2022 is even more illustrative. The blue arrow in the top panel shows that the overall market continued its loss and lost more than 5% since early May, while OHI stock price gained more than 14%. It is a classical sentiment reversal signal when a stock maintained its gains against an overall market correction.

And, as we’ll see next, the company’s operations are also improving at a fundamental level and the stock’s valuation is still quite attractive.

Seeking Alpha

COVID impact and OHI’s future past COVID

As aforementioned, COVID has unevenly impacted a core demographic of OHI’s customer base. The occupancy rate fell ~13% after the breakout. The contagion rate within SNFs declined significantly in 1H21. The ripple effects are still persisting and will likely linger longer. According to its fourth-quarter earnings conference and 10-K filing, one of its operators still failed to pay its contractual rent in January and February as an aftermath of the COVID impact. This operator accounts for about 3.5 percent of OHI’s 4Q21 contractual rent and mortgage interest,

My view is that the worst has passed and business operations are now showing signs of reversal too. Occupancy rates rebounded about ~3% through December 2021. Even though many questions and uncertainties remain, OHI has developed a coherent plan and is well-poised to weather these uncertainties. I am optimistic about its prospects in the long term and its secular support as our society faces an aging population. As commented in its earnings report, management shares the same optimism and also sees a strengthened relationship with operators going forward:

- Skilled nursing facilities still fulfill an essential need within the healthcare continuum

- The secular tailwind of improving demographics will remain in place after this pandemic

- Our relationship with our operators will be even stronger for having faced this pandemic together

OH earnings report

Valuation and projected returns

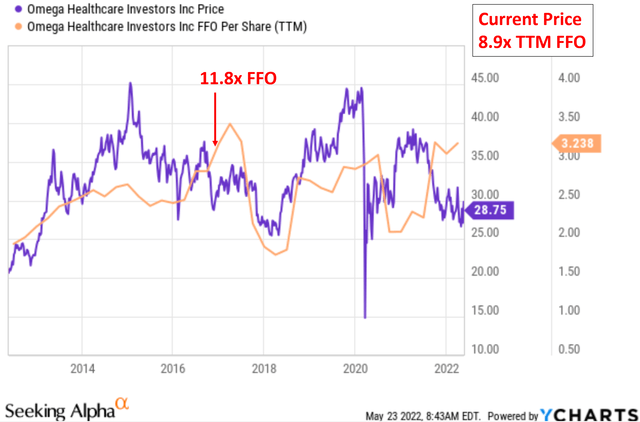

Despite its recent price gains, the stock is still very attractively valued both in terms of FFO multiples and dividends. It offers an excellent balance of value (about 9x AFFO), high current income (9%+ dividend yield), and also healthy growth prospects given the secular tailwind. As you can see from the following chart, the stock has been trading at an average valuation of 11.8x FFO historically. It is now priced only at about 8.9x FFO, more than 25% below the historical average.

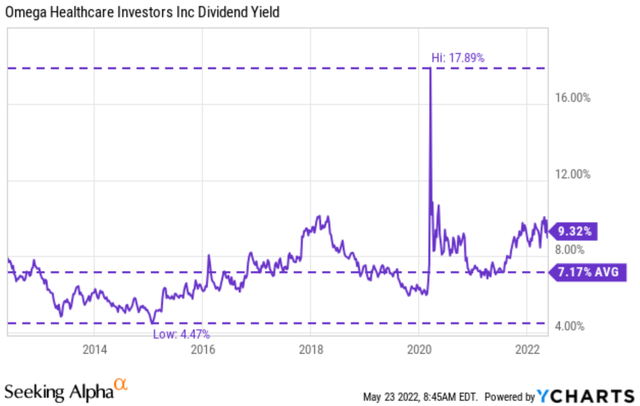

The valuation picture is very similar in terms of dividend yield. As you can see from the second chart, the stock has been paying a dividend of about 7.17% on average during the past decade. And at the current price level, its dividend yield is about 9.32%, about 29% above the historical average (i.e., about a 29% valuation discount in terms of dividends) – very similar to the observation made from the FFO multiple.

Combing its projected growth rate and a valuation reversion to the mean, a double-digit annual return is very likely in the next 3 to 5 years.

Seeking Alpha

Seeking Alpha

Summary and risks

COVID has negatively and substantially impacted OHI’s operations in the past year or so. The thesis here is that the worst has passed and OHI has turned a corner. Sentiment began to reverse as demonstrated by a strong technical. Business fundamentals began to improve as the occupancy rate rebounded.

Despite large price gains recently, the stock is still very attractively valued. It is discounted from its historical average valuation by about 25% or more, both in terms of FFO multiples and dividends, offering a thick margin of safety for investors under current conditions.

Finally, a few words about risks. The COVID situation remains its largest risk. It is simply just unpredictable when the pandemic will end. Operator costs could remain elevated due to increased COVID infection control and also labor cost. It is also uncertain if government reimbursement would increase in correspondence to such elevated operator costs. All these factors could impact its profits and also financial standing, as summed up by its Chief Financial Officer Bob Stephenson during the earnings report:

However, if the collateral is exhausted, a decrease in EBITDA will impact our liquidity ratios. The actions taken to-date provide us with significant liquidity and flexibility to weather the continued impact on our business, primarily driven by COVID-19.