Brandon Bell/Getty Images News

Investment Thesis

Shopify Inc. (NYSE:SHOP) is a leading ecommerce infrastructure provider, giving its customers the tools to help start, grow, market, and manage a retail business of any size. In my previous article, I laid out my full analysis of Shopify and why I believed it to be a “Strong Buy” at the time.

One of the most appealing aspects of Shopify, for me, is the split of its business model between the recurring, subscription-based revenues from its Subscription Solutions & the customer-aligned performance-based revenues from its Merchant Solutions. This enables the company to have a solid base of recurring revenues alongside Merchant Solutions that have the potential to grow quicker, as Shopify continues to roll out more and more solutions to its customers.

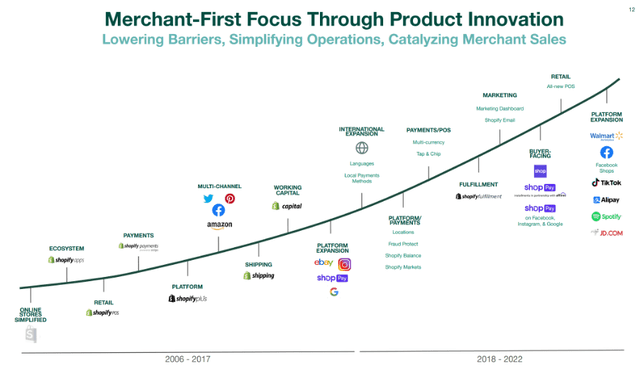

Shopify Q4’21 Investor Deck

Whilst this founder-led business might have seen revenues soar throughout the pandemic, it has had a very difficult 2022. The combination of a reopening world that is less reliant on ecommerce & increasing economic uncertainty has hurt Shopify, and recent news of a 10% staff layoff has only increased the dark clouds above this company.

Investors are now hoping that Shopify’s Q2’22 results will stem the negativity, but have their wishes come true? Let’s take a look.

Earnings Overview

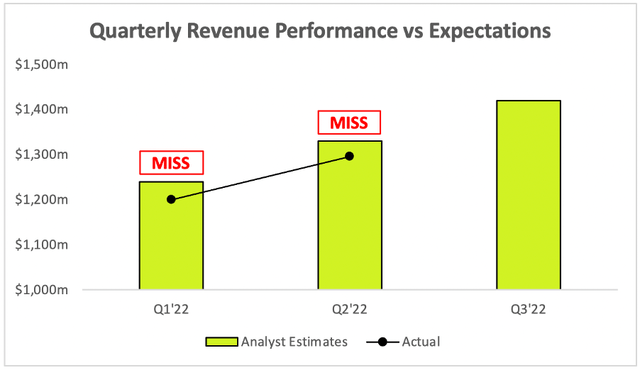

Shopify’s management team doesn’t give exact guidance on revenue or EPS, so it’s only possible to compare against analyst estimates – and sadly, Shopify fell short of these expectations. Analysts expected revenue of €1.33b, but Shopify delivered total revenue of €1.295b – a miss of ~€35m.

Investing.com / Shopify / Excel

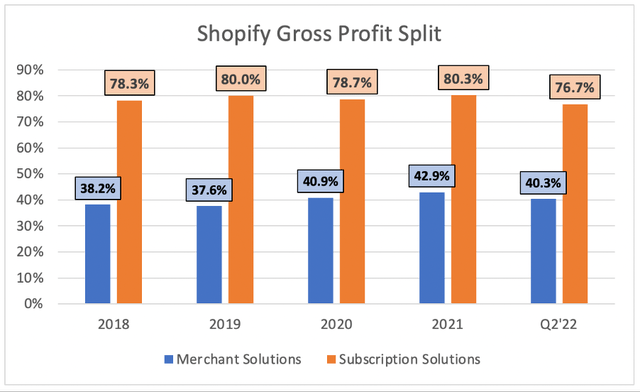

Moving further down the income statement, the picture doesn’t get much prettier for Shopify. Gross profit margins fell from 56% in Q2’21 to 51% this quarter, although that is unsurprising – revenue growth for the lower margin Merchant Solutions continues to outpace Subscription Solutions (this is as expected, and a good thing in the long run!).

Yet it’s still not a great sign, as gross profit margins in Q2’22 were lower than margins in both 2020 and 2021 when split out by segment. Shopify incurred additional expenses within gross profit this quarter related to investments in cloud infrastructure, and also saw lower margins in Shopify Payments due to merchant and card mix.

Shopify SEC Filings / Excel

Going onto the bottom line, Shopify swung to a loss in the quarter, with an adjusted EPS of -$0.03 coming in below analysts’ expectations of €0.03. I personally don’t concern myself too much with Shopify’s bottom line, since the company has a stellar balance sheet and is usually free cash flow positive (not that it was this quarter). The company uses the money it makes to reinvest back into the business, but that does not mean it isn’t careful with cash – as shown by the recent decision to cut headcount by 10%, but more on that later.

I would also encourage investors to take Shopify’s net income with a huge grain of salt, as it is prone to wild swings due to its equity investments – primarily, its investment in Affirm (NASDAQ:AFRM). This boosted net income by ~$780m in Q2’21, and decreased net income by ~$1 billion this quarter.

It’s Time For Some Perspective

One of my previous articles was entitled Shopify: It’s Time For Some Perspective, and I believe that is what investors will need to pay attention to with these results.

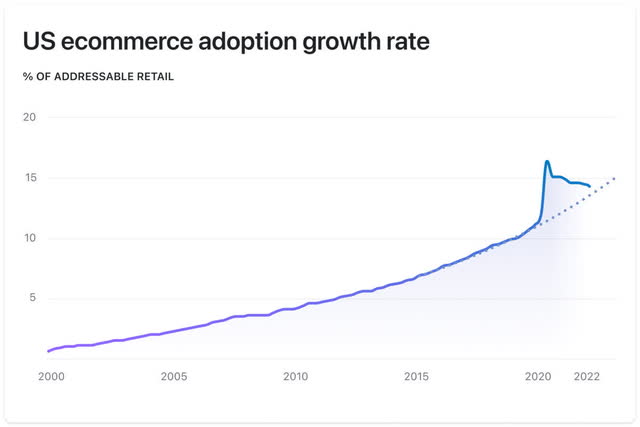

Let’s be frank; it has been a terrible year to be a Shopify shareholder. Not only have high-growth tech names pulled back substantially, but Shopify in particular has faced a number of headwinds in 2022. Inflation is hurting the consumer, SMBs are more likely to be negatively impacted by a recession, a strong dollar is weakening Shopify’s income from abroad, and ecommerce penetration has slowed down substantially following 2 years of boom.

US Census Bureau

The question I put forward is this: do any of these headwinds take away from Shopify’s long-term potential? I think not.

The company has a very resilient balance sheet, and the long-term tailwinds of growing ecommerce adoption are not going away. The company itself cannot control the macro environment, and even so it is succeeding where others are failing. In its Q2’22 earnings press release, CFO Amy Shapero stated:

Our merchants’ GMV growth continued to outpace the growth of the broader U.S. online and offline retail markets as consumers shopped across more surfaces.

Shopify might have had a difficult quarter, but they continue to outperform the growth of their peers. It would appear that this remains a great business in a temporarily struggling industry, rather than a struggling business in a temporarily great industry (see Peloton (PTON)).

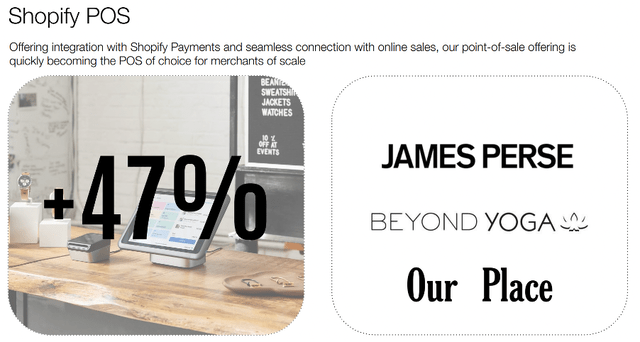

Shapero’s comments also highlight the benefit of Shopify’s omnichannel approach. Whilst it may specialize in ecommerce infrastructure and solutions, the company also has its own point-of-sale hardware devices. In fact, it saw 47% YoY growth in offline GMV in Q2’22, demonstrating the benefits of this diversification.

Shopify Q2’22 Investor Deck

Another item for perspective is the 10% reduction in headcount. When the news first came out about this earlier in the week, I felt disheartened – both as a shareholder, but also for those who are being let go from the company in a tough economic environment.

I did wonder if this demonstrated some severe misjudgment from management, and turns out it did. CEO Tobi Lütke’s email to his employees was posted online, and outlined exactly how Shopify ended up in this position:

Before the pandemic, ecommerce growth had been steady and predictable. Was this surge to be a temporary effect or a new normal? And so, given what we saw, we placed another bet: We bet that the channel mix – the share of dollars that travel through ecommerce rather than physical retail – would permanently leap ahead by 5 or even 10 years. We couldn’t know for sure at the time, but we knew that if there was a chance that this was true, we would have to expand the company to match.

It’s now clear that bet didn’t pay off. What we see now is the mix reverting to roughly where pre-Covid data would have suggested it should be at this point. Still growing steadily, but it wasn’t a meaningful 5-year leap ahead. Our market share in ecommerce is a lot higher than it is in retail, so this matters. Ultimately, placing this bet was my call to make and I got this wrong. Now, we have to adjust. As a consequence, we have to say goodbye to some of you today and I’m deeply sorry for that.

This admission should give shareholders some relief. Not only does it offer an insight into management’s thinking, and the reasons behind these substantial layoffs, but it also demonstrates a CEO who holds his hands up when he gets things wrong.

The good news for shareholders that this decision does not seem to have a significant bearing on the future opportunity for Shopify, which continues to look bright despite these dark clouds.

New Solutions & New Markets

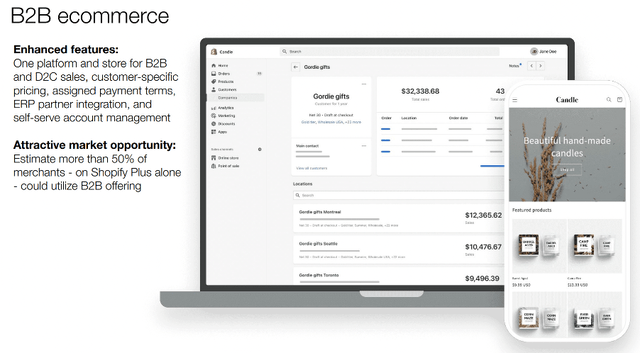

Despite the difficult macro environment, Shopify continued to innovate and launch new solutions in the quarter. It launched over 100 updates, new products, and improvements in its Summer ’22 Shopify Editions, a semi-annual product showcase. Some of the standout changes include a B2B functionality integrated directly into the Shopify platform, a Twitter (TWTR) Shopping channel enabling merchants to reach consumers directly from their Twitter profiles, and Tap to Pay on iPhone which allows merchants to easily expand into offline retail through their iPhone.

Shopify Q2’22 Investor Deck

This B2B ecommerce feature in particular provides substantial opportunities, with Shopify estimating that more than 50% of merchants on Shopify Plus alone could benefit from its new B2B offering. The company also continued its move upmarket, adding the likes of Tetley, Hewlett Packard (HPE), and ASICS Corporation (OTCPK:ASCCF) to Shopify Plus in Q2.

Shopify Q2’22 Investor Deck

Furthermore, Shopify recently partnered with YouTube to launch YouTube Shopping, offering an integrated shopping experience whereby merchants can add products from their online stores into live streams, videos, and a new store tab on their YouTube channel.

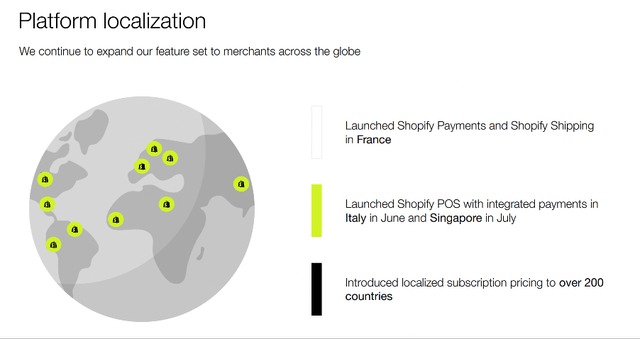

The company also continued its expansion across the globe, with launches of additional solutions in France, Italy, and Singapore.

Shopify Q2’22 Investor Deck

In truth, there are too many additional solutions for me to cover each of them in detail – this is fantastic, particularly for a company that is “struggling.” My whole investment thesis around Shopify focuses on their ability to land and expand with customers. In order to keep growing revenues, Shopify has to keep growing its offerings – and the company is doing just that.

Shopify Is Getting Stronger

I always invest in companies with the intention of holding them for years, if not decades. But businesses are constantly changing and evolving, so it’s important to look at the results every quarter to ensure that the company is continuing to perform.

Despite the headwinds faced by this company, I think that under the surface it is continuing to build & get even stronger. It continues to roll out more solutions and offerings for customers, thereby making the platform stickier & also providing a springboard from which it can grow revenues rapidly once these headwinds ease up. The fact that Shopify is continuing to outperform its peers shows that this is not a Shopify problem – it is just ecommerce slowing down after a very hot two years.

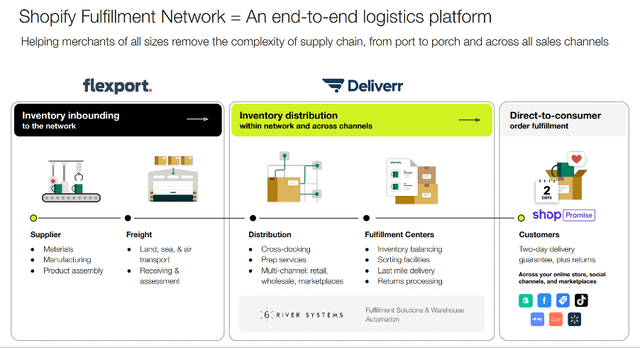

Perhaps the most exciting and impactful new solution is the Shopify Fulfilment Network, which will be a high priority for CEO Lütke now that the Deliverr acquisition is closed & integration can properly begin. During this quarter, Shopify completed the rollout of its warehouse management system, and also began offering early access to the Shop Promise – a two-day delivery guarantee, which is helping these SMBs compete with the next-day delivery of Amazon (AMZN).

Shopify Q2’22 Investor Deck

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Shopify is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

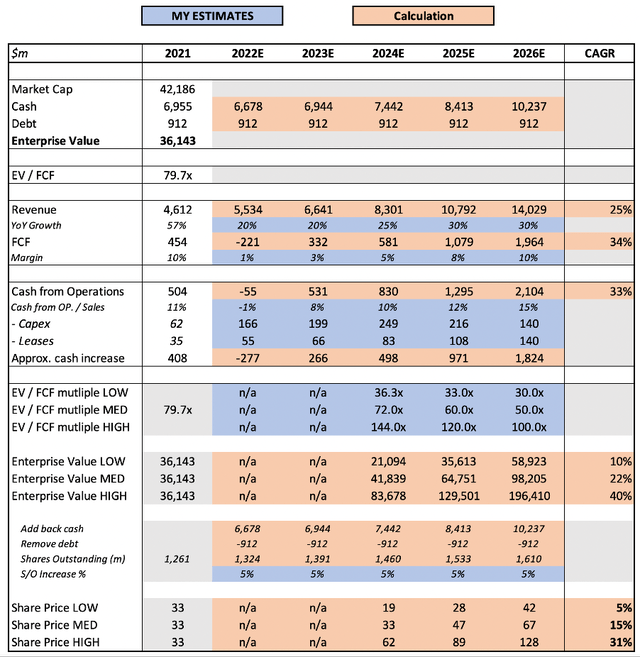

Shopify SEC Filings / Excel

In my previous article, I outlined the general rationale behind my valuation model assumptions. The only changes I will make in this model include a reduction in revenue growth for 2022, a reduction in free cash flow margins due to the headwinds outlined above, and slight adjustments to the final EV / FCF multiples to better reflect the lower multiples that Shopify currently is trading at & offer a more prudent final valuation. I have also updated the market capitalization, cash, and debt positions accordingly.

I am substantially lowering my revenue growth estimates for 2022 from 25% YoY to 20% YoY. Shopify had previously said in Q1’22 that revenue growth should be stronger towards the end of the year, however the following information was given in its Q2’22 press release:

Both GMV and total revenue in 2022 to be more evenly distributed across the four quarters, similar to 2021, given the increasing pressure on consumer spending on goods and currency headwinds from the stronger U.S. dollar we are expecting in the back half of this year

I still expect H2 to be stronger than H1, and H1 saw YoY revenue growth of 18.5% – hence, I am lowering my forecast to 20% YoY.

Put that all together, and I can see Shopify shares achieving a 15% CAGR through to 2026 in my mid-range scenario.

Investing Thesis: On Track

My personal thesis for owning Shopify is this:

It has a product with extremely high switching costs which only continue to get higher as customers take up more solutions. It is also helping SMBs (and now larger businesses) easily create ecommerce stores and join the digital economy, and this is a tailwind that should continue throughout the next decade.

Whilst the ecommerce tailwind has turned into a short-term headwind with difficult YoY comps, I think Shopify is continuing to execute on the main part of my thesis. As long as it keeps rolling out new products, growing Merchant Solutions, and keeps making ecommerce easier for everyone, then Shopify will keep its place in my portfolio.

Given the company’s stellar balance sheet & relentless innovation, combined with the current share price pullback that I believe is driven by temporary headwinds, I am keeping my “Strong Buy” rating on Shopify shares.