Kristian1108/iStock Unreleased via Getty Images

Currently there’s a lot of pressure on the markets. There’s a lot happening that puts downward pressure on the financial markets and one recurring question I get is whether Boeing (NYSE:BA) is a sell at this time. Boeing is a company with a lot of dynamics involved as it’s active in the commercial aircraft and defense industry. Each industry comes with its own set of dynamics while some overlap. I’m sure that the company is so complex, so versatile and so long-term oriented that you could easily construct a bearish thesis, but also a bullish thesis. In this report I will highlight some of the bearish pressures faced today and show how the macro pressures are affecting Boeing from multiple sides. I also will show how they run contrary to some of the bullish pressures discussed last week.

Macro pressure: Inflation

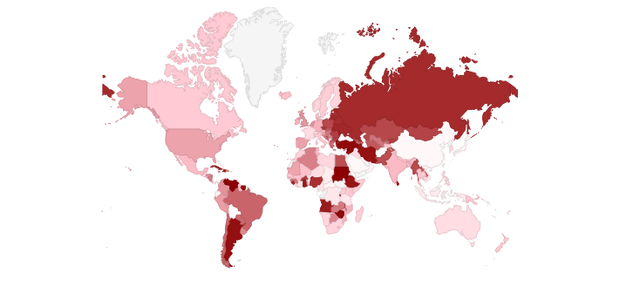

Worldwide inflation (Trading Economics)

Inflation in the US hit 8.6% in May, and we see that in most parts of the world the inflation rates are far above the targeted 2% which is considered a sweet spot. The surge in inflation is triggered by a combination of pent-up demand and the war in Ukraine. The war in Ukraine has sent energy prices sky high, which obviously puts pressure on purchasing power. At the same time, consumers are trying to do the things they couldn’t do for the past few years. During the pandemic governments around the world provided extremely generous financial aid packages. Consumers now want to spend that money and that’s a problem. Many companies did shrink during the pandemic, and they’re now not up to scale to handle the increase in demand. Supply chain issues and demand exceeding supply are the result of that and further increase consumer prices.

Inflation is something that’s affecting all of us. Many companies are hiring to keep up with demand, and combined with the high inflation, they’re seeing increased labor and material costs. So, demand exceeding supply does not necessarily mean that we’re seeing margin expansion. Boeing, like many other companies, face increased labor and material costs. On the side of aircraft sales, Boeing is well protected against inflation contractually, but the problem is mostly the end market or end consumer of air travel. If airlines cannot outrun inflation, the pricing power of airlines drops as consumers feel pressure on their ability to spend money. As a result, demand for air travel will drop and demand for aircraft will dry up again. That’s not something that will be felt overnight by Boeing or Airbus (OTCPK:EADSF), but inflation does put pressure. What should be kept in mind is that this pressure is not unique to Boeing.

Macro pressure: Recession risk

As I previously described, purchasing power drops on the back of inflation and it can even be seen as an ingredient of a recession. Fears of recession and actual reduced purchasing power ultimately lead to a reduction economic activity, not just in the consumer markets but also the higher yield markets for airlines as well as all forms of shipping. Demand for air travel is a function of economic activity, amongst others. So, recession is a major risk to Boeing. Is it a risk that’s specific to Boeing? Again, just like inflation it’s not a Boeing-specific risk. If you consider travel a luxury, in times of recessions those spendings have to be cut and airlines as well as jet makers will feel increased pressure.

Boeing pressure: Debt levels

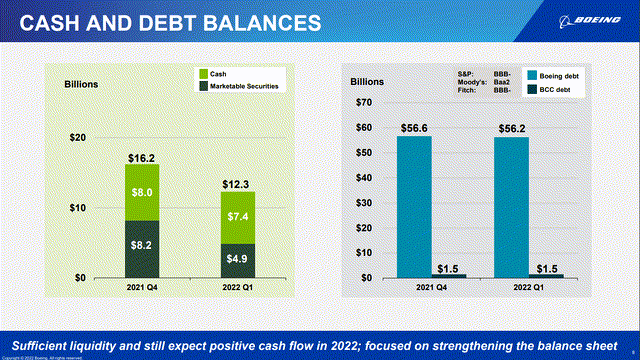

Boeing debt balance (The Boeing Company)

What I consider to be a Boeing-specific risk are the current debt levels. Throughout the MAX crisis and pandemic, Boeing kept raising its debt levels. Those levels piled up north of $60 billion as Boeing kept the Boeing 737 MAX in production for some time. The company continued Boeing 737 MAX production as a hedge against customer compensations. Boeing assumed that demand would remain solid and by continuing building the Boeing 737 MAX it would have the jets ready as customers were eagerly awaiting them. With that in mind, it made sense for Boeing to increase its debt levels. However, the pandemic significantly eroded demand for aircraft and Boeing basically raised its debt levels to park the jets as there was little demand for new jets. While it seems that the pandemic messed up Boeing’s plans, I also believe that with the Boeing 737 MAX recertification timeline sliding the pandemic was something that put a damper on Boeing’s liabilities. My internal estimates suggest that absent of the pandemic, Boeing’s liabilities would have ballooned north of $20 billion and I have significant doubts whether Boeing would have been able to cope with that if that scenario would have unfolded.

While the scenario did not unfold, Boeing still has a debt of $57.7 billion which could pose some challenges. Cash flow is expected to grow in the coming years, but especially this year that will happen at a slower than expected rate as it’s unlikely Boeing will be able to meet its delivery target of 500 jets this year. So, Boeing’s debt levels will be reduced at a rate slower than initially intended, and with Boeing’s unique debt position I do consider that to be a Boeing-specific pressure.

Throughout the pandemic as well as the Boeing 737 MAX crisis, Boeing showed strength being able to secure loans. With increased inflation levels, central banks are increasing interest rates to battle inflation and that makes refinancing debt at attractive terms more difficult. I do not expect any direct problems for Boeing regarding their ability to repay their debt, but the company is feeling pressure as operating cash flow will not come in as strong as initially anticipated and refinancing debt at attractive terms will be more difficult in an environment where interest rates are rising. Boeing is, however, shielded by a rather vague outlook on its cash flow and availability of undrawn credit facilities. So, the debt level is a reason for concern given potential demand side pressures as well as refinancing debt becoming a weaker tool to service debt.

Boeing Commercial Airplanes: Short-term pain

Boeing 737 MAX (The Boeing Company)

Boeing is facing a lot of pain in its commercial airplanes segment. The Boeing 737 MAX and Boeing 787, which on any normal day are the company’s cash cow programs, are either not performing or underperforming. The Boeing 737 MAX program rates will go up to 31 aircraft per month in Q2 2022, or at least that’s the plan, but Boeing just like Airbus is being plagued by supply chain issues that even forced Boeing to hold the line last month. These issues provide headwinds to stabilizing the targeted rate of 31 aircraft per month while demand-side pressures from China have pushed out another increase in production rate this year. To a major extent these issues explain why there will be cash flow headwinds this year compared to the earlier plans. The rate not going up might be a good thing to achieve stability, not only in Boeing’s assembly line but also in the supply chain. However, it also means there are volume-driven pressures that consist of lower deliveries and a lower cost efficiency on production.

The Boeing 787 is the other value contributing program of concern. Boeing has over 100 jets awaiting delivery and the timeline on a delivery resumption has slipped several times. However, airline delivery schedules do indicate that the Boeing 787 deliveries will soon be resumed again. The Boeing 787 will return in a market plagued by inflation and recession fears, but I do believe that in the current market environment there’s a place for this aircraft.

As a result, I do believe that the cash cow programs for Boeing do not provide a justified reason to sell. Indeed, the recovery is going to be slower than one would hope for but if you didn’t sell your shares when Boeing wasn’t able to deliver the Boeing 737 MAX nor the Boeing 787 to customers it does not make a lot of sense to sell shares of Boeing when the company is delivering the Boeing 737 MAX again and is on the verge of resuming Dreamliner deliveries both of which should positively impact the balance sheet. Where I do see concerns for Boeing is its ability to compete with Airbus over the longer term as a decision on a long overdue commercial aircraft development program has been dragging on for years and a decision is not expected any time soon.

Boeing Defense: A mixed outlook

Boeing MQ-25 Stingray drone (The Boeing Company)

Boeing’s share prices have lagged its peers. Amid recession fears, defense stocks should provide a nice stability. However, for Boeing that obviously is not the case. The problems and challenges faced on the Commercial Airplanes segment is one reason. The other reason are the defense pressures that Boeing faces on its programs. Boeing’s most recent quarterly earnings included a flurry of cost overruns on programs on which Boeing competed in a way that would not shield itself from the current inflation and timeline challenges. Its most recent quarterly earnings showed a -17% margin for the defense business. While I have marked Boeing as one of the beneficiaries of an improved defense budget environment, we see that the company results are dampened by previous agreements. Raytheon Technologies (RTX) with commercial as well as defense exposure is having margins of around 8%, while pure defense names such as Northrop Grumman (NOC) and Lockheed Martin (LMT) have margins of 10 to 14 percent.

It can safely be said that Boeing’s defense arm has been underperforming significantly and if you couple that to the rather disappointing performance at the Commercial Airplanes arm, it does not come as a surprise that Boeing’s share prices have contracted by 50% over the past 12 months while competitors saw share prices increase in value.

Boeing Stock: A Buy, Hold or Sell?

Readers who follow my work know that last week I wrote an article with a bullish tag on Boeing. In this article, I’m a lot less bullish on Boeing and that obviously requires some explanation. So, the main explanation I have for differing ratings are the timelines. Sometimes bullish moves or bearish moves are driven by news items during the week, which was the case last week. Some items can be projected into the futures such as aircraft orders, while others cannot. So, difference in timelines can cause a rating to change between Buy, Hold and Sell. Does this mean that I actually changed my rating? No, I’m simply putting a rating based on the prevalent timeline of the article. Sometimes, we’re talking about short-term news events, sometimes we are dealing with short term events with long term implications and sometimes we’re dealing with long-term projections. All of these, due to their timeline differences, can cause a different rating even when articles are written in the same week. Additionally, Boeing has complex products and is active in different industries with different dynamics which also drives our ratings, and what’s an exit point for someone is an entry point for someone else.

So, in the last weeks we saw some bullish events which give us confidence about the future and it explained the bullish price movement in the prior trading days. In this article, I have highlighted reasons to assume that Boeing shares will be under pressure going forward. This item was ready for publication prior to market open on Monday, but as I have been working to make it suitable for publication it hasn’t been published during the trading day where Boeing set a new 52-week low. So, the pressure I have tried to warn investors for already impacted shareholder prices.

However, in the longer term I believe Boeing is a nice name to own. So, short term we see bearish pressure, part of which already translated into the stock prices, but long term we’re still bullish on the prospects of Boeing as a manufacturer of commercial aircraft and defense equipment.

Conclusion

In this report, I have looked at the main reasons why investors currently are bearish on Boeing. What should be noted is that supply chain challenges, inflation and recession risk are real, and they’re a risk to Boeing. However, these are a risk to Boeing as much as they are a risk to many other companies. The reasons why Boeing is in a worse spot are the high debt level, weakened opportunity to refinance debt on rising interest rates to fight inflation and challenges to increase production.

Looking at its business the Boeing commercial aircraft programs are not performing as initially expected. However, it should be noted that Airbus is suffering from the same issues on supply chain side. While the Boeing 737 MAX and Boeing 787 are underperforming, I do believe that if you held shares during the pandemic and during the MAX crisis it would make little sense to sell your shares now as Boeing deliveries are on the verge of ramping up. The ramp up will be slower than anticipated, but there should be significant improvement in cash flow in the quarters ahead and especially next year even with soft demand for aircraft. Selling your shares now would be the famous “buy high, sell low” action, which is not a way to make money for long investors.

On defense side, I have been rather disappointed with Boeing’s performance, but this still is a business segment that can add to Boeing’s earnings at a 10% margin and add services revenues for which margins are around 15% while the landscape for Defense is improving.

In my view, the pressures are real for Boeing and the most recent earnings weren’t great either, and if you cannot stomach the current recession fears on the market then Boeing is not a name you would want to hold. However, if you have been holding shares of Boeing through the pandemic and much of the Boeing 737 MAX crisis, from fundamental point of view the prospects of improvement despite being dampened should make Boeing a Hold for the longer term and not so much a sell. For the short term based on recession fears and inflation I’m marking Boeing a short-term sell, part of that has already been translated into the share prices. If you do not believe in the long-term picture for Boeing, then you might be better off selling. While I marked Boeing a sell based on the current market environment, I do continue holding my own shares as I’m part of the group that believes that Boeing will get through the current environment and fix their issues. So, long term I believe there’s a buying opportunity and short term there is major weakness.