D Dipasupil/Getty Images Entertainment

Introduction

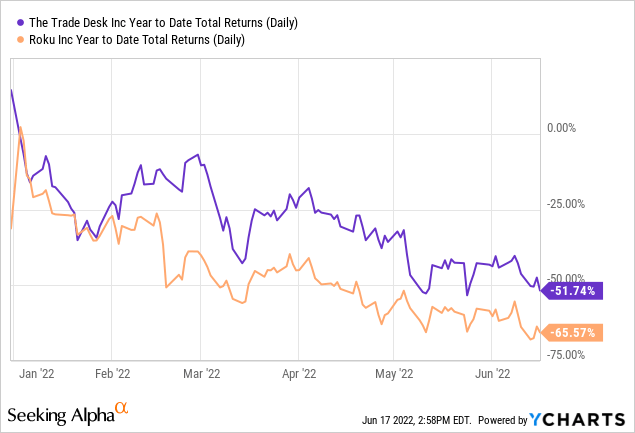

Shares of The Trade Desk (NASDAQ:TTD) and Roku Inc. (NASDAQ:ROKU) have been trading vis-à-vis amidst the broader tech selloff which began in November 2021. While both companies are commonly understood as key beneficiaries of the secular trend towards CTV advertising, the underlying business fundamentals of these perceived twins suggest that shares of Trade Desk will likely outperform Roku should markets get past fears of inflation, rate hikes and a slowing economy.

Similar Industry Tailwinds

Trade Desk and Roku are the primary beneficiaries of CTV advertising. As per GroupM, overall U.S. TV ad spend will see muted growth in the next several years (from $71 billion in 2022 to just $72 billion in 2024), but its sub-categories will experience changing dynamics. One is traditional TV advertising, expected to contract from $59 billion to $55 billion between 2022 and 2024. The other is CTV ad spend, set to grow from $12 billion to $17 billion, going from 17% of total TV ad budgets to 23% during the same period.

Not too long ago, Netflix also announced the intention to go into advertising (analysis here), which could potentially open up more opportunities in the CTV space. Under this macro trend, Trade Desk serves as a one-stop shop for advertisers to manage their CTV campaigns, while Roku is a streaming platform that helps advertisers reach its massive user base.

But Different Business Models

Roku’s business fundamentals are very much tied to consumers, as marketers see value in reaching its 61 million households. This makes Roku a walled garden similar to Snap (SNAP) and Meta (META), where user growth is an important metric to the investment community. In a post-Covid environment, however, Roku will likely face headwinds in expanding its user base given much of consumers’ streaming demand had been pulled forward during the pandemic and new accounts will depend on sales of smart TVs pre-installed with the Roku OS.

Looking across the retail space, recent results from Walmart (WMT), Target (TGT) and Best Buy (BBY) all point to a slowdown in discretionary spending thanks to a strong 2021 driven by stimulus checks. In March, TSMC (TSM) warned of slowing smartphone and PC demand. On 6/16, Samsung (OTC:SSNLF), the world’s leading TV and smartphone maker, reportedly asked suppliers to pause shipment of electronic components in response to growing inventories. These developments will likely weigh on Roku’s account growth going forward.

On the other hand, Trade Desk operates as an ad platform that works mainly with advertising agencies (e.g. WPP, Publicis and Omnicom). The business model does not rely on hardware sales, nor does it need a large user base to attract advertising budgets, since it’s not a walled garden. Instead, the independent demand-side platform (DSP) charges a take rate (19%-20%) on clients’ total ad spend across channels such as mobile, display, audio and CTV.

In terms of platform neutrality, Trade Desk has no first-party user data or owned content that may potentially create conflicts of interest with publishers and advertisers. In contrast, Roku has been investing aggressively in The Roku Channel (TRC) which competes with other advertising-based video on demand (AVOD) offerings such as Peacock and Tubi. Roku owns 100% of ad inventory on TRC and takes a certain percentage of inventory from other AVOD publishers, a situation similar to Amazon taking a cut from third-party sellers on every sale while offering its private-label products that compete with them. Additionally, if Roku does somehow get acquired by Netflix, it would be difficult to see a Netflix-owned Roku asking for ad inventory from other AVOD players such as Disney+ and Hulu (analysis here).

And Different Earnings Outlook

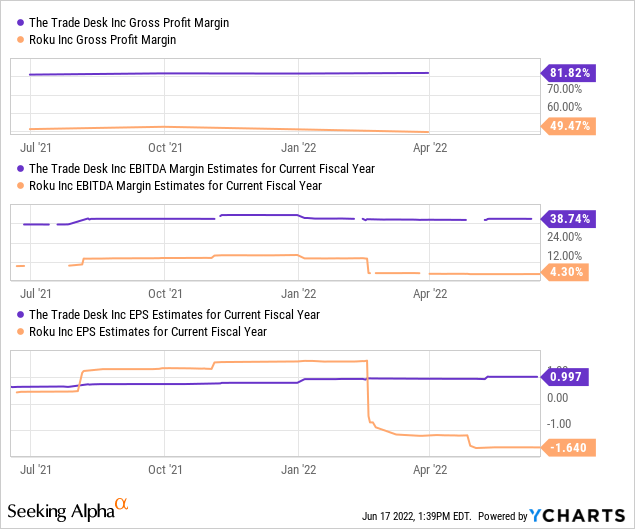

It’s clear that investors are no longer being rewarded for taking risks in unprofitable growth stories in a challenging macro backdrop driven by inflation and a tightening monetary policy. This is where profitability matters. As a leading independent DSP, Trade Desk has been able to maintain a very attractive margin profile and is expected to deliver adjusted EPS of ~$1 in 2022 and $1.18 in 2023.

Despite Roku being a leader in the streaming space, its gross margin is challenged by an unprofitable Player business where management believes it’s best to sell streaming sticks at a loss to drive user accounts, weighing on its advertising business that has a ~60% gross margin. Historically, Roku isn’t a very profitable business, with negative operating income in 4 of the last 5 years. As management guided to a 4% adjusted EBITDA margin for 2022, EPS for the year will again be in negative territory.

Hence, Different Valuations

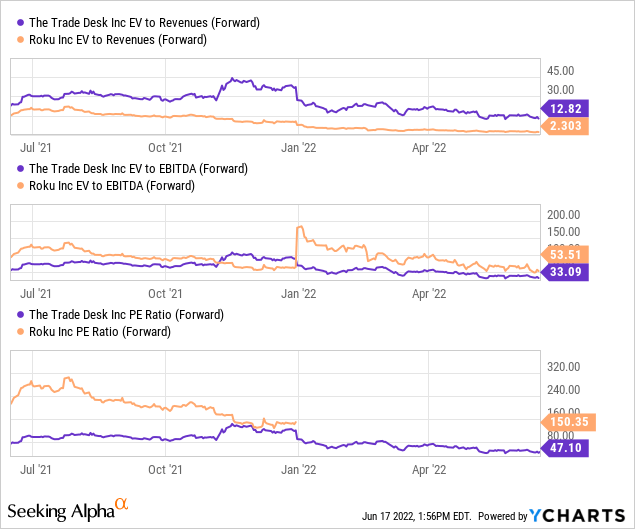

From a relative valuation standpoint, Trade Desk does trade at a significant premium vs. Roku at 12.8x forward EV/sales. Digging further, however, Trade Desk looks relatively more reasonable at 33x forward EV/EBITDA and 47x forward P/E against Roku’s 54x forward EV/EBITDA and no P/E given a lack of bottom-line earnings. While EV/sales has historically been a popular metric amongst growth investors, I believe markets are increasingly trying to value stocks based on earnings rather than sales as the investment landscape shifts from one of abundance to one of scarcity.

Risks

The most obvious risk to the long side of the trade is that Trade Desk delivers underwhelming results due to either lower-than-expected growth in CTV advertising or a significant slowdown in the broader advertising landscape, which impacts ad budgets across every channel and potentially Trade Desk’s take rates. On the short end of the trade, Roku’s stock is indeed in very oversold territory and buyers may find the valuation very undemanding, at least from an EV/sales perspective. Additionally, Roku could in fact be acquired by another company (e.g. Netflix), which will immediately send shares up as arbitrageurs take advantage of the situation.

Bottom line

Trade Desk and Roku are both expected to grow revenue by more than 30% in 2022 as the structural shift towards CTV remains largely intact despite current macro headwinds. Following Snap’s recent guide down, Trade Desk reiterated its 2Q22 outlook and Roku did not provide an update. That said, the underlying fundamentals of both companies are meaningfully different and have produced diverging financial results and valuations as a result. Should investors believe in the long-term prospects of Trade Desk, Roku could be an effective hedge against short-term volatility. When the market does return to a normal state, I believe shares of Trade Desk will likely outperform Roku.