cineman69/iStock Editorial via Getty Images

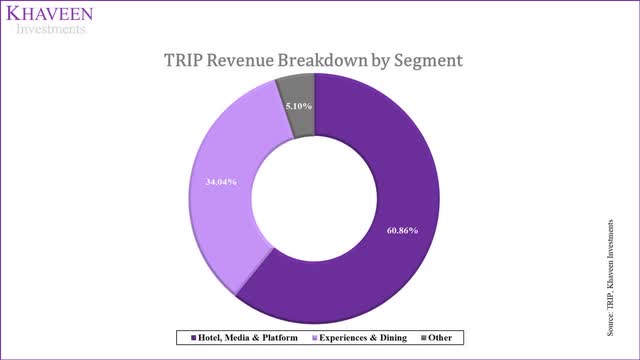

In this analysis of Tripadvisor, Inc. (NASDAQ:TRIP), we analyzed its Experiences & Dining (E&D) segment, which allows users to make bookings for attractions and restaurant reservations through Viator and The Fork, as it has superior revenue growth than its main Hotels booking segment. In 2021, the E&D segment represented 34.04% of the company’s revenue, making it the second-largest behind its Hotels segment.

TripAdvisor

Revenue Growth

|

Segment Growth |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Experiences & Dining |

372 |

456 |

186 |

307 |

360 |

423 |

496 |

582 |

683 |

|

Growth |

41% |

23% |

-59% |

65% |

17% |

17% |

17% |

17% |

17% |

|

% of revenue |

23% |

29% |

31% |

34% |

39% |

45% |

50% |

55% |

61% |

|

Hotels, Media & Platform |

1001 |

939 |

361 |

549 |

525 |

501 |

479 |

458 |

438 |

|

Growth |

-2% |

-6% |

-62% |

52% |

-4% |

-4% |

-4% |

-4% |

-4% |

|

% of revenue |

62% |

60% |

60% |

61% |

57% |

53% |

48% |

44% |

39% |

|

Others |

242 |

165 |

57 |

46 |

31 |

21 |

15 |

10 |

7 |

|

Growth |

-10% |

-32% |

-65% |

-19% |

-32% |

-32% |

-32% |

-32% |

-32% |

|

% of revenue |

15% |

11% |

9% |

5% |

3% |

2% |

1% |

1% |

1% |

Source: TripAdvisor, Khaveen Investments

The E&D segment managed to achieve a higher average 5-year revenue growth of 17% as compared to the Hotels, Media and Platform segment which had an average growth of -4%. As a result, over the past 4 years, the E&D segment had grown to become a larger segment for the company accounting for 34% of revenue in 2021, whereas both its Hotels and other segments’ revenue as a % of total revenue had declined during the period.

According to Statista, the Hotels segment in the travel and tourism market is expected to have a CAGR of 11.34% through 2026. However, according to Trefis, TripAdvisor’s hotel segment revenue decline is mainly due to lower click-based advertising revenues on TripAdvisor-branded websites. Hence, we expect the company’s revenue growth to be supported by its E&D segment with its superior growth and could reach 61% of total revenue by 2026 while becoming its largest segment by 2024 ahead of its Hotels segment.

Profitability

|

Company |

EBITDA Margin (5-years) |

Revenue ($ mln) |

|

TripAdvisor |

-1.16% |

902 |

|

Booking Holdings (BKNG) |

32.36% |

10,958 |

|

Expedia (EXPE) |

3.72% |

8,598 |

|

Airbnb (ABNB) |

-18.98% |

5,992 |

|

Average |

3.98% |

6,612 |

Source: SeekingAlpha, Khaveen Investments

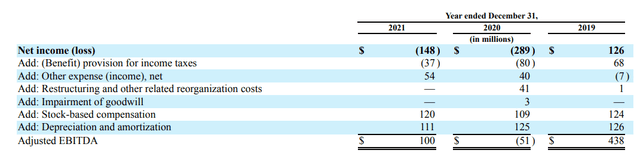

Based on a comparison of its competitors with higher revenues, the average EBITDA margin is higher than the company which we believe highlights the opportunity for its profitability to increase as it grows. The company reports its adjusted EBITDA which is different as it also includes other income, stock-based compensation, goodwill impairments, legal reserves and settlements, restructuring costs and other non-recurring expenses. Based on its annual report, its stock-based compensation is the largest item ($120 mln) included in its adjusted EBITDA.

Tripadvisor

However, we believe this may not be highly reflective of the company’s results, as its stock-based compensation growth had been higher than its revenue growth in the past 5 years, at 9% compared to 1%, resulting in a higher difference between its adjusted EBITDA margins than the unadjusted margin.

|

Adjusted EBITDA Margin |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Hotel, Media & Platform |

24% |

31% |

40% |

4% |

20% |

|

Experiences & Dining |

1% |

-42% |

-12% |

||

|

Others |

13% |

14% |

33% |

26% |

54% |

|

Company Adjusted EBITDA Margin % |

14.9% |

17.9% |

15.8% |

-21.4% |

2.3% |

|

Company Unadjusted EBITDA Margin % |

11.1% |

14.4% |

15.6% |

-38.1% |

-9.6% |

Source: TripAdvisor, Khaveen Investments

Based on the table, the E&D segment’s margin is lower than its Hotels segment and weighed on its total company’s margin despite the segment’s superior revenue growth is superior. According to management, the adjusted EBITDA for the E&D segment is low due to high strategic investment such as in marketing. However, the company expects the EBITDA margin for this segment to increase in the long term as explained below.

For E&D, we expect sort of long-term margins to be a mid-to-high percentage of EBITDA margin, mid-to-high-20s percentage EBITDA. – Ernst Teunissen – Chief Financial Officer

According to analyst Vince Ciepiel from Cleveland Research, the segment’s variable cost as a percentage of revenue is over 50% which is higher than its Hotels segment at around 30%.

|

Adjusted EBITDA |

2022F |

2023F |

2024F |

|

Hotel, Media & Platform |

20% |

20% |

20% |

|

Experiences & Dining |

-1% |

9% |

20% |

|

Others |

54% |

54% |

54% |

|

Company Adjusted EBITDA Margin % |

8.9% |

15.1% |

21% |

|

Company Adjusted EBITDA |

82.0 |

142.9 |

202.9 |

|

Stock-Based Compensation |

121.9 |

125.8 |

131.7 |

|

Other expenses (income) |

54 |

54 |

54 |

|

Unadjusted EBITDA |

-39.9 |

17.1 |

71.3 |

|

Company Unadjusted EBITDA Margin % |

-4.4% |

1.8% |

7.2% |

Source: TripAdvisor, Khaveen InvestmentsWe expect the E&D segment’s EBITDA margins could increase to reach 20% based on its Hotels segment margin in 2021 as we expect the E&D segment’s margin to increase as it grows in scale and reach almost the size of its Hotels segment in terms of revenue by 2024 and a total margin of 21% for the company. However, we expect its unadjusted company EBITDA margin to be only 7.2% in 2024 after factoring in our forecast of its stock-based compensation ($131.7 mln) and other expenses ($54 mln).

Competitor Product Comparison

|

Company |

The Fork (TripAdvisor) |

Eatapp |

Resy (American Express (AXP)) |

Opentable (Booking Holdings (BKNG)) |

Yelp (YELP) |

Tablein |

|

Price per month |

$95 |

$129 |

$399 |

$449 |

$249 |

$110 |

|

Online reservations |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Table management |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Waitlist |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Pre-payments |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Guest CRM |

Yes |

Yes |

Yes |

Yes |

N/A |

N/A |

|

Online ordering + Contactless dining |

N/A |

Yes |

Yes |

Yes |

N/A |

N/A |

|

POS integration |

Yes |

Yes |

Yes |

Yes |

N/A |

N/A |

|

Partnership network |

Yes |

Yes |

Yes |

Yes |

N/A |

N/A |

|

Discounts & yield management |

Yes |

Yes |

N/A |

Yes |

N/A |

Yes |

|

Capacity management |

Yes |

Yes |

Yes |

Yes |

N/A |

Yes |

Source: GuestRevu, Investopedia, TheFork

We compared The Fork with its competitors based on the fee charged to the merchants and the benefits provided to the merchants. We identified that as compared to its competitors, The Fork has the lowest fee charged which could be attractive to merchants. Besides, The Fork is only behind Eatapp in terms of features provided with 9 out of 10 features. Thus, we believe that The Fork’s competitive pricing and comprehensive features provide it with an advantage over its competitors.

|

Company |

Reviews |

Total Visits (‘mln’) |

|

Viator.com (TripAdvisor) |

4.3 |

20.6 |

|

getyourguide.com |

4.3 |

10.9 |

|

lonelyplanet.com |

2.3 |

4.1 |

|

Klook.com |

2.3 |

9.9 |

Source: Trust Pilot, Similarweb

Furthermore, we analyzed the competitive advantage of Viator.com based on the reviews and customer traffic. As compared to its competitors, Viator, the booking platform for tours, activities, and attractions, has a higher review and higher total visits for its website amounting to 20.6 mln. We believe Viator would continue to drive customer traffic and revenue due to its high reviews.

Risk: High Competition

We see one of the risks for the company is that it is in a fragmented market with low barriers to entry due to its less capital-intensive nature as the majority of its operations are based on its online platform. Hence, we believe this could increase the competitive threat to TripAdvisor.

Verdict

To conclude, we believe that the company’s E&D segment could benefit from its superior revenue growth at a 5-year average of 17% compared to its Hotels segment at -4% supported by its competitive advantages with competitive fees and comprehensive features for the Fork as well as high reviews and web traffic for its Viator platform. Additionally, we expect the company’s profitability to improve with the growth of its E&D segment in the long-term with greater economies of scale and forecasted its unadjusted EBITDA margin to reach 7.2% by 2024. Overall, the analyst consensus price target for TripAdvisor is $28.63, representing an upside of 22%.