Bet_Noire/iStock via Getty Images

Introduction

Post Holdings, Inc. (NYSE:POST), most popularly known for its cereal brands, is one of the largest food manufacturers in the world. The company has a very consistent and stable operations base that is paired with M&A activity. Post has seen slow, consistent growth over the years in its most reliable segments. The company trades at 37x average five-year earnings and doesn’t offer a dividend, so I am uninterested in a position at this point.

Historical Financials

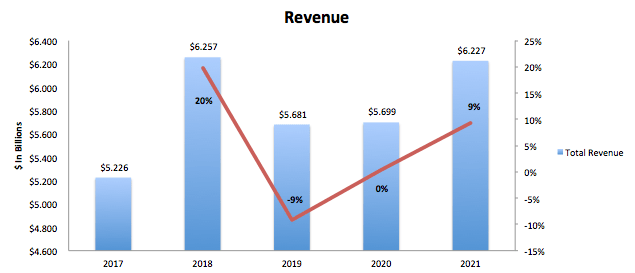

Post Revenue (SEC.gov)

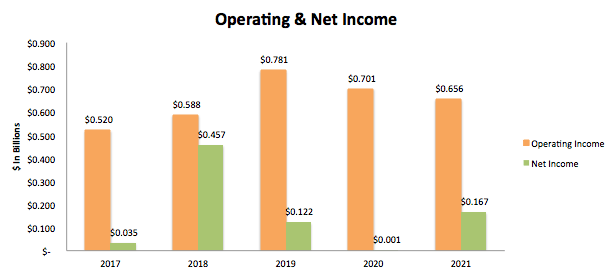

Post Operating & Net Income (SEC.gov)

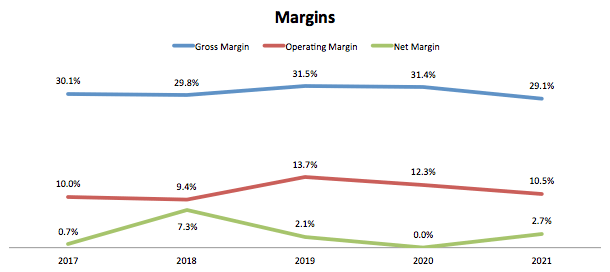

Post Margins (SEC.gov)

Post is a well-known food brand that sells an assortment of food products allowing for scale and reach. The company, therefore, has a base demand and consistent revenue streams. Post has seen a variety of results over the years due to many M&A activities. Looking at total revenue shows this. In 2018, the company’s revenue popped with the acquisitions of Bob Evans and Weetabix Group. In 2019, Post capitalized the Private Brands segment to 8th Avenue.

Since then, much of the growth has been organic. Overall, the company grew revenue at a pace of 3.57% per year. These transactions also can be seen on the bottom half of the income statement. Operating and net income was affected by increases and decreases over the period from tax benefits, debt extinguishment, income/cost from swaps, and gain/loss on the sale of the business. So Post is rather “volatile” due to the M&A activity it engages in. While this is the case, the main business is rather stable, as can be seen by the gross margin, which has a variance of 2.4%. SG&A as a percent of revenue also only has a variance of 1%.

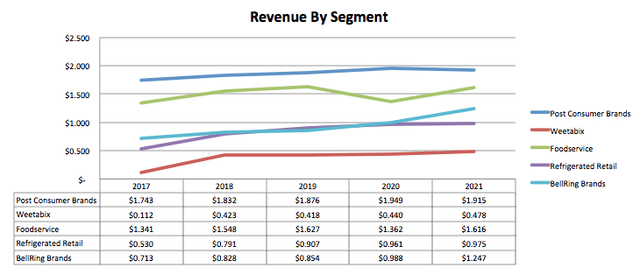

Post Revenue By Segment (SEC.gov)

Looking at each segment shows the cows and stars. The cash cow of the business has been Post Consumer Brands, which has been very consistently providing a third of revenue. This segment also reports consistent margins of 18-20%. Weetabix, Foodservice, and Refrigerated Retail have all been consistent too. Weetabix and Refrigerated Retail only make up 8% and 15% of revenue each, while Foodservice is about a quarter of the sale.

These three are question marks for the company due to margins. Weetabix has margins of mid-twenties, Refrigerated Retail single digits to teens, and the larger segment Foodservice has low single digits. Al four of these segments have been slow growers but consistent. BellRing, on the other hand, has been the growth star segment, with a CAGR of 11.83% over the last five years and making up 20% of revenue in 2021.

This Year

So far in the half-year reported in 2022, Post has seen revenue grow by 16% year-over-year. The company continued some M&A activity by spinning off the BellRing segment. The results of this were a charge gain of the sale, which increased net income by 163%. But operating income decreased by 28% due to gross profit declining by 2% and higher SG&A costs. Each segment saw good growth, with Post Consumer Brands growing 17%, Weetabix 4%, Foodservice 23%, and Refrigerated Retail 8%. But margins fell off for the half-year in the Post Consumer Brands and Refrigerated Retail segments by 4% and 6%, respectively. Overall, not the greatest start to the year, and it will be important to see if this evens out for the full year.

Balance Sheet

Post may have one of the most solid balance sheets I’ve seen, with very high liquidity and easily manageable debt. The current and quick ratios for the company are 1.6x and 1.95x, meaning without inventory Post can almost cover immediate debts twice. This is honestly too high in my opinion, and the company should look to effectively use this capital for better returns. Post also only has a debt-to-equity of 2.3x, very manageable for such a stable industry. Taken all together, the company has a very safe foundation to fall back on and is unlikely to have issues if a hard time arises.

Valuation

As of writing, Post trades around the $80 level. At this price, the company trade at a price to average five-year EPS of 37.4x. I am using the average of the five years as the bottom-line results differ so much due to M&A activities, thus evening out for a baseline EPS. The company also only trades at a P/BV of 1.4x. I think the company is trading a bit over fair value, and I would wait for a margin of safety to come about. The fact that Post doesn’t offer a dividend takes away reason to dollar cost average a position.

Conclusion

Post is one of the largest providers of various food items in the world. The company has a very consistent base operation, but also does a lot of M&A activity. These activities can muddy the consistency of the financials, nonetheless, Post is a strong stable business. The company currently trades at 37x average five-year earnings and doesn’t offer a dividend, therefore, I would need a margin of safety to enter a position.