AzmanL/E+ via Getty Images

Investment Thesis

Celsius Holdings (NASDAQ:CELH) was the subject of my first Seeking Alpha article, in which I highlighted the stock as my highest conviction idea for 2021. Although I have been invested in the company since early 2020, the stock has come a long way and is by far the best performing holding in my main portfolio. Now that Celsius has been blessed by PepsiCo (NASDAQ:PEP) with a massive $550 million investment and distribution deal, the bullish case for the stock has never been stronger.

Short interest remains elevated at just over 16%, which is quite high given the recent news of Pepsi’s major investment in the company. While speculating on short-squeezes is not part of my investment strategy, it is worth noting that many short-sellers are continuing to target the company despite continued outperformance. The recent earnings report from Celsius surprised to the upside once again, and the best is most likely yet to come. The PepsiCo distribution deal should add considerable value for shareholders over the long-term, as the product will soon reach a large percent of the U.S. population, with major advertising dollars going to promoting the brand on a larger scale.

C-stores, gas stations, gyms, as well as new retail stores will likely contribute to explosive revenue growth in the years ahead, continuing the trend that has been in place. With distribution being handled by Pepsi, the company can focus more on operating efficiencies. Resisting the urge to sell will be paramount for long-term holders of the stock, as the backing of a company like PepsiCo is a bullish development that should not be overlooked. However, risk tolerance is also an important thing to consider here, as Celsius continues to be a volatile stock with a high beta and is prone to volatile price movements.

In my opinion, now that PepsiCo has a vested interest in making sure the company does well, Celsius should not be viewed as a speculative investment, as it may have been in previous years. Taking advantage of short-term price fluctuations and buying more shares on pullbacks could prove to be a winning strategy for long-term shareholders.

Introduction

Celsius Holdings has been my highest conviction stock for over two years, and during this time it has become my first twenty-bagger in the stock market, with more gains on the horizon. In my first-ever Seeking Alpha article, I suggested that the company could one day rival Monster Beverage (MNST) and take on other big industry players like Red Bull, as the company was showing rising market share and explosive revenue growth. The growth story played out almost exactly as I thought it would over this time frame, and now that the company has been tapped by beverage giant PepsiCo with an 8.5% equity stake and distribution deal, the next several years could prove to be truly monumental.

One important thing I can stress to readers is that doing ‘boots-on-the-ground’ research is highly valuable for market participants considering an investment in any company, as it definitely was in my case with Celsius Holdings. This type of research can give you an upper hand against others who may judge a stock based on a single variable, such as P/E or other valuation metrics. Clearly, big beverage has found value in the company despite the high valuation, and others have begun to finally take notice.

While competition is somewhat of a risk factor going forward, the risks are not as great as they were in early 2020 when the company was viewed as an underdog in the energy drink space. However, the surging U.S. dollar, inflation, and recent increase in fuel costs continue to hurt Celsius’ margins, as I correctly predicted in my first article on the company. A much bigger risk, in my opinion, is competition from new entrants to the market, such as Ghost Energy and a slew of other newer products. However, over the last few years Celsius has proven that it can be a top three competitor in the energy drink market, and has also just been added to the S&P MidCap 400 Index. With PepsiCo’s distribution, Celsius still has a long growth runway ahead and resisting the urge to take profits now could prove to be wise in the long-term.

Celsius From A Technical Standpoint

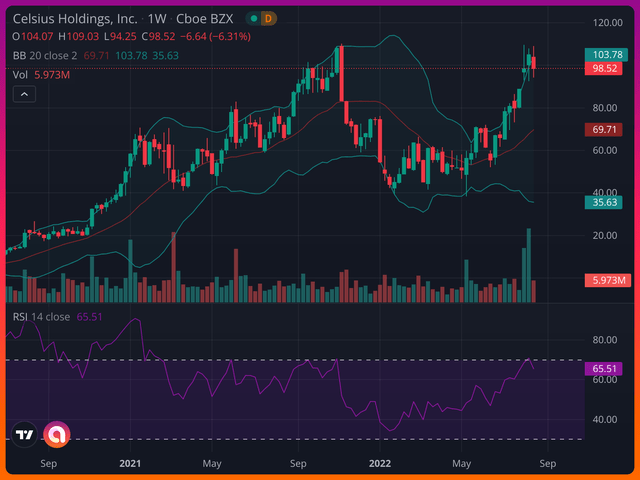

Celsius stock touched overbought territory over a long-term time frame on the back of the announcement of PepsiCo’s investment in the company on August 1st, 2022. Since then, some selling has occurred as short-term speculators took profits and the earnings report came out, which showed another EPS beat and continued North American revenue growth.

CELH Weekly Chart (AlphaBot)

The RSI is currently showing a level of 65.51, which suggests that the recent volume spikes were enough to push the stock into overbought territory briefly, but now that the price has corrected to just under $100 per share, the overbought conditions are beginning to subside. This situation could present investors with some buying opportunity in the near-term if the selling persists, and while the stock is near all-time highs, the technical picture remains strong.

Since August 1st, 2022, the stock corrected slightly from being overbought and has held onto the gains, beginning to put in a base near the $100 level.

CELH Since Pepsi’s Investment (Google)

Another interesting point to bring up is that PepsiCo’s stock has actually surged more than Celsius’s stock over the same time frame. While CELH has remained mostly flat since the announcement, PEP has surged almost 2% to within 6 cents of a new all-time high as of this time of writing.

This tells me that the market is responding positively to PepsiCo’s investment in the company, and value is being created for all parties involved. Sentiment is decidedly positive, and I view Pepsi as a logical choice for handling the distribution of Celsius’s products, even though I was initially skeptical of a deal getting done between the two companies.

PepsiCo is actually one of the first stocks I ever bought, and I continue to be long the shares. Once more selling hits the market and the technical picture begins to look more inviting, I will undoubtedly be looking to add to my stake in both companies.

Pepsi’s Big Bet – Why Both Stocks Could Be Buys Soon

The synergy between Pepsi and Celsius is an interesting development in the business and accomplishes a few notable things for both companies. For one, it further expands Celsius’s reach into new market segments within North America and reinforces my ideas about the company’s ability to reach a huge percent of the U.S. population within the next couple years. This was a topic I brought up in my previous article on the company, in which I extrapolated into the future and gave some thoughts on Celsius’s recent wins in the industry.

To quote myself –

“While there are still many physical locations that do not carry Celsius yet, the company will likely start to hit a huge percent of the US population in terms of reach within the next year or two. If the company does not have to worry about expanding inventories and distribution, they can focus on operating efficiencies maximizing profit margins. However, the company is at this point nowhere close to being done in terms of scaling up.”

Source: Author

Now that PepsiCo will be handling the distribution side of things, this focus on operating efficiencies can be fully realized, which should contribute to massive earnings growth ahead. Another point that I brought up in my previous article was Rockstar Energy Drink, and the product lagging behind in the marketplace compared to new competition. Pepsi became well aware of this after acquiring Rockstar, and now has set its sights on Celsius as the newest product which is rapidly taking market share with strong staying power. Bravo, Pepsi.

Celsius’s rapid rise in terms of online market share growth on Amazon has caught the attention of the big players in the industry, and it shows that with Pepsi’s enhanced distribution, the translation of more market share growth in physical retail store placements is highly likely going forward. This gives Pepsi a real chance to compete with Coca-Cola (KO) and Monster Energy, which have both seen incredible results from their strategic partnership over the years.

If you had bought Monster Energy’s stock in the summer of 2015 on the back of this partnership, you would have nearly doubled your money holding through the volatility to today. The most you could have lost over a one-year period would have been around 12%, showing that impatience and short-term thinking can ultimately be the most destructive thing to an investor’s portfolio.

When it comes to investing in Celsius post-Pepsi, a long-term mindset is the most important thing to keep and battling with the urge to sell and take profits after a great rally.

Conclusion

Celsius Holdings remains a long-term hold on the back of the recent deal with PepsiCo. Similar to the strategic partnership between Coca-Cola and Monster Energy, this synergistic relationship is beneficial for shareholders of both companies and creates substantial value while removing risk. Celsius’s recent earnings report also showed continued revenue growth and beat EPS targets by a wide margin. However, the coming quarters after enhanced distribution takes effect will be the most monumental in terms of business performance, as Celsius can focus more on operating efficiencies. Battling short-term thinking and impatience will be paramount for shareholders going forward, as Celsius’s high beta and volatile price movements continue to jostle investors. In my opinion, competition is now one of the single biggest risks to the company, as well as inflation, the surging U.S. dollar, and a potential economic slowdown, which could hurt sales momentum and profitability. However, with PepsiCo’s vested interest, these short-term risks are pale in comparison to the long-term potential. I currently view the shares of CELH as a Hold, but buying on meaningful pullbacks in the share price could be a smart strategy for long-term investors.