Noah Berger/Getty Images Entertainment

Amazon (NASDAQ:NASDAQ:AMZN) is in an interesting position currently due its multiple segments having different futures. Investors are worried about the company’s core retail segment due to rising gas prices and inflation causing strain on profit margins. However, the company’s secondary segments are set to prosper in the upcoming periods. AWS continues to be an industry leader in the cloud market and is set to benefit heavily from exponential industry growth and higher demand.

Prime Video and Music also are growing to become major threats in their respective industries and could be on track to overtake each industry’s leader. Since these segments will likely support the company’s fundamentals in a market downturn, as well as the current price the stock is trading at, investors may want to consider jumping into the stock.

The Retail Industry Will Likely Struggle Due to Rising Costs and Lower Demand

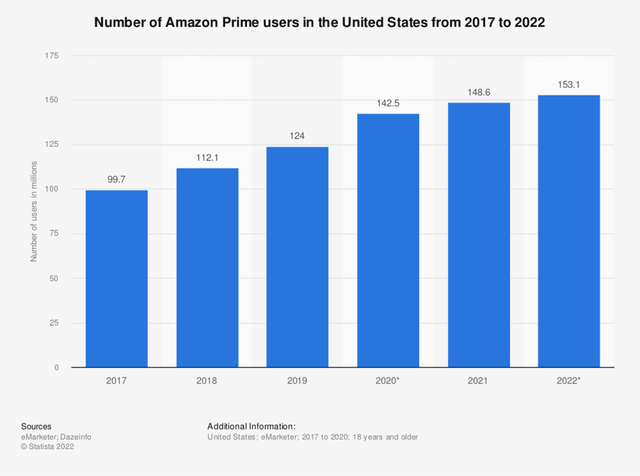

The biggest problem for many investors is the future of Amazon’s core retail segment, and rightfully so. The company saw highly-inflated demand during the pandemic due to consumers shopping from home on a much higher scale. From 2019-2021, Amazon increased its revenue by 67%. In the same time period, its prime subscribers in the United States grew from 124 million to about 149 million. This trend is expected to continue throughout the end of 2022 with the U.S. prime subscriber count expected to reach about 153 million consumers.

Amazon Prime Subscribers, 2017-2022 (Statista)

However, the fading of COVID-19 is now causing e-commerce to fade with it and decrease the demand for Amazon’s retail services. In a recent Mastercard SpendingPulse report, e-commerce transactions saw a decline of 1.8% from 2021. On the other hand, in-store sales grew by 10% in the same time span. This report hurt e-commerce stocks heavily, including Amazon. This slowdown and return to in-person shopping caused Amazon to experience its slowest revenue growth since the dot com crash in 2001 and further frighten investors.

Along with decreased demand, Amazon’s retail segment is seeing much higher costs. Rising gas prices harm the already low margins retail companies experience. Recently, national gas prices reached about $5 per gallon and diesel prices reached about $5.81 per gallon. Since most of Amazon’s shipping is performed by massive trucks with very low fuel efficiency, the vastly higher cost of diesel is detrimental to Amazon’s business as shipping costs are one of the most important factors for the company’s margins.

Because of these increased costs, Amazon has informed its third-party sellers it will be implementing a 5% fuel and inflation surcharge to combat the effects of these rising prices. These costs will likely be passed on to the consumer and lead to lower volumes on Amazon. Therefore, the concerns investors are having about Amazon’s retail segment are likely justified. This means the company will have to rely on its secondary segments to support the business during market downturns.

AWS Will Continue to Be the Industry Leader and Capitalize on Exponential Growth

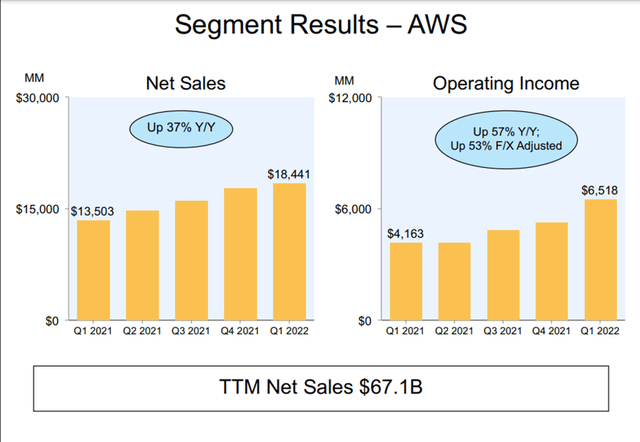

AWS is seen by investors as one of the key bright spots of Amazon’s upcoming future. AWS is currently the largest cloud services provider with a 33% market share while only accounting for 14% of Amazon’s total revenue. This likely means that AWS has room to grow for Amazon’s total sales, as well as in the industry. In the company’s most recent earnings report, AWS thrived while retail struggled. The segment grew by 36.5% Y/Y and beat analyst projections for revenue and operating income. The segment’s operating margin also increased from 29.8% to 35.3%. All of this has allowed AWS to generate $67.1 billion in sales in the past 12 months and continue to rise as cloud services see more demand.

AWS Segment Results (1Q22 Earnings Report)

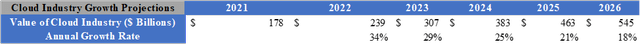

The reason behind AWS’s massive growth is due to the rising demand for cloud services and exponential growth of the industry. Over the past few years, the cloud industry has consistently grown at about 34% per year. With this growth rate, we can project how large the cloud services industry may be in upcoming years. By starting with the industry’s current size of about $178 billion and a 34% growth rate that wanes by 15% each year, the cloud industry could be worth about $545 billion in 2026.

For a conservative estimate, let’s say Amazon loses some of its market share from Microsoft (MSFT), Google (GOOG)(GOOGL), and other small competitors and would only hold a 25% market share. This would value AWS at about $136 billion compared to the $59 billion it is currently worth. Therefore, AWS will likely continue to thrive despite future issues with the retail segment. This could give Amazon a competitive advantage over other popular retailers and become an attractive pick as an investment.

Cloud Industry Growth Projections (Created by Author)

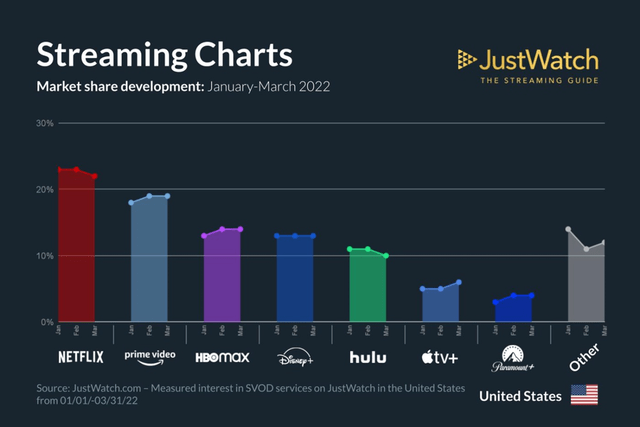

Prime Video and Music Are Growing to Overtake Industry Leaders

Prime Video is quickly becoming one of the largest names in streaming mainly due to the large rise in prime subscribers mentioned previously. This has caused Prime Video’s market share to increase at a steady pace and far outperform its competitors. Currently, Prime Video’s market share of the streaming industry is 19% and on the rise. Conversely, Netflix’s (NFLX) currently sits at 23% but is declining. With the number of U.S. prime subscribers expected to reach 168.3 million by 2025, Prime Video could surpass Netflix as the top streaming service. This would further help support the company during a market downturn while the retail segment struggles.

Market Share of Streaming Services (JustWatch.com)

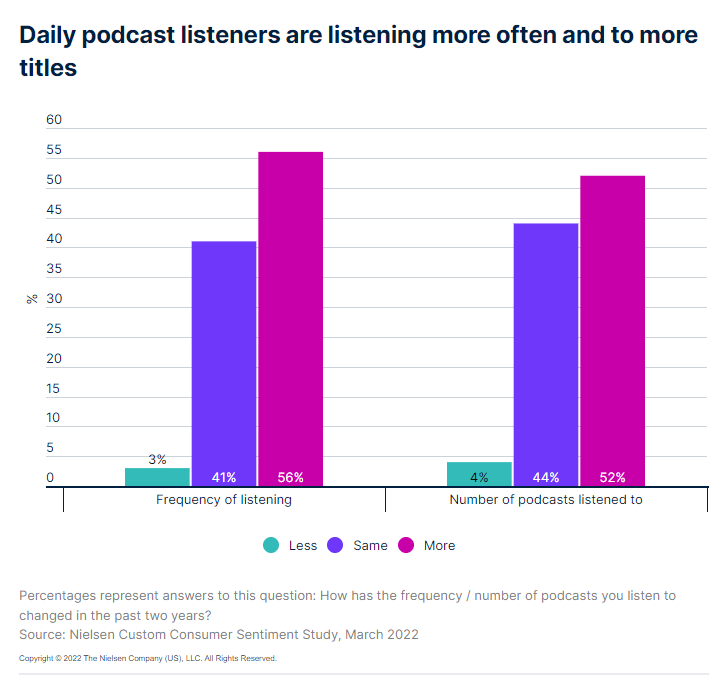

Amazon Music and Audible also are rising in popularity and could become a home to many popular podcasts in the upcoming future. Currently, Amazon Music’s market share is the third largest in the industry at 13%. This is behind Apple (AAPL) at 15% and Spotify (SPOT) at 31%. However, each music streaming service has nearly identical libraries. This means the only separating factors across each platform is exclusive podcast talent. Amazon may want to consider signing exclusive podcast talent as the market for podcasts has risen drastically in previous periods. Over the past three years, the listener base for podcasts has grown by over 40%, with 51% of consumers starting to listen to podcasts over the past two years.

Podcast Listener Base Statistics (Nielsen)

Other podcast companies like Spotify have captured this growing market by signing exclusive deals with many of the top podcast talents, such as Call Her Daddy and The Joe Rogan Experience. Now, Amazon may have its chance to attain an exclusive deal with a top podcast talent by signing Higher Ground by Barack and Michelle Obama. The Obamas are planning to leave Spotify and are now seeking a new deal worth tens of millions of dollars. Two of the most likely landing spots for the podcast are Amazon and iHeartMedia (IHRT).

However, iHeartMedia may not have enough cash to go through with this deal. The company currently has about $280 million in cash, meaning a deal worth tens of millions of dollars could put the company in a tough financial position. However, Amazon has more than $66 billion in cash. Therefore, a deal worth tens of millions of dollars would not be a huge expense for the company while also making its platforms much more popular among competitors and further support the company during a downturn.

Valuation

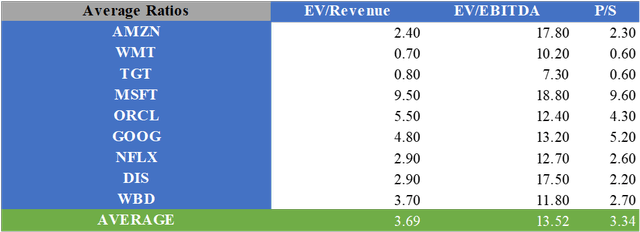

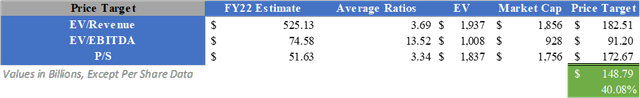

Amazon’s share price is down over 35% YTD, leading to many investors believing the stock is at a bargain. By multiplying consensus analyst estimates for FY22 by the average multiples for EV/Revenue, EV/EBITDA, and P/S of Amazon and its competitors, a fair value of $148.79 can be calculated after adjusting for the company’s cash and debt. This gives the stock an implied upside of about 40.08%. As for analysts, the average 12-month price target currently sits at $178.56, giving an implied upside of 68.21%.

Relative Valuation for AMZN

What Does This Mean for Investors?

Investors are frightened for the future of Amazon because of the decreased demand and higher expenses for its core retail business. However, the company’s secondary segments will likely support the overall business during a market downturn. AWS continues to be the industry leader in the cloud services industry and will benefit heavily from increasing demand and exponential industry growth. Prime Video is on track to surpass Netflix as the top streaming service in terms of market share due to rising prime subscriptions.

Furthermore, Amazon Music and Audible are some of the top platforms in the audio industry and could solidify itself among the strongest players by signing exclusive podcast talent. With all of this in mind, the idea to be greedy when others are fearful, and the current price the stock is trading at, I believe applying a Buy rating is appropriate at this time.