alvarez/E+ via Getty Images

Note: This was co-produced with DerekCheung and Darren McCammon and was originally released on Cash Flow Kingdom in a longer version.

Article Thesis

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) is a container liner that has had an excellent 2021, and that could have an even better 2022 if rates remain at the current very elevated level. Thanks to a high shareholder payout and a very low valuation, ZIM is attractive following the recent pullback.

ZIM Integrated Overview

ZIM’s core business is like an ocean-going version of FedEx or UPS. It delivers goods from one destination to another across the sea and charges a fee that depends on a range of factors, with distance traveled being the most important one. The cargo that it delivers is packaged in standardized containers that come in either 20-foot or 40-foot lengths.

ZIM’s approach is a bit different than that of other shipping liners since it operates an asset-light business, meaning that the company leases most of the container ships that it needs to deliver cargo via time charter. The average length of ZIM’s time charters is around 27 months or a little more than two years.

They have been in business since 1945 and IPO’d on the NYSE in Jan 2021 at $15. Since then, its stock price has more than quadrupled due to record-high demand straining the world’s supply chains and driving sky-high container shipping rates, which led to an incredible rise in ZIM’s profits.

Summary of ZIM’s First Quarter Earnings

ZIM delivered an outstanding quarter:

- Net income was $1.7B

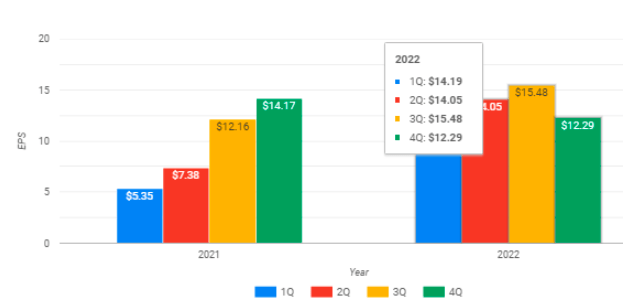

- EPS was $14.19 (87% earnings yield run rate), compared to $5.13 in the same quarter last year

- The company’s reported revenue was $3.7B, up 113% year-over-year

- The average freight rate per twenty-foot equivalent unit (TEU) in the first quarter was $3,848, a year-over-year increase of 100%

Consistent with ZIM’s generous dividend policy of paying out 30-50% of its annual net profit, ZIM declared a dividend of $2.85 payable on June 8. ZIM typically distributes 20% of its targeted total dividends each quarter, making up the difference to get to the 30% – 50% annual distribution with a big payment in April of the following year. This quarter’s dividend represents a little more than 4% of the share price as of May 23, but you basically have to double it when considering what the eventual dividend payout for Q1 will be — at the current rate, ZIM is thus offering an annualized yield of more than 30% as long as they hit the 40% midpoint of the dividend payout guidance.

During this quarter, ZIM made additional progress in securing 17 ship newbuilds with long-term charter agreements, to be delivered in future years. These newbuilds will have the latest environmentally friendly propulsion technology in order to meet IMO regulations coming into play in 2023. Having this “clean” technology is also expected to allow these ships to travel faster than dirty ships who are required to dampen their speed in order to meet EEXI 2023. This faster speed/quicker delivery should allow them to charge a premium vs. containers shipped via slower ships, which should come in handy once rates normalize and decline to a lower level compared to where they are today.

Additionally, ZIM announced that they had concluded negotiations for 1-year contracts on the Trans-pacific (e.g., Asia to the US) trade lane. The TP is ZIM’s largest trade lane, representing 45% of total volume. The contract rates affect 50% of ZIM’s TP volume (22.5% of total volume), with the negotiations resulting in rate increases of more than 100%. When asked about specific numbers, the CFO indicated they were comparable to the spot rate at the time of the conference call (about $4,200 per TEU, based on the Drewry Shanghai-LA index).

Regarding volumes delivered, ZIM had a year-over-year increase of 5% and was flat quarter to quarter. This is despite a macro backdrop of severe volume disruptions originating with China lockdowns due to COVID. ZIM grew the number of ships from 125 to 137.

From a debt point of view, ZIM’s balance sheet is very strong — the company has zero net debt. ZIM does have contract lease liabilities for the vessels that are chartered, but on the balance sheet, these liabilities are offset by the corresponding right-of-use in assets. ZIM also reported cash on hand of $5.1B ($3.1 billion after the April 4 dividend payment of $2B, which was paid out after the end of the quarter).

On the back of the strong first-quarter results and still very strong container rates, ZIM increased its estimated 2022 adjusted EBITDA to $7.8 – 8.2 billion, or $66.77 /share, which is an increase of 10% from the previous guidance provided in March.

Earnings Model Update

Given this context of exceptional earnings and outlook for both the company and sector, we updated our earnings model with the following EPS projections: 2Q $14.05, 3Q $15.48, and 4Q $12.29, for a total of $56. At a minimum, we have a high degree of confidence that 2022 will be at least as strong as last year’s astonishing $39 EPS result.

CFK model

This model makes the following assumptions on top of using the base rate from Q1 2022 earnings of $3,848 per TEU:

Q2 2022: Our model shows rates flat with the previous quarter. US longshoremen contract negotiations will take place during the summer of 2022. Where practical, we expect shippers to advance their shipments into Q2 to avoid this uncertainty. Longer-term TP freight contracts expiring in May 2022 will be renegotiated to higher rates, thereby helping the tail end of this quarter’s revenue. Again, we already know these longer-term rates were increased by 100% or more based on management’s comments.

Q3 2022: Average rates increase 10% from Q2. In addition to longer-term freight contracts having been renegotiated at higher rates, peak surcharge season comes into effect in Q3 (pre-Christmas deliveries). Due to late shipment experiences which occurred in 2021 and the risk of a longshoreman strike, we expect most retailers will seek to order and ship their Christmas goods a little earlier than normal. If there is an extended longshoreman strike, this would represent additional upside to the forecast.

Q4 2022: We have modeled a 10% reduction in rates from the prior quarter. Most Christmas deliveries have already occurred by the time Q4 rolls around. Additionally, the further out we go, the more conservative we want to be with our predictions, due to lower visibility.

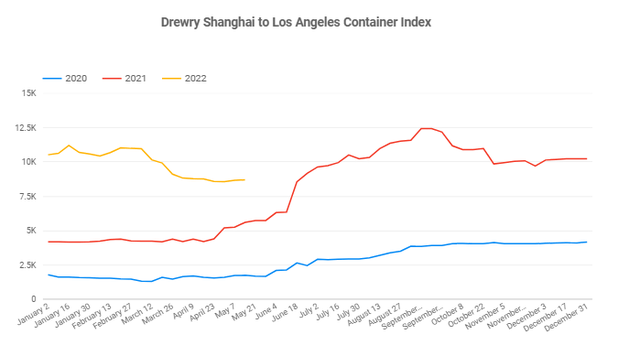

In addition to the very high contracted rates starting May 1 for the TP trade lane, spot rates are also now starting to stabilize at a high level, before moving into the traditional peak season:

Source: Drewry

We can clearly see that, so far, 2022 is a significantly stronger year than 2021 and 2020. With the coming months usually seeing an increase in rates, the same could hold true this year.

Catalysts

There are a few potential catalysts, on top of the low valuation, for share price appreciation that could occur in the near future:

- The high TP rates ZIM contracted, taking effect May 1, will have a small impact on 2Q revenues and will have a major impact starting in 3Q and beyond. The actual positive impact could be larger compared to what we modeled.

- Share buybacks: ZIM has the ability to retire a significant number of outstanding shares with its cash pile. Utilizing even half the expected cash hoard to buy back stock at current rates could reduce the share count by over 30%. Of course, these share buybacks could potentially also drive up ZIM’s share price, resulting in the share count reduction being smaller. Nevertheless, share buybacks should be highly accretive, although they are not a given.

- Asset and Service Growth: ZIM management has indicated they are looking at opportunistic adds, especially to Intra-Asia and South America routes. They will likely also use some cash to foster a new freight forwarding service launched in October 2021, called Ship4wd, as well as provide some strategic investments in Israeli AI and Digital firms involved in shipping.

- The massive COVID lockdowns in China over the past few months have caused a backlog of volume to build in Chinese ports. As the lockdowns ease in the coming weeks, we expect to see a surge of volume flow into US ports, adding to the volumes of the traditional peak season. This may send spot rates much higher, similar to what we saw at the beginning of the pandemic.

Risks

- Stock market volatility. With the Ukraine war and inflation concerns, sell-offs can affect all stocks independent of underlying fundamentals. Despite the volatility, ZIM has performed well year to date, with total returns of 36% vs the S&Ps -17%. Additionally, ZIM’s cash balance and pristine balance sheet limit the downside.

- Spot rate normalization. ZIM still has approximately 75% of its freight tied to the spot rate which is quite volatile. We are now entering into the traditional peak season for shipping, with ports continuing to experience congestion. Spot rates for 2Q and 3Q look strong with the backlog of volume from China’s lockdown and/or a longshoreman’s strike being a potential catalyst for even higher rates over the next several quarters. But rates will normalize eventually, which will lead to lower profits for ZIM. The timing and magnitude of that rate decline, relative to the currently very elevated levels, is not known yet.

Long-term Investment Thesis

The outlook for outsized performance in 2022 is bright, we believe. Beyond 2022, there is an emerging long-term thesis that we’ll need to monitor. Specifically, ZIM has been launching many high-margin trade lanes with express services (China to US West Coast, China to US East Coast, and recently, Intra Asia, including New Zealand and Australia). During the earnings call, the CFO alluded that there is some demand for a more cost-effective alternative to Air Freight and that ZIM’s express service, combined with its logistics ability across end-to-end solutions, including expedited rail and trucking, could allow it to address that need.

Additionally, ZIM’s asset-light model could become a competitive advantage due to the IMO regulations coming into effect in 2023. ZIM’s ability to replace its fleet with ships equipped with the latest environmentally friendly technology will allow them to gain the benefit of the new fleet more quickly. Ships with older technologies will need to operate at slower speeds in order to comply with IMO regulations. Leasing vs owning appears to be an advantageous position for making this transition. In fact, at the 1Q earnings call, the ZIM management team called out that the IMO regulations are an opportunity for ZIM, while for others, it is more of a risk.

Takeaway

2022 will be an exciting year for ZIM. It is one of the deepest value stocks on the market with this year’s expected earnings ($56.05) totaling 80% of the current share price. Its very strong balance sheet includes a large cash pile which will give it the option to seize opportunities when they emerge — we hope that this will include share buybacks. Following the recent share price pullback from above $90, ZIM is looking like a good investment again.