zodebala

(Note: This article was in the newsletter on June 4, 2022 and was updated as needed.)

A company like Exxon Mobil Corporation (NYSE:XOM) (“ExxonMobil”) needs a very large project to make an impact. Fortunately for investors, this company found such a project off the coast of Guyana. Since the project is in the early stages of generating cash flow, the incremental results are not yet significant on an annual basis. But the project cash flow is getting larger so that will change in the near future.

The project is also beginning to show tangible upside potential. It is not just the announcement of a neighboring find in Suriname by another partnership. But also, a very public discussion about the upside by John Hess, the CEO of Hess (HES) whose company is a partner in the Guyana project.

At the recent Bernstein Conference, Mr. Hess discussed the fact that a recent discovery was in the 18,000 foot depth range. Previous discoveries were in the 15,000 foot interval. This has opened up a whole new interval for the Guyana partnership to explore. The partners are hopeful that this interval will likely contain billions of barrel as the more explored shallower zone. Should that be the case, the project will have considerable upside both on a geographic basis, meaning the production area will continue to expand from what is now known, and operators can drill deeper wells that are cost competitive to produce more wells. The result of this is that the growth horizon for the project has now extended beyond the long-range view of most companies.

Mr. Hess has projected that this project should allow production to increase 10% annually for the foreseeable future. Initial production increases will be lumpy until a reasonable size (production base) is established. Since Hess is a smaller company, the production growth will be significant to Hess much sooner. But a project of this size will also become significant for a company the size of ExxonMobil. That significance could allow a growth rate seldom seen for a company the size of ExxonMobil.

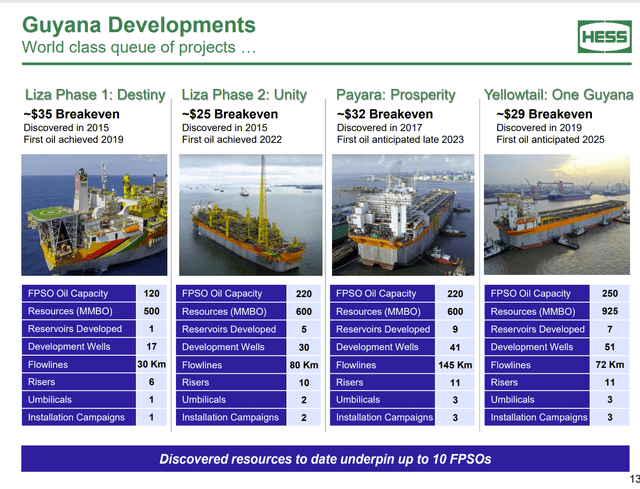

Hess Corporation FPSO’s That Are Producing And Will Produce (Hess Corporation Presentation At J.P. Morgan Energy, Power & Renewables Conference June 23, 2022.)

This partnership already has two floating production storage and offloading (FPSO) units producing. The second of those has ramped up production to the point that the partners have been reviewing add-on projects to increase production capability. That ability raises the profitability of the initial production projects higher. The real question is if more of these cheap projects are available for the production platforms.

That places this partnership well ahead of others in Guyana in terms of cash flow production. The market has not come close to responding to the discovery in Guyana. But the beginning of cash flow should change the picture for a smaller company like Hess. It will also begin to affect the market perception of a company like ExxonMobil.

Notice that the partnership shows the ability to underpin 10 FPSOs. Those ships are not cheap. In fact the cost of a project like this requires a lot of reserves to justify the cost of building and installing an FPSO.

The current price of oil and gas is extremely important when a partnership like this is just beginning cash flow. The reason is that payback happens very quickly. The assets like FPSO generally have long paybacks to go with the long-lived production.

But now the payback of the project is very fast. At a production rate of 200,000 BOD (very roughly), that current production sells for $20 million at current prices (not including natural gas and other production). That rate is $6 billion per year for the partnership which means the cost of an FPSO is roughly recovered in one year in revenues. That is practically unheard-of in a major offshore project like this.

Mr. Hess estimates that the Hess share of cash flow is about $1 billion a year for each FPSO producing (except the first one) at current prices. That is the Hess share of the cash flow. ExxonMobil has a larger interest. Therefore, ExxonMobil has a larger benefit. That makes this project self-financing (practically) at current prices. As more FPSOs begin to produce, the pace of exploration and development is very likely to increase.

Note that the public discussion used $90 for the price of oil next year. Next year is an extremely long time in an industry like this one with very low visibility. Therefore, the projection likely has a wide variation in terms of the actual price when that future arrives.

Now the Yellowtail project, which is estimated to come online sometime in 2025, also has the highest projected cost at $10 billion. However, the current price atmosphere makes this a very profitable project. Mr. Hess talked about the sticker shock aspect of this FPSO project. That may at some point in the future make another FPSO a nonstarter until prices improve. But for the time being the low breakeven of any of these production projects is impressive enough to make that a remote possibility.

The bottom line is not needing to add cash or needing to add less cash when production first begins raises the overall profitability on this project significantly because cash received sooner has a far larger influence on calculations like ROI than does cash received later.

Furthermore, should an industry downturn occur, the partnership is in a position to use debt to continue to increase production when the first few assets have fast paybacks and likely remain debt free.

Summary

The partnership has been increasing activity lately in response to higher oil prices. That has resulted in an increased pace of discovery announcements.

ExxonMobil just announced two more discoveries to bring the discovery totals to the highest number ever for the partnership. There will likely be more to add in the future because the year is not close to over yet.

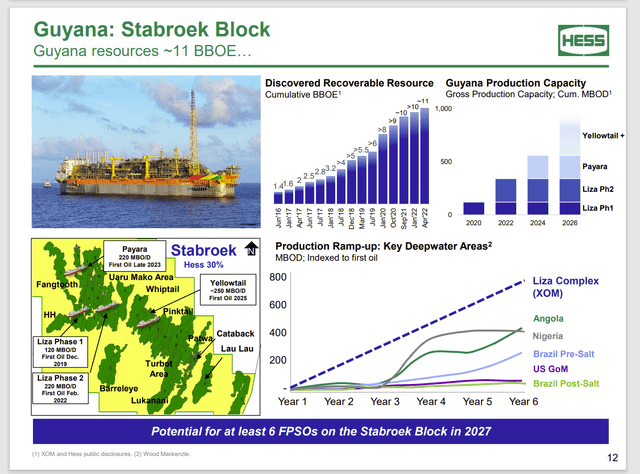

Hess Presentation Of Guyana Discoveries And Projected Production Growth (Hess Presentation At J.P. Morgan Energy, Power And Renewables Conference June 23, 2022)

The recoverable resource has been trending upward for some time. For shareholders the importance of the beginning of production is shown in the lower right of the slide. Production is increasing at a time of a demand imbalance. The timing of production expansion could not be better. More to the point, investors can already see more than 300,000 BOD of production with another FPSO scheduled to begin oil production in the 2023.

Even for a company the (KING) size of ExxonMobil, that more than 500,000 barrels of low breakeven production is significant (as a partner) in 2023. The projected 6 FPSOs shown above are likely to generate production of at least 1.5 million BOD. At that point, the production growth for ExxonMobil is likely to move into a pace rarely seen for a company the size of ExxonMobil.

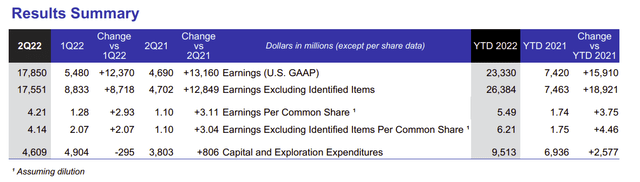

ExxonMobil Operating Results Summary Second Quarter 2022. (ExxonMobil Earnings Press Release July 29, 2022)

The whole industry including this company is reporting previously unexpected levels of cash flow and earnings. That allows the initial Guyana investments that were made during times of offshore low prices to pay back very quickly. Having the initial assets of the partnership payback in a huge project like this is an unbelievable competitive advantage that is seldom seen. It single handedly raises the project profitability because more dollars sooner are worth more in any time value of money calculation (not to mention ROE calculations). It also means that the partnership can support a higher level of activity earlier. That is shown initially by the record number of discoveries.

The effect of currently high prices on long term projects like building FPSOs is muted because those projects along with the infrastructure take years. A partnership does not want to be caught in an industry downturn with big bills from too many expansion projects.

The project promises production growth that will be significant to ExxonMobil for a very long time. That will make the company a growth and income vehicle that is seldom seen in a cyclical industry. Returns may be on the low side as the production continues to build in the near future. But that will change even if another discovery is never made again (highly unlikely).

The nice part about offshore projects is that growth is often predictable for years into the future. In this case, the project production will clearly grow for the rest of the decade just based upon discoveries made. The extremely low breakeven point will help all the partners lower the corporate breakeven considerably. For those with patience, this stock, even at the current price is likely to prove a decent long-term buy.