bjdlzx/E+ via Getty Images

Investors who panic sell tend to remove good companies among the poorly run ones. Dycom Industries (NYSE:DY), an engineering and construction firm in the industrials space, is the former. Investors may have taken the chart’s bearish, “double top” at over $100 as an excuse to sell. After bottoming at close to $75, shares rebounded by 17.45% to $94.21 on May 25, 2022.

What did investors like about Dycom’s first-quarter results besides beating on earnings and revenue expectations? Dycom raised its outlook. Despite telecom companies like Verizon (VZ) and AT&T (T) underperforming in a rising interest rate environment, Dycom has a moat. It supplies skilled people, the most critical resource in the telecom service provider market.

Dycom Industries Q1/2023 Results

In the first quarter, Dycom posted earnings per share of 65 cents on a GAAP basis. Revenue grew by 20.5% year-on-year to $876.3 million. The firm increased its contract revenue for the second quarter. It expects revenue to increase in the mid-teens to 20% as a percentage of contract revenues. Furthermore, its adjusted EBITDA as a percentage of contract revenues is potentially higher on a Y/Y basis.

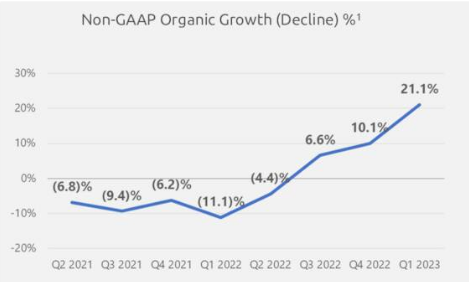

Per slide 6, Dycom’s organic growth is rising consistently. Frontier and AT&T are notable customers with strong organic growth.

Dycom Q1/2023 Presentation

Source: Dycom Q1/2023 Presentation

Moreover, the company reported its fifth consecutive quarter of organic growth with AT&T. Comcast (CMCSA) accounted for 12.7% or $111.3 million of revenue. It is Dycom’s second-largest customer.

Fiber construction revenue from electric utilities grew organically by 47% Y/Y. It contributed to $69.6 million, or 7.9% of total contract revenues in the quarter.

Opportunity

Investors who sold DY stock based on the bearish chart missed the recent rally. Cost pressures, such as the impact of fuel costs and labor, are industry-wide. Dycom, like other companies, is addressing those costs. Fortunately, fuel costs had an impact of just 58 basis points on margin.

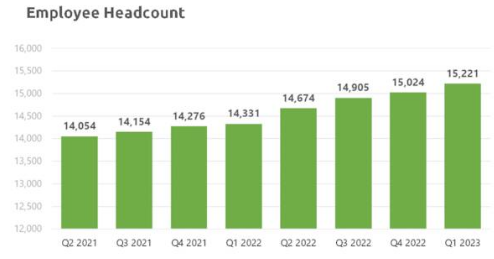

Organic growth from Dycom’s largest customers more than offset its higher costs. It will increase its service quality to support its continued organic growth of over $150 million Y/Y. It is committed to hiring talented staff to serve its customers.

Staff Hiring since Q2/2021 (Dycom Q1/2023 Presentation)

Source: Dycom Q1/2023 Presentation

In the bar chart above, the company increased its headcount steadily. Its biggest telecom customers are increasing their business activities as a result. For example, Dycom provides placement services for AT&T. It offers fiber construction staff for Brightspeed and Frontier.

To offset higher capital equipment costs, Dycom has new investment initiatives in fixed assets. This will have a positive impact on capital returns.

Dycom’s Backlog

Dycom has a healthy backlog. It remained steady at around $5.5 billion in the last eight quarters:

Dycom Q1/2023 Presentation

Source: Dycom Q1/2023 Presentation

On its conference call, President and Chief Executive Officer Steven Nielson did not elaborate on the new opportunities for the current quarter. Shareholders should only care that none of its clients are slowing down on their project plans. If true, DY stock deserves a higher growth score. It should rise from B- to A- within the next quarter:

SA Premium

Expect Dycom to match customer plans with staff resource availability. The increased profits will more than offset the cost inflation that everyone in the industry faces.

Risks

Dycom added over 250 new employees in the quarter. Training them adds to costs. Churn would add to losses as the employee hiring levels tighten. Fortunately, the company proved it could increase its capacity. It works well with its subcontractors to assign workers to attractive places.

Dycom ended the quarter with $660.1 million in notional net debt. Higher interest rates will increase the cost of servicing its debt. Fortunately, the company’s 4.50% senior notes will mature in April 2029. Its senior credit facility of $345.6 million matures on April 2026.

Dycom has strong liquidity of $309.5 million. It has plenty of capital to support its organic growth plans. In addition, it could buy back stock or acquire companies if the opportunity arises.

DY Stock Fair Value

On Wall Street, the average price target is $117.71. Alternatively, investors may build a 5-year discounted cash flow model: EBITDA Exit. Assume the following conservative metrics:

|

Metrics |

Range |

Conclusion |

|

Discount Rate |

9.5% – 8.5% |

9.00% |

|

Terminal EBITDA Multiple |

6.6x – 8.6x |

7.6x |

|

Fair Value |

$72.82 – $101.56 |

$86.90 |

|

Upside |

-0.355 |

7.40% |

In a base case, Dycom’s revenue would grow at no more than around 7% annually. This suggests a fair value of around $87.00.

Investors may want to wait for investors to lock in a profit on the stock before buying shares.

Dycom’s stock chart (finviz)

In the chart above, the stock could settle at below $90 at the 50-day simple moving average. MasTec (MTZ), which I rated a buy here, rallied many times since then. Dycom stock did the same on May 24. With MasTec, profit-takers sold the stock each time.

Dycom beat expectations and issued a strong outlook for the quarter. Consider building a core position on the stock on any weakness.