guvendemir

Investment Thesis

I last covered Horizon Therapeutics (NASDAQ:HZNP) for Seeking Alpha back in October 2020, when the company’s stock was in the middle of a stunning bull run, which saw shares rise from a low of $25 in March 2020, after the pandemic related market sell-off, to a high of $120 in October 2021.

My suggestion – when shares traded at $78 – that Horizon stock could pass $100 per share was proven accurate as Horizon smashed its own, already raised FY20 guidance, earning $2.2bn of revenues, and then went on to achieve revenues of $3.3bn in FY21 – up 47% year-on-year.

A dip to lows of ~$86 in early 2022 was ended by the publication of FY21 results, led by $1.67bn of revenues generated by Thyroid Eye Disease (“TED”) therapy Tepezza – up 103% year-on-year (the drug was approved in January 2020) – $565m from gout therapy Krystexxa – up 39% year-on-year – $292 from urea cycle disorder treatment Ravicti, $190m from rare kidney disease treatment Procysbi, $117m from Actimmune, used to treat Chronic Granulomatous Disease (“CGD”), and $330m from an Inflammation drug segment led by Pennsaid, a topical NSAID designed to target your osteoarthritis knee pain.

Horizon’s acquisition of Viela Bio, a company spun out of the pharmaceutical giant AstraZeneca (AZN), in a $3bn deal in February 2021 gave it access to Viela’s lead candidate Uplizna, which was approved to treat neuromyelitis optica spectrum disorder (“NMOSD”) in the US, and was approved for the same indication in Europe in Q122, whilst label expansions into conditions such as Myasthenia Gravis and immunoglobulin G4 (“IgG4) related disease are likely.

The Viela buyout also bolstered Horizon’s drug development pipeline with 3 assets targeting autoimmune conditions such as Systemic Lupus Erythematosus (“SLE”) Rheumatoid Arthritis and Sjögren’s Syndrome. Horizon believes there is a $3bn per annum revenue opportunity in these assets alone, although the consensus amongst analysts is closer to $1bn.

Horizon defied analysts’ expectation with Tepezza, however, easily exceeding expectations, and management prides itself on its ability to drive revenue generation. In the past, as I explained in my last note, this led to Horizon overstepping the line, creating complex sales strategies that attempted to bypass Pharmacy Benefit Managers (“PBMs”) and hiking the prices of products that were essentially combinations of much cheaper generic products. That led to name change from Horizon Pharma to Horizon Therapeutics, emphasising its commitment to patient care.

Since FY21 results were announced Horizon stock has dipped again. The share price is presently $83, resulting in a market cap valuation of $19bn. Based on management’s FY22 revenue projections of $3.9 – $4bn, that works out at a forward price to sales (“P/S”) ratio of ~4.8x. Adjusted EBITDA is forecast to be $1.63 – $1.7bn – after applying the lower tax rate of ~11% for Irish domiciled companies, the forward price to earnings ratio works out ~13x. Horizon also boasts a healthy cash position of $1.64bn.

With Q222 earnings expected to be announced on August 3rd, there are certainly reasons to believe that Horizon stock can recapture some of the value lost in 2022 to date, which I will discuss below, whilst long term, shareholders can look forward to 6 data readouts in 2023, commercial launches of Tepezza and Ulizna in Brazil, and some ambitious peak sales targets that suggest ~$7bn in overall revenue generation may be achievable by 2025.

Horizon does not pay a dividend, so there is an element of risk when investing in the company. Ultimately, the investment case may rest on whether management’s ambitious peak sales targets can be reached, the strength of the pipeline opportunities, and Horizon’s ability to avoid the controversies of the past.

Personally, I suspect that the sensational gains of ~364% between March 2020 and April 2022 will be replaced with incremental growth for the next 12-18 months, as revenue growth plateaus slightly, although a top line revenues CAGR of >15% looks achievable between 2022 and 2025 if management’s targets are met, and beyond that, the potential of the pipeline offers sustained growth at around the same rate.

As such, there may be as much as 60% upside potential over a 3-5 year period in relation to Horizon stock, in my view, although I would discount that by as much as 50% due to the risks involved. That is enough to support a “BUY” recommendation, and makes buying the current dip a tempting prospect for investors.

Horizon – Recent Performance

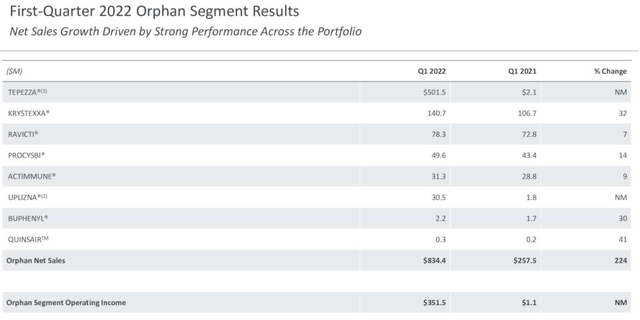

Horizon Orphan Segment performance Q122. (earnings presentation)

As we can see, the performance of Horizon’s Orphan drug segment in Q122 was impressive across the board, although overall performance is heavily skewed by a short-term COVID-related supply disruption for Tepezza in Q121.

Still, Krystexxa’s growth of 32% year-on-year is impressive, and things could improve, if not in Q222 then certainly across the rest of the year and beyond, since Krystexxa was approved – in combo with methotrexate – for treatment of uncontrolled gout in July, expanding its addressable patient population, with 71% of patients achieving the primary endpoint of serum uric acid (“sUA”) reduction versus 39% receiving Krystexxa plus placebo. The global gout treatment market is expected to reach $8.3bn in size by 2025, and Krystexxa is the only FDA approved therapy to treat the condition.

Similarly, growth in sales of Uplizna ought to be significant across the rest of the year, thanks to a recent approval in Europe. Ravicti and Procysbi are no longer patent protected, but it does not seem to be preventing them making meaningful, and growing revenue contributions. Operating income of $352m is satisfactory, although the figure will need to be higher in the remaining 3 quarters of the year if Horizon’s forward PE is to remain low enough to drive share price upside in the shorter term. At current price, I believe the forward PE needs to stay below 15x – the Big Pharma sector average is ~23x.

By contrast, revenues in the Inflammation segment fell by 40% year-on-year, to $51m, and operating income was just $15.3m. This division is on its way out, and Horizon will be hoping that its pipeline will more than compensate for falling revenues in this division.

2022 Guidance Looks Enticing But Management Does Not Need To Overdeliver

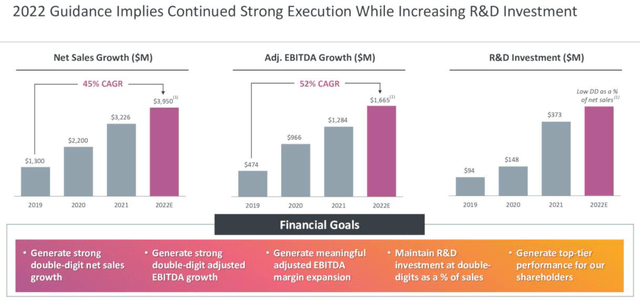

Horizon 2022 Guidance and long term goals. (earnings presentation)

The above slide from the Q122 earnings presentation shows just how impressive Horizon’s performance has been over the past few years, and management is promising continued “double digit” growth, although as mentioned in my intro, I believe this refers to mid-teens, rather than the >50% CAGR that has characterised the past few years.

It is interesting to see management forecasting for “meaningful” margin expansion, since by my calculation, Horizon earned an operating margin of ~37% – ~$880m sales, and operating profit of ~$330m – in Q122, which is already very high. I think most investors would be satisfied with such a margin, since it ought to create strong cash flow generation as it has done in the past, allowing Horizon to perhaps introduce a dividend or a share repurchase program, or engage in more M&A.

The relentless focus on profit might represent too much of a throwback to the “bad old days” of elaborate sales strategies, price hikes, and government investigations.

Pipeline Has “Wow Factor” But Horizon Is 2-3 Years Away From New Product Launches

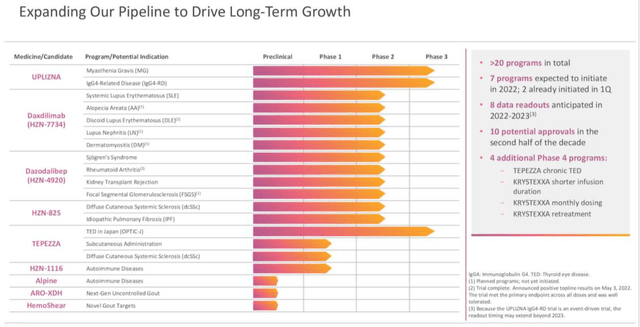

Horizon Pipeline. (earnings presentation)

Label expansions for Uplizna and Tepezza ought to help Horizon’s Tepezza and Uplizna grow, and with Krystexxa already approved in combo with methotrexate, management’s belief is that these 3 drugs can generate peak sales of $3.5bn, $1bn and $1bn respectively. If those peak sales were to occur in 2025, the CAGR would be 21%, 15%, and >100% respectively.

With the remainder of the portfolio growing at an average (I estimate) CAGR of 5%, the overall CAGR would be in the region of 18%, hence the upside potential suggested in my intro, but looking further ahead, management believes there could be a further $3bn per annum revenue potential across the remainder of its portfolio.

The 3 assets to pay closest attention to here are Daxdilimab, Dazodalibep, and HZN-825. All 3 have Phase 2 studies underway, with Dazodalibep expected to read out data in Rheumatoid Arthritis (“RA”), Kidney transplant rejection and Sjogren’s Syndrome either this year or next, and Daxdilimab in SLE.

Markets such as RA and SLE offer blockbuster (>$1bn per annum) sales opportunities but it has to be pointed out that analysts do not share Horizon’s enthusiasm on that front, as we can see below.

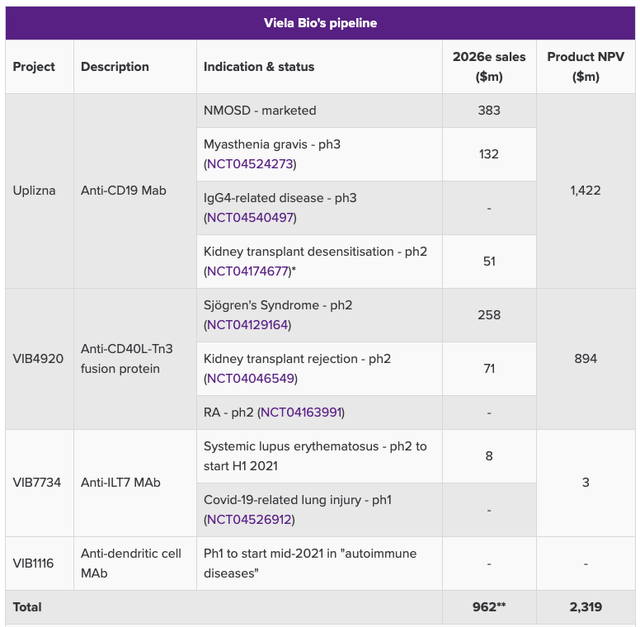

Analysts forecasts for sales of Viela Bio pipeline drugs. (Evaluate Pharma)

In my view, prospective Horizon investors may be better off using the analysts’ forecasts, because when forecasting for future sales of pipeline assets, the possibility of clinical trial failures, unexpected issues, rivals bringing superior drugs to market etc. ought to be factored in.

If we factor in $1bn of peak sales from Daxdilimab, Dazodalibep, and HZN-825, without worrying about which drug contributes what volume of sales, by 2025, we are looking at revenues of <$7bn if the Tepezza, Kyrstexxa and Uplizna peak sales targets are met, and a CAGR revenue growth of ~22%.

If we take the net profit margin from FY21 of 17% (net profits in FY21 were $534m), and apply that to our theoretical revenue figure of ~$7.2bn in 2025, we arrive at EPS of $5, and a forward PE of ~16x.

Conclusion – Horizon Is Not A Conservative Company, But Conservatively Speaking, Its Stock Is A Buy

What I mean by my conclusion above is that Horizon appears to be a relentlessly ambitious company that is aiming for the stars, and has performed exceptionally well for investors, but whose future potential may be better evaluated using more traditional or conservative methods.

If we do that, as explained above, it is not too hard to envisage a situation where Horizon grows its revenues from the FY22 forecast of $3.9 – $4bn, to >$7bn by FY25, profit margins remain consistent, and the case for share price upside of ~30% looks attractive.

The Viela acquisition looks to be an outstanding piece of business even if the pipeline’s contribution never exceeds $1bn per annum, whilst the label expansion opportunities already secured by Krystexxa and Uplizna, with potentially more to come, and also for Tepezza, look realistically achievable.

There are risks to factor in – management’s over-exuberance, the prospect of rivals encroaching on the market dominance currently enjoyed by Krystexxa and Tepezza, and the failure of pipeline assets to make it to market – but Horizon’s attractive cash flow generation ought to mean the company can make further acquisitions, and bolster its late stage portfolio, and management has a good track record here. The favourable Irish tax regime is another plus point from a profitability perspective.

A final point which I find a positive is the discrepancy between the EBITDA profit margin which is >35%, and the operating profit which is much lower – ~17% in FY21. Horizon does not have much debt – ~$4bn reported as of FY21 – so the difference between these 2 margins ought to narrow, meaning operating profits will grow.

Horizon doesn’t pay a dividend, and it is at heart a company that embraces a reasonable level of risk, in my view, but it is a company that by most measures stands a very good chance of regaining former share price highs of $120, and perhaps exceeding them, and there is an attractive, 30-45% upside opportunity in play here, in my view.