kynny

Data I/O (DAIO) is the market leader in programming, selling machines that put data on chips before they go into stuff. They sell to programming centers but most of it (58% of revenue in Q2/22) goes to the automotive sector, selling to almost all of the top OEMs.

The amount of electronics in need of programming is expected to grow at a CAGR of 12%-15% a year in automotive, giving the company a nice secular tailwind.

A couple of years ago they came up with a new device for secure provisioning, the SentriX, especially relevant for the security-sensitive IoT market. This got off to a slow start but it’s now gaining traction after they changed the business model and made it a lot easier to operate.

They have 50 patents (20 for the SentriX), a strong balance sheet, and an installed base of 420 PSV systems that produce an increasing demand for consumables (31% of revenue in Q2/22) and services (15% of revenue in Q2/22).

The company has faced a very tough couple of years with a host of macro problems, like the pandemic, supply chain problems (especially in automotive), Chinese lockdowns and the war in Ukraine, and a strong dollar.

The cyclical upturn that seemed to happen a year ago but was cut short because of these macro problems, but in Q2 another episode of sunshine seems to break through the clouds, except in Europe where demand remains weak.

So their business is a lot stronger than the macro picture seems to indicate (apart from Europe), the automotive supply chains are improving and almost back to normal with chips production capacity shifting as other markets see diminishing demand.

FinViz

Financial results

| Q1/20 | Q2 | Q3 | Q4 | Q1/21 | Q2 | Q3 | Q4 | Q1/22 | Q2 | |

| Sales | 4.8 | 4.7 | 5.9 | 4.9 | 6.0 | 6.7 | 6.7 | 6.4 | 5.0 | 4.8 |

| Bookings | 4.3 | 5.0 | 5.6 | 6.0 | 5.4 | 8.9 | 5.0 | 6.2 | 6.2 | 6.4 |

| Backlog | 2.3 | 2.8 | 2.8 | 3.9 | 3.0 | 5.0 | 3.3 | 2.9 | 4.1 | 5.8 |

| Gros Marg | 58.2 | 52.4 | 55 | 52.9 | 55.5 | 57 | 60.7 | 54.4 | 46.4 | 57.8 |

| Adj. EBITDA | -11K | 23K | 169K | -194K | 173K | 597K | 564K | 117K | -932K | -64K |

Bookings were above $6M for a third consecutive quarter, and the company won 6 new customers in Q2, testifying to strong underlying demand. Most bookings came late in the quarter, leading to a high backlog which management expects to clear by the end of Q3.

Therefore, management expects a significant improvement in financial performance in H2/22 and some $1M in order delays because of Chinese lockdowns will be cleared before yearend as well.

There was some success with the SentriX as they gained two orders and had another customer go into volume production (apart from an outright CapEx sale, the SentriX also has a per-use business model).

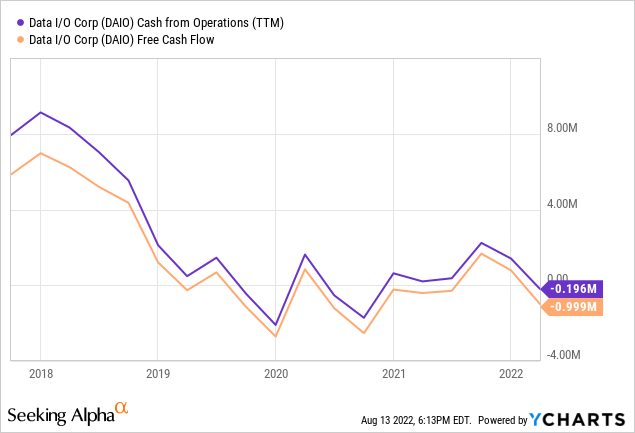

While Q2 isn’t yet in the graph, it’s notable the company hasn’t been making any cash since 2018, but they were plagued first by a cyclical downturn and then by an assortment of macro problems. Fundamentally the company is better positioned than during the last cyclical upturn.

They also have a strong balance sheet with no cash and $10.3M in cash, management argues that they are the best-capitalized company in the business and that it is an important competitive advantage.

Valuation

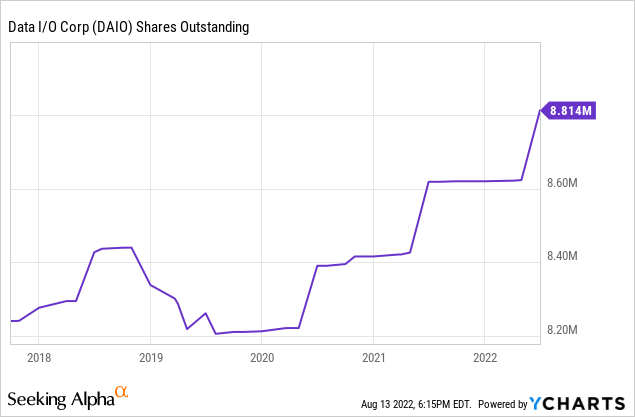

There has hardly been any dilution, the share count went up from 8.2M to 8.6M in the past 5 years:

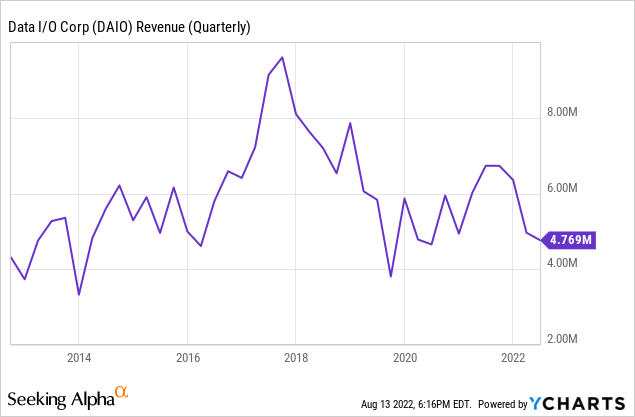

So the market cap (at $3.6 share price) is $31M and the EV is $21M. At an estimated FY22 revenue of $21.5M, the shares are selling at 1x EV/S. But analysts don’t expect profits anytime soon with EPS estimated at -$0.64 this year rising to -$0.46 in 2023.

We think it can be considerably better if the guided H2 improvement is durable. This is because their long-term model contains:

- Gross margins in the mid to high 50s

- R&D at $1.6-1.7M/Q

- SG&A less than $2M/Q except Q1

- CapEx is really only $500K a year

In order to break even, they need to produce quarterly revenue of $6.7M or more. This has happened before in the previous cyclical top in 2017 and again last year:

But they are now in a better position:

- They are gaining market share

- Secular growth has increased the TAM

- They have a larger installed base leading to higher consumable sales

- They have additional revenue from the SentriX

But this won’t be a crazy profitable company anytime soon and a couple of things have to go right.

Reasons to buy

- Strong market position and secular tailwind from their biggest market, automotive.

- Ever more chips are going into ever more stuff which creates another secular tailwind for the company.

- A slow shift towards more recurring revenues as their installed base of machines steadily increases the demand for consumables and services.

- The SentriX is a bit of a wild card, uptake has been slower than we expected but it could still become significant.

- The company produces mid to high 50s gross margins.

- Healthy balance sheet, no debt, and over $10M in cash.

On the minus side:

- The company has not been consistently profitable and while we think there will be a gradual improvement on this score, downturns will still be part of the game.

- While easing now, macroeconomic problems could come back.

If the upturn proves durable, we think the shares could come back to $5+, but in this environment, this isn’t guaranteed.