miniseries/E+ via Getty Images

Investment Thesis

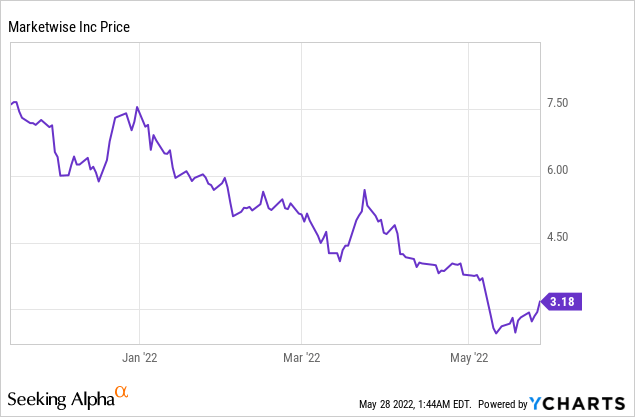

MarketWise (NASDAQ:MKTW), a multi-brand financial digital subscription services platform went public through a SPAC merger with Ascendant Digital Acquisition Corp last July. The stock initially popped from $10 to $15 but then quickly started plummeting and is now trading at $3.18, almost 80% below its all-time high. The company has multiple subscription-based products which makes it a financial SaaS (software as a service) company. Its business model is very capital-light and therefore enjoys strong margins and cash flow. However, management execution has been disappointing lately and they seem to be failing at capitalizing on new subscribers. I believe the company is a hold at the moment as I see the potential for further monetization, but the management team will have to prove its capability to execute.

Introduction

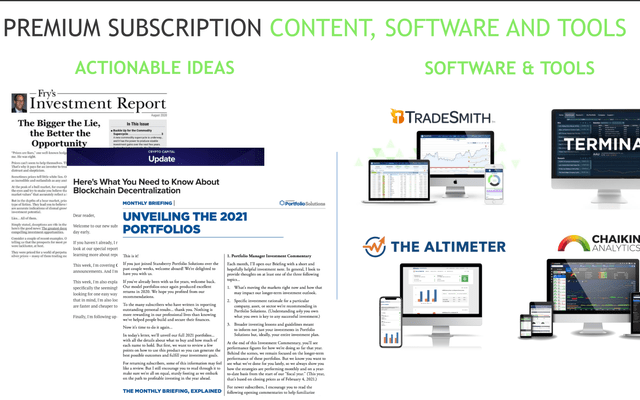

MarketWise is an unfamiliar name for most investors but it is a mother company that comprises 12 primary customer-facing brands reaching more than 10 million self-directed investors. The company provides products such as financial research, education, investment software, and more. All of their products are 100% digital and direct-to-consumer. Some of their brands are quite well known which include the likes of InvestorPlace, TradeSmith, and Stansberry Research. MarketWise aims to give individual investors better investing tools by providing a leading financial subscription services platform.

The company is comprised of 12 primary brands and each of them serves different products. These 12 brands combined have over 160 products and are able to provide a very wide range of offering that other financial companies may not be able to provide. This also reduces the risk of having a high concentration on solely one product. Here is a brief overview of some of the brands under the company.

InvestorPlace

InvestorPlace provides market news, stocks advice, and market tips. It is currently one of the largest and most popular financial publishers in the world with over 40 years of heritage.

TradeSmith

TradeSmith provides stocks research and investment tools for individual investors, it is one of the most popular daily graphs online investment research services with unparalleled pro-level equity researching capabilities and an intuitive product flow.

Stansberry Research

Stansberry research provides premium research services that cover a wide range of investment strategies including dividend investing, fixed income, value investing, etc., and also complete portfolio solutions.

Chaikin Analytics

Chaikin Analytics is a stock trading idea platform for investors and advisors. Its rating system uses its own indicator that helps pick winning stocks and drop losing stocks ahead of market shifts.

Marketwise

Opportunities

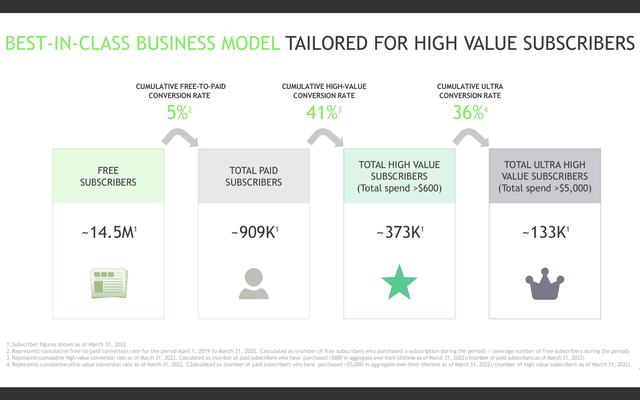

MarketWise’s multiple products combined are able to provide a full suite of solutions for customers. The company aims to leverage its engaging content and drive users from free subscribers to paid subscribers. Customers are easy to retain once they start to rely on the content provided. The company is highly scalable as it is able to keep up-sell and cross-sell between different brands without extra cost, which leads to a higher ARPU (average revenue per user). This is a strong edge for MarketWise as there are not many other companies that have a strong product portfolio like them.

The self-served financial market is also huge as individual investors are continuously seeking more professional services and tools. According to the company, the current global TAM (total addressable market) for global financial wellness solutions is $129 billion with an expected CAGR (compounded annual growth rate) of 9% from 2021 to 2023. The US alone currently has over 75 million self-directed investors. The market is ever-expanding as more new investors enter the market. Demand for these solutions is increasing due to the rise of self-directed millennials, gen-z, and retired investors. The increasing number and complexity of investment instruments (e.g. ETFs, options, cryptos) are also providing tailwinds.

Marketwise

Financials and Valuations

The company reported disappointing first-quarter earnings for FY22. Total revenue for the quarter is $136.8 million, up 12.5% from $119.7 million in the previous year. Net Income is $23.0 Million, compared to a loss of $615 million in the previous year. Billings decreased from $255.3 million to $136 million. Adjusted CFFO (cash flow from operations) decreased from $98 million to $1.1 million with CFFO margins decreasing from 38% to 1%. Total subscribers showed a strong increase, up 23.1% from 11.9 million to 15.4 million. However, paid subscribers decreased 9% from 1 million to 910 thousand with ARPU (average revenue per user) down 23% from $825 to $636. This shows that the company is having trouble retaining and monetizing paid subscribers. The management team mentioned that the sudden drop in paid subscribers and ARPU is largely due to the uncertainty associated with the macro environment.

Mark Arnold, CEO on Q1 results:

Many companies and consumers are facing challenges at the moment as we emerge from a 100-year pandemic, face 40-year high inflation, and as a full-blown war in Europe has developed. The human cost of these forces cannot be overlooked. But these conditions have also negatively impacted many businesses and in particular many in the direct to consumer and investment analysis sectors such as MarketWise. We are seeing significant volatility across most asset classes causing investor indecision, lower consumer engagement, and elevated advertising costs. This has impacted our ability to attract significant numbers of new subscribers in a cost-effective way, and our Billings have been slowed somewhat.

Despite the weak result during the quarter, the company still recorded a TTM adjusted free cash flow margin of 16% and 99% of its revenue remains recurring. The balance sheet is also strong with cash of $125 million and only $8 million in debt. The management team also mentioned that they are already addressing the issue and are trying different methods to increase the engagement rate.

Mark Arnold, CEO, on MarketWise going forward:

“We continue to work to deliver new content and tools for our subscribers so they can better understand and adjust to current markets. Our professionals are adjusting to these market forces and bringing new content to our subscribers, and we believe the results of these efforts will emerge over the course of the year. In addition to this, we continue our work to deploy our pan-MarketWise technology platform, to develop deeper expertise around data science across our organization, and to look for ways to better leverage our technology products by combining them with content.”

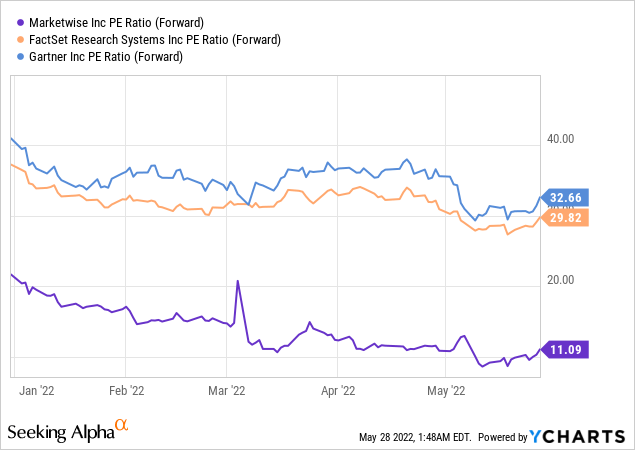

After the large drop, the company is currently trading at a P/E ratio of 11.09. This is very cheap compared to other financial service companies. From the chart below you can see that other financial research companies like Gartner (IT) and FactSet Research (FDS) are trading at a P/E ratio of 32.7 and 29.8 respectively, representing a 2.5x+ premium compared to MarketWise. Even though Gartner and FactSet Research are much more established with stronger financials, I believe the valuation gap should be smaller. The Financial Select Sector SPDR® Fund (XLF) is currently trading at a P/E ratio of 13.31 with an expected EPS growth rate of 9.41% for the next 3-5 years. If we use this as a benchmark, this will represent a 16.7% upside for MarketWise.

Conclusion

In conclusion, I believe MarketWise is a business with strong potential but is facing temporary headwinds. The company has a strong and diverse portfolio reaching more than 10 million self-directed investors. The self-served financial market remains huge for MarketWise to expand into thanks to the increasing interest from millennials, Gen-Z, and retired investors. The current volatility might further increase demand as investors may need more financial guidance to navigate through these tough environments. The company’s business model is very scalable as it required minimal cost to up-sell and cross-sell subscribers. The subscription-based model also allows them to have a relatively stable revenue stream with high forward visibility.

However, the company’s financials for the quarter is disappointing with CFFO, ARPU, and the number of paid subscribers all decreasing. This may be attributed to the headwind from the current macro environment but the management team should have done a better job handling the situation in my opinion. The company’s valuation is fair as it is currently trading at a similar level to XLF, which is a good benchmark for financial companies. I believe the company is a hold at the moment and will upgrade it to a buy if the management team is able to navigate through current headwinds and figure out how to re-accelerate the number of paid subscribers and increase ARPU.