J2R/iStock Editorial via Getty Images

Thesis

Commonly, a company’s intrinsic value is derived from discounting the remaining lifetime of future cash flows back to the present value. Because of this, I believe it is essential to evaluate the durability of those potential cash flows as well as the purchase price of the security in relation.

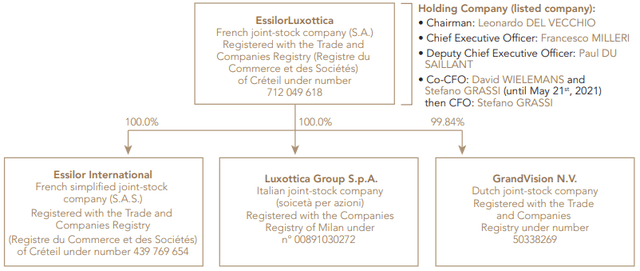

EssilorLuxottica (OTCPK:ESLOF) is the global leader in designing, manufacturing, and distributing eyewear lenses, frames, and sunglasses. Not only does EssilorLuxottica control a dominating portion of the eyewear market share, but they also control their entire vertical from R&D, to manufacturing, to the distribution network, to insurance. An important reason I believe their moat is so large is because of their portfolio of well-known brands, including proprietary brands like Ray-Ban and Oakley, as well as licensing agreements with many designer brands. Strong designer brand names coupled with the human necessity for prescription eyewear creates a unique demand structure for EssilorLuxottica in my opinion.

I believe this demand structure may continue to support positive free cash flow leading to more substantial acquisitions, consistent dividends, and reinvestment in the business to sustain organic growth. After trading down ~30% from all-time highs set late last year, EssilorLuxottica currently trades at a free cash flow multiple comparable to the depths of 2008 providing a potentially advantageous entry point.

Background

Industry

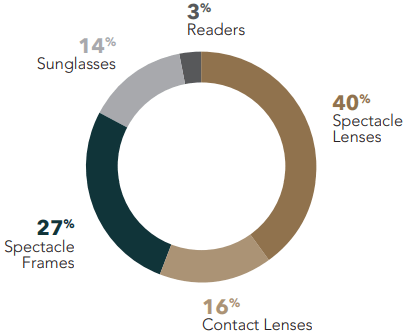

The global eyewear industry is estimated to be worth around $107 billion in annual consumer revenue and is expected to grow in the low-to-mid single digits for the foreseeable future. The industry is broken up into five segments and the market share is shown in the chart below:

EssilorLuxottica

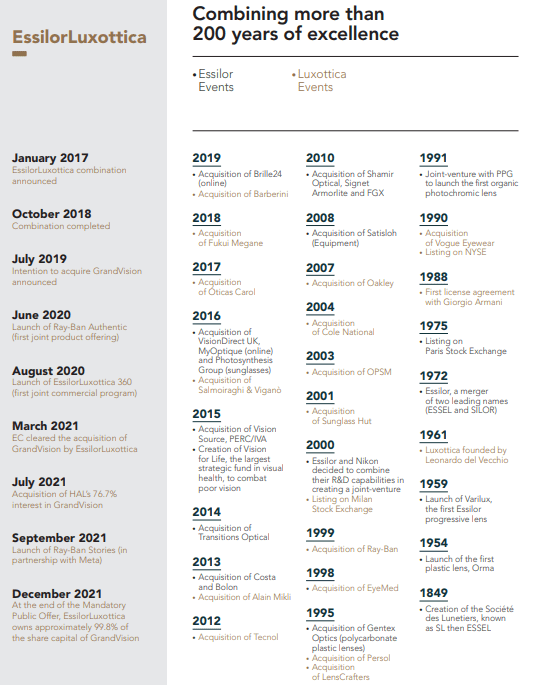

The eyewear industry has been historically fragmented, with numerous different companies created over the past two centuries. Over time, EssilorLuxottica has taken significant market share through organic and M&A-related growth. Below is the list of M&A history for the company:

EssilorLuxottica

Company

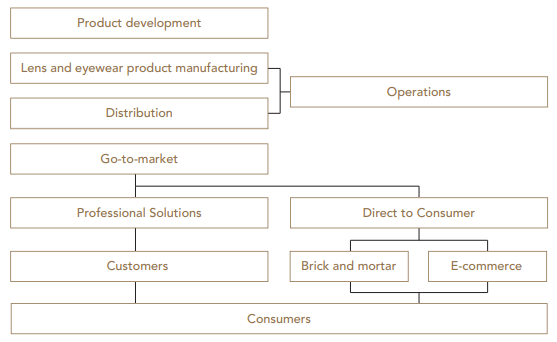

Over the course of history, through organic business breakthroughs and consolidation of the industry, EssilorLuxottica has grown to where it is today. Instead of focusing on a specific industry niche, EssilorLuxottica controls the entire value chain in the eyewear vertical. From designing iconic eyewear and high-quality contact lenses; to developing optical instruments; to manufacturing frames, lenses, and lab equipment; to distribution; to insurance, this one company controls it all:

EssilorLuxottica

Not only does EssilorLuxottica control the value chain, but they also have a portfolio of brands I believe are beloved by consumers around the globe. Proprietary brands the company controls include names like Ray-Ban, Oakley, Transitions, and Kodak Lens. Prestigious licensed brands apart from the company’s family also include Giorgio Armani, Bulgari, Burberry, Chanel, Coach, Dolce & Gabbana, Ferrari, Michael Kors, Prada, Ralph Lauren, Tiffany & Co., Tory Burch, Valentino, and Versace. The company also produces lens surfacing and coating equipment for opticians, optometrists, and ophthalmologists worldwide with brands like Essilor Instruments and Satisloh.

It’s also important to note that EssilorLuxottica’s distribution network includes ~18000 stores worldwide that offer products directly to consumers as well as high-quality vision care. Stores under the company’s umbrella include an array of different brick-and-mortar and e-commerce platforms, with some of the most notable including Sunglass Hut, LensCrafters, and Apollo.

While EssilorLuxottica’s business model is vast and complex in nature, I don’t want to fill this article extensively with information purely regarding their model. To uncover more about their operational structure, value chain characteristics, and brand/licensing information; pages 10-50 on their Annual Report have excellent, consolidated information.

EssilorLuxottica

Thesis Support

Innovation

I believe an important part of EssilorLuxottica’s business comes from the very start of the value chain, research & development plus new innovations. EssilorLuxottica is focused on organic product innovation through design craftsmanship, new sustainable materials, and breakthrough products with the goal of improving livelihood for millions. With over 11000 eyewear-related patents, the company continues to innovate as well as protect its intellectual property.

Brand Demand

Sparked through acquisition and organic innovation, EssilorLuxottica has built a portfolio of eyewear brands that rank among the highest levels in terms of consumer satisfaction. The total portfolio of proprietary brands and licensing agreements are below:

EssilorLuxottica

While the company has internally stated its brands are highly ranked, two online surveys show the company controls on average 75% of the top 20 rated brands. Both surveys had Ray-Ban at the #1 spot, a proprietary EssilorLuxottica brand. Continued customer satisfaction and high regard for their portfolio brands will be key for sustained future growth in my opinion.

Secular Trends

According to the Vision Council of America, approximately 75% of adults in the U.S. use either eyeglasses (64%) or contact lenses (11%). For growth context, the total U.S. adult population wearing protective eyewear in 1965 was ~45%. This number also increases with age. While 59% of Americans between 25-39 wear corrective eyewear, that number jumps to 93% for those between 65-75 years old. Along with corrective eyewear, 85% of the population uses sunglasses.

I believe if the global population continues to grow, the technology and accessibility to corrective eyewear increases, and the need for multipurpose eyewear (readers, driving-specific eyewear, transition lenses) heightens, EssilorLuxottica will benefit from potential secular trends. Also, as life expectancy increases globally and the potential need for corrective eyewear increases because of the negative effects screen time has on our eyes, EssilorLuxottica may experience long-term tailwinds.

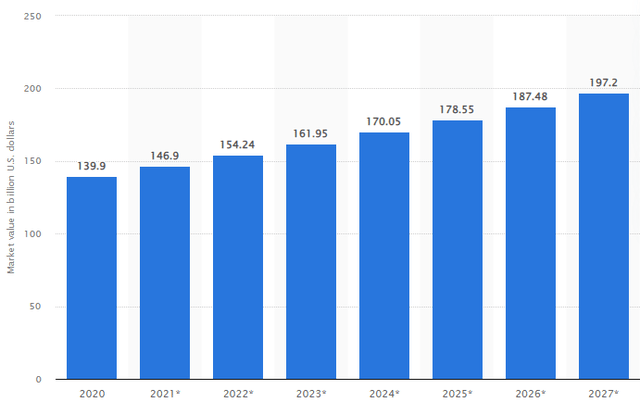

According to data gathered on Statista, the value of the global eyewear market will increase at a CAGR of 5% per annum through 2027:

Statista

While these statistics are based on the United States and EssilorLuxottica is a global company, I still believe it is a good proxy for worldwide eyewear statistics as the U.S. is the largest retail market.

Financials

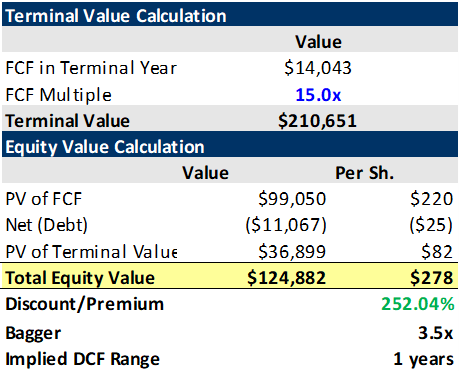

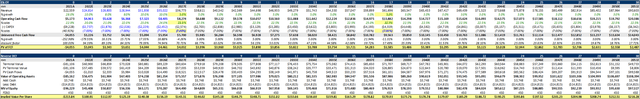

Discounted Cash Flow

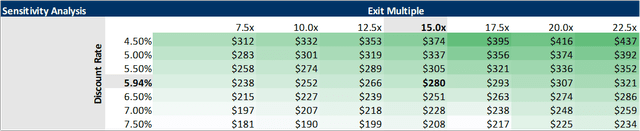

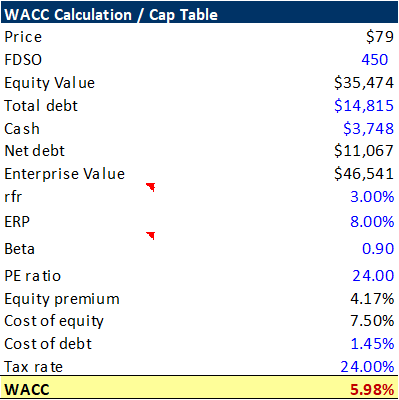

After analyzing the fundamental business behind the cash flows for the company, I conducted a discounted cash flow [DCF] analysis to find EssilorLuxottica’s intrinsic value. Below I’ve enclosed my intrinsic value calculation, my DCF sensitivity table, the weighted average cost of capital [WACC] calculations, and the DCF inputs:

Created By Author

Created By Author

Created By Author

Created By Author

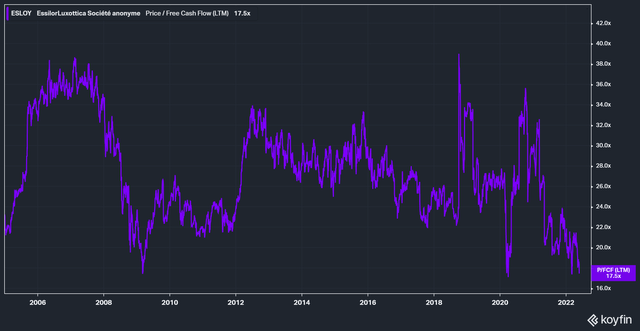

Valuation

Not only do I believe EssilorLuxottica is discounted to its potential future cash flows, but it’s trading at a historically low part of its market cap. / FCF range:

Koyfin

Historically, purchasing the company’s stock below 18x LTM FCF has provided great returns for shareholders moving forward.

Risk / Reward

Even if EssilorLuxottica’s free cash flow multiple contracted to the previous all-time low set in 2003 (13.5x) and free cash flow stayed constant, that would put the potential downside at -23% from current levels. Comparing that bear case to the possible 252% discount derived from my DCF, I believe EssilorLuxottica currently trades with a high margin of safety.

Risks

Competition

I believe a key reason EssilorLuxottica has had positive performance over the past decade is that their market share of the total eyewear industry continues to grow, benefitting their economies of scale. Recently, competition from companies like Warby Parker has made strong efforts to steal market share back from EssilorLuxottica. If successful, a declining market share for EssilorLuxottica could have detrimental effects.

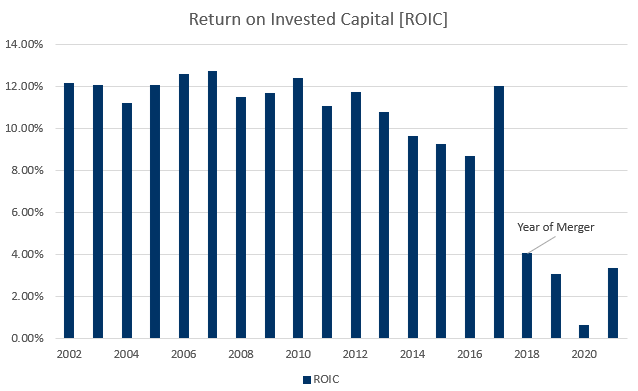

Multiple Suppression

If EssilorLuxottica sees competitive pressure eat at their growing market share, I believe the company could see valuation multiples contract as the stock may be less attractive to investors. Declining market share in an industry expected to CAGR at 5% for the next five years could also continue to burden their declining return on invested capital [ROIC]. Historically, the company’s ROIC has stayed between 10-12.5% but has recently declined following the merger between Essilor and Luxottica to where it currently sits below 4%.

Koyfin

While free cash flow may continue to support dividends and future acquisitions, declining profitability could suppress multiples leading to reductions in the stock price, in my opinion.

Summary

By controlling their entire vertical, having a portfolio of household names, and creating demand from both luxury and medical customers, I believe EssilorLuxottica’s future cash flows are very durable. With more than 11,000 patents, 2,350 designs, and 3,460 trademarks, I also believe they have the intellectual property to further substantiate their moat in the eyewear industry. With Essilor and Luxottica completing their combination in late 2018, I still believe the potential synergies as a product of the merger are not fully reflected, especially in the stock price currently.